Employer match contributions provide an immediate return on your investment by effectively boosting your retirement savings with free money, enhancing your overall portfolio growth. The Mega Backdoor Roth strategy allows for substantial after-tax contributions to a Roth account, enabling tax-free growth and withdrawals in retirement, which is ideal for high earners looking to maximize tax-advantaged savings. Prioritizing employer match ensures guaranteed benefits while the Mega Backdoor Roth offers greater long-term tax flexibility and potential wealth accumulation.

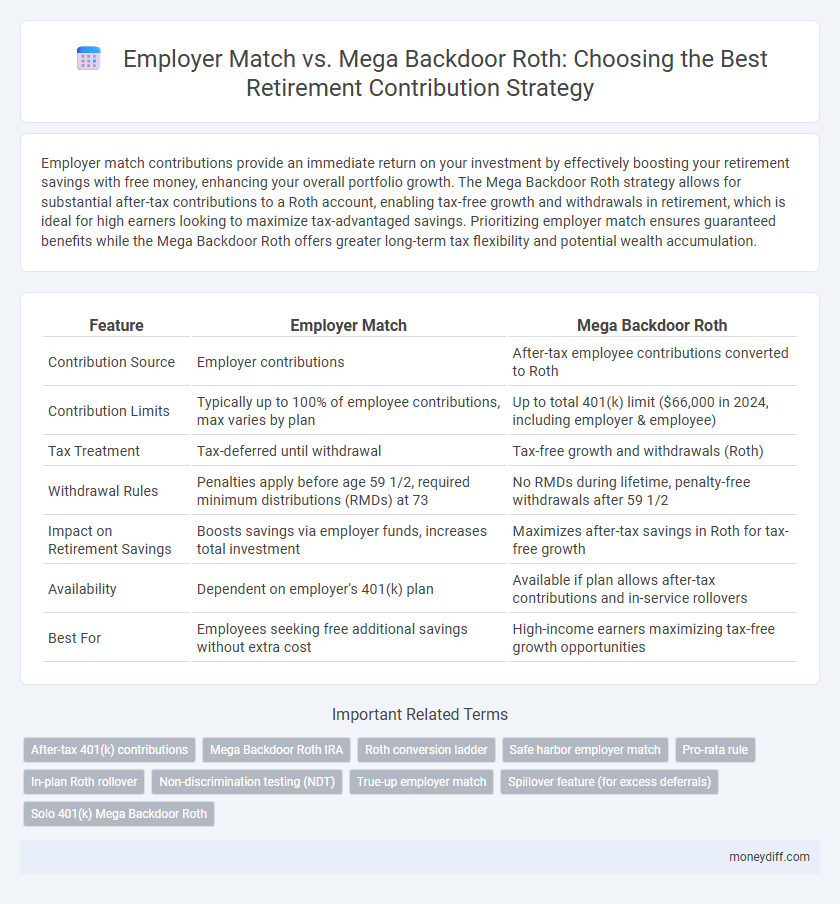

Table of Comparison

| Feature | Employer Match | Mega Backdoor Roth |

|---|---|---|

| Contribution Source | Employer contributions | After-tax employee contributions converted to Roth |

| Contribution Limits | Typically up to 100% of employee contributions, max varies by plan | Up to total 401(k) limit ($66,000 in 2024, including employer & employee) |

| Tax Treatment | Tax-deferred until withdrawal | Tax-free growth and withdrawals (Roth) |

| Withdrawal Rules | Penalties apply before age 59 1/2, required minimum distributions (RMDs) at 73 | No RMDs during lifetime, penalty-free withdrawals after 59 1/2 |

| Impact on Retirement Savings | Boosts savings via employer funds, increases total investment | Maximizes after-tax savings in Roth for tax-free growth |

| Availability | Dependent on employer's 401(k) plan | Available if plan allows after-tax contributions and in-service rollovers |

| Best For | Employees seeking free additional savings without extra cost | High-income earners maximizing tax-free growth opportunities |

Understanding Employer Match: Maximizing Free Money

An employer match in retirement contributions provides a direct, tax-advantaged boost to your savings by effectively increasing your investment without reducing your take-home pay. Understanding your employer's matching policy ensures you capitalize on every dollar available, often up to a specific percentage of your salary, maximizing your long-term retirement funds. Prioritizing employer match contributions before exploring strategies like the Mega Backdoor Roth secures guaranteed returns and enhances overall retirement portfolio growth.

What Is a Mega Backdoor Roth?

A Mega Backdoor Roth allows high-income earners to contribute significantly more to their Roth retirement account by making after-tax contributions to a 401(k) plan and then converting those funds to a Roth IRA. Unlike the standard employer match, which typically offers a limited percentage of your salary as a contribution, the Mega Backdoor Roth can potentially add tens of thousands of dollars annually to your tax-advantaged retirement savings. This strategy maximizes retirement contributions beyond traditional limits, providing substantial tax-free growth and withdrawal benefits in retirement.

Eligibility Requirements for Employer Match and Mega Backdoor Roth

Employer match programs typically require employees to contribute a specific percentage of their salary to qualify for the match, with common eligibility criteria including minimum tenure and participation in a traditional 401(k) plan. Mega backdoor Roth contributions depend on the plan allowing after-tax contributions and in-service withdrawals or conversions, which are often limited to highly compensated employees or those in companies with specialized 401(k) options. Understanding the differences in eligibility helps maximize retirement savings by selecting the optimal strategy based on plan rules and individual income levels.

Contribution Limits: Comparing Employer Match and Mega Backdoor Roth

Employer match contributions to a 401(k) plan typically max out at 3% to 6% of an employee's salary, effectively adding free money to retirement savings without impacting the employee's contribution limit. The Mega Backdoor Roth strategy allows after-tax contributions up to the total 401(k) limit of $66,000 in 2024 (including employer contributions), significantly exceeding standard Roth IRA limits of $6,500, enabling much larger tax-advantaged growth. Comparing these options highlights that employer matching provides immediate leverage on pre-tax salary portions, while Mega Backdoor Roth maximizes after-tax contributions and accelerates Roth accumulation toward retirement.

Tax Benefits of Employer Match vs Mega Backdoor Roth

Employer matching contributions to a 401(k) provide immediate tax advantages by reducing taxable income and growing investments tax-deferred until withdrawal. The Mega Backdoor Roth, allowing after-tax contributions with in-service rollovers to a Roth account, offers tax-free growth and withdrawals, maximizing long-term tax benefits. Employer matches boost retirement savings without annual tax costs, while the Mega Backdoor Roth leverages higher contribution limits and tax-free compounding for significant retirement wealth accumulation.

Investment Growth Potential and Long-Term Gains

Employer match contributions provide an immediate return by effectively increasing your investment principal, boosting compound growth potential from day one. Mega backdoor Roth contributions offer tax-free growth and withdrawals, maximizing long-term gains by allowing higher post-tax contributions to grow without future tax liability. Combining employer matches with mega backdoor Roth strategies can significantly enhance overall investment growth through both upfront matching funds and tax-advantaged compounding.

Withdrawal Rules and Penalties Explained

Employer match contributions are typically subject to standard 401(k) withdrawal rules, meaning distributions before age 59 1/2 may incur a 10% early withdrawal penalty and ordinary income taxes. In contrast, Mega Backdoor Roth contributions allow for tax-free growth and qualified withdrawals without penalties after age 59 1/2, provided the account has been open for at least five years. Understanding these distinctions is crucial for optimizing retirement withdrawals and minimizing potential penalties.

Prioritizing Contributions: Employer Match or Mega Backdoor Roth First?

Maximizing employer match contributions should take priority as it provides an immediate, risk-free return on retirement savings, often up to 5-6% of salary. Once the match is fully captured, utilizing the Mega Backdoor Roth allows for significantly higher after-tax contributions with tax-free growth and withdrawals in retirement. Balancing both strategies optimizes overall retirement savings potential by combining guaranteed employer funds with enhanced tax advantages.

Combining Both Strategies for Optimal Retirement Savings

Combining employer matching contributions with the mega backdoor Roth strategy maximizes retirement savings by leveraging both tax advantages and increased contribution limits. Employer matches provide immediate, risk-free growth while the mega backdoor Roth allows after-tax contributions to be converted for tax-free withdrawals, significantly boosting retirement nest eggs. Integrating these strategies ensures diversified tax treatment and capitalizes on employer benefits alongside higher savings potential.

Common Mistakes to Avoid with Employer Match and Mega Backdoor Roth

Failing to maximize employer match contributions can lead to lost free money essential for boosting retirement savings, while neglecting income limits and contribution caps in the Mega Backdoor Roth can result in costly tax penalties. Overlooking the distinction between regular Roth IRA contributions and the Mega Backdoor Roth strategy may cause compliance errors and reduce retirement fund growth potential. Ensuring proper adherence to plan rules and contribution limits helps investors fully leverage both employer matches and Mega Backdoor Roth benefits for optimal retirement outcomes.

Related Important Terms

After-tax 401(k) contributions

After-tax 401(k) contributions enable high earners to maximize retirement savings beyond standard limits by facilitating Mega Backdoor Roth conversions, offering tax-free growth potential. Employer match contributions provide immediate, guaranteed returns without additional participant contributions, making them a vital component of retirement funding strategies.

Mega Backdoor Roth IRA

The Mega Backdoor Roth IRA allows high-income earners to contribute up to $66,000 annually in after-tax 401(k) funds, which can then be converted to Roth, significantly exceeding the standard Roth IRA contribution limits. While employer matching contributions boost retirement savings, the Mega Backdoor Roth offers unparalleled tax-free growth potential and greater flexibility for aggressive retirement planning.

Roth conversion ladder

Employer match contributions maximize immediate retirement savings by providing free additional funds, while Mega Backdoor Roth allows significantly higher after-tax contributions converted to a Roth account, enabling a Roth conversion ladder strategy that provides tax-free income access before age 59 1/2. Utilizing the Mega Backdoor Roth accelerates tax-advantaged growth and withdrawal flexibility, complementing employer matches by expanding the total retirement portfolio beyond traditional limits.

Safe harbor employer match

Safe Harbor employer match guarantees a 100% contribution on employee deferrals up to a specific percentage, ensuring immediate vesting and compliance with IRS nondiscrimination rules. Unlike the Mega Backdoor Roth, which allows after-tax contributions to be converted to Roth IRA avoiding future taxes, the employer match provides a risk-free, employer-funded boost that maximizes retirement savings with no additional employee out-of-pocket expense.

Pro-rata rule

Employer match contributions offer immediate tax advantages and compound growth without impacting the pro-rata rule, while the Mega backdoor Roth strategy requires careful navigation of the IRS pro-rata rule to avoid unintended tax consequences on after-tax IRA conversions. Understanding the interaction between employer matches and the pro-rata rule is crucial for maximizing retirement savings efficiency and minimizing tax liabilities.

In-plan Roth rollover

In-plan Roth rollovers allow employees to convert traditional 401(k) balances into Roth accounts within the same plan, providing tax-free growth potential and increased withdrawal flexibility at retirement. While employer matches boost overall retirement savings through immediate contributions, utilizing a Mega Backdoor Roth via in-plan rollovers offers higher after-tax contribution limits, maximizing tax-advantaged growth beyond standard 401(k) limits.

Non-discrimination testing (NDT)

Employer match contributions avoid Non-Discrimination Testing (NDT) as they are mandatory and standardized across eligible employees, ensuring fair benefit distribution. Mega backdoor Roth contributions, classified as after-tax deferrals, must pass NDT to confirm high earners do not receive disproportionate tax advantages, making this testing crucial for compliance.

True-up employer match

True-up employer match ensures employees receive the full employer contribution amount even if their deferral contributions vary throughout the year, optimizing overall retirement savings. Utilizing a Mega Backdoor Roth alongside a True-up match can maximize tax-advantaged retirement contributions by allowing higher after-tax contributions and tax-free growth.

Spillover feature (for excess deferrals)

Employer match contributions maximize immediate tax-advantaged growth by adding free funds to your 401(k) while the Mega Backdoor Roth allows higher after-tax contributions with the spillover feature enabling excess deferrals to be converted into Roth accounts, increasing tax-free retirement income potential. Utilizing the spillover feature lets high earners bypass traditional deferral limits and optimize retirement savings by accelerating Roth conversions beyond standard contribution caps.

Solo 401(k) Mega Backdoor Roth

Solo 401(k) Mega Backdoor Roth contributions enable high-income earners to maximize tax-advantaged retirement savings beyond employer match limits by allowing after-tax contributions and in-plan Roth conversions up to $66,000 (2024 limit), significantly exceeding traditional matching thresholds. Employer matching typically caps at 3-6% of compensation, making the Mega Backdoor Roth a powerful strategy for solo entrepreneurs to accelerate tax-free growth and optimize retirement wealth accumulation.

Employer match vs Mega backdoor Roth for retirement contributions. Infographic

moneydiff.com

moneydiff.com