Immediate withdrawal allows retirees to access funds quickly for expenses, providing flexibility but risking rapid depletion of savings. Guardrails withdrawal uses predetermined spending limits tied to portfolio performance, helping to preserve assets and sustain income over time. This strategy balances financial security and adaptability, reducing the likelihood of outliving retirement funds.

Table of Comparison

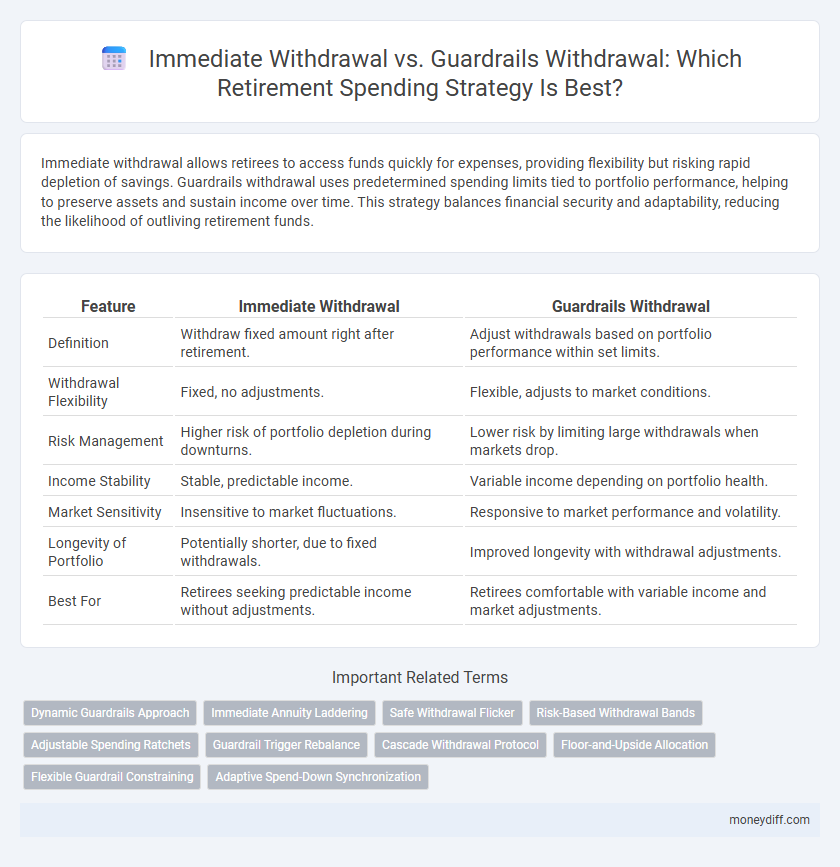

| Feature | Immediate Withdrawal | Guardrails Withdrawal |

|---|---|---|

| Definition | Withdraw fixed amount right after retirement. | Adjust withdrawals based on portfolio performance within set limits. |

| Withdrawal Flexibility | Fixed, no adjustments. | Flexible, adjusts to market conditions. |

| Risk Management | Higher risk of portfolio depletion during downturns. | Lower risk by limiting large withdrawals when markets drop. |

| Income Stability | Stable, predictable income. | Variable income depending on portfolio health. |

| Market Sensitivity | Insensitive to market fluctuations. | Responsive to market performance and volatility. |

| Longevity of Portfolio | Potentially shorter, due to fixed withdrawals. | Improved longevity with withdrawal adjustments. |

| Best For | Retirees seeking predictable income without adjustments. | Retirees comfortable with variable income and market adjustments. |

Understanding Immediate Withdrawal and Guardrails Withdrawal Approaches

Immediate withdrawal involves taking a fixed amount from retirement savings right after retirement, providing consistent income but risking faster depletion during market downturns. Guardrails withdrawal adjusts spending based on portfolio performance, increasing withdrawals during good years and reducing them in bad years to preserve longevity. Understanding these approaches helps retirees balance income stability with portfolio sustainability over time.

Key Differences Between Immediate and Guardrails Withdrawal Strategies

Immediate withdrawal strategy involves starting to draw down retirement savings right after retirement at a fixed or predetermined rate, ensuring steady income but with higher risk of depleting funds during market downturns. Guardrails withdrawal strategy adjusts withdrawals based on portfolio performance, increasing spending when markets perform well and reducing withdrawals during downturns to preserve capital and extend portfolio longevity. Key differences hinge on flexibility, risk management, and adaptability to market fluctuations, with Guardrails offering dynamic spending aligned with investment returns versus Immediate's fixed, predictable income.

Pros and Cons of Immediate Withdrawal for Retirement

Immediate withdrawal in retirement offers the advantage of access to funds without delay, providing flexibility for unexpected expenses and lifestyle choices. However, this approach carries the risk of depleting savings too rapidly, potentially leading to financial insecurity in later years. Without structured limits, immediate withdrawal can complicate long-term retirement planning and may increase the likelihood of running out of money during retirement.

Guardrails Withdrawal: Flexibility and Risk Management

Guardrails withdrawal offers a dynamic approach to retirement spending by adjusting withdrawals based on portfolio performance, thereby enhancing flexibility and mitigating the risk of depleting assets prematurely. Unlike immediate withdrawal methods that set fixed annual amounts, guardrails use predefined thresholds to increase or decrease spending, aligning cash flow with market conditions. This strategy helps maintain financial stability over a longer retirement horizon by balancing income needs with sustainable portfolio longevity.

Impact on Portfolio Longevity: Immediate vs Guardrails Withdrawal

Immediate withdrawal strategies often lead to higher initial spending but can accelerate portfolio depletion, reducing overall longevity especially in volatile markets. Guardrails withdrawal methods adjust spending in response to portfolio performance, enhancing sustainability by mitigating the risk of overspending during downturns. Studies show guardrails approaches can extend portfolio life by up to 20 years compared to fixed immediate withdrawal plans under typical market conditions.

Adapting to Market Volatility With Guardrails Withdrawal

Guardrails withdrawal strategy adjusts retirement spending in response to market fluctuations, maintaining a balance between preserving portfolio longevity and providing sustainable income. Unlike immediate withdrawal, which fixes spending amounts regardless of market conditions, guardrails dynamically increase or decrease withdrawals based on predefined thresholds tied to portfolio performance. This adaptive approach reduces the risk of depleting retirement savings during market downturns and enhances financial resilience.

Immediate Withdrawal: Simplicity vs Sustainability

Immediate withdrawal offers retirees a straightforward spending approach by allowing access to funds without complex restrictions, providing ease and clarity in managing finances. However, this simplicity may compromise long-term sustainability, increasing the risk of depleting retirement savings prematurely. Balancing immediate withdrawal with financial planning tools enhances both accessibility and the preservation of assets over time.

Income Stability in Retirement: Comparing Both Methods

Immediate withdrawal provides retirees with flexible access to funds but may expose income to market volatility, potentially jeopardizing long-term stability. Guardrails withdrawal employs predetermined spending limits linked to portfolio performance, helping maintain consistent income by adjusting withdrawals during market fluctuations. Comparing both, guardrails strategies generally offer enhanced income stability by balancing spending needs with investment preservation over time.

Choosing the Right Withdrawal Strategy for Your Retirement Goals

Choosing the right withdrawal strategy for retirement depends on balancing income needs and portfolio longevity, with Immediate Withdrawal providing instant access to funds but potentially increasing longevity risk. Guardrails Withdrawal offers a more flexible approach by adjusting spending based on portfolio performance, helping to preserve capital during market downturns. Assessing factors such as spending stability, risk tolerance, and anticipated retirement duration ensures alignment with your long-term financial goals.

Practical Tips for Implementing Your Chosen Withdrawal Plan

Immediate withdrawal allows retirees to access funds without delay, ideal for covering urgent expenses but may increase tax liabilities and deplete savings faster. Guardrails withdrawal strategies monitor portfolio performance and adjust spending based on market conditions, promoting long-term sustainability by reducing the risk of outliving assets. Implement practical tips such as setting clear spending thresholds, regularly reviewing financial goals, and consulting with a financial advisor to tailor the withdrawal plan and optimize retirement income.

Related Important Terms

Dynamic Guardrails Approach

The Dynamic Guardrails Approach for retirement spending adjusts withdrawals based on portfolio performance and market conditions, helping to balance income stability with portfolio longevity. Unlike immediate withdrawal methods that fix spending amounts, this approach uses flexible guardrails to increase or decrease withdrawals, reducing the risk of depleting assets prematurely.

Immediate Annuity Laddering

Immediate annuity laddering offers a strategic approach to retirement spending, providing guaranteed income streams at different intervals to reduce longevity risk and market volatility impact. Compared to guardrails withdrawal, this method ensures predictable cash flow by purchasing multiple immediate annuities that start at staggered times, enhancing financial stability throughout retirement.

Safe Withdrawal Flicker

Safe Withdrawal Flicker occurs when retirees alternate between Immediate withdrawal and Guardrails withdrawal strategies to balance sustainable income and portfolio longevity; Immediate withdrawal provides consistent initial cash flow, while Guardrails withdrawal adjusts spending based on portfolio performance, minimizing the risk of depletion. Combining these methods helps manage sequence of returns risk, ensuring retirees maintain financial security throughout variable market conditions.

Risk-Based Withdrawal Bands

Risk-Based Withdrawal Bands offer a dynamic approach to retirement spending, adjusting withdrawals based on market performance to reduce the risk of portfolio depletion. Unlike immediate withdrawal strategies that fix spending amounts, guardrails withdrawal methods maintain spending within predefined bands, preserving capital during downturns and allowing for increased withdrawals in favorable market conditions.

Adjustable Spending Ratchets

Immediate withdrawal strategies provide retirees with flexible income by allowing withdrawals based on current portfolio values, while guardrails withdrawal methods adjust spending only when portfolio performance crosses predefined thresholds. Adjustable spending ratchets enhance both approaches by enabling systematic increases or decreases in withdrawal amounts, helping maintain sustainable retirement income aligned with market conditions and longevity risk.

Guardrail Trigger Rebalance

Guardrail withdrawal strategies for retirement spending utilize trigger points to rebalance withdrawals, helping to preserve portfolio longevity by adjusting spending based on market performance and portfolio value. This approach contrasts with immediate withdrawal plans, as the guardrail method dynamically controls spending to reduce the risk of depleting assets prematurely.

Cascade Withdrawal Protocol

Cascade Withdrawal Protocol balances immediate withdrawal and guardrails withdrawal by initially tapping liquid assets before systematically drawing from tax-advantaged accounts, optimizing retirement income sustainability. This method reduces sequence-of-returns risk and prolongs portfolio longevity by adapting withdrawals to market conditions and individual spending needs.

Floor-and-Upside Allocation

Floor-and-Upside Allocation balances immediate withdrawal by securing a guaranteed income floor with upside potential from invested assets, minimizing sequence risk in retirement spending. This approach contrasts Guardrails withdrawal, which adjusts spending based on portfolio performance without a fixed income floor, offering flexibility but increased volatility.

Flexible Guardrail Constraining

Flexible Guardrail Constraining in retirement spending allows for adaptive withdrawals that adjust spending based on portfolio performance and market conditions, aiming to preserve longevity of assets compared to Immediate Withdrawal, which sets a fixed withdrawal amount regardless of investment fluctuations. This method helps retirees balance income needs with risk management by reducing spending during downturns and increasing it when the portfolio performs well.

Adaptive Spend-Down Synchronization

Adaptive Spend-Down Synchronization balances the benefits of Immediate withdrawal, which provides flexibility and liquidity, with Guardrails withdrawal strategies that impose spending limits to preserve portfolio longevity. This dynamic approach adjusts spending in real-time based on market performance and portfolio health, optimizing retirement income sustainability while minimizing the risk of depleting assets prematurely.

Immediate withdrawal vs Guardrails withdrawal for retirement spending. Infographic

moneydiff.com

moneydiff.com