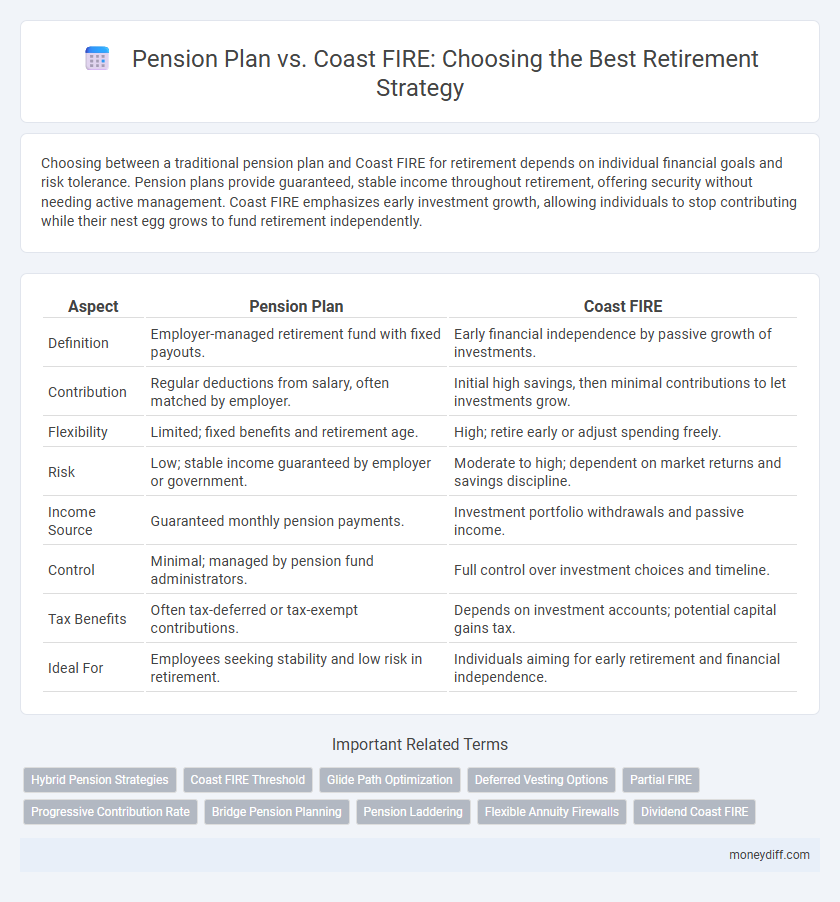

Choosing between a traditional pension plan and Coast FIRE for retirement depends on individual financial goals and risk tolerance. Pension plans provide guaranteed, stable income throughout retirement, offering security without needing active management. Coast FIRE emphasizes early investment growth, allowing individuals to stop contributing while their nest egg grows to fund retirement independently.

Table of Comparison

| Aspect | Pension Plan | Coast FIRE |

|---|---|---|

| Definition | Employer-managed retirement fund with fixed payouts. | Early financial independence by passive growth of investments. |

| Contribution | Regular deductions from salary, often matched by employer. | Initial high savings, then minimal contributions to let investments grow. |

| Flexibility | Limited; fixed benefits and retirement age. | High; retire early or adjust spending freely. |

| Risk | Low; stable income guaranteed by employer or government. | Moderate to high; dependent on market returns and savings discipline. |

| Income Source | Guaranteed monthly pension payments. | Investment portfolio withdrawals and passive income. |

| Control | Minimal; managed by pension fund administrators. | Full control over investment choices and timeline. |

| Tax Benefits | Often tax-deferred or tax-exempt contributions. | Depends on investment accounts; potential capital gains tax. |

| Ideal For | Employees seeking stability and low risk in retirement. | Individuals aiming for early retirement and financial independence. |

Understanding Pension Plans: Traditional Retirement Security

Pension plans provide a reliable stream of income during retirement, often guaranteed for life, making them a cornerstone of traditional retirement security. These defined benefit plans pool contributions from employees and employers, managing investments to ensure steady payouts regardless of market fluctuations. Understanding the stability and predictability of pension plans is essential when comparing them to Coast FIRE strategies, which rely on early investment growth and minimal ongoing contributions.

What is Coast FIRE? Early Financial Independence Explained

Coast FIRE refers to achieving enough savings early in life so that, with compounded growth, the investments will fund retirement without additional contributions. Unlike traditional pension plans that provide guaranteed income based on years of service and salary, Coast FIRE emphasizes financial independence through passive growth and minimal ongoing savings. This strategy allows individuals to stop or reduce work contributions and focus on lifestyle choices while retirement funds continue to grow untouched.

Key Differences Between Pension Plans and Coast FIRE

Pension plans provide a defined benefit with regular, guaranteed payments based on salary and years of service, ensuring steady retirement income without the need for active management. Coast FIRE involves saving aggressively early on to cover future retirement needs solely through investment growth, allowing individuals to stop contributions while maintaining financial independence later. The crucial difference lies in pension plans offering predictable, employer-backed security, whereas Coast FIRE depends on personal investment discipline and market performance.

Pros and Cons of Pension Plans for Retirement

Pension plans offer guaranteed, lifelong income which provides financial stability and reduces longevity risk, making them a reliable pillar for retirement security. However, they often lack flexibility, may have limited beneficiary options, and can be subject to inflation risk, potentially diminishing purchasing power over time. Dependence on employer solvency and limited control over investment strategies are additional drawbacks compared to more self-directed approaches like Coast FIRE.

Coast FIRE: Benefits and Drawbacks for Future Retirees

Coast FIRE allows individuals to stop contributing to retirement savings early while relying on compound interest to grow their existing investments until traditional retirement age. The benefits include financial freedom during prime earning years and reduced stress from aggressive saving, but the drawbacks involve vulnerability to market volatility and inability to boost retirement funds later if expenses rise. Future retirees must carefully evaluate their risk tolerance and long-term financial goals when choosing between a pension plan's guaranteed income and the self-directed growth strategy of Coast FIRE.

Assessing Risk: Pension Plans vs. Coast FIRE

Pension plans offer a stable, guaranteed income stream during retirement, reducing longevity and market risks through employer-backed benefits. Coast FIRE relies on accumulating sufficient investments early to grow passively, exposing individuals to market volatility and sequence of returns risk before full retirement. Evaluating risk tolerance and financial stability is crucial when choosing between the predictability of pension plans and the self-directed growth approach of Coast FIRE.

Flexibility and Control: Which Retirement Path Wins?

A Pension plan offers guaranteed income with limited flexibility, often tying retirees to fixed payout schedules and restricted access to funds. Coast FIRE, on the other hand, empowers individuals with greater control over investment choices and timing, enabling a customizable financial strategy tailored to changing lifestyle needs. Flexibility and control clearly favor Coast FIRE for those prioritizing autonomy in retirement planning.

Required Savings: Pension Plan Versus Coast FIRE Targets

Required savings for a traditional pension plan typically depend on years of service and salary history, offering a predictable income stream with minimal upfront capital. In contrast, Coast FIRE requires accumulating a specific investment amount early to allow compound growth to fund retirement without additional contributions. While pension plans emphasize steady employer contributions, Coast FIRE targets demand precise early savings aligned with investment returns to retire comfortably.

Combining Pension Plans with Coast FIRE: Is It Possible?

Combining pension plans with Coast FIRE is possible and can offer a balanced retirement strategy by leveraging guaranteed income from pensions alongside early financial independence through Coast FIRE savings. Pension plans provide a stable, lifelong income stream, while Coast FIRE emphasizes accumulating a sufficient nest egg early and allowing it to grow passively until retirement. This hybrid approach reduces reliance on market timing and enhances financial security by blending steady pension benefits with flexible, self-directed investment growth.

Choosing the Right Strategy: Factors to Consider for Your Retirement

Evaluating a pension plan versus Coast FIRE involves assessing factors such as risk tolerance, desired retirement age, and expected income stability. Pension plans offer guaranteed lifetime income, which appeals to those seeking financial security, while Coast FIRE requires aggressive early saving but provides flexibility and potential investment growth. Consider your personal financial goals, market conditions, and retirement lifestyle preferences to determine the optimal strategy for your retirement planning.

Related Important Terms

Hybrid Pension Strategies

Hybrid pension strategies combine the stability of traditional pension plans with the flexibility of Coast FIRE, enabling retirees to leverage guaranteed income streams while allowing investment growth to fund later years. This approach optimizes retirement security by balancing predictable pension benefits and early financial independence through disciplined saving and market appreciation.

Coast FIRE Threshold

The Coast FIRE threshold represents the amount of retirement savings required to allow investments to grow passively to the desired retirement corpus without additional contributions, contrasting with the steady, employer-managed accumulation typical of pension plans. Reaching this threshold early provides financial independence and flexibility, whereas traditional pension plans rely on fixed monthly benefits tied to years of service and salary history.

Glide Path Optimization

Glide Path Optimization strategically adjusts the asset allocation in a pension plan or Coast FIRE strategy to balance growth and risk over time, ensuring sustainable retirement income. Pension plans typically optimize glide paths to reduce market risk near retirement, whereas Coast FIRE emphasizes early accumulation with higher risk tolerance followed by a shift to preservation as the portfolio matures.

Deferred Vesting Options

Deferred vesting options in pension plans ensure employees gain full ownership of retirement benefits after a specified period, offering predictable income during retirement unlike Coast FIRE strategies that rely on early investment growth without ongoing contributions. Pension plans with deferred vesting provide stable, long-term financial security, while Coast FIRE requires disciplined saving and market-dependent portfolios to achieve financial independence before full retirement age.

Partial FIRE

Partial FIRE allows individuals to achieve financial independence without fully retiring, balancing a pension plan's steady income with Coast FIRE's emphasis on early saving growth. Combining a pension plan's guaranteed benefits with Coast FIRE's strategy of letting investments grow while working can optimize retirement security and flexibility.

Progressive Contribution Rate

A pension plan with a progressive contribution rate adjusts employee contributions based on income growth, ensuring a steadily increasing retirement fund that aligns with rising earnings. Coast FIRE relies on early, substantial investments growing passively without further contributions, prioritizing sufficient initial capital over progressive contribution adjustments.

Bridge Pension Planning

Bridge pension planning serves as a strategic approach in retirement by providing a temporary income source that covers essential expenses until Coast FIRE assets mature, ensuring financial stability without prematurely depleting retirement savings. This method optimizes cash flow management by leveraging pension benefits to bridge the gap, allowing for sustained accumulation of investments while maintaining lifestyle standards.

Pension Laddering

Pension laddering involves strategically timing pension payouts to create a reliable income stream that complements Coast FIRE, allowing retirees to minimize reliance on investment withdrawals while maximizing tax efficiency and long-term financial security. By aligning pension commencement ages with phases of Coast FIRE savings growth, this method optimizes cash flow management and mitigates inflation risk throughout retirement.

Flexible Annuity Firewalls

Flexible Annuity Firewalls offer a strategic advantage in retirement planning by combining the guaranteed income of a pension plan with the adaptable withdrawal rates of Coast FIRE, allowing retirees to balance stability and flexibility. This hybrid approach enables individuals to secure a steady income stream while preserving investment growth potential, minimizing longevity risk without sacrificing financial autonomy.

Dividend Coast FIRE

Dividend Coast FIRE leverages dividend-generating investments to cover future retirement expenses without further contributions, allowing investors to reach financial independence by letting their portfolio grow over time. Compared to traditional pension plans, Dividend Coast FIRE offers greater flexibility and control over investment choices, potentially yielding higher returns while reducing reliance on employer-sponsored benefits.

Pension plan vs Coast FIRE for retirement. Infographic

moneydiff.com

moneydiff.com