Traditional retirement accounts, such as 401(k)s and IRAs, offer tax advantages and structured saving plans designed for long-term growth and steady income after retirement. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving, investing, and frugality to achieve financial independence well before the typical retirement age. Both approaches require disciplined financial planning, but the FIRE movement prioritizes rapid wealth accumulation and lifestyle flexibility over conventional age-based retirement goals.

Table of Comparison

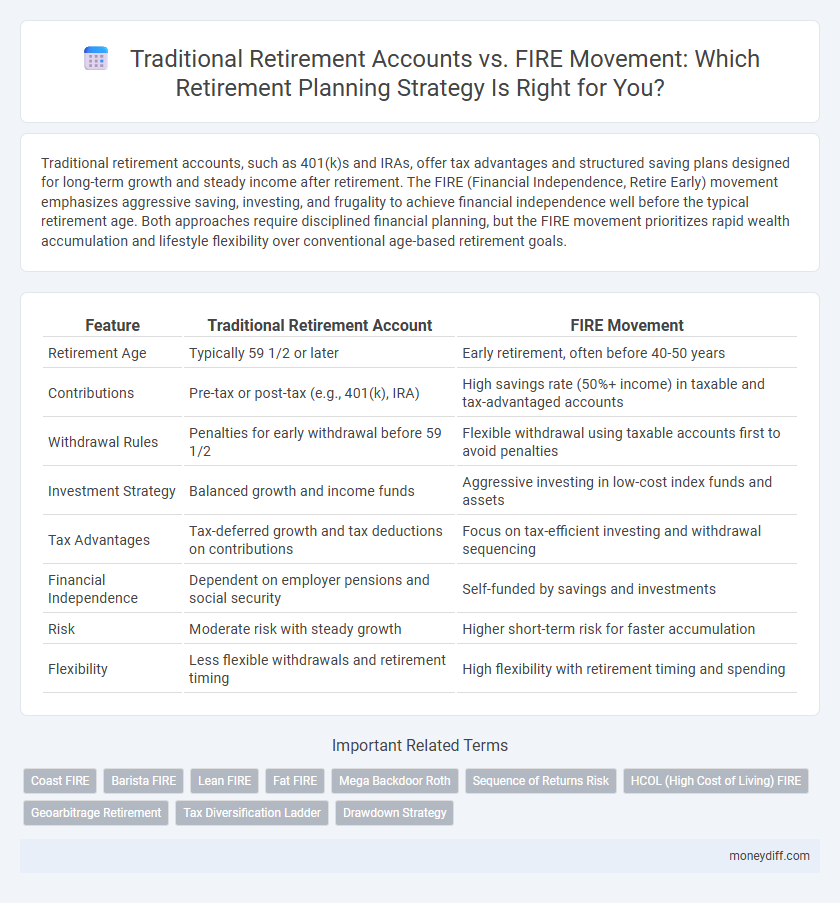

| Feature | Traditional Retirement Account | FIRE Movement |

|---|---|---|

| Retirement Age | Typically 59 1/2 or later | Early retirement, often before 40-50 years |

| Contributions | Pre-tax or post-tax (e.g., 401(k), IRA) | High savings rate (50%+ income) in taxable and tax-advantaged accounts |

| Withdrawal Rules | Penalties for early withdrawal before 59 1/2 | Flexible withdrawal using taxable accounts first to avoid penalties |

| Investment Strategy | Balanced growth and income funds | Aggressive investing in low-cost index funds and assets |

| Tax Advantages | Tax-deferred growth and tax deductions on contributions | Focus on tax-efficient investing and withdrawal sequencing |

| Financial Independence | Dependent on employer pensions and social security | Self-funded by savings and investments |

| Risk | Moderate risk with steady growth | Higher short-term risk for faster accumulation |

| Flexibility | Less flexible withdrawals and retirement timing | High flexibility with retirement timing and spending |

Understanding Traditional Retirement Accounts

Traditional retirement accounts such as 401(k)s and IRAs offer tax advantages that encourage long-term savings, with contributions often made pre-tax to reduce taxable income. These accounts typically impose penalties for early withdrawals before age 59 1/2, making them less flexible compared to strategies favored by the FIRE (Financial Independence, Retire Early) movement. Understanding contribution limits, tax implications, and withdrawal rules is crucial for optimizing retirement planning within traditional accounts.

What Is the FIRE Movement?

The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve financial independence well before traditional retirement age, often in one's 30s or 40s. Unlike Traditional Retirement Accounts, which are designed for gradual wealth accumulation with tax advantages and age-based withdrawal restrictions, the FIRE strategy prioritizes maximizing savings rate and investing in diversified assets for early withdrawal flexibility. This approach reshapes retirement planning by focusing on reducing expenses, increasing passive income streams, and achieving early financial freedom rather than relying solely on conventional retirement timelines.

Core Differences Between Traditional Retirement and FIRE

Traditional retirement accounts, such as 401(k) and IRAs, emphasize steady contributions and tax-deferred growth with the goal of comfort in later years at a standard retirement age. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving, high investment returns, and extreme frugality to achieve financial independence and retire significantly earlier than traditional timelines. Core differences include the speed of wealth accumulation, risk tolerance, lifestyle choices, and flexibility in work and spending habits during retirement planning.

Contribution Limits and Savings Strategies

Traditional Retirement Accounts like 401(k)s and IRAs enforce annual contribution limits of $22,500 for 401(k)s and $6,500 for IRAs as of 2024, guiding savings strategies with tax advantages and required minimum distributions. The FIRE Movement emphasizes aggressive savings, often targeting 50-70% of income, using both tax-advantaged accounts and taxable investments to bypass contribution limits and achieve early financial independence. Optimizing contributions while diversifying savings vehicles enhances retirement readiness and aligns with individual goals in conventional versus FIRE retirement planning approaches.

Withdrawal Rules and Early Access to Funds

Traditional Retirement Accounts like 401(k)s and IRAs enforce strict withdrawal rules, often penalizing distributions taken before age 59 1/2, which can limit early access to funds. In contrast, the FIRE (Financial Independence, Retire Early) movement emphasizes strategies such as Roth IRA conversions and taxable investment accounts to enable flexible withdrawals before traditional retirement age without penalties. Understanding these differences is crucial for effective retirement planning and optimizing access to funds during early retirement phases.

Investment Approaches: Traditional vs. FIRE

Traditional retirement accounts prioritize steady contributions to tax-advantaged vehicles like 401(k)s and IRAs, emphasizing long-term growth through diversified, often conservative investments. The FIRE (Financial Independence, Retire Early) movement advocates aggressive savings and high-risk, high-reward strategies, including substantial equity exposure and alternative assets to accelerate wealth accumulation. Both approaches revolve around investment discipline, but the FIRE strategy demands higher risk tolerance and a significant percentage of income allocated to investments compared to the incremental and balanced investment style of traditional retirement planning.

Tax Implications in Each Strategy

Traditional retirement accounts, such as 401(k)s and IRAs, offer tax-deferred growth where contributions reduce taxable income, but withdrawals during retirement are taxed as ordinary income. The FIRE (Financial Independence, Retire Early) movement emphasizes maximizing savings and investments outside tax-advantaged accounts, often resulting in higher current taxable income but potentially greater tax diversification. Understanding tax implications, including potential early withdrawal penalties in traditional accounts versus capital gains taxes in taxable investment accounts, is critical for optimizing each strategy's retirement planning benefits.

Pros and Cons: Traditional Retirement Accounts

Traditional retirement accounts, such as 401(k)s and IRAs, provide tax-deferred growth and often include employer matching contributions, boosting long-term savings potential. However, these accounts impose mandatory withdrawal rules starting at age 73, which can limit flexibility and may increase taxable income in retirement. While they offer a structured and secure path to accumulate funds, their reliance on age-based restrictions contrasts with the financial independence and early retirement goals emphasized by the FIRE movement.

Pros and Cons: FIRE Movement

The FIRE Movement emphasizes aggressive saving and investing to achieve financial independence and retire early, offering the advantage of greater life flexibility and the ability to pursue passions sooner. However, it demands strict budgeting, high savings rates often exceeding 50%, and assumes consistent market returns, which can be risky and stressful. Unlike Traditional Retirement Accounts, which provide tax advantages and a more gradual saving approach, FIRE requires significant lifestyle sacrifices that may not be sustainable for everyone.

Which Retirement Path Fits Your Money Goals?

Traditional retirement accounts, like 401(k)s and IRAs, offer tax advantages and structured growth aimed at long-term financial security, ideal for those prioritizing steady income and conventional retirement timelines. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement, appealing to individuals seeking flexibility and control over their money goals. Evaluating your risk tolerance, desired retirement age, and lifestyle aspirations is crucial to determining which path aligns best with your financial objectives.

Related Important Terms

Coast FIRE

Traditional retirement accounts such as 401(k)s and IRAs provide tax-advantaged savings with penalties for early withdrawal, emphasizing long-term accumulation until a typical retirement age. The Coast FIRE approach advocates achieving enough savings early to let investments grow passively without additional contributions, enabling financial independence and flexible retirement timing well before traditional ages.

Barista FIRE

Traditional retirement accounts like 401(k)s and IRAs offer tax advantages and structured saving options ideal for long-term growth, whereas the Barista FIRE strategy combines part-time work with lower expenses to achieve early retirement with financial flexibility. Barista FIRE emphasizes maintaining healthcare benefits and a steady income stream through reduced work hours, providing a practical alternative to fully quitting employment while pursuing financial independence.

Lean FIRE

Traditional retirement accounts like 401(k)s and IRAs offer tax advantages and employer matching benefits that support long-term wealth accumulation. Lean FIRE emphasizes aggressive saving and frugal living to achieve early retirement with minimal expenses, challenging conventional retirement timelines by prioritizing financial independence over traditional income replacement strategies.

Fat FIRE

Fat FIRE emphasizes achieving a high-retirement income through aggressive saving and investment strategies, contrasting with Traditional Retirement Accounts that focus on tax-deferred growth and long-term compounding. The FIRE movement prioritizes financial independence by early retirement, often requiring a savings rate exceeding 50% of income, while Traditional Retirement Accounts typically involve steady contributions until reaching the standard retirement age.

Mega Backdoor Roth

The Mega Backdoor Roth strategy allows high-income earners to maximize Roth IRA contributions beyond standard limits by leveraging after-tax 401(k) contributions, aligning closely with the FIRE movement's emphasis on early financial independence through aggressive savings and tax-efficient growth. In contrast, traditional retirement accounts offer tax-deferred growth but often lack the flexibility and accelerated wealth-building potential that Mega Backdoor Roth contributions provide for fast-tracking retirement goals.

Sequence of Returns Risk

Traditional Retirement Accounts rely heavily on consistent market returns, making them vulnerable to Sequence of Returns Risk during the withdrawal phase. In contrast, the FIRE Movement emphasizes aggressive savings and early withdrawals, requiring robust strategies to mitigate the impact of negative early returns on portfolio longevity.

HCOL (High Cost of Living) FIRE

Traditional retirement accounts like 401(k)s and IRAs offer tax advantages and long-term growth for high-cost-of-living (HCOL) areas, but the FIRE movement emphasizes aggressive saving and investing to achieve early financial independence despite higher housing and living expenses. HCOL FIRE strategies often require higher savings rates and diversified income streams to offset increased living costs while maintaining the goal of early retirement.

Geoarbitrage Retirement

Traditional retirement accounts like 401(k)s and IRAs offer tax advantages and stable growth for long-term savings, while the FIRE movement emphasizes aggressive saving and investing to achieve financial independence early, often leveraging geoarbitrage by relocating to lower-cost regions to extend retirement funds. Geoarbitrage retirement strategies optimize living expenses and maximize investment withdrawals, enabling retirees to maintain a higher standard of living compared to traditional retirement plans tied to fixed incomes in high-cost areas.

Tax Diversification Ladder

Traditional retirement accounts like 401(k)s and IRAs offer tax-deferred growth and potential tax deductions on contributions, creating a foundation for tax diversification through deferred income. The FIRE (Financial Independence, Retire Early) movement emphasizes building a tax diversification ladder by integrating Roth IRAs, taxable brokerage accounts, and traditional accounts to optimize withdrawal strategies and minimize tax burdens throughout retirement.

Drawdown Strategy

Traditional Retirement Accounts typically rely on systematic withdrawals after age 59 1/2, balancing required minimum distributions with tax implications, whereas the FIRE Movement emphasizes aggressive savings and early withdrawal strategies, often leveraging Roth IRAs or taxable accounts to avoid penalties. Effective drawdown strategies in FIRE prioritize preserving capital through flexible spending rates and sequence of return risk management, contrasting with the more rigid, age-based withdrawal guidelines of traditional plans.

Traditional Retirement Account vs FIRE Movement for retirement planning Infographic

moneydiff.com

moneydiff.com