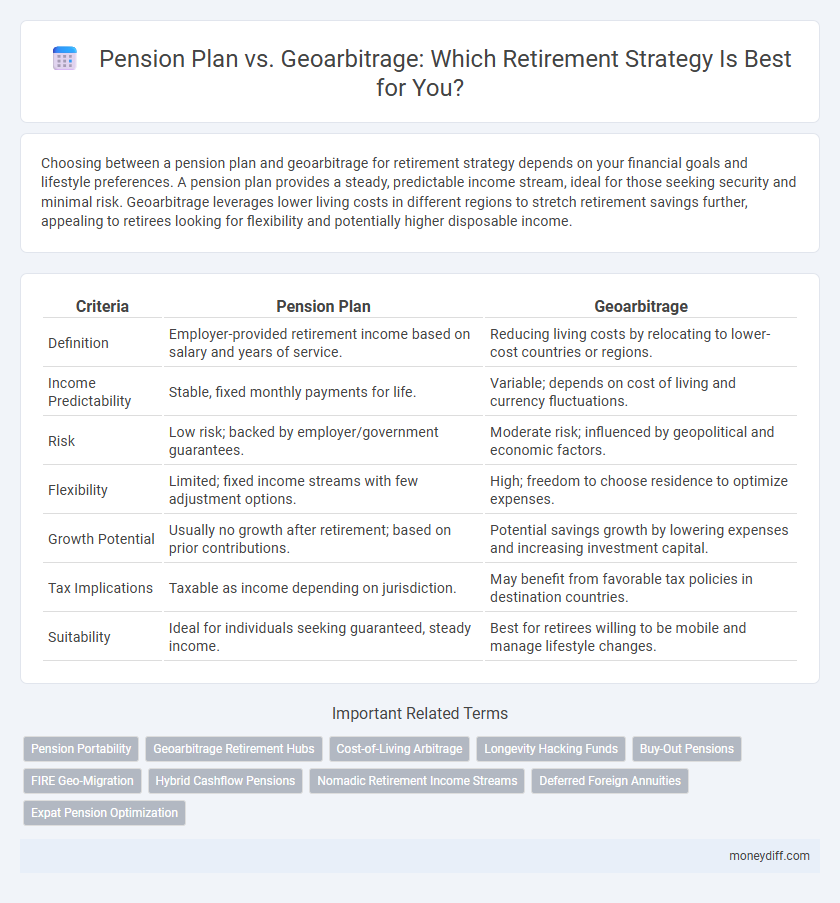

Choosing between a pension plan and geoarbitrage for retirement strategy depends on your financial goals and lifestyle preferences. A pension plan provides a steady, predictable income stream, ideal for those seeking security and minimal risk. Geoarbitrage leverages lower living costs in different regions to stretch retirement savings further, appealing to retirees looking for flexibility and potentially higher disposable income.

Table of Comparison

| Criteria | Pension Plan | Geoarbitrage |

|---|---|---|

| Definition | Employer-provided retirement income based on salary and years of service. | Reducing living costs by relocating to lower-cost countries or regions. |

| Income Predictability | Stable, fixed monthly payments for life. | Variable; depends on cost of living and currency fluctuations. |

| Risk | Low risk; backed by employer/government guarantees. | Moderate risk; influenced by geopolitical and economic factors. |

| Flexibility | Limited; fixed income streams with few adjustment options. | High; freedom to choose residence to optimize expenses. |

| Growth Potential | Usually no growth after retirement; based on prior contributions. | Potential savings growth by lowering expenses and increasing investment capital. |

| Tax Implications | Taxable as income depending on jurisdiction. | May benefit from favorable tax policies in destination countries. |

| Suitability | Ideal for individuals seeking guaranteed, steady income. | Best for retirees willing to be mobile and manage lifestyle changes. |

Understanding Pension Plans: Basics and Benefits

Pension plans provide a reliable, lifelong income stream based on years of service and salary history, offering financial security during retirement. They often include survivor benefits and cost-of-living adjustments, shielding retirees from inflation and longevity risks. Understanding pension plans helps retirees evaluate guaranteed income versus the flexible but variable returns from geoarbitrage strategies.

What is Geoarbitrage? An Overview for Retirees

Geoarbitrage involves relocating to a region with a lower cost of living to stretch retirement savings further, offering retirees greater financial flexibility compared to traditional pension plans. By optimizing expenses through geographic moves, retirees can maintain or improve their quality of life without increasing their income. This strategy contrasts with fixed pension income, allowing for dynamic adjustments based on local economic conditions and lifestyle preferences.

Comparing Financial Security: Pension Plan vs Geoarbitrage

Pension plans provide guaranteed monthly income streams based on years of service and salary history, ensuring predictable financial security in retirement. Geoarbitrage leverages cost-of-living differences between locations, enabling retirees to stretch savings by living in lower-cost regions while maintaining a similar or higher quality of life. Evaluating pension plan stability against the flexibility and potential savings of geoarbitrage helps retirees optimize long-term financial resilience.

Cost of Living Considerations in Retirement Strategies

Pension plans provide a stable, predictable income stream during retirement, but their fixed payments may not keep pace with regional cost of living variations. Geoarbitrage leverages lower-cost locations to maximize purchasing power, allowing retirees to stretch savings further and improve lifestyle affordability. Evaluating retirement strategies with a focus on cost of living can enhance financial security and optimize retirement income longevity.

Flexibility and Lifestyle: Pension vs Geoarbitrage Retirees

Pension plans offer retirees a predictable income stream with minimal effort, providing financial stability but limited flexibility in lifestyle choices and location. Geoarbitrage enables retirees to maximize their purchasing power by relocating to lower-cost regions, enhancing lifestyle options and financial freedom but requiring active management and adaptability. Choosing between a pension plan and geoarbitrage depends on prioritizing stable income versus flexible living arrangements and potential cost savings.

Risks and Challenges of Relying on Pension Plans

Relying on pension plans for retirement poses risks such as potential underfunding, reduced payouts due to market volatility, and changes in government policies that can diminish benefits. Pension plans may also lack flexibility, leaving retirees vulnerable to inflation and unexpected economic shifts. Geoarbitrage offers an alternative by leveraging lower living costs abroad, but it requires careful planning to navigate legal, tax, and healthcare challenges.

Geoarbitrage: Pros, Cons, and Real-World Examples

Geoarbitrage leverages cost-of-living differences by relocating to affordable regions, maximizing retirement savings and enhancing quality of life. Pros include lower expenses, increased purchasing power, and exposure to new cultures, while cons involve potential healthcare access issues, currency risks, and social isolation. Real-world examples include retirees moving from high-cost cities in the U.S. to Mexico, Portugal, or Thailand to stretch pension benefits and maintain a comfortable lifestyle.

Tax Implications: Staying Local vs Retiring Abroad

Retiring abroad through geoarbitrage often provides significant tax advantages, such as lower income tax rates and favorable treatment of foreign pensions, compared to staying local where pension income may be heavily taxed. Many countries offer tax treaties that can reduce double taxation but require careful planning to maximize benefits. Understanding the specific tax implications of local pension plans versus foreign residency is crucial to optimize after-tax retirement income.

Factors to Consider Before Choosing Your Retirement Strategy

When choosing between a pension plan and geoarbitrage as a retirement strategy, factors such as income stability, cost of living, and tax implications must be carefully evaluated. Pension plans offer predictable monthly income but may lack flexibility, while geoarbitrage can reduce living expenses by relocating to lower-cost regions, enhancing retirement savings longevity. Healthcare accessibility, currency risk, and lifestyle preferences also play critical roles in determining the optimal approach for long-term financial security.

Which Retirement Path Suits You: Pension Plan or Geoarbitrage?

Choosing between a pension plan and geoarbitrage for retirement hinges on factors like financial stability, lifestyle preferences, and risk tolerance. Pension plans offer guaranteed income and long-term security, ideal for those valuing consistent cash flow and minimal management. Geoarbitrage leverages cost-of-living differences by relocating to lower-expense regions, maximizing retirement funds but requiring adaptability and proactive planning.

Related Important Terms

Pension Portability

Pension portability allows retirees to transfer their earned benefits across different regions or countries, enhancing flexibility compared to geoarbitrage strategies that rely on relocating to lower-cost areas for retirement income maximization. While geoarbitrage leverages local cost-of-living differences, pension portability ensures stable, long-term income without the need for frequent relocations or financial risk exposure related to currency fluctuations and foreign tax laws.

Geoarbitrage Retirement Hubs

Geoarbitrage retirement hubs such as Chiang Mai, Mexico City, and Lisbon offer significantly lower living costs, enabling retirees to maximize their pension plans' value while enjoying high-quality healthcare and vibrant local cultures. Unlike traditional pension plans tied to fixed income in high-cost regions, geoarbitrage leverages global economic disparities to stretch retirement savings further and enhance lifestyle flexibility.

Cost-of-Living Arbitrage

Pension plans provide guaranteed income based on contributions and years of service, offering financial stability during retirement, while geoarbitrage leverages lower cost-of-living locations to maximize purchasing power and stretch retirement savings further. Cost-of-living arbitrage in geoarbitrage allows retirees to maintain or improve their quality of life by relocating to affordable regions with favorable economic conditions and lower housing, healthcare, and daily expenses.

Longevity Hacking Funds

Pension plans offer stable, lifetime income streams crucial for longevity hacking funds by ensuring consistent cash flow during extended retirements. Geoarbitrage enhances retirement strategy by leveraging lower-cost living regions to stretch pension payouts, maximizing financial sustainability over prolonged lifespans.

Buy-Out Pensions

Buy-out pensions provide retirees with a lump sum payment or guaranteed income stream secured by an insurance company, offering stability and reduced longevity risk compared to self-managed pension plans. Geoarbitrage leverages lower cost-of-living regions to stretch retirement income, but may involve currency risk and healthcare accessibility challenges absent in buy-out pension strategies.

FIRE Geo-Migration

A Pension Plan provides a predictable income stream based on years of service and contributions, ensuring financial security during retirement, while Geoarbitrage leverages relocating to lower-cost regions to extend savings and accelerate achieving Financial Independence, Retire Early (FIRE) goals. FIRE Geo-Migration strategically combines location-based cost reductions with investment growth, maximizing retirement lifestyle flexibility beyond traditional pension constraints.

Hybrid Cashflow Pensions

Hybrid cashflow pensions integrate guaranteed income from traditional pension plans with flexible withdrawals enabled by geoarbitrage, optimizing retirement funds by balancing stability and cost-effective living expenses. This strategy leverages pension security while maximizing purchasing power in lower-cost regions, providing diversified income streams and enhancing long-term financial resilience.

Nomadic Retirement Income Streams

Pension plans offer stable, predictable income streams based on years of service, providing financial security during retirement, while geoarbitrage leverages lower cost-of-living areas to maximize retirement savings and extend income longevity. Nomadic retirement strategies benefit from geoarbitrage by combining flexible destination choices with diverse income sources, optimizing cash flow in varying economic environments.

Deferred Foreign Annuities

Deferred foreign annuities offer a tax-advantaged retirement income stream that can complement or outperform traditional pension plans by leveraging geoarbitrage opportunities. Utilizing lower-cost living abroad combined with deferred payouts maximizes retirement savings growth and enhances purchasing power in retirement destinations.

Expat Pension Optimization

Expat pension optimization leverages geoarbitrage by relocating to countries with lower living costs and favorable tax treaties, maximizing pension income and extending retirement funds. Strategic pension plan selection combined with cost-effective international living creates a robust framework for sustainable wealth preservation in retirement.

Pension Plan vs Geoarbitrage for retirement strategy Infographic

moneydiff.com

moneydiff.com