Traditional pension plans offer stable, predictable income streams backed by established financial institutions, ensuring a reliable foundation for retirement savings. Cryptopensions leverage blockchain technology to provide greater transparency, flexibility, and potential for higher returns but carry increased volatility and regulatory uncertainties. Choosing between the two depends on individual risk tolerance, investment goals, and preference for innovation versus security.

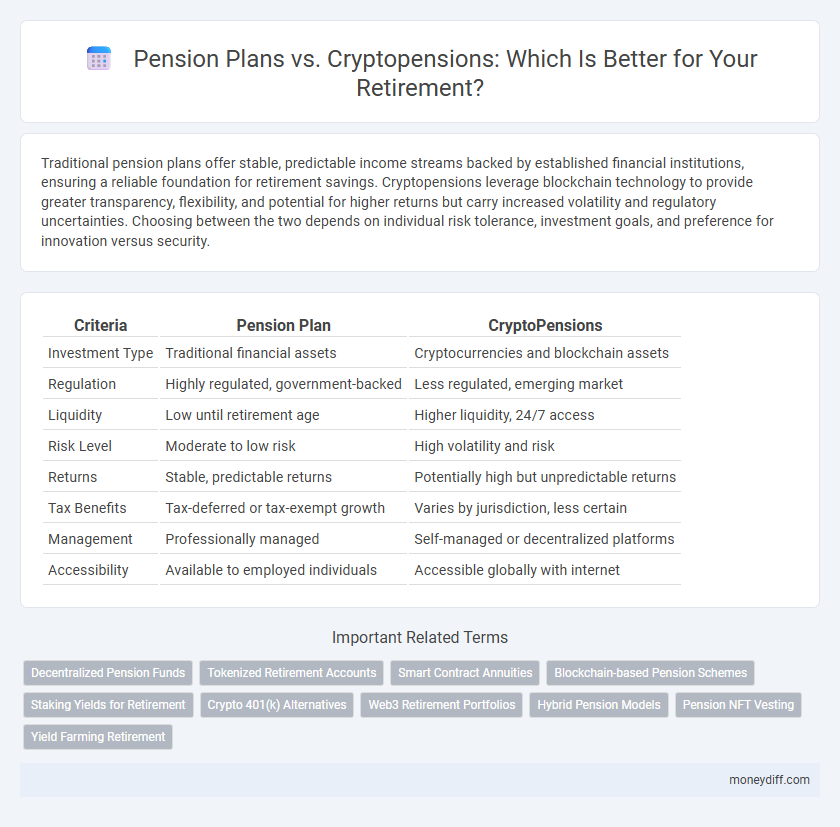

Table of Comparison

| Criteria | Pension Plan | CryptoPensions |

|---|---|---|

| Investment Type | Traditional financial assets | Cryptocurrencies and blockchain assets |

| Regulation | Highly regulated, government-backed | Less regulated, emerging market |

| Liquidity | Low until retirement age | Higher liquidity, 24/7 access |

| Risk Level | Moderate to low risk | High volatility and risk |

| Returns | Stable, predictable returns | Potentially high but unpredictable returns |

| Tax Benefits | Tax-deferred or tax-exempt growth | Varies by jurisdiction, less certain |

| Management | Professionally managed | Self-managed or decentralized platforms |

| Accessibility | Available to employed individuals | Accessible globally with internet |

Understanding Traditional Pension Plans

Traditional pension plans rely on employer-funded contributions to provide retirees with stable, predictable income streams based on salary history and years of service. These defined benefit plans are regulated and insured, offering security and longevity protection that cryptocurrency pensions currently lack due to volatility and regulatory uncertainty. Understanding the structure and guarantees of traditional pensions helps retirees evaluate the risk and stability compared to emerging cryptopension options.

What Are Cryptopensions?

Cryptopensions are decentralized digital retirement funds leveraging blockchain technology to offer transparency, security, and potentially higher returns compared to traditional pension plans. Unlike conventional pensions managed by financial institutions, cryptopensions operate via smart contracts, enabling automated, trustless transactions that reduce administrative costs and enhance user control over assets. These innovative pension schemes also provide access to global investment opportunities through cryptocurrencies, appealing to tech-savvy retirees seeking diversification beyond traditional markets.

Key Differences Between Pension Plans and Cryptopensions

Traditional pension plans offer fixed, employer-managed retirement benefits with predictable payouts based on salary and years of service, ensuring stability and regulatory protection. Cryptopensions leverage blockchain technology to provide decentralized, self-managed retirement funds with potential for higher returns but increased volatility and regulatory uncertainty. The key differences lie in control, transparency, risk exposure, and reliance on traditional financial systems versus emerging digital assets.

Risks and Security in Pension Solutions

Traditional pension plans offer regulatory oversight and established legal protections that reduce risks related to fund mismanagement and fraud. Cryptopensions provide higher transparency through blockchain technology but face security risks including cyberattacks, hacking vulnerabilities, and regulatory uncertainties. Evaluating pension solutions requires balancing the stability and insurance features of traditional plans against the innovative but potentially volatile nature of crypto-based retirement funds.

Growth Potential: Comparing Returns

Traditional pension plans offer steady, predictable returns based on fixed interest rates and investment portfolios managed by financial institutions. Cryptopensions, leveraging blockchain technology and decentralized finance, present higher growth potential through exposure to volatile but high-yield digital assets like cryptocurrencies and tokenized investments. While cryptopensions can deliver significant returns in bullish markets, they also carry increased risk compared to the conservative growth typical of conventional pension plans.

Regulation and Legal Protections

Pension plans are typically governed by strict regulatory frameworks such as ERISA in the United States, providing participants with strong legal protections, fiduciary oversight, and government-backed insurance through entities like the Pension Benefit Guaranty Corporation (PBGC). Cryptopensions operate in a relatively nascent and less regulated environment, exposing investors to heightened risks related to regulatory uncertainty, lack of standardized legal safeguards, and potential vulnerability to fraud or platform insolvency. Understanding the differences in regulatory oversight and legal protections is crucial for individuals assessing the security and legitimacy of retirement savings options.

Accessibility and Flexibility Explained

Pension plans traditionally offer structured retirement savings with fixed contributions and regulated payouts, ensuring consistent income but limited flexibility in accessing funds before retirement age. Crypto pensions provide enhanced accessibility by allowing users to manage and withdraw digital assets more freely, often without the strict vesting periods imposed by conventional plans. The decentralized nature of crypto pensions also supports greater flexibility in investment choices and portfolio adjustments, catering to diverse risk appetites and financial goals.

Tax Implications: Pension Plans vs Cryptopensions

Traditional pension plans offer tax-deferred growth, allowing contributions to reduce taxable income and taxes to be paid upon withdrawal, often during retirement when income may be lower. Cryptopensions, relying on cryptocurrency investments, face complex tax implications due to volatility, potential capital gains taxes on transactions, and regulatory uncertainties varying by jurisdiction. Careful tax planning is essential for cryptopensions to optimize benefits and avoid unforeseen liabilities compared to the more established tax advantages of conventional pension plans.

Which Option is Right For Your Retirement Goals?

Pension plans offer traditional, stable income streams backed by established financial institutions, ideal for retirees seeking low-risk, predictable returns. Cryptopensions leverage blockchain technology to provide potentially higher yields and increased portfolio diversification but come with greater market volatility and regulatory uncertainty. Assess your risk tolerance, retirement timeline, and desired income stability to determine whether the security of a pension plan or the innovation of cryptopensions aligns best with your long-term retirement goals.

The Future of Retirement: Blending Pensions with Crypto

Blending traditional pension plans with crypto pensions offers a diversified approach to retirement planning, leveraging the stability of regulated funds and the growth potential of blockchain assets. Crypto pensions provide increased flexibility, transparent transactions, and potential for higher returns through decentralized finance, appealing to tech-savvy investors. Integrating these options can create a resilient retirement strategy that balances risk and innovation in the evolving financial landscape.

Related Important Terms

Decentralized Pension Funds

Decentralized pension funds leverage blockchain technology to offer transparent, secure, and user-controlled retirement savings, reducing reliance on traditional pension plans that often face regulatory and solvency challenges. These crypto pensions enable participants to manage assets in a trustless environment, potentially yielding higher returns through decentralized finance (DeFi) protocols compared to conventional pension funds constrained by regulatory frameworks.

Tokenized Retirement Accounts

Tokenized Retirement Accounts leverage blockchain technology to offer increased transparency, liquidity, and fractional ownership compared to traditional pension plans, enabling beneficiaries to manage and transfer assets effortlessly. These crypto-based pension alternatives provide diversified investment opportunities within decentralized finance ecosystems, potentially enhancing retirement portfolio yields while mitigating risks associated with centralized fund management.

Smart Contract Annuities

Smart Contract Annuities offer a decentralized alternative to traditional pension plans by automating payments and reducing administrative costs through blockchain technology. This innovation ensures transparency, security, and real-time adjustments, enhancing retirement income reliability compared to conventional pension schemes.

Blockchain-based Pension Schemes

Blockchain-based pension schemes offer enhanced transparency, security, and real-time auditing compared to traditional pension plans, reducing the risk of fraud and mismanagement. Cryptopensions enable decentralized management and global accessibility, allowing participants greater control over their retirement assets through smart contracts and tokenization.

Staking Yields for Retirement

Pension plans offer stable, predictable returns with modest growth, while cryptopensions using staking yields can provide significantly higher annual returns, often ranging from 5% to 15%, enhancing retirement income potential. However, staking yields in decentralized finance are subject to market volatility and regulatory risks, contrasting with the security and regulatory oversight of traditional pension plans.

Crypto 401(k) Alternatives

Crypto 401(k) alternatives offer decentralized, blockchain-based retirement savings with potential for higher returns through cryptocurrency investments compared to traditional pension plans, which typically provide fixed, regulated benefits. These modern crypto pensions enable greater portfolio diversification and tax advantages but come with increased volatility and regulatory uncertainty.

Web3 Retirement Portfolios

Web3 retirement portfolios integrate cryptopensions, leveraging blockchain technology to offer decentralized, transparent, and customizable retirement savings compared to traditional pension plans. These cryptopensions provide enhanced liquidity, reduced fees, and potential for higher returns through digital asset diversification within smart contract-governed ecosystems.

Hybrid Pension Models

Hybrid pension models combine traditional pension plans with cryptopensions to diversify retirement income streams, leveraging the stability of employer-sponsored funds alongside the growth potential of blockchain-based assets. These models optimize risk management by integrating regulated pension contributions with decentralized finance, offering retirement portfolios resilience against market volatility and inflation.

Pension NFT Vesting

Pension NFT vesting offers a transparent, blockchain-based alternative to traditional pension plans by enabling secure, time-locked digital asset allocations that ensure gradual access to retirement funds. Unlike conventional pensions, these crypto pensions provide enhanced liquidity, programmable vesting schedules, and verifiable ownership, transforming retirement planning through decentralized finance.

Yield Farming Retirement

Pension plans typically offer stable, government-backed returns with predictable payouts, while cryptopensions leveraging yield farming provide higher potential yields through decentralized finance protocols but come with increased volatility and risk. Yield farming for retirement involves staking cryptocurrencies in liquidity pools to earn compound interest, presenting an innovative yet speculative alternative to traditional pension schemes.

Pension plan vs cryptopensions for retirement. Infographic

moneydiff.com

moneydiff.com