Choosing between Social Security and a bridge strategy for retirement cash flow depends on timing and income needs. Claiming Social Security benefits early may reduce monthly payments, while a bridge strategy uses short-term assets or part-time work to cover expenses until full benefits begin. Balancing these options can optimize retirement income and ensure financial stability throughout retirement years.

Table of Comparison

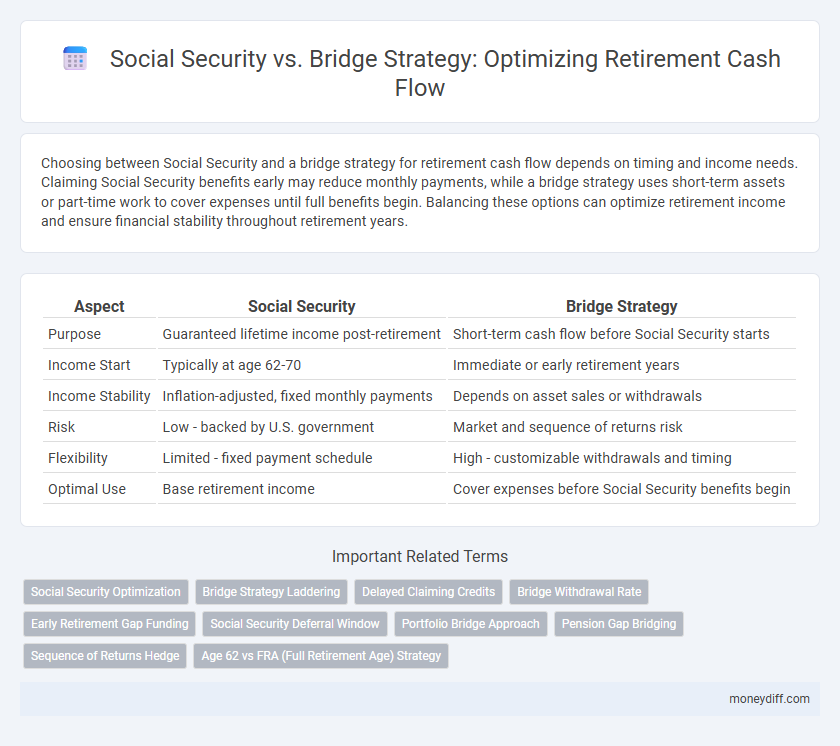

| Aspect | Social Security | Bridge Strategy |

|---|---|---|

| Purpose | Guaranteed lifetime income post-retirement | Short-term cash flow before Social Security starts |

| Income Start | Typically at age 62-70 | Immediate or early retirement years |

| Income Stability | Inflation-adjusted, fixed monthly payments | Depends on asset sales or withdrawals |

| Risk | Low - backed by U.S. government | Market and sequence of returns risk |

| Flexibility | Limited - fixed payment schedule | High - customizable withdrawals and timing |

| Optimal Use | Base retirement income | Cover expenses before Social Security benefits begin |

Understanding Social Security Benefits for Retirees

Social Security benefits provide a guaranteed lifetime income based on an individual's earnings history and claiming age, offering a foundational cash flow source during retirement. Understanding the optimal claiming strategy, such as delaying benefits to increase monthly payments or claiming early based on financial needs, is crucial for maximizing Social Security's value. Comparing this with a bridge strategy, which uses personal savings to cover expenses before Social Security begins, helps retirees balance liquidity and income stability for a sustainable retirement cash flow.

What Is the Bridge Strategy in Retirement Planning?

The Bridge Strategy in retirement planning involves using non-Social Security income sources, such as personal savings or pensions, to cover expenses before claiming Social Security benefits at full retirement age or later. This approach allows retirees to delay Social Security, increasing their eventual monthly payments and maximizing lifetime benefits. By bridging the cash flow gap, individuals enhance financial security and optimize Social Security's value in their retirement portfolio.

Comparing Social Security and Bridge Strategy: Key Differences

Social Security provides guaranteed lifetime income starting at age 62, offering inflation protection and spousal benefits, whereas the Bridge Strategy involves using personal savings or investments to cover expenses before claiming Social Security. The Bridge Strategy allows for delayed Social Security benefits, resulting in a higher monthly payout, but requires sufficient liquid assets to fund early retirement years. Understanding the trade-off between guaranteed income and upfront liquidity is crucial for optimizing retirement cash flow.

Timing Social Security: Early vs Delayed Claiming Options

Delaying Social Security benefits until full retirement age or beyond increases monthly payouts by approximately 8% per year, maximizing lifetime income for many retirees. Early claiming at age 62 reduces benefits by about 25-30%, which may create a cash flow gap unless supplemented by a bridge strategy using personal savings or part-time income. Strategic timing of Social Security combined with effective bridge solutions optimizes retirement cash flow and mitigates longevity risk.

How the Bridge Strategy Replaces Early Social Security Income

The Bridge Strategy replaces early Social Security income by utilizing taxable investment accounts to generate cash flow during the initial retirement years before claiming Social Security benefits. This approach preserves Social Security annual increases by delaying benefits until full retirement age or later, maximizing monthly payments and lifetime income potential. Investors optimize tax efficiency and retirement sustainability by strategically drawing from taxable accounts first, ensuring Social Security benefits remain untouched until they yield the greatest advantage.

Financial Implications: Longevity and Sustainable Cash Flow

The Social Security vs Bridge Strategy impacts retirement cash flow by balancing longevity risk and sustainable income streams. Claiming Social Security benefits early reduces monthly payments, potentially depleting funds in longer lifespans, whereas using a bridge strategy with taxable accounts delays Social Security, enhancing future cash flow sustainability. Effective management of withdrawal rates and sequencing income sources ensures optimal financial outcomes throughout extended retirement horizons.

Tax Considerations: Social Security vs Bridge Withdrawals

Social Security benefits are taxed based on combined income, with up to 85% potentially subject to federal taxes, impacting net retirement cash flow. Bridge withdrawals from tax-deferred accounts like IRAs or 401(k)s are fully taxable as ordinary income, possibly pushing retirees into higher tax brackets if not managed carefully. Strategic timing and coordination of Social Security claiming with bridge withdrawals can optimize tax efficiency and maximize after-tax income during retirement.

Risk Management in Retirement Income Strategies

The Bridge Strategy in retirement income focuses on mitigating longevity risk by providing cash flow before Social Security benefits begin, ensuring seamless income without depleting assets prematurely. Social Security offers guaranteed lifetime income protected from market volatility, serving as a foundational risk management tool in retirement planning. Combining a Bridge Strategy with Social Security optimizes portfolio longevity and reduces exposure to sequence-of-returns risk during market downturns.

Which Strategy Suits Different Retirement Lifestyles?

Social Security provides a guaranteed monthly income that suits retirees seeking stable, lifelong cash flow, especially those with moderate expenses and conservative investment approaches. The Bridge Strategy, which involves delaying Social Security benefits while using other assets for income, fits retirees with higher risk tolerance and flexible lifestyles who expect to maximize long-term benefits. Choosing the right strategy depends on factors like health status, desired lifestyle, and other income sources, making personalized financial planning essential.

Steps to Evaluate and Choose Your Optimal Retirement Cash Flow

Evaluate your retirement cash flow by analyzing projected Social Security benefits and potential bridge income sources like part-time work or investment withdrawals. Calculate the timing and amount of Social Security claiming to maximize lifetime benefits, considering factors such as breakeven age and life expectancy. Compare net cash flow scenarios to determine the optimal blend that sustains your desired retirement lifestyle while minimizing risk and tax impact.

Related Important Terms

Social Security Optimization

Maximizing Social Security benefits through delayed claiming until full retirement age or beyond significantly enhances guaranteed lifetime income, reducing the risk of outliving assets. Incorporating a Social Security optimization strategy within a bridge plan ensures a stable cash flow while other retirement accounts grow, improving overall financial security.

Bridge Strategy Laddering

Bridge Strategy Laddering enhances retirement cash flow by strategically timing withdrawals from taxable, tax-deferred, and tax-exempt accounts to fill income gaps before Social Security benefits commence. This method optimizes tax efficiency and preserves Social Security's longevity, providing a tailored cash flow plan that adapts to changing retirement needs.

Delayed Claiming Credits

Delaying Social Security benefits increases monthly payments through Delayed Retirement Credits, optimizing lifetime income compared to the Bridge Strategy, which relies on tapping savings before claiming benefits. This approach leverages higher Social Security cash flow later in retirement, enhancing financial stability and reducing early withdrawal risks.

Bridge Withdrawal Rate

The Bridge Withdrawal Rate in retirement cash flow planning serves as a temporary income source before Social Security benefits commence, typically involving drawing from investment portfolios or other assets. Optimizing the Bridge Withdrawal Rate ensures sufficient liquidity while preserving long-term Social Security income, balancing immediate cash needs with retirement sustainability.

Early Retirement Gap Funding

The Bridge Strategy leverages taxable investment accounts to cover living expenses during the early retirement gap before Social Security benefits commence, optimizing cash flow and preserving tax-advantaged accounts. By strategically delaying Social Security, retirees increase their future benefits while using bridge assets to maintain financial stability, effectively managing longevity risk and enhancing retirement income sustainability.

Social Security Deferral Window

Maximizing retirement income often hinges on strategically navigating the Social Security deferral window, where delaying benefits past full retirement age increases monthly payments by approximately 8% per year, thereby enhancing lifetime cash flow. The bridge strategy complements this by utilizing other liquid assets or part-time work income during the deferral period, ensuring stable cash flow without prematurely drawing Social Security benefits or depleting retirement portfolios.

Portfolio Bridge Approach

The Portfolio Bridge Approach leverages investment assets to generate income before Social Security benefits begin, optimizing retirement cash flow while maximizing Social Security's delayed retirement credits. This strategy reduces the need to liquidate assets prematurely, enhancing long-term portfolio sustainability and providing financial flexibility throughout retirement.

Pension Gap Bridging

Bridging the pension gap during retirement often involves choosing between Social Security benefits and a Bridge Strategy, which uses personal savings or part-time income to cover expenses before Social Security kicks in. Employing a Bridge Strategy can optimize cash flow by mitigating early benefit reductions and maximizing lifetime Social Security payments.

Sequence of Returns Hedge

The Sequence of Returns Hedge in retirement cash flow management reduces risk by delaying Social Security benefits while using a bridge strategy, such as withdrawals from taxable accounts, to cover expenses during early retirement. This approach protects Social Security income from adverse market volatility and enhances portfolio longevity by smoothing the sequence of returns impact.

Age 62 vs FRA (Full Retirement Age) Strategy

Claiming Social Security benefits at Age 62 reduces monthly payments by approximately 30% compared to waiting until Full Retirement Age (FRA), impacting lifetime income and retirement cash flow. Employing a Bridge Strategy involves using personal savings or part-time work to cover expenses until reaching FRA, optimizing total Social Security benefits and ensuring stronger financial stability throughout retirement.

Social Security vs Bridge Strategy for retirement cash flow Infographic

moneydiff.com

moneydiff.com