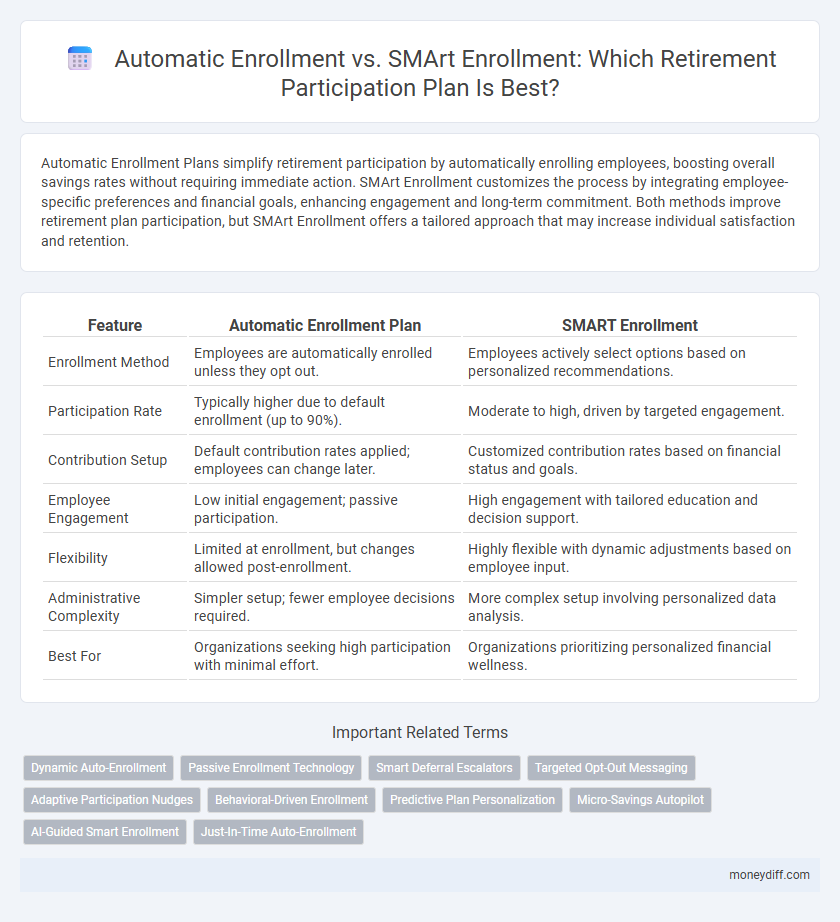

Automatic Enrollment Plans simplify retirement participation by automatically enrolling employees, boosting overall savings rates without requiring immediate action. SMArt Enrollment customizes the process by integrating employee-specific preferences and financial goals, enhancing engagement and long-term commitment. Both methods improve retirement plan participation, but SMArt Enrollment offers a tailored approach that may increase individual satisfaction and retention.

Table of Comparison

| Feature | Automatic Enrollment Plan | SMART Enrollment |

|---|---|---|

| Enrollment Method | Employees are automatically enrolled unless they opt out. | Employees actively select options based on personalized recommendations. |

| Participation Rate | Typically higher due to default enrollment (up to 90%). | Moderate to high, driven by targeted engagement. |

| Contribution Setup | Default contribution rates applied; employees can change later. | Customized contribution rates based on financial status and goals. |

| Employee Engagement | Low initial engagement; passive participation. | High engagement with tailored education and decision support. |

| Flexibility | Limited at enrollment, but changes allowed post-enrollment. | Highly flexible with dynamic adjustments based on employee input. |

| Administrative Complexity | Simpler setup; fewer employee decisions required. | More complex setup involving personalized data analysis. |

| Best For | Organizations seeking high participation with minimal effort. | Organizations prioritizing personalized financial wellness. |

Understanding Automatic Enrollment Plans

Automatic Enrollment Plans simplify retirement savings by automatically enrolling eligible employees in employer-sponsored retirement accounts, boosting participation rates significantly. These plans reduce the need for employees to actively opt in, ensuring a more consistent accumulation of retirement funds. Employers benefit from streamlined administration and improved workforce financial security through higher engagement in retirement programs.

What is SMArt Enrollment in Retirement Plans?

SMArt Enrollment in retirement plans is a streamlined approach that combines automatic enrollment with personalized investment advice, helping employees make informed decisions about their contributions and asset allocation. Unlike traditional Automatic Enrollment Plans that default participants into a standard investment fund, SMArt Enrollment tailors recommendations based on individual risk tolerance and retirement goals, enhancing long-term retirement readiness. This method increases plan participation rates and promotes better financial outcomes by aligning investment choices with employees' specific needs.

Key Differences Between Automatic and SMArt Enrollment

Automatic Enrollment Plan secures retirement participation by automatically signing up eligible employees, generally requiring them to opt out if they prefer not to contribute, ensuring higher enrollment rates. SMArt Enrollment, or Save More Tomorrow, allows employees to commit in advance to increase their contributions gradually, typically aligned with salary raises, fostering increased savings over time without immediate financial strain. The primary difference lies in Automatic Enrollment's immediate default enrollment, while SMArt Enrollment emphasizes future incremental contribution escalation based on pre-commitment.

Impact on Employee Participation Rates

Automatic Enrollment Plans typically boost retirement participation rates by seamlessly enrolling employees without requiring initial action, leading to higher overall savings. SMArt Enrollment enhances this effect by offering personalized contribution recommendations based on individual financial situations, further increasing engagement and long-term commitment. Studies indicate that combining auto-enrollment with tailored advice results in participation rates exceeding 85%, compared to lower rates in traditional opt-in systems.

Behavioral Economics Behind Enrollment Strategies

Automatic Enrollment Plans leverage behavioral economics by reducing decision inertia and defaulting employees into retirement savings, significantly boosting participation rates through the power of default bias. SMArt Enrollment enhances this approach by combining simplified choices with active decision-making prompts, addressing choice overload and promoting more deliberate, informed participation. Together, these strategies utilize principles like loss aversion and mental accounting to increase retirement savings engagement effectively.

Cost Implications for Employers

Automatic Enrollment Plans often result in higher upfront administrative costs for employers due to mandatory employee enrollment processes and ongoing opt-out management. SMArt Enrollment, by contrast, strategically enrolls employees based on eligibility and interest data, potentially lowering costs related to unnecessary contributions and administrative overhead. Employers seeking to optimize retirement participation expenses should weigh the immediate administrative savings of SMArt Enrollment against the broader coverage benefits of Automatic Enrollment.

Compliance and Regulatory Considerations

Automatic Enrollment Plans ensure compliance with ERISA and IRS regulations by mandating employee participation unless they opt out, thus increasing retirement plan adherence and minimizing employer fiduciary risk. SMART Enrollment integrates ongoing education and personalized nudges, aligning with DOL guidelines on participant disclosures and consent, enhancing regulatory compliance through transparency and informed decision-making. Both methods must adhere to specific contribution limits and notice requirements under federal law to maintain plan qualification and protect participant rights.

Customization and Flexibility in Plan Design

Automatic Enrollment Plans provide a standardized approach with limited customization, automatically enrolling employees at a preset contribution rate to encourage participation. SMArt Enrollment offers greater flexibility by allowing employers to tailor enrollment timing, default contribution rates, and investment choices, aligning plan design closely with workforce demographics and preferences. This customization enhances employee engagement and supports diverse retirement goals, making SMArt Enrollment a more adaptable solution for varied organizational needs.

Long-Term Outcomes for Retirement Savings

Automatic Enrollment Plans significantly increase participation rates by enrolling employees by default, leading to higher long-term retirement savings accumulation through consistent contributions. SMART Enrollment enhances this approach by personalizing contribution rates and investment options, optimizing participant engagement and improving portfolio growth over time. Studies show SMART Enrollment participants typically achieve better retirement readiness due to tailored strategies that balance risk and maximize returns.

Choosing the Best Enrollment Strategy for Your Workforce

Choosing the best enrollment strategy for your workforce involves comparing Automatic Enrollment Plans, which automatically enroll employees into retirement savings with an opt-out option, against SMART Enrollment systems that use tailored algorithms to optimize participation and contribution rates. Automatic Enrollment ensures higher baseline participation by simplifying the process, while SMART Enrollment leverages data analytics to personalize savings recommendations, potentially increasing long-term retirement readiness. Employers should evaluate workforce demographics, participation goals, and technological capabilities to select a strategy that maximizes engagement and retirement outcomes.

Related Important Terms

Dynamic Auto-Enrollment

Dynamic Auto-Enrollment in retirement plans improves participation rates by automatically adjusting contribution rates based on employee behavior and plan defaults, contrasting with static Automatic Enrollment Plans that set fixed percentages. SMArt Enrollment tailors investment allocation dynamically, but combining it with Dynamic Auto-Enrollment creates a more responsive retirement saving strategy that maximizes employee engagement and long-term financial outcomes.

Passive Enrollment Technology

Passive Enrollment Technology enhances retirement participation by automatically enrolling eligible employees in retirement plans, boosting enrollment rates without requiring immediate action. Compared to Automatic Enrollment Plans, SMArt Enrollment leverages data-driven algorithms to tailor participation options, maximizing long-term savings and engagement through personalized, seamless enrollment processes.

Smart Deferral Escalators

Smart Deferral Escalators enhance retirement participation by gradually increasing employee contribution rates over time, compared to Automatic Enrollment Plans which set a fixed initial deferral. This dynamic approach leverages behavioral finance principles to boost long-term savings and improve retirement readiness more effectively.

Targeted Opt-Out Messaging

Automatic Enrollment Plans increase retirement plan participation by enrolling employees by default, while Smart Enrollment enhances this approach through targeted opt-out messaging that addresses individual concerns and motivations. Research shows that personalized opt-out messages can reduce opt-out rates by up to 30%, significantly boosting long-term retirement savings.

Adaptive Participation Nudges

Automatic Enrollment Plans use default enrollment to boost retirement participation by seamlessly including employees unless they opt out, while SMArt Enrollment leverages Adaptive Participation Nudges that dynamically tailor communication and incentives based on individual engagement patterns, significantly increasing enrollment rates and long-term savings behavior. This targeted approach in SMArt Enrollment enhances personalized decision-making and helps overcome procrastination and inertia common in retirement planning.

Behavioral-Driven Enrollment

Automatic Enrollment Plans leverage behavioral-driven enrollment by defaulting employees into retirement savings programs, significantly increasing participation rates through inertia and reduced decision-making barriers. In contrast, SMART Enrollment enhances this approach by customizing default contribution rates and investment options based on individual behavior and preferences, optimizing engagement and long-term retirement outcomes.

Predictive Plan Personalization

Automatic Enrollment Plans increase retirement participation by enrolling employees by default, but SMArt Enrollment leverages predictive plan personalization to tailor investment options and contribution rates to individual risk profiles, maximizing engagement and optimizing long-term savings outcomes. Predictive analytics in SMArt Enrollment use employee data to forecast optimal retirement strategies, enhancing plan effectiveness beyond the standard auto-enrollment approach.

Micro-Savings Autopilot

Automatic Enrollment Plan streamlines retirement participation by enrolling employees by default, maximizing contribution rates early, while SMArt Enrollment leverages Behavioral Economics to adjust savings automatically based on life changes, enhancing long-term micro-saving habits. Both methods integrate Micro-Savings Autopilot strategies, promoting consistent, incremental contributions that compound over time, ensuring improved retirement readiness and financial security.

AI-Guided Smart Enrollment

AI-Guided Smart Enrollment leverages advanced algorithms to personalize retirement plan participation, increasing employee engagement and optimizing contribution strategies based on individual financial profiles. Unlike traditional Automatic Enrollment Plans, Smart Enrollment dynamically adjusts recommendations to enhance long-term retirement readiness and maximize fund growth potential.

Just-In-Time Auto-Enrollment

Just-In-Time Auto-Enrollment enhances retirement participation by automatically enrolling employees in retirement plans precisely when they become eligible, reducing delays compared to traditional Automatic Enrollment Plans. SMArt Enrollment focuses on seamless, data-driven onboarding but may not match the immediate activation benefits offered by Just-In-Time Auto-Enrollment, which ensures timely contribution starts and optimized savings growth.

Automatic Enrollment Plan vs SMArt Enrollment for retirement participation. Infographic

moneydiff.com

moneydiff.com