Mandatory retirement age often forces individuals to stop working at a predetermined age, regardless of their financial readiness, whereas Barista FIRE allows retirees to transition gradually by working part-time jobs like barista roles to supplement their income. Barista FIRE offers flexibility and financial independence without relying solely on savings, blending continued employment with early retirement goals. This approach provides a smoother, customizable retirement path compared to the rigid constraints of mandatory retirement age policies.

Table of Comparison

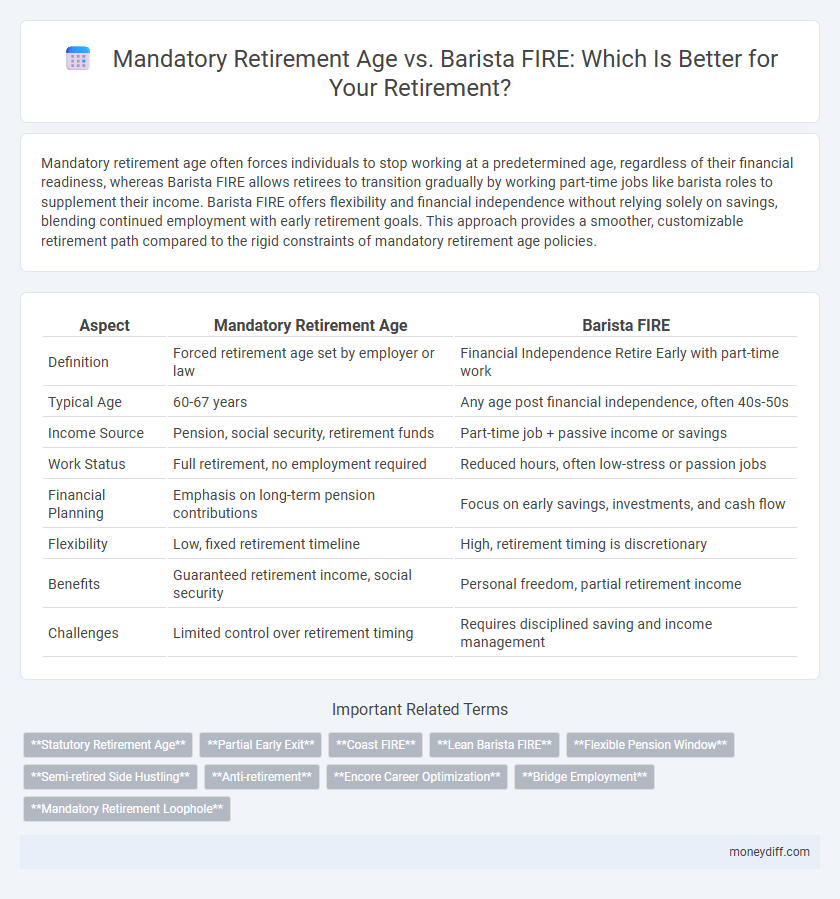

| Aspect | Mandatory Retirement Age | Barista FIRE |

|---|---|---|

| Definition | Forced retirement age set by employer or law | Financial Independence Retire Early with part-time work |

| Typical Age | 60-67 years | Any age post financial independence, often 40s-50s |

| Income Source | Pension, social security, retirement funds | Part-time job + passive income or savings |

| Work Status | Full retirement, no employment required | Reduced hours, often low-stress or passion jobs |

| Financial Planning | Emphasis on long-term pension contributions | Focus on early savings, investments, and cash flow |

| Flexibility | Low, fixed retirement timeline | High, retirement timing is discretionary |

| Benefits | Guaranteed retirement income, social security | Personal freedom, partial retirement income |

| Challenges | Limited control over retirement timing | Requires disciplined saving and income management |

Understanding Mandatory Retirement Age: Pros and Cons

Mandatory retirement age sets a fixed age for exit from the workforce, ensuring workforce turnover and opening positions for younger employees, yet it can limit individual freedom and reduce the potential for prolonged income generation. Barista FIRE (Financial Independence, Retire Early) offers an alternative by enabling early partial retirement with part-time work, providing financial flexibility and continued engagement. Understanding these options helps individuals balance security, personal goals, and lifestyle in retirement planning.

What Is Barista FIRE and How Does It Work?

Barista FIRE refers to achieving partial financial independence early enough to work part-time in a low-stress job, like being a barista, while covering living expenses without relying solely on mandatory retirement funds. This strategy involves accumulating enough savings to reduce working hours significantly, balancing between income generation and lifestyle flexibility before reaching mandatory retirement age. It offers a practical alternative to full early retirement by blending continued employment with increased financial freedom.

Financial Flexibility: Mandatory Retirement vs. Barista FIRE

Mandatory retirement age enforces a fixed endpoint for career income, often limiting financial flexibility and requiring larger savings to ensure comfort post-retirement. Barista FIRE, a strategy combining partial work with reduced living expenses, enhances financial flexibility by allowing continued income generation without full-time employment stress. This hybrid approach mitigates the risk of depleting retirement funds prematurely, providing a smoother transition into full retirement.

Income Streams: Pension Plans vs. Part-Time Work

Mandatory retirement age often limits income streams to fixed pension plans, providing predictable but potentially inflexible financial resources. Barista FIRE emphasizes diversified income by combining part-time work with investments, offering greater control and adaptability in retirement finances. This hybrid approach allows retirees to maintain cash flow while reducing dependence on traditional pensions.

Health Insurance Considerations for Early vs. Traditional Retirees

Mandatory retirement age often guarantees continuous health insurance coverage through employer-sponsored plans until retirement, whereas Barista FIRE retirees must navigate securing private health insurance or marketplace options early. Early retirees face higher premiums and potential coverage gaps due to ineligibility for Medicare before age 65, requiring careful financial planning to maintain affordable health benefits. Health insurance costs significantly impact retirement budgeting, making it crucial to evaluate coverage options alongside retirement timing strategies.

Lifestyle Choices: Structured Retirement vs. Flexible FIRE Living

Mandatory retirement age enforces a structured retirement timeline often dictated by organizational policies or government regulations, offering predictability but limiting personal freedom. Barista FIRE emphasizes flexible retirement living by allowing individuals to partially retire and supplement income through part-time or passion-driven work, thereby sustaining lifestyle and financial independence. This approach prioritizes lifestyle customization over rigid timelines, aligning work with personal interests and evolving retirement goals.

Savings Requirements for Mandatory Retirement vs. Barista FIRE

Mandatory retirement age typically requires accumulating a substantial pension or savings amount to sustain life post-retirement without employment income, often demanding 70-80% of pre-retirement salary in savings. Barista FIRE (Financial Independence, Retire Early) minimizes savings requirements by combining partial part-time work with reduced lifestyle expenses, allowing for a smaller nest egg of around 50-60% of traditional retirement savings. This hybrid approach balances income generation and financial freedom, reducing the pressure of reaching full savings targets before ceasing full-time work.

Psychological Impact: Full Retirement Compared to Partial Work

Mandatory retirement age often triggers a significant psychological shift, as individuals face a sudden end to their professional identity, whereas Barista FIRE allows for gradual transition by maintaining part-time work, reducing stress and preserving self-worth. Studies indicate that partial work engagement supports mental health by fostering social connections and routine, which can mitigate feelings of loss and improve overall life satisfaction. The balance of income and purpose from Barista FIRE contributes to a smoother emotional adjustment compared to the abrupt lifestyle change that accompanies full retirement.

Risk Factors: Longevity, Inflation, and Market Changes

Mandatory retirement age poses risks related to longevity, as individuals may outlive their savings if retirement funds are insufficient, while Barista FIRE strategies face vulnerabilities from inflation eroding purchasing power and unpredictable market changes impacting investment returns. Longevity risk necessitates careful financial planning beyond fixed retirement ages, whereas Barista FIRE requires dynamic adjustments to expenses and income sources to maintain financial independence amid economic fluctuations. Both approaches must address the balance between sustainable withdrawals and market volatility to ensure long-term retirement security.

Choosing the Best Retirement Path: Key Factors to Consider

Evaluating mandatory retirement age versus Barista FIRE requires analyzing financial independence timelines, lifestyle needs, and income stability. Key factors include healthcare benefits continuity, anticipated living expenses, and desired work-life balance after retirement. Prioritizing flexible income sources in Barista FIRE can enhance retirement satisfaction compared to rigid mandatory retirement plans.

Related Important Terms

Statutory Retirement Age

The statutory retirement age, typically set by government legislation between 60 and 67 years, defines the earliest point at which individuals can access full pension benefits or mandatory withdrawal, directly influencing retirement planning decisions. In contrast, Barista FIRE promotes early financial independence and part-time work well before this mandatory threshold, allowing retirees to blend continued income with lifestyle flexibility outside the constraints of statutory retirement policies.

Partial Early Exit

Partial early exit through Barista FIRE allows individuals to reduce work hours or switch to less demanding jobs before reaching the mandatory retirement age, blending continued income with increased leisure. This strategy provides financial flexibility by supplementing savings with part-time earnings while delaying full retirement benefits to optimize long-term wealth accumulation.

Coast FIRE

Coast FIRE allows individuals to stop contributing to retirement savings once their investments grow sufficiently to fund retirement by mandatory retirement age, contrasting with Barista FIRE where part-time work extends financial independence. This strategy emphasizes early investing and compounding returns to ensure financial security without the pressure of immediate full retirement or mandatory age constraints.

Lean Barista FIRE

Lean Barista FIRE emphasizes achieving financial independence through part-time work and minimalist living, allowing retirees to delay or bypass the mandatory retirement age while maintaining a sustainable income. This strategy contrasts with traditional retirement models that rely on savings depletion by leveraging flexibility, reduced expenses, and supplementary earnings to extend financial freedom.

Flexible Pension Window

The flexible pension window allows individuals to adjust their retirement timeline, enabling a gradual transition from work to leisure rather than adhering strictly to a mandatory retirement age. This flexibility supports the Barista FIRE strategy, where partial work income supplements early retirement savings, optimizing financial independence without exhausting pension benefits prematurely.

Semi-retired Side Hustling

Semi-retired side hustling enables individuals to extend financial independence beyond the mandatory retirement age by generating supplemental income through flexible, passion-driven work. This approach aligns with the Barista FIRE strategy, where part-time gigs replace traditional full-time employment, reducing dependency on retirement savings while enhancing lifestyle satisfaction.

Anti-retirement

Mandatory retirement age imposes a fixed endpoint on careers, restricting financial independence and personal freedom, while Barista FIRE promotes anti-retirement values by encouraging ongoing part-time work combined with financial independence to extend purpose and income without full withdrawal from the workforce. This approach counters traditional retirement norms by prioritizing flexibility, reducing reliance on pension systems, and supporting lifelong engagement in meaningful employment.

Encore Career Optimization

Mandatory retirement age often limits individuals' ability to continue working beyond a certain point, whereas Barista FIRE empowers retirees to optimize their encore careers by combining part-time work with financial independence, enhancing both income and personal fulfillment. Leveraging encore career opportunities in fields like consulting or education allows retirees to maintain active engagement and supplement retirement income without relying solely on mandatory retirement constraints.

Bridge Employment

Bridge employment serves as a strategic option between mandatory retirement age and Barista FIRE, allowing individuals to gradually transition from full-time work to retirement while maintaining financial stability and social engagement. This phased approach helps retirees supplement income, reduce reliance on retirement savings, and adapt to lifestyle changes without abrupt cessation of professional activity.

Mandatory Retirement Loophole

The Mandatory Retirement Loophole allows individuals to circumvent fixed retirement ages by pursuing Barista FIRE, a strategy where semi-retirement income from part-time work supports financial independence early retirement goals. This approach leverages flexible work opportunities to extend earning potential beyond mandated cutoff ages, optimizing retirement planning and delaying full reliance on pension or Social Security benefits.

Mandatory retirement age vs Barista FIRE for retirement. Infographic

moneydiff.com

moneydiff.com