Choosing between a 401(k) and a self-directed IRA for retirement depends on factors such as investment flexibility, fees, and control. A 401(k) typically offers employer contributions and easier access to traditional investment options, while a self-directed IRA allows greater freedom to invest in alternative assets like real estate or private companies. Understanding your risk tolerance and retirement goals helps determine which plan aligns better with your long-term financial strategy.

Table of Comparison

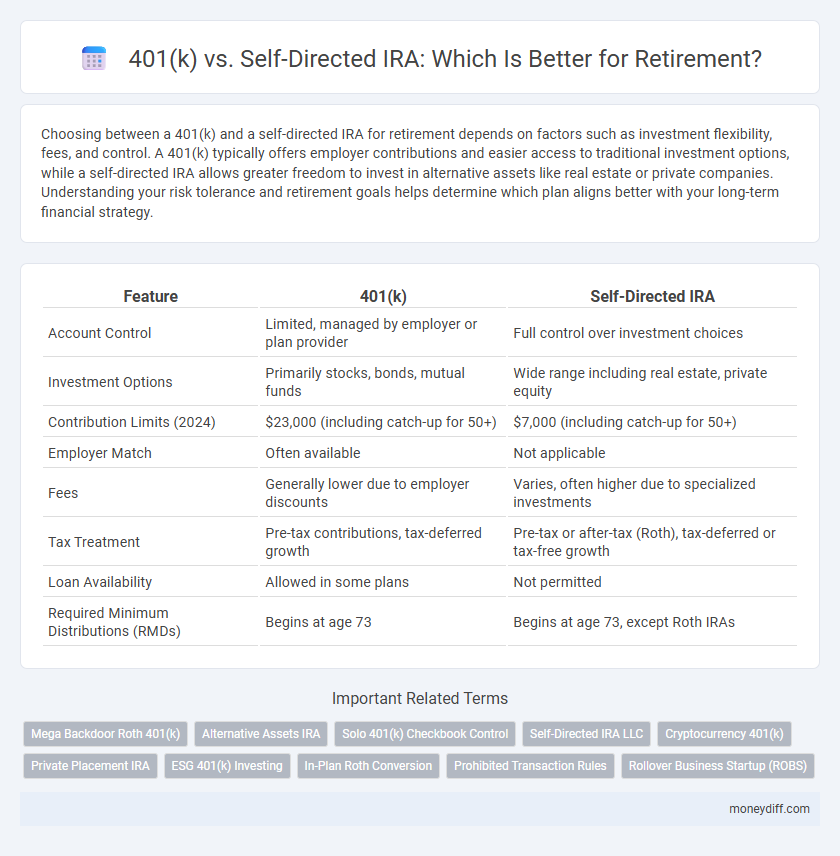

| Feature | 401(k) | Self-Directed IRA |

|---|---|---|

| Account Control | Limited, managed by employer or plan provider | Full control over investment choices |

| Investment Options | Primarily stocks, bonds, mutual funds | Wide range including real estate, private equity |

| Contribution Limits (2024) | $23,000 (including catch-up for 50+) | $7,000 (including catch-up for 50+) |

| Employer Match | Often available | Not applicable |

| Fees | Generally lower due to employer discounts | Varies, often higher due to specialized investments |

| Tax Treatment | Pre-tax contributions, tax-deferred growth | Pre-tax or after-tax (Roth), tax-deferred or tax-free growth |

| Loan Availability | Allowed in some plans | Not permitted |

| Required Minimum Distributions (RMDs) | Begins at age 73 | Begins at age 73, except Roth IRAs |

Understanding 401(k) Plans: An Overview

401(k) plans are employer-sponsored retirement savings accounts that offer tax advantages, such as pre-tax contributions and tax-deferred growth, making them a popular choice for long-term retirement planning. Contributions are typically limited to $23,000 annually for those under 50, with employer matching potential increasing overall savings. These plans invest in a pre-selected range of mutual funds or ETFs, providing simplicity but less flexibility compared to self-directed IRAs.

What Is a Self-Directed IRA? Key Features Explained

A Self-Directed IRA (Individual Retirement Account) offers greater investment flexibility compared to a traditional 401(k) by allowing individuals to invest in a broader range of assets, including real estate, private equity, and precious metals. Key features include tax-deferred or tax-free growth depending on whether it's a traditional or Roth IRA, increased control over investment choices, and the ability to diversify beyond stocks and bonds commonly found in 401(k) plans. This account requires thorough due diligence and compliance with IRS rules to avoid prohibited transactions and penalties.

Contribution Limits: 401(k) vs Self-Directed IRA

The 401(k) plan allows annual contributions up to $22,500 for 2024, with an additional $7,500 catch-up contribution for participants over 50. In contrast, self-directed IRAs have a lower contribution limit of $6,500 per year, plus a $1,000 catch-up for those aged 50 and above. Understanding the differing contribution limits is essential for maximizing retirement savings within each account type.

Investment Options: Comparing Flexibility and Control

Self-directed IRAs offer significantly greater investment flexibility compared to 401(k) plans, allowing account holders to invest in a broader range of assets including real estate, private equity, and precious metals. In contrast, 401(k) options are typically limited to a predefined list of mutual funds, stocks, and bonds chosen by the plan administrator. This increased control in self-directed IRAs enables investors to tailor their retirement portfolios more precisely to their risk tolerance and investment goals.

Tax Advantages and Implications

A 401(k) offers tax-deferred growth with contributions made pre-tax, lowering taxable income and taxes until withdrawal, generally at retirement age. Self-directed IRAs provide tax advantages through both traditional (tax-deferred) and Roth (tax-free growth) options, with greater investment flexibility but stricter IRS rules and potential penalties for early withdrawals. Understanding contribution limits, tax treatment on distributions, and required minimum distributions is crucial when choosing between a 401(k) and a self-directed IRA for retirement planning.

Fees and Account Management Costs

401(k) plans typically involve higher fees due to employer administration and limited investment options, which can reduce overall retirement savings growth. Self-directed IRAs offer greater control over investment choices and often lower fees, but require active management and a deeper understanding of account administration. Comparing the expense ratios, transaction costs, and custodian fees between both accounts is crucial for maximizing long-term retirement benefits.

Employer Contributions: 401(k) Match vs Self-Directed IRA

Employer contributions through a 401(k) match significantly boost retirement savings by providing free money, often up to a certain percentage of employee contributions, which is not available in a self-directed IRA. The absence of employer matching in self-directed IRAs places the entire responsibility for funding on the individual, but these accounts offer more investment flexibility and control. Maximizing a 401(k) match can accelerate wealth accumulation, making it a valuable component of a comprehensive retirement strategy.

Risk Factors and Asset Protection

A 401(k) plan generally offers stronger asset protection from creditors under federal laws, reducing risk exposure during financial hardship, while self-directed IRAs may have varied levels of protection depending on state regulations. Risk factors in 401(k)s are often limited due to employer-managed investments, whereas self-directed IRAs involve greater personal responsibility and potential for high-risk asset allocation. Choosing between the two requires evaluating the trade-offs between federal asset protection in 401(k)s and the broader investment flexibility--but increased risk--of self-directed IRAs.

Withdrawal Rules and Required Minimum Distributions (RMDs)

401(k) plans require withdrawals to begin at age 73, with RMDs calculated based on life expectancy and account balance, ensuring mandatory distribution to avoid penalties. Self-directed IRAs also mandate RMDs starting at age 73 but offer greater investment flexibility, including real estate and private equity, which can affect withdrawal strategies. Both vehicles penalize early withdrawals before age 59 1/2 unless specific exceptions apply, impacting retirement income planning and tax efficiency.

Choosing the Right Path: 401(k) or Self-Directed IRA for Your Retirement

Choosing between a 401(k) and a self-directed IRA depends on your investment preferences and desired control over assets. A 401(k) offers employer-sponsored benefits with limited investment options, while a self-directed IRA provides greater flexibility to invest in alternative assets such as real estate and private equity. Evaluating fees, tax advantages, and risk tolerance is essential to determine the optimal retirement savings strategy.

Related Important Terms

Mega Backdoor Roth 401(k)

A Mega Backdoor Roth 401(k) allows for after-tax contributions significantly exceeding standard 401(k) limits, offering higher potential retirement savings compared to self-directed IRAs. While self-directed IRAs provide diverse investment options, the Mega Backdoor Roth 401(k) enables tax-free growth and withdrawals by converting after-tax contributions into a Roth account within the 401(k) plan.

Alternative Assets IRA

A self-directed IRA allows investors to include alternative assets such as real estate, precious metals, and private equity, offering greater diversification than traditional 401(k) plans limited to stocks and bonds. Alternative Assets IRAs provide tax-advantaged growth while enabling control over non-traditional investments ideally suited for retirement portfolio diversification.

Solo 401(k) Checkbook Control

Solo 401(k) plans offer superior checkbook control compared to self-directed IRAs, enabling participants to directly manage investments such as real estate and private equity without custodian approval. This enhanced flexibility allows for faster transactions and reduced administrative hurdles, making Solo 401(k) an ideal choice for self-employed individuals seeking maximum control over retirement funds.

Self-Directed IRA LLC

A Self-Directed IRA LLC offers greater investment flexibility for retirement by enabling direct control over alternative assets such as real estate and private equity, unlike a traditional 401(k) that is limited to conventional stocks and bonds. This structure allows investors to actively manage their retirement portfolio while potentially reducing fees and enhancing diversification.

Cryptocurrency 401(k)

Cryptocurrency 401(k) plans offer a unique retirement strategy by allowing investments in digital assets within a tax-advantaged account, providing both growth potential and tax benefits compared to self-directed IRAs that require more active management and may have higher fees. The 401(k) structure also typically offers stronger fiduciary protections and easier access to employer matching contributions, making it a compelling choice for those seeking to integrate cryptocurrency into their retirement portfolio.

Private Placement IRA

A Private Placement IRA offers greater investment flexibility compared to a traditional 401(k), allowing retirement funds to be directed into alternative assets like real estate, private equity, and cryptocurrencies. Unlike 401(k) plans, Private Placement IRAs provide investors with control over diverse asset allocations while maintaining tax-deferred growth benefits.

ESG 401(k) Investing

ESG 401(k) investing allows employees to align retirement savings with environmental, social, and governance principles through employer-sponsored plans, offering diversified funds vetted for sustainability. In contrast, self-directed IRAs provide broader investment choices, including alternative ESG assets, but require greater individual management and due diligence.

In-Plan Roth Conversion

In-plan Roth conversions allow 401(k) participants to transfer pre-tax funds to a Roth account, enabling tax-free growth and withdrawals in retirement compared to traditional self-directed IRAs where conversions must be done outside the plan. Maximizing this option within a 401(k) can provide greater control over tax diversification and long-term retirement income strategies.

Prohibited Transaction Rules

Prohibited transaction rules strictly regulate 401(k) and self-directed IRA accounts to prevent self-dealing, with violations potentially triggering severe tax penalties and loss of tax benefits. Self-directed IRAs often carry higher risks for prohibited transactions due to broader investment choices, requiring careful adherence to IRS guidelines to maintain tax-advantaged status.

Rollover Business Startup (ROBS)

ROBS allows entrepreneurs to use 401(k) or self-directed IRA funds tax-free to start or buy a business, combining retirement savings with business investment. This strategy offers more control compared to traditional rollovers, though it requires strict adherence to IRS rules to avoid penalties.

401(k) vs self-directed IRA for retirement. Infographic

moneydiff.com

moneydiff.com