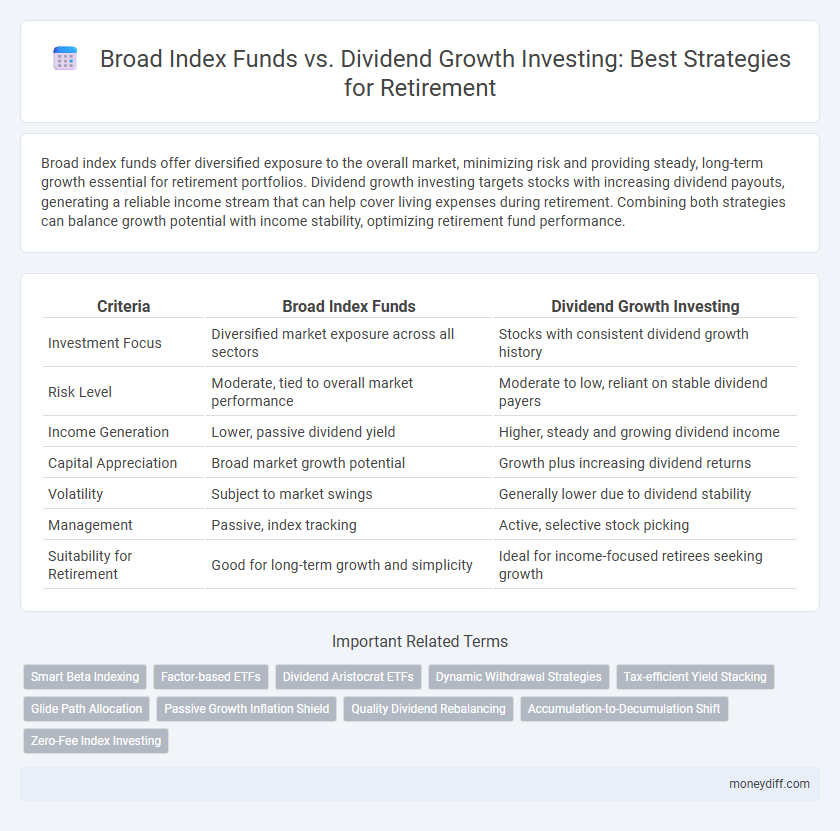

Broad index funds offer diversified exposure to the overall market, minimizing risk and providing steady, long-term growth essential for retirement portfolios. Dividend growth investing targets stocks with increasing dividend payouts, generating a reliable income stream that can help cover living expenses during retirement. Combining both strategies can balance growth potential with income stability, optimizing retirement fund performance.

Table of Comparison

| Criteria | Broad Index Funds | Dividend Growth Investing |

|---|---|---|

| Investment Focus | Diversified market exposure across all sectors | Stocks with consistent dividend growth history |

| Risk Level | Moderate, tied to overall market performance | Moderate to low, reliant on stable dividend payers |

| Income Generation | Lower, passive dividend yield | Higher, steady and growing dividend income |

| Capital Appreciation | Broad market growth potential | Growth plus increasing dividend returns |

| Volatility | Subject to market swings | Generally lower due to dividend stability |

| Management | Passive, index tracking | Active, selective stock picking |

| Suitability for Retirement | Good for long-term growth and simplicity | Ideal for income-focused retirees seeking growth |

Understanding Broad Index Funds and Dividend Growth Investing

Broad index funds provide diversified exposure to a wide range of stocks, reducing risk through market capitalization-weighted investments in major indexes like the S&P 500. Dividend growth investing targets companies with a consistent history of increasing dividend payouts, offering potential for rising income and long-term capital appreciation. Understanding these strategies helps retirees balance growth and income objectives while managing portfolio volatility and inflation risk.

Key Differences Between Broad Index Funds and Dividend Growth Strategies

Broad index funds provide diversified exposure across entire market sectors, minimizing risk through broad asset allocation and typically offering steady, market-matching returns. Dividend growth investing concentrates on companies with a strong history of increasing dividends, aiming for income growth and potential tax advantages, often resulting in a more stable cash flow during retirement. Key differences include risk diversification, income stability, and growth potential, with broad index funds focusing on overall market performance and dividend growth strategies targeting income and capital appreciation from dividend-paying stocks.

Historical Performance: Index Funds vs Dividend Growth Stocks

Broad index funds historically provide steady, market-matching returns with lower volatility, averaging around 7-10% annual growth over decades. Dividend growth stocks, while often offering higher income through rising dividends, have delivered competitive total returns, driven by both capital appreciation and yield reinvestment. Long-term retirement portfolios benefit from combining index funds' diversification with dividend growth stocks' income stability and potential for inflation-beating payouts.

Risk Factors in Retirement Portfolios

Broad index funds provide diversified exposure to the entire market, minimizing unsystematic risk through wide asset allocation. Dividend Growth Investing focuses on companies with consistent dividend increases, offering potential income stability but with concentration risks in specific sectors. Balancing these strategies can help mitigate risks like inflation, market volatility, and interest rate changes in retirement portfolios.

Income Generation: Dividends vs Capital Appreciation

Broad index funds provide diversified exposure to the entire market, typically emphasizing capital appreciation through a mix of growth and value stocks. Dividend Growth Investing concentrates on companies with a consistent history of increasing dividends, prioritizing steady income generation critical for retirement cash flow. Balancing dividend yield with total return potential influences retirement income stability and wealth preservation over time.

Portfolio Diversification and Stability for Retirees

Broad index funds provide retirees with extensive portfolio diversification by tracking a wide range of sectors and companies, reducing individual stock risk and promoting stability. Dividend growth investing targets companies with a history of increasing dividend payouts, offering a steady income stream and potential inflation protection. Combining both strategies can balance growth potential with reliable cash flow, enhancing overall portfolio stability during retirement.

Cost and Fees: Comparing Investment Approaches

Broad index funds typically have lower expense ratios, often below 0.10%, making them a cost-efficient choice for retirement portfolios. Dividend growth investing may involve higher fees due to active management and frequent trades, with expense ratios frequently exceeding 0.50%. Minimizing costs in retirement accounts is crucial as lower fees translate to greater compounding potential and higher accumulated wealth over time.

Tax Implications for Retirement Accounts

Broad index funds in retirement accounts typically generate lower taxable distributions due to their passive management and lower turnover, enhancing tax efficiency within tax-deferred accounts like IRAs and 401(k)s. Dividend growth investing, while providing rising income streams, often results in higher taxable dividends in taxable accounts, but qualified dividends benefit from favorable tax rates when held in taxable accounts. Strategic allocation of broad index funds to tax-advantaged retirement accounts and dividend growth stocks to taxable accounts can optimize after-tax retirement income.

Rebalancing and Managing Retirement Investments

Broad index funds offer diversified exposure to the entire market, providing consistent growth with lower risk through automatic rebalancing based on market capitalization. Dividend Growth Investing requires more active management to monitor individual stocks and reinvest dividends, ensuring income stability and portfolio growth aligned with retirement goals. Effective retirement portfolio management involves periodic rebalancing to maintain target asset allocation and optimize returns while managing risks.

Which Strategy Fits Your Retirement Goals?

Broad index funds offer diversified exposure across numerous sectors, providing steady growth with lower risk, ideal for retirees seeking stability and capital preservation. Dividend Growth Investing targets companies with consistent dividend increases, generating reliable income streams suited for those prioritizing cash flow during retirement. Assessing your risk tolerance, income needs, and retirement timeline helps determine which strategy aligns best with your long-term financial goals.

Related Important Terms

Smart Beta Indexing

Smart Beta indexing offers a strategic edge in retirement portfolios by blending broad index fund diversification with factor-based enhancements such as value, momentum, and low volatility, potentially outperforming traditional dividend growth investing. This approach balances systematic risk with targeted exposure, aiming to optimize income streams and capital appreciation for long-term retirement security.

Factor-based ETFs

Factor-based ETFs combine characteristics of broad index funds and dividend growth investing by targeting specific financial metrics like value, quality, and momentum to enhance retirement portfolio performance. Compared to traditional dividend growth strategies, factor-based ETFs offer diversified exposure to stocks with strong fundamentals, potentially delivering more consistent income and capital appreciation for long-term retirement planning.

Dividend Aristocrat ETFs

Dividend Aristocrat ETFs offer a reliable income stream and potential for capital appreciation by investing in companies with a 25+ year history of dividend growth, providing retirees with inflation protection and reduced volatility compared to broad index funds. While broad index funds deliver diversified market exposure, Dividend Aristocrat ETFs specifically target financially stable firms, enhancing portfolio resilience during retirement by prioritizing consistent dividend growth over pure market capitalization.

Dynamic Withdrawal Strategies

Broad index funds offer diversified market exposure with generally lower volatility, making them suitable for dynamic withdrawal strategies that adjust spending based on portfolio performance. Dividend Growth Investing provides steady income streams potentially enhancing withdrawal sustainability, but requires careful monitoring and sector diversification to mitigate concentration risks in retirement portfolios.

Tax-efficient Yield Stacking

Broad index funds provide diversified market exposure with lower turnover, offering tax-efficient growth suitable for retirement portfolios, while dividend growth investing emphasizes stacking tax-advantaged dividend yields to enhance income streams. Combining broad index funds with dividend growth stocks can optimize tax-efficient yield stacking, balancing growth and income for a more resilient retirement strategy.

Glide Path Allocation

Broad index funds offer diversified exposure with low fees, promoting steady retirement growth, while Dividend Growth Investing emphasizes consistent income through companies with increasing payouts, aligning with a glide path allocation that shifts toward lower-risk dividend stocks as retirement nears. This allocation strategy balances growth and income, reducing volatility during the transition from accumulation to distribution phases.

Passive Growth Inflation Shield

Broad index funds offer diversified exposure across entire markets, providing steady passive growth that outpaces inflation over time, making them a reliable cornerstone for retirement portfolios. Dividend Growth Investing targets companies with rising dividend payouts, delivering inflation-shielded income streams that can enhance long-term purchasing power during retirement.

Quality Dividend Rebalancing

Quality dividend rebalancing within dividend growth investing prioritizes companies with consistent earnings and rising payouts, providing a stable income stream ideal for retirement portfolios. Broad index funds offer diversified market exposure but may lack the targeted focus on dividend quality and growth essential for maximizing sustainable retirement income.

Accumulation-to-Decumulation Shift

Broad index funds offer diversified exposure and lower fees, supporting steady accumulation of retirement wealth, while dividend growth investing provides growing income streams ideal for decumulation phases, aligning with retirees' cash flow needs. Shifting from accumulation to decumulation involves balancing broad market growth with reliable dividend payouts to optimize portfolio sustainability and income stability.

Zero-Fee Index Investing

Zero-fee broad index funds offer cost-effective diversification with exposure to a wide market, maximizing long-term retirement wealth through minimal expense ratios. Dividend growth investing emphasizes steady income and inflation protection but often involves higher fees and concentrated risk compared to zero-fee index funds.

Broad index funds vs Dividend Growth Investing for retirement. Infographic

moneydiff.com

moneydiff.com