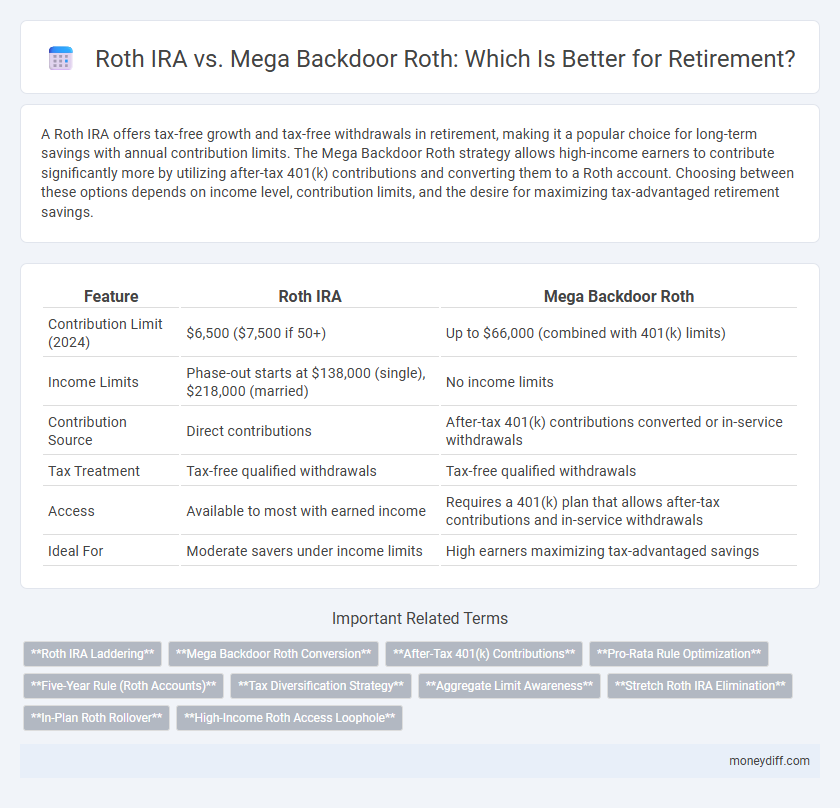

A Roth IRA offers tax-free growth and tax-free withdrawals in retirement, making it a popular choice for long-term savings with annual contribution limits. The Mega Backdoor Roth strategy allows high-income earners to contribute significantly more by utilizing after-tax 401(k) contributions and converting them to a Roth account. Choosing between these options depends on income level, contribution limits, and the desire for maximizing tax-advantaged retirement savings.

Table of Comparison

| Feature | Roth IRA | Mega Backdoor Roth |

|---|---|---|

| Contribution Limit (2024) | $6,500 ($7,500 if 50+) | Up to $66,000 (combined with 401(k) limits) |

| Income Limits | Phase-out starts at $138,000 (single), $218,000 (married) | No income limits |

| Contribution Source | Direct contributions | After-tax 401(k) contributions converted or in-service withdrawals |

| Tax Treatment | Tax-free qualified withdrawals | Tax-free qualified withdrawals |

| Access | Available to most with earned income | Requires a 401(k) plan that allows after-tax contributions and in-service withdrawals |

| Ideal For | Moderate savers under income limits | High earners maximizing tax-advantaged savings |

Understanding Roth IRA: Key Features and Benefits

A Roth IRA offers tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met, making it a powerful tool for long-term savings. Contributions are made with after-tax dollars, allowing earnings to accumulate without the burden of future taxes, which is particularly beneficial for those expecting higher tax rates in retirement. This account also offers flexibility with no required minimum distributions (RMDs) during the account holder's lifetime, enabling continued tax-free growth.

What is a Mega Backdoor Roth?

A Mega Backdoor Roth is a powerful retirement strategy that enables high-income earners to contribute significantly more to a Roth IRA beyond the standard limits by utilizing after-tax 401(k) contributions and in-service rollovers to a Roth account. This method leverages the 401(k) plan's higher combined contribution limit, which includes employee and employer contributions up to $66,000 (2024 limit), allowing for potential tax-free growth. Unlike the traditional Roth IRA contribution cap of $6,500 (2024 limit), the Mega Backdoor Roth can dramatically increase retirement savings, making it a valuable tool for maximizing tax-advantaged investments.

Contribution Limits: Roth IRA vs Mega Backdoor Roth

Roth IRA contribution limits for 2024 are capped at $6,500 annually, with a $1,000 catch-up contribution for those aged 50 and above, whereas the Mega Backdoor Roth strategy leverages after-tax 401(k) contributions allowing up to $66,000 total contributions, including employer matches. This substantial difference enables Mega Backdoor Roth participants to significantly accelerate tax-free retirement savings beyond Roth IRA income restrictions. High-income earners benefit from the Mega Backdoor Roth's higher thresholds, bypassing Roth IRA phase-out limits that begin at $138,000 for single filers and $218,000 for married couples filing jointly.

Eligibility Requirements Compared

Roth IRA eligibility requires earning income below the IRS limits--$153,000 for single filers and $228,000 for married couples in 2024. The Mega Backdoor Roth, accessible via after-tax 401(k) contributions, has no income ceiling, allowing high earners to contribute significantly more into a Roth structure. Understanding these eligibility differences is crucial for maximizing tax-advantaged retirement savings.

Tax Advantages for Retirement Savings

Roth IRAs offer tax-free growth and tax-free withdrawals in retirement, providing significant long-term tax advantages for retirement savings. The Mega Backdoor Roth enables high earners to contribute after-tax dollars beyond regular Roth limits, maximizing tax-advantaged savings potential. Leveraging both strategies can optimize retirement tax efficiency by combining annual contribution limits with enhanced after-tax contributions.

Withdrawal Rules and Penalties

Roth IRA withdrawals are tax-free and penalty-free after age 59 1/2 and a five-year holding period, while earnings withdrawn earlier may incur taxes and a 10% penalty. The Mega Backdoor Roth allows larger after-tax contributions converted to Roth, but withdrawals of converted amounts are tax- and penalty-free after five years; earnings withdrawn before age 59 1/2 face taxes and penalties. Understanding these withdrawal rules and penalties is critical for maximizing retirement savings and avoiding unexpected costs.

Investment Options in Each Account

Roth IRA offers a wide range of investment options including stocks, bonds, mutual funds, ETFs, and real estate, allowing for diversified retirement portfolios and tax-free growth. Mega Backdoor Roth contributions, which involve after-tax 401(k) funds converted to Roth accounts, typically provide access to the investment options available within the employer's 401(k) plan, often including mutual funds, target-date funds, and stable value funds. Choosing between these accounts depends on the investor's preference for broader investment choices in a Roth IRA versus higher contribution limits and potential employer plan options through a Mega Backdoor Roth.

Long-Term Growth Potential

Roth IRAs offer tax-free growth on contributions up to annual limits, making them a powerful tool for long-term wealth accumulation in retirement. Mega Backdoor Roth strategies enable significantly higher after-tax contributions by utilizing employer 401(k) plans with in-service rollovers, exponentially increasing potential compound growth. Investors prioritizing maximum tax-advantaged growth should consider combining both options to optimize retirement savings over multiple decades.

Choosing the Right Strategy for Your Retirement Goals

Choosing between a Roth IRA and a Mega Backdoor Roth depends on your income level, contribution limits, and tax planning goals. A Roth IRA allows after-tax contributions with tax-free growth and withdrawals, ideal for those within income limits, while the Mega Backdoor Roth enables significantly higher after-tax contributions through employer 401(k) plans offering in-service rollovers. Evaluating factors such as current income, future tax bracket expectations, and employer plan options ensures alignment with long-term retirement strategies.

Common Mistakes to Avoid with Roth IRAs and Mega Backdoor Roths

Common mistakes when utilizing Roth IRAs and Mega Backdoor Roths include exceeding contribution limits, neglecting income eligibility rules, and failing to account for potential tax implications upon withdrawal. Overlooking the complexity of Mega Backdoor Roth contributions, such as employer plan restrictions and after-tax contribution tracking, can result in disqualification or unintended taxes. Careful planning and consultation with a financial advisor ensure maximum tax benefits and compliance with IRS regulations for both retirement vehicles.

Related Important Terms

Roth IRA Laddering

Roth IRA laddering involves systematically converting traditional IRA funds into a Roth IRA over multiple years to minimize tax impact and access contributions penalty-free after five years. Leveraging the Mega Backdoor Roth allows higher income earners to maximize after-tax contributions in their 401(k) plan, significantly boosting Roth IRA laddering strategies for accelerated tax-free growth and retirement withdrawals.

Mega Backdoor Roth Conversion

Mega Backdoor Roth conversion enables high-income earners to contribute significantly more to their Roth savings by utilizing after-tax 401(k) contributions and in-service rollovers, exceeding the standard Roth IRA limits. This strategy maximizes tax-free growth potential and retirement wealth accumulation beyond traditional Roth IRA contributions.

After-Tax 401(k) Contributions

After-tax 401(k) contributions enable high-income earners to maximize retirement savings by contributing beyond traditional limits, facilitating Mega Backdoor Roth conversions that allow tax-free growth on substantial amounts. Unlike Roth IRA contribution limits capped at $6,500 (2024), Mega Backdoor Roth strategies leverage after-tax 401(k) balances up to the $66,000 total deferral limit, accelerating tax-advantaged wealth accumulation.

Pro-Rata Rule Optimization

Maximizing retirement savings involves strategic use of the Mega Backdoor Roth to bypass the Pro-Rata Rule, enabling tax-free growth by converting after-tax 401(k) contributions without the traditional IRA aggregation. Unlike a Roth IRA, which is limited by income caps and the Pro-Rata Rule during conversions, the Mega Backdoor Roth facilitates higher after-tax contributions and clean Roth rollovers, optimizing tax efficiency for high-income earners.

Five-Year Rule (Roth Accounts)

The Five-Year Rule for Roth IRAs requires withdrawals of earnings to be tax-free only after the account has been open for five years and the account holder has reached age 59 1/2, while the Mega Backdoor Roth, contributed through after-tax 401(k) rollovers, inherits this rule but allows earlier access to contributions without penalties. Understanding the distinction in timing and tax implications between traditional Roth IRAs and Mega Backdoor Roth conversions is crucial for optimizing retirement tax strategies.

Tax Diversification Strategy

Roth IRA and Mega Backdoor Roth both serve as powerful tools for tax diversification within retirement portfolios, as Roth IRA contributions are made with after-tax dollars, allowing for tax-free growth and withdrawals. The Mega Backdoor Roth amplifies this strategy by enabling significantly higher after-tax contributions through 401(k) plans, maximizing tax-advantaged savings and ultimately enhancing retirement income flexibility and tax efficiency.

Aggregate Limit Awareness

Understanding the aggregate contribution limit is crucial when choosing between a Roth IRA and a Mega Backdoor Roth for retirement savings. While a Roth IRA has an annual contribution cap of $6,500 (or $7,500 if over 50) as of 2024, the Mega Backdoor Roth allows after-tax contributions up to the total defined contribution plan limit of $66,000, including employer contributions, thereby significantly increasing the potential retirement nest egg.

Stretch Roth IRA Elimination

The elimination of the Stretch Roth IRA significantly impacts long-term retirement planning by restricting beneficiaries to withdraw inherited Roth IRA funds within a 10-year period, reducing the advantage of tax-free compounding over multiple decades. The Mega Backdoor Roth offers a strategic response by allowing higher after-tax contributions to be converted into a Roth IRA, maximizing tax-free growth despite the shortened distribution period.

In-Plan Roth Rollover

In-plan Roth rollovers enable employees to convert pre-tax 401(k) funds into after-tax Roth accounts within the same plan, offering tax-free growth and withdrawals in retirement. Compared to the Mega Backdoor Roth, this strategy simplifies the process by avoiding external rollovers while maximizing tax diversification in retirement portfolios.

High-Income Roth Access Loophole

The High-Income Roth Access Loophole allows high earners to bypass Roth IRA contribution limits by using a Mega Backdoor Roth strategy, which involves after-tax 401(k) contributions and in-service rollovers. This method significantly increases retirement savings potential by enabling larger Roth conversions beyond standard IRA contribution caps.

Roth IRA vs Mega Backdoor Roth for retirement. Infographic

moneydiff.com

moneydiff.com