Employer match contributions provide an immediate, guaranteed return on retirement savings by effectively increasing the amount invested without any extra cost to the employee. The Mega Backdoor Roth allows for significantly higher after-tax contributions to a Roth account, enabling tax-free growth and withdrawals, but requires meeting specific plan rules and may involve more administrative complexity. Weighing the instant benefit of employer matches against the long-term tax advantages of the Mega Backdoor Roth helps optimize retirement savings strategies.

Table of Comparison

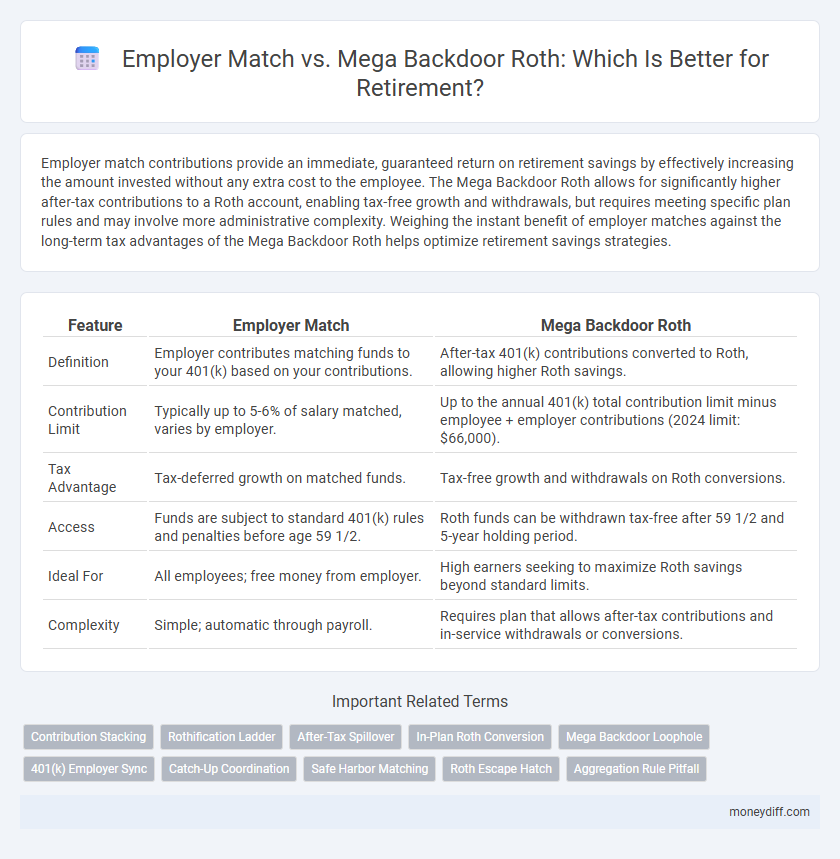

| Feature | Employer Match | Mega Backdoor Roth |

|---|---|---|

| Definition | Employer contributes matching funds to your 401(k) based on your contributions. | After-tax 401(k) contributions converted to Roth, allowing higher Roth savings. |

| Contribution Limit | Typically up to 5-6% of salary matched, varies by employer. | Up to the annual 401(k) total contribution limit minus employee + employer contributions (2024 limit: $66,000). |

| Tax Advantage | Tax-deferred growth on matched funds. | Tax-free growth and withdrawals on Roth conversions. |

| Access | Funds are subject to standard 401(k) rules and penalties before age 59 1/2. | Roth funds can be withdrawn tax-free after 59 1/2 and 5-year holding period. |

| Ideal For | All employees; free money from employer. | High earners seeking to maximize Roth savings beyond standard limits. |

| Complexity | Simple; automatic through payroll. | Requires plan that allows after-tax contributions and in-service withdrawals or conversions. |

Understanding Employer Match: Maximizing Free Money

Employer match programs offer a crucial opportunity to maximize retirement savings by providing free contributions based on a percentage of employee deferrals, often up to 3-6% of salary. Understanding the specific match formula of your employer enables you to contribute just enough to capture the full benefit, effectively increasing your investment without additional cost. Prioritizing employer match contributions before exploring Mega Backdoor Roth strategies ensures you do not leave free money on the table in your retirement planning.

What is a Mega Backdoor Roth IRA?

A Mega Backdoor Roth IRA is a powerful retirement savings strategy that allows high-income earners to contribute significantly more to a Roth IRA by utilizing after-tax contributions to a 401(k) plan combined with in-service rollovers. Unlike the traditional employer match, which is typically a percentage of your contributions up to a limit, the Mega Backdoor Roth can potentially enable contributions exceeding standard Roth IRA limits, accelerating tax-free growth. This strategy is especially advantageous for maximizing retirement savings beyond conventional contribution caps while benefiting from tax-free withdrawals in retirement.

Contribution Limits: Employer Match vs Mega Backdoor Roth

Employer matches typically contribute up to 5-6% of an employee's salary, effectively boosting retirement savings without impacting personal contribution limits. The Mega Backdoor Roth strategy allows after-tax contributions up to the overall 401(k) limit, which in 2024 is $66,000 including employer contributions. Maximizing contributions through a Mega Backdoor Roth can significantly surpass employer match limits, facilitating greater tax-advantaged retirement savings.

Tax Advantages: Comparing Both Strategies

Employer match contributions provide immediate tax-deferred growth by lowering taxable income on a pre-tax basis, maximizing employer-funded retirement savings with no immediate tax liability. The Mega Backdoor Roth enables after-tax contributions to be converted to a Roth IRA, allowing for tax-free growth and withdrawals, optimizing long-term tax efficiency for high-income earners. Comparing tax advantages, employer match offers upfront tax savings, while the Mega Backdoor Roth prioritizes tax-free income during retirement.

Eligibility Requirements for Employer Match and Mega Backdoor Roth

Eligibility requirements for an employer match typically include participation in a traditional 401(k) plan, meeting a minimum service period--often one year of employment--and contributing a portion of salary to receive the full match. The Mega Backdoor Roth, enabled through after-tax contributions to a 401(k) plan with a subsequent in-service rollover to a Roth IRA, requires the plan to allow after-tax contributions and in-service withdrawals. High earners with the option for large after-tax contributions in eligible 401(k) plans can leverage the Mega Backdoor Roth for increased tax-advantaged retirement savings beyond standard employer match limits.

Withdrawal Rules: Traditional 401(k), Roth, and Mega Backdoor Roth

Traditional 401(k) withdrawals are taxed as ordinary income and subject to required minimum distributions (RMDs) starting at age 73, while Roth 401(k) withdrawals are tax-free and not subject to RMDs if held for at least five years and the owner is over 59 1/2. The Mega Backdoor Roth allows after-tax contributions to be converted to a Roth account, providing tax-free growth and withdrawals with the same rules as a Roth 401(k). Understanding these distinctions is crucial for maximizing tax efficiency and retirement income flexibility.

Impact on Retirement Savings Growth

Employer match contributions boost retirement savings by providing immediate, risk-free returns that compound over time, significantly increasing the account balance. The Mega Backdoor Roth enables higher after-tax contributions converted to Roth status, allowing tax-free growth and withdrawals, maximizing long-term savings potential. Combining employer match and Mega Backdoor Roth strategies can exponentially accelerate retirement portfolio growth through diversified tax advantages and increased contribution limits.

Potential Risks and Downsides of Each Option

Employer match contributions are subject to vesting schedules and may limit investment flexibility, posing a risk if an employee leaves the company early. Mega Backdoor Roth IRA contributions face IRS annual limits and complex tax rules, increasing the potential for inadvertent non-compliance and penalties. Both options carry risks related to market volatility affecting account balances, but the Mega Backdoor Roth involves more intricate administrative requirements.

Choosing the Right Strategy Based on Income Level

High-income earners often benefit more from the Mega Backdoor Roth due to its higher contribution limits and tax-free growth potential, exceeding typical employer match benefits. Lower to moderate-income employees may optimize retirement savings by prioritizing employer match contributions, which provide immediate, risk-free returns on their investment. Evaluating individual income levels against contribution limits and tax scenarios ensures choosing the most advantageous retirement strategy.

Combining Employer Match and Mega Backdoor Roth for Optimal Retirement Planning

Maximizing retirement savings involves strategically combining employer match contributions with the Mega Backdoor Roth conversion to capitalize on both immediate tax benefits and long-term tax-free growth. Employer matches provide guaranteed free money that boosts your 401(k) balance, while Mega Backdoor Roths allow higher after-tax contributions to grow tax-free, significantly increasing retirement nest eggs. Coordinating these strategies ensures a diversified tax advantage, enhances compound growth, and optimizes overall retirement readiness.

Related Important Terms

Contribution Stacking

Maximizing retirement savings involves contribution stacking, where employer match programs provide immediate tax-advantaged growth while Mega Backdoor Roth IRAs enable higher after-tax contributions that grow tax-free. Combining employer matches up to 6% of salary with Mega Backdoor Roth contributions exceeding $36,500 annually can significantly enhance overall retirement portfolio value.

Rothification Ladder

Employer match contributions maximize retirement savings through immediate tax-deferred growth, but the Mega Backdoor Roth enables higher after-tax contributions and Rothification ladder strategies for tax-free withdrawals over time. Utilizing a Mega Backdoor Roth ladder accelerates Roth conversions, creating a tax-efficient retirement income stream beyond the employer match limits.

After-Tax Spillover

After-tax spillover occurs when contributions exceed the plan's limit, allowing excess funds to be allocated into a Mega Backdoor Roth, maximizing tax-advantaged growth beyond traditional employer match caps. This strategy enables higher retirement savings compared to relying solely on employer match contributions, which are typically limited and taxed at withdrawal.

In-Plan Roth Conversion

In-plan Roth conversions enable employees to convert pre-tax 401(k) contributions, including employer matches, into after-tax Roth accounts, allowing for tax-free growth and withdrawals in retirement. While employer matches provide immediate tax-deferred growth benefits, the Mega Backdoor Roth offers higher after-tax contribution limits, maximizing retirement savings potential through tax diversification.

Mega Backdoor Loophole

The Mega Backdoor Roth strategy allows high-income earners to contribute up to $43,500 annually after-tax into their 401(k), significantly surpassing the standard employer match limit and maximizing tax-advantaged growth. Unlike employer matches, which typically cap contributions at 5% of salary, the Mega Backdoor Roth exploits a unique IRS loophole to potentially convert substantial after-tax savings into tax-free Roth funds, accelerating retirement wealth accumulation.

401(k) Employer Sync

Maximizing a 401(k) employer match is essential for retirement savings, as it provides an immediate, risk-free return on contributions often equivalent to 50% to 100% of employee deferrals up to a set limit. In contrast, the Mega Backdoor Roth strategy allows for significantly higher after-tax contributions that convert to Roth funds, offering tax-free growth but lacks the guaranteed employer contribution benefit of the standard match.

Catch-Up Coordination

Employer match contributions provide immediate tax-advantaged growth by boosting your 401(k) balance, while the Mega Backdoor Roth allows for significantly higher after-tax contributions and tax-free growth, especially valuable during catch-up years when contribution limits increase. Coordinating these strategies maximizes retirement savings potential by leveraging the employer match for baseline contributions and utilizing the Mega Backdoor Roth to accelerate tax-free wealth accumulation in your catch-up phase.

Safe Harbor Matching

Safe Harbor Matching guarantees full employer contributions to your 401(k) without vesting delays, maximizing tax-advantaged growth compared to the Mega Backdoor Roth's higher after-tax contribution limits but potential plan complexity. Prioritizing Safe Harbor contributions ensures stable, predictable retirement savings while the Mega Backdoor Roth serves as a supplementary strategy for high-income earners seeking additional tax-free growth.

Roth Escape Hatch

Employer match contributions offer immediate tax-deferred growth and guaranteed returns, while the Mega Backdoor Roth provides significant after-tax growth potential with tax-free withdrawals in retirement, leveraging the Roth escape hatch for aggressive tax planning. Utilizing the Mega Backdoor Roth strategy allows high-income earners to maximize Roth IRA contributions beyond standard limits, creating a powerful tax-advantaged retirement savings vehicle compared to relying solely on employer match.

Aggregation Rule Pitfall

Employer match contributions in retirement plans are subject to the Aggregation Rule, which limits the ability to combine multiple accounts from the same employer for maximum tax advantages, potentially diminishing overall benefits. In contrast, the Mega Backdoor Roth allows high-contribution limits via after-tax contributions and in-service rollovers, bypassing some aggregation restrictions and maximizing tax-advantaged growth.

Employer Match vs Mega Backdoor Roth for retirement. Infographic

moneydiff.com

moneydiff.com