Retirement accounts provide a structured, tax-advantaged way to save for the future, typically through employer-sponsored plans or IRAs that encourage consistent contributions over time. The FIRE (Financial Independence, Retire Early) strategy emphasizes aggressive saving and investing to achieve early retirement, often relying on diversified investments outside traditional retirement accounts for flexibility. Choosing between a retirement account and the FIRE approach depends on individual goals, risk tolerance, and desired retirement timeline.

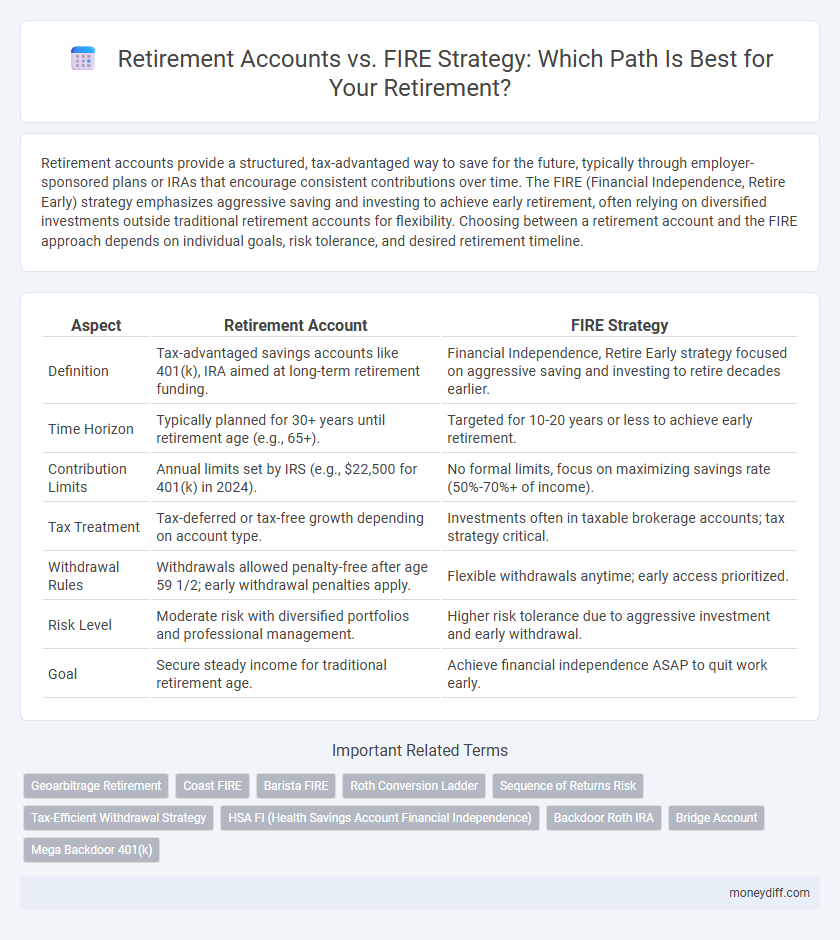

Table of Comparison

| Aspect | Retirement Account | FIRE Strategy |

|---|---|---|

| Definition | Tax-advantaged savings accounts like 401(k), IRA aimed at long-term retirement funding. | Financial Independence, Retire Early strategy focused on aggressive saving and investing to retire decades earlier. |

| Time Horizon | Typically planned for 30+ years until retirement age (e.g., 65+). | Targeted for 10-20 years or less to achieve early retirement. |

| Contribution Limits | Annual limits set by IRS (e.g., $22,500 for 401(k) in 2024). | No formal limits, focus on maximizing savings rate (50%-70%+ of income). |

| Tax Treatment | Tax-deferred or tax-free growth depending on account type. | Investments often in taxable brokerage accounts; tax strategy critical. |

| Withdrawal Rules | Withdrawals allowed penalty-free after age 59 1/2; early withdrawal penalties apply. | Flexible withdrawals anytime; early access prioritized. |

| Risk Level | Moderate risk with diversified portfolios and professional management. | Higher risk tolerance due to aggressive investment and early withdrawal. |

| Goal | Secure steady income for traditional retirement age. | Achieve financial independence ASAP to quit work early. |

Understanding Retirement Accounts: Traditional Pathways

Retirement accounts such as 401(k)s and IRAs serve as foundational elements in traditional retirement planning, offering tax advantages and structured contribution limits that promote long-term savings. These accounts provide benefits like tax-deferred growth and potential employer matching, which are critical for maximizing retirement funds over time. Understanding the specific rules, withdrawal penalties, and required minimum distributions of these accounts is essential for aligning with conventional retirement strategies.

What is the FIRE Strategy? Key Principles Explained

The FIRE strategy, which stands for Financial Independence, Retire Early, emphasizes aggressive savings and investments to achieve early retirement by maximizing income and minimizing expenses, often targeting a savings rate of 50% or more. Key principles include reducing lifestyle costs, increasing passive income streams, and focusing on low-cost index fund investments to build a sustainable portfolio that generates sufficient returns to cover living expenses without traditional employment. Unlike conventional retirement accounts limited by contribution caps and tax rules, FIRE relies on flexible investment accounts and frugality to enable financial freedom typically decades before standard retirement age.

Core Differences: Retirement Accounts vs. FIRE Approach

Retirement accounts, such as 401(k)s and IRAs, provide tax-advantaged savings specifically designed for long-term financial security with regulated contribution limits and required minimum distributions. The FIRE (Financial Independence, Retire Early) strategy emphasizes aggressive saving, investing, and lifestyle optimization to achieve early retirement by accumulating sufficient assets independently of traditional retirement accounts. Core differences lie in the structured nature and tax benefits of retirement accounts versus the flexible, self-directed investment approach and faster timeline characteristic of FIRE.

Tax Implications: Comparing FIRE and Retirement Accounts

Retirement accounts such as 401(k)s and IRAs offer tax advantages, including tax-deferred growth and potential employer matching, which can significantly enhance long-term savings. The FIRE (Financial Independence, Retire Early) strategy often relies on a combination of taxable, tax-deferred, and tax-free accounts to maximize flexibility and minimize tax burdens during early retirement withdrawals. Evaluating tax implications between FIRE and traditional retirement accounts is crucial, as early withdrawals from tax-advantaged accounts may trigger penalties and higher tax rates, while strategic asset allocation in FIRE can optimize after-tax income.

Flexibility and Accessibility of Funds

Retirement accounts such as 401(k)s and IRAs offer tax advantages but often impose penalties on early withdrawals, limiting fund accessibility before the age of 59 1/2. The FIRE (Financial Independence, Retire Early) strategy emphasizes building diverse income streams and liquid assets, providing greater flexibility to access funds at any time without restrictions. This approach allows retirees to customize their financial planning and access resources based on personal needs rather than regulatory constraints.

Investment Choices: FIRE vs. Traditional Retirement Accounts

FIRE (Financial Independence, Retire Early) strategies often emphasize aggressive, diversified investments in taxable brokerage accounts to maximize growth and liquidity, while traditional retirement accounts like 401(k)s and IRAs prioritize tax-advantaged growth with contribution limits and withdrawal restrictions. Investment choices in FIRE focus on high equity exposure and real estate to expedite wealth accumulation, contrasting with the conservative asset allocation commonly recommended for traditional retirement plans. Understanding the trade-offs between immediate access and tax deferral is crucial when choosing a strategy tailored to individual retirement timelines and risk tolerance.

Risk Management in Retirement Planning

Retirement accounts provide structured risk management through diversification and regulatory protections, ensuring steady growth and tax advantages for long-term security. The FIRE (Financial Independence, Retire Early) strategy emphasizes aggressive saving and investment to achieve early retirement but requires careful risk management to avoid market volatility and sequence-of-returns risk. Balancing traditional retirement accounts with FIRE tactics can optimize asset allocation and safeguard against unexpected financial downturns during retirement.

Lifestyle Impact: Which Suits Your Retirement Goals?

Retirement accounts offer structured savings with tax advantages but may limit early access to funds, aligning well with traditional retirement timelines. The FIRE (Financial Independence, Retire Early) strategy emphasizes aggressive saving and investing to achieve financial freedom sooner, enabling a more flexible and often more frugal lifestyle. Choosing between these approaches depends on your desired retirement lifestyle, risk tolerance, and willingness to adjust spending habits to meet early retirement goals.

Withdrawal Strategies: FIRE vs. Retirement Accounts

Withdrawal strategies for Retirement accounts typically follow Required Minimum Distributions (RMDs) starting at age 73, ensuring taxed income flow, while FIRE (Financial Independence, Retire Early) advocates for flexibility by using a sequence of tax-efficient withdrawals from taxable, Roth IRA, and traditional retirement accounts. FIRE strategies prioritize minimizing taxes and maximizing portfolio longevity through dynamic withdrawal rates tailored to market conditions, in contrast to the more rigid RMD schedule of traditional retirement accounts. Understanding tax implications and withdrawal sequencing is critical in optimizing retirement income sustainability under both approaches.

Choosing Your Path: Factors to Consider for Retirement Security

Evaluating retirement accounts versus the FIRE strategy requires analyzing factors such as risk tolerance, savings rate, and desired retirement timeline. Retirement accounts offer tax advantages and structured growth, while FIRE emphasizes aggressive saving and early retirement through financial independence. Understanding your financial goals, lifestyle preferences, and market variability helps determine which approach best ensures long-term retirement security.

Related Important Terms

Geoarbitrage Retirement

Retirement accounts like 401(k)s and IRAs offer tax advantages and structured savings, but the FIRE (Financial Independence, Retire Early) strategy leverages geoarbitrage by relocating to lower-cost regions to maximize withdrawal longevity and lifestyle quality. Geoarbitrage enhances FIRE by reducing living expenses, allowing earlier retirement and increased financial independence compared to traditional retirement accounts alone.

Coast FIRE

Coast FIRE emphasizes reaching a retirement account balance early enough so investments can grow without additional contributions, enabling financial independence by covering future expenses through compounding interest alone. Unlike traditional retirement accounts that require continuous contributions, Coast FIRE allows saving to pause while still ensuring a secure retirement timeline.

Barista FIRE

Barista FIRE combines maintaining a part-time job, often with employee benefits, while gradually building a retirement account to ensure financial security and healthcare coverage without fully relying on traditional retirement savings. This strategy balances steady income from a Barista job with the long-term growth potential of tax-advantaged retirement accounts like 401(k)s and IRAs, optimizing both cash flow and investment returns.

Roth Conversion Ladder

A Roth Conversion Ladder strategically mitigates tax burdens by gradually converting traditional retirement accounts to Roth IRAs, enabling penalty-free withdrawals during early retirement and aligning with the FIRE (Financial Independence, Retire Early) strategy. This approach maximizes tax efficiency and liquidity, supporting a seamless transition from active income to sustainable retirement funding.

Sequence of Returns Risk

Retirement accounts provide structured tax advantages and lower risk through diversified portfolios, mitigating Sequence of Returns Risk by allowing systematic withdrawals aligned with market conditions. The FIRE (Financial Independence, Retire Early) strategy often entails aggressive early withdrawals that can amplify the impact of Sequence of Returns Risk, increasing vulnerability during market downturns in initial retirement years.

Tax-Efficient Withdrawal Strategy

Retirement accounts like 401(k)s and IRAs offer tax-deferred growth but require minimum distributions, whereas the FIRE (Financial Independence, Retire Early) strategy emphasizes creating diversified income streams, including taxable, tax-deferred, and tax-free accounts to optimize tax-efficient withdrawals. Implementing a tax-efficient withdrawal strategy involves careful sequencing of withdrawals from Roth IRAs, traditional accounts, and taxable investments to minimize tax liability and maximize retirement income longevity.

HSA FI (Health Savings Account Financial Independence)

Health Savings Accounts (HSAs) offer a unique advantage in retirement planning by combining tax-free contributions, growth, and withdrawals specifically for medical expenses, making them a powerful tool within the FIRE (Financial Independence, Retire Early) strategy. Incorporating an HSA into a retirement account portfolio enhances financial flexibility and healthcare security, crucial for sustaining long-term financial independence.

Backdoor Roth IRA

Backdoor Roth IRA offers a strategic advantage for high-income earners seeking tax-free growth beyond the contribution limits of traditional Retirement accounts; this approach complements the FIRE strategy by enabling accelerated tax-advantaged savings and early withdrawal flexibility. Incorporating Backdoor Roth IRAs within the FIRE framework maximizes long-term wealth accumulation and supports earlier retirement timelines without sacrificing tax efficiency.

Bridge Account

A Bridge Account serves as an essential funding tool within the FIRE (Financial Independence, Retire Early) strategy, providing liquidity between early retirement and access to traditional Retirement Accounts like 401(k)s or IRAs. This account minimizes penalties by covering expenses before age-based withdrawals are allowed, ensuring a smoother transition to long-term retirement income sources.

Mega Backdoor 401(k)

The Mega Backdoor 401(k) strategy allows high-income earners to contribute after-tax dollars up to $66,000 annually, significantly boosting retirement savings beyond traditional 401(k) and IRA limits, making it a powerful tool compared to typical FIRE strategies reliant on aggressive savings and investments. Utilizing this method can accelerate wealth accumulation for retirement by maximizing tax-advantaged contributions, offering greater flexibility and growth potential than standard Retirement accounts alone.

Retirement account vs FIRE strategy for retirement. Infographic

moneydiff.com

moneydiff.com