Social Security provides a foundational income source throughout retirement, but longevity insurance specifically protects against outliving your savings by offering guaranteed income later in life. While Social Security benefits are based on lifetime earnings and determine monthly payments, longevity insurance requires a separate purchase and starts payouts at an advanced age, such as 80 or 85. Combining both strategies can create a more secure retirement income plan that balances immediate needs with protection against longevity risk.

Table of Comparison

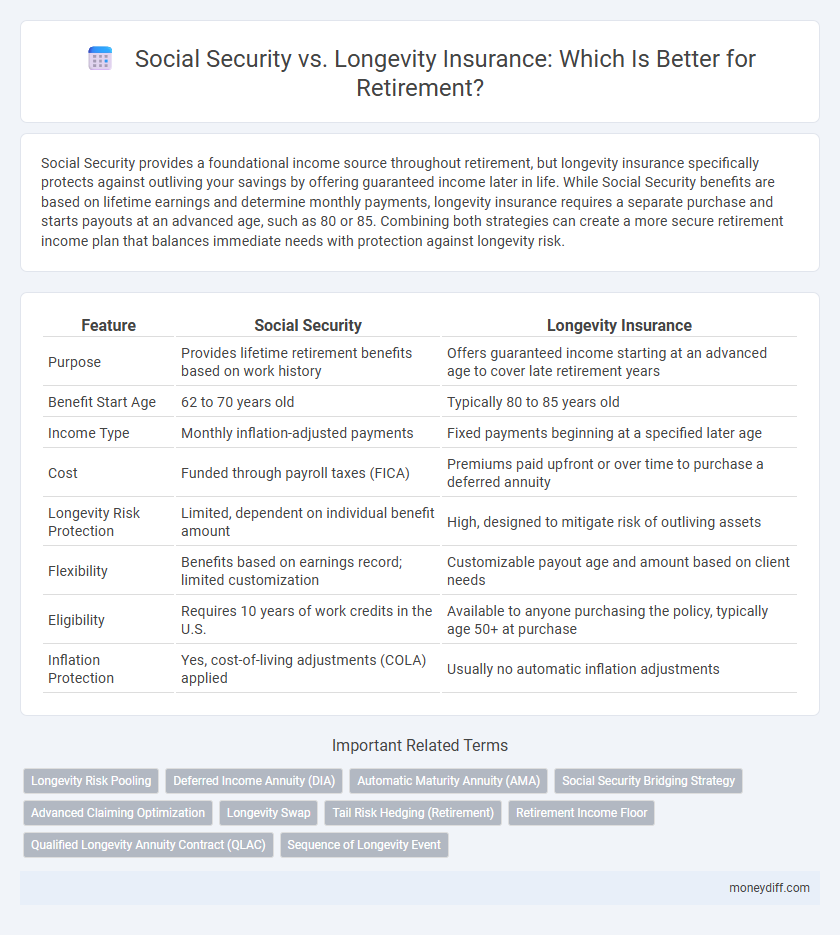

| Feature | Social Security | Longevity Insurance |

|---|---|---|

| Purpose | Provides lifetime retirement benefits based on work history | Offers guaranteed income starting at an advanced age to cover late retirement years |

| Benefit Start Age | 62 to 70 years old | Typically 80 to 85 years old |

| Income Type | Monthly inflation-adjusted payments | Fixed payments beginning at a specified later age |

| Cost | Funded through payroll taxes (FICA) | Premiums paid upfront or over time to purchase a deferred annuity |

| Longevity Risk Protection | Limited, dependent on individual benefit amount | High, designed to mitigate risk of outliving assets |

| Flexibility | Benefits based on earnings record; limited customization | Customizable payout age and amount based on client needs |

| Eligibility | Requires 10 years of work credits in the U.S. | Available to anyone purchasing the policy, typically age 50+ at purchase |

| Inflation Protection | Yes, cost-of-living adjustments (COLA) applied | Usually no automatic inflation adjustments |

Understanding Social Security Benefits for Retirees

Social Security benefits provide a foundational income source for retirees, calculated based on lifetime earnings and age at claiming, with full benefits available between ages 66 and 67 depending on birth year. Eligibility for spousal and survivor benefits enhances financial security, while cost-of-living adjustments help maintain purchasing power. Understanding the differences between lifetime guaranteed benefits from Social Security and the targeted, time-limited protection offered by longevity insurance is crucial for effective retirement planning.

What is Longevity Insurance and How Does It Work?

Longevity insurance, also known as a deferred income annuity, provides guaranteed income beginning at an advanced age, typically around 80 or 85, to help protect retirees from outliving their savings. Unlike Social Security, which starts paying benefits as early as age 62 based on your earnings history, longevity insurance requires upfront premium payments and begins disbursing income later in life. This financial product complements Social Security by ensuring a steady cash flow in the later years, mitigating the risk of exhausting retirement assets.

Key Differences Between Social Security and Longevity Insurance

Social Security provides a guaranteed monthly income based on lifetime earnings and is funded through payroll taxes, while longevity insurance is a private annuity designed to pay out starting at an advanced age, typically 80 or 85, to protect against outliving savings. Social Security benefits adjust for inflation with cost-of-living increases, whereas longevity insurance payouts are usually fixed without inflation adjustments. Eligibility for Social Security depends on work credits and age, whereas longevity insurance requires purchasing a policy with premium payments during retirement or pre-retirement years.

Pros and Cons of Relying on Social Security

Relying on Social Security for retirement ensures a guaranteed monthly income adjusted for inflation, providing a stable financial foundation for retirees. However, Social Security benefits may not fully cover all living expenses, especially given increasing healthcare costs and longer life expectancies. Dependence solely on Social Security carries the risk of reduced benefits due to potential future funding shortfalls or policy changes.

Advantages of Longevity Insurance in Retirement Planning

Longevity insurance provides a secure income stream starting at an advanced age, protecting retirees from outliving their savings and ensuring financial stability during extended lifespans. Unlike Social Security, which offers fixed benefits subject to government policy changes, longevity insurance policies often provide inflation-adjusted payouts tailored to individual needs. This targeted protection enhances retirement planning by addressing the specific risk of longevity, allowing for more flexible and confident financial decisions.

Eligibility and Payout Structures Compared

Social Security benefits require individuals to have earned sufficient credits through working and paying Social Security taxes, with eligibility typically beginning at age 62, while longevity insurance targets retirees around age 80 or later, offering payouts that start much later in life to address the risk of outliving other retirement income. Social Security provides monthly payments based on lifetime earnings history, adjusted for inflation, whereas longevity insurance offers fixed or increasing payouts designed to secure income during the advanced years of retirement when other resources may be depleted. This fundamental difference in eligibility age and payout timing makes Social Security a primary, broad-based safety net and longevity insurance a specialized tool for late-life financial protection.

Cost Considerations: Social Security vs Longevity Annuities

Social Security provides a guaranteed, inflation-adjusted income with no upfront cost, funded through payroll taxes over a working lifetime. Longevity annuities often require a substantial initial premium but offer higher payouts starting at advanced ages, effectively hedging against outliving Social Security benefits. Comparing cost considerations involves evaluating immediate accessibility and inflation protection of Social Security against the targeted, potentially larger future income from longevity annuities.

Risk Management: Securing Lifetime Income

Social Security provides a guaranteed lifetime income backed by the federal government, making it a foundational risk management tool against outliving savings. Longevity insurance, also called deferred income annuities, supplements Social Security by offering additional income starting later in retirement, specifically designed to protect against the financial risk of living beyond average life expectancy. Combining both strategies enhances lifetime income security and mitigates the risk of income shortfalls in advanced age.

Integrating Social Security and Longevity Insurance in Your Strategy

Integrating Social Security benefits with longevity insurance creates a robust retirement strategy that balances guaranteed lifetime income and protection against outliving savings. Social Security provides a foundational, inflation-indexed income stream, while longevity insurance supplements this with a deferred payout starting at advanced ages, typically 80 or 85, enhancing financial security during extended lifespans. Combining these tools allows retirees to optimize cash flow, manage longevity risk, and maintain financial independence throughout retirement.

Which Option Best Fits Different Retirement Lifestyles?

Social Security provides a consistent, inflation-adjusted income stream ideal for retirees seeking stable, lifelong financial support without additional management. Longevity insurance, or deferred income annuities, suits individuals anticipating longer lifespans who want to secure higher payments starting at advanced ages, reducing the risk of outliving savings. Retirees with moderate needs and preference for simplicity often benefit more from Social Security, while those with significant assets and concerns about prolonged longevity may find longevity insurance a better fit.

Related Important Terms

Longevity Risk Pooling

Longevity insurance offers a targeted solution to combat longevity risk pooling by providing guaranteed income streams for life, addressing the financial uncertainty of outliving Social Security benefits. This differs from Social Security's broad longevity risk pool, which redistributes income but may fall short for retirees with extended lifespans seeking stable, inflation-adjusted retirement income.

Deferred Income Annuity (DIA)

Deferred Income Annuities (DIAs) provide a reliable income stream beginning at a specified future date, making them a strategic solution for longevity risk that social security alone may not fully address. DIAs complement Social Security by guaranteeing income beyond traditional retirement benefits, helping retirees secure financial stability as they live longer.

Automatic Maturity Annuity (AMA)

Automatic Maturity Annuity (AMA) enhances retirement security by providing a guaranteed income stream that complements Social Security benefits, addressing longevity risk through automatic payouts starting at a specified age. Unlike traditional longevity insurance requiring complex underwriting, AMA simplifies income planning by automatically converting accumulated funds into lifetime annuity payments, ensuring sustained financial stability throughout retirement.

Social Security Bridging Strategy

Social Security provides a guaranteed lifetime income, making it a foundational component of retirement planning, while longevity insurance offers additional protection against outliving assets by kicking in at advanced ages. The Social Security Bridging Strategy maximizes monthly benefits by delaying Social Security claims until age 70 and relying on other income sources in the interim, optimizing lifetime retirement income security.

Advanced Claiming Optimization

Advanced claiming optimization leverages strategic timing to maximize Social Security benefits, balancing immediate income with future longevity risks. Longevity insurance complements this approach by providing a guaranteed income stream later in retirement, reducing the risk of outliving Social Security payments.

Longevity Swap

Longevity swaps offer a strategic alternative to traditional Social Security by transferring the risk of outliving retirement savings to a counterparty, ensuring steady income regardless of lifespan. This financial instrument enables retirees to hedge longevity risk more effectively than standard longevity insurance, optimizing retirement income stability in an aging population.

Tail Risk Hedging (Retirement)

Social Security provides baseline income with inflation adjustments, while longevity insurance specifically hedges tail risk by guaranteeing lifetime income beyond typical life expectancy, protecting retirees from outliving their assets. Tail risk hedging through longevity insurance is crucial in retirement planning as it addresses the uncertainty of lifespan, ensuring financial stability even in extreme longevity scenarios.

Retirement Income Floor

Establishing a robust retirement income floor involves integrating Social Security benefits with longevity insurance to ensure stable cash flow throughout extended retirement periods. Social Security provides a guaranteed base income indexed to inflation, while longevity insurance offers additional payouts starting at advanced ages, protecting against the financial risks of outliving traditional savings.

Qualified Longevity Annuity Contract (QLAC)

Qualified Longevity Annuity Contracts (QLACs) offer a strategic option for retirees seeking guaranteed income beginning at an advanced age, typically 80 or 85, complementing Social Security benefits by addressing longevity risk. While Social Security provides lifelong inflation-adjusted payments starting as early as 62, QLACs allow deferral of required minimum distributions from retirement accounts, optimizing tax efficiency and ensuring additional financial security in late retirement.

Sequence of Longevity Event

Social Security provides guaranteed lifetime income starting at a set age, whereas longevity insurance delays payouts until advanced age, protecting against outliving assets by covering expenses in the late retirement phase. The sequence of longevity events impacts retirement planning, with Social Security offering early stable income and longevity insurance acting as a financial safety net during years of extended lifespan.

Social Security vs longevity insurance for retirement. Infographic

moneydiff.com

moneydiff.com