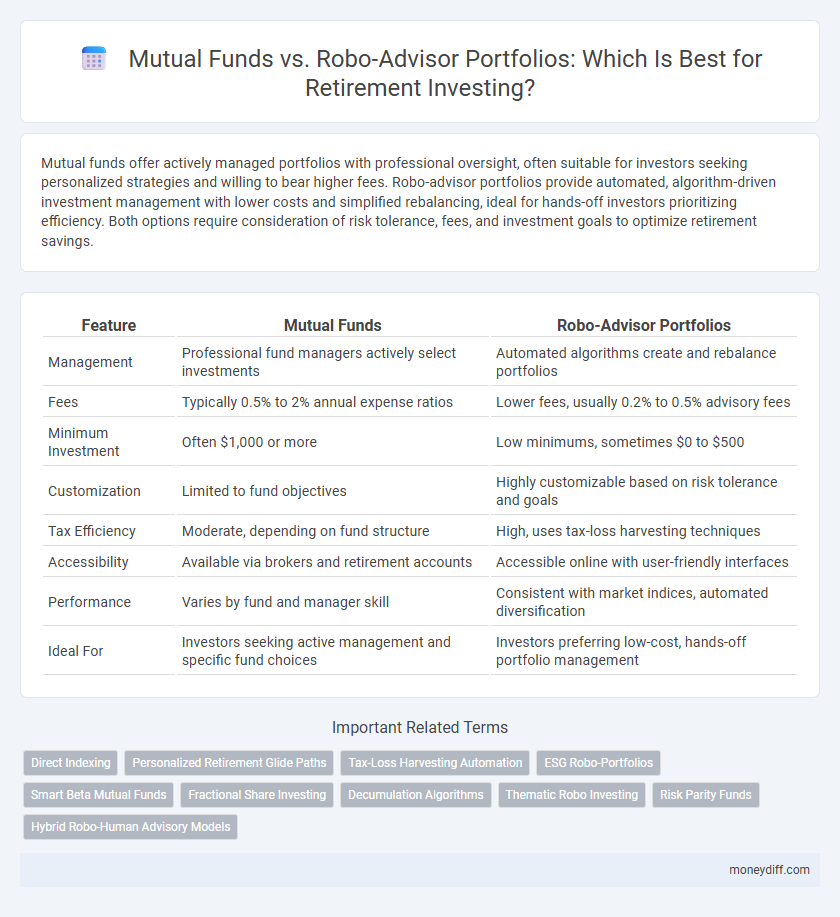

Mutual funds offer actively managed portfolios with professional oversight, often suitable for investors seeking personalized strategies and willing to bear higher fees. Robo-advisor portfolios provide automated, algorithm-driven investment management with lower costs and simplified rebalancing, ideal for hands-off investors prioritizing efficiency. Both options require consideration of risk tolerance, fees, and investment goals to optimize retirement savings.

Table of Comparison

| Feature | Mutual Funds | Robo-Advisor Portfolios |

|---|---|---|

| Management | Professional fund managers actively select investments | Automated algorithms create and rebalance portfolios |

| Fees | Typically 0.5% to 2% annual expense ratios | Lower fees, usually 0.2% to 0.5% advisory fees |

| Minimum Investment | Often $1,000 or more | Low minimums, sometimes $0 to $500 |

| Customization | Limited to fund objectives | Highly customizable based on risk tolerance and goals |

| Tax Efficiency | Moderate, depending on fund structure | High, uses tax-loss harvesting techniques |

| Accessibility | Available via brokers and retirement accounts | Accessible online with user-friendly interfaces |

| Performance | Varies by fund and manager skill | Consistent with market indices, automated diversification |

| Ideal For | Investors seeking active management and specific fund choices | Investors preferring low-cost, hands-off portfolio management |

Understanding Mutual Funds and Robo-Advisors for Retirement

Mutual funds pool investors' money into diversified portfolios managed by professionals, offering active management and potential tax advantages ideal for retirement growth. Robo-advisor portfolios use algorithm-driven strategies to create low-cost, automated, and personalized retirement investment plans, adapting asset allocation based on risk tolerance and retirement goals. Comparing fees, control, and customization helps investors select between mutual funds' hands-on management and robo-advisors' efficient, technology-driven approach for optimal retirement planning.

Key Differences: Mutual Funds vs Robo-Advisor Portfolios

Mutual funds offer actively managed portfolios with human fund managers selecting securities, while robo-advisor portfolios utilize algorithms to create automated, low-cost investment strategies based on individual risk tolerance and goals. Mutual funds often have higher expense ratios and minimum investment requirements compared to robo-advisors, which provide diversified portfolios with automatic rebalancing and tax-loss harvesting features. Investors seeking personalized advice and hands-on management may prefer mutual funds, whereas those prioritizing lower fees and ease of access might find robo-advisors more suitable for retirement investing.

Costs and Fees Comparison: Mutual Funds vs Robo-Advisors

Mutual funds often charge higher expense ratios averaging 0.50% to 1.5%, alongside potential sales loads and management fees, increasing the overall cost for retirement investors. Robo-advisors typically offer lower fees, ranging from 0.20% to 0.50%, with minimal or no sales commissions, which can significantly improve net returns over time. Cost efficiency in robo-advisor portfolios may make them a more attractive option for retirement planning compared to traditional mutual funds with higher fee structures.

Investment Strategy and Diversification

Mutual funds offer broad diversification by pooling assets from many investors to invest in a variety of stocks, bonds, and other securities, providing a professionally managed portfolio tailored to retirement goals. Robo-advisor portfolios use algorithm-driven strategies to automatically diversify investments across low-cost ETFs, adjusting allocations based on risk tolerance and market conditions for a hands-off approach. Both strategies aim to optimize retirement returns through diversification, but robo-advisors provide dynamic rebalancing and personalized investment strategies leveraging technology.

Ease of Use and Accessibility

Mutual funds offer straightforward investment options with professional management, making them accessible to most retirement investors through traditional brokerage accounts and retirement plans. Robo-advisor portfolios provide highly user-friendly platforms with automated portfolio management and low account minimums, ideal for tech-savvy investors seeking convenience and continuous portfolio rebalancing. Both options simplify retirement investing, but robo-advisors excel in ease of use through digital interfaces and personalized algorithms.

Performance and Historical Returns

Mutual funds for retirement investing offer decades of historical performance data, enabling investors to assess long-term returns and volatility patterns. Robo-advisor portfolios leverage algorithm-driven asset allocation, showing competitive performance with lower fees and adaptive rebalancing strategies. Studies reveal mutual funds often have higher average returns over multiple market cycles, but robo-advisors provide consistent returns with a focus on cost efficiency and risk management.

Risk Management Approaches

Mutual funds employ active risk management through portfolio managers who adjust holdings based on market trends and economic forecasts, aiming to mitigate losses and optimize returns. Robo-advisor portfolios utilize algorithm-driven diversification and automatic rebalancing to maintain risk levels aligned with an investor's retirement timeline and risk tolerance. Both approaches balance risk differently: mutual funds rely on human expertise, while robo-advisors leverage technology for consistent, data-driven risk adjustments.

Customization and Personalization for Retirement Goals

Mutual funds offer a wide range of pre-built portfolios but often lack the deep customization that robo-advisor platforms provide by using algorithms tailored to individual retirement goals, risk tolerance, and time horizons. Robo-advisor portfolios continuously rebalance and adapt to changing financial circumstances, providing a personalized investment strategy aligned with evolving retirement needs. This dynamic adjustment capability gives investors a more customized experience compared to the static nature of traditional mutual fund selections.

Tax Efficiency and Retirement Planning

Mutual funds often face higher capital gains distributions, reducing tax efficiency in retirement accounts, whereas robo-advisor portfolios utilize tax-loss harvesting techniques to minimize tax liabilities. Robo-advisors dynamically rebalance portfolios to optimize tax outcomes, improving after-tax returns essential for long-term retirement planning. Investors prioritizing tax efficiency and personalized retirement strategies may find robo-advisor platforms better suited for managing retirement accounts compared to traditional mutual funds.

Choosing the Right Retirement Investment Option

Choosing between mutual funds and robo-advisor portfolios for retirement investing depends on factors like management style, fees, and personalization. Mutual funds offer professional management with diversified assets but may have higher expense ratios and minimum investment requirements. Robo-advisor portfolios provide algorithm-driven asset allocation with lower fees, automated rebalancing, and tailored risk levels, making them suitable for cost-conscious investors seeking hands-off retirement strategies.

Related Important Terms

Direct Indexing

Direct indexing within robo-advisor portfolios allows investors to hold individual securities that mimic an index, offering enhanced tax-loss harvesting and customization compared to traditional mutual funds. This approach can lead to more efficient retirement investing by reducing fees and improving after-tax returns while maintaining diversified exposure.

Personalized Retirement Glide Paths

Mutual funds offer predefined retirement glide paths that adjust asset allocation based on age, while robo-advisor portfolios provide highly personalized retirement glide paths using algorithms that factor in individual risk tolerance, goals, and timeline. Personalized retirement glide paths from robo-advisors enable dynamic portfolio rebalancing tailored to evolving financial situations, potentially optimizing retirement outcomes more effectively than generic mutual fund options.

Tax-Loss Harvesting Automation

Robo-advisor portfolios offer automated tax-loss harvesting, systematically identifying and selling securities at a loss to offset capital gains and reduce taxable income. Mutual funds typically lack this feature, requiring manual intervention for tax efficiency, which may result in higher tax liabilities for retirement investors.

ESG Robo-Portfolios

ESG robo-advisor portfolios offer automated, algorithm-driven investment strategies that incorporate environmental, social, and governance criteria, providing a hands-off, diversified approach tailored to socially responsible retirement investing. Mutual funds focused on ESG criteria typically involve active management with human oversight, potentially delivering more nuanced selection but often at higher fees compared to low-cost ESG robo-advisor portfolios ideal for long-term retirement savings.

Smart Beta Mutual Funds

Smart Beta mutual funds strategically blend factors like value, momentum, and low volatility to enhance returns and manage risk in retirement portfolios, offering a more nuanced approach than traditional index funds. These funds often outperform robo-advisor portfolios by leveraging advanced factor-based investing techniques while maintaining cost efficiency and diversification critical for long-term retirement growth.

Fractional Share Investing

Fractional share investing allows both mutual funds and robo-advisor portfolios to offer diversified retirement investments with lower capital requirements, enabling investors to purchase partial shares that fit their budget. Robo-advisors optimize these fractional allocations through algorithm-driven portfolio rebalancing, while mutual funds provide professionally managed fractional units tied to underlying assets.

Decumulation Algorithms

Mutual funds offer traditional portfolio management with human oversight, while robo-advisor portfolios utilize advanced decumulation algorithms to optimize systematic withdrawals and minimize sequence-of-returns risk during retirement. These algorithms tailor withdrawal rates based on lifespan projections and market conditions, providing a dynamic approach that can enhance portfolio longevity compared to static distribution methods commonly found in mutual fund strategies.

Thematic Robo Investing

Thematic robo-advisor portfolios offer retirement investors targeted exposure to high-growth sectors such as clean energy, technology, and healthcare through algorithm-driven asset allocation, providing a personalized and cost-effective alternative to traditional mutual funds. These digital platforms optimize diversification and tax efficiency while continuously rebalancing to align with evolving market trends and individual retirement goals.

Risk Parity Funds

Risk Parity Funds balance risk across various asset classes, offering a diversified approach that can reduce volatility compared to traditional Mutual Funds for retirement portfolios. Robo-Advisor Portfolios leveraging Risk Parity strategies provide automated, algorithm-driven asset allocation, optimizing risk-adjusted returns tailored to an investor's retirement time horizon and risk tolerance.

Hybrid Robo-Human Advisory Models

Hybrid robo-human advisory models combine algorithm-driven investment strategies with personalized financial advice, optimizing retirement investing by balancing automated efficiency and expert guidance. These models leverage the low-cost benefits of mutual funds managed through robo-advisors while enhancing portfolio customization and risk management through human oversight, resulting in more tailored outcomes for retirement goals.

Mutual Funds vs Robo-Advisor Portfolios for retirement investing Infographic

moneydiff.com

moneydiff.com