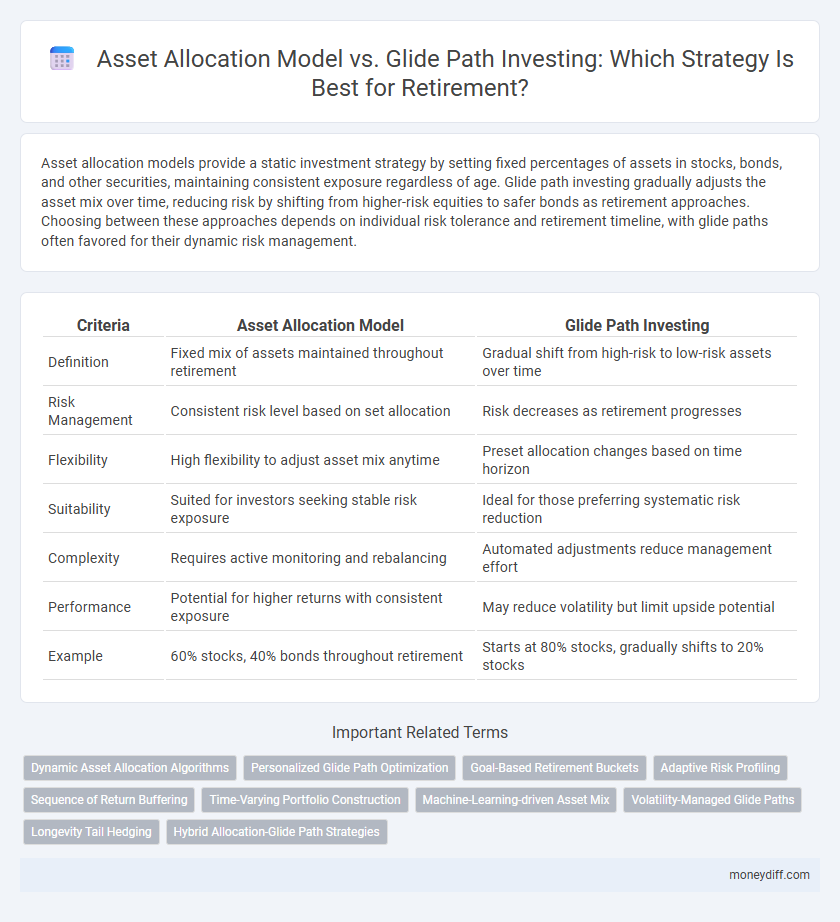

Asset allocation models provide a static investment strategy by setting fixed percentages of assets in stocks, bonds, and other securities, maintaining consistent exposure regardless of age. Glide path investing gradually adjusts the asset mix over time, reducing risk by shifting from higher-risk equities to safer bonds as retirement approaches. Choosing between these approaches depends on individual risk tolerance and retirement timeline, with glide paths often favored for their dynamic risk management.

Table of Comparison

| Criteria | Asset Allocation Model | Glide Path Investing |

|---|---|---|

| Definition | Fixed mix of assets maintained throughout retirement | Gradual shift from high-risk to low-risk assets over time |

| Risk Management | Consistent risk level based on set allocation | Risk decreases as retirement progresses |

| Flexibility | High flexibility to adjust asset mix anytime | Preset allocation changes based on time horizon |

| Suitability | Suited for investors seeking stable risk exposure | Ideal for those preferring systematic risk reduction |

| Complexity | Requires active monitoring and rebalancing | Automated adjustments reduce management effort |

| Performance | Potential for higher returns with consistent exposure | May reduce volatility but limit upside potential |

| Example | 60% stocks, 40% bonds throughout retirement | Starts at 80% stocks, gradually shifts to 20% stocks |

Understanding Asset Allocation Models for Retirement

Asset allocation models for retirement strategically distribute investments across asset classes to balance risk and growth potential based on an investor's age, risk tolerance, and retirement timeline. These models optimize portfolio performance by adjusting the proportion of stocks, bonds, and cash, aiming to protect capital while maximizing returns as the individual approaches retirement. Understanding the dynamics of asset allocation enables retirees to maintain financial stability and meet long-term income needs efficiently.

What Is Glide Path Investing?

Glide path investing is a retirement strategy that gradually shifts an investor's asset allocation from higher-risk equities to lower-risk bonds as they approach retirement age, aiming to reduce portfolio volatility over time. The glide path adjusts the balance of stocks and bonds systematically to align with an individual's risk tolerance and target retirement date, optimizing growth potential early on and capital preservation later. This approach contrasts with a static asset allocation model by providing a dynamic, time-based adjustment that seeks to manage investment risk throughout the entire retirement timeline.

Key Differences: Asset Allocation vs Glide Path

Asset allocation models maintain a fixed mix of stocks, bonds, and cash tailored to an investor's risk tolerance and financial goals, providing consistent portfolio balance throughout retirement. Glide path investing gradually adjusts the asset mix by decreasing equity exposure and increasing fixed income as the investor approaches and moves through retirement, aiming to reduce risk over time. Key differences lie in timing and flexibility: asset allocation stays static, while glide path dynamically shifts asset classes based on retirement proximity.

Risk Management Strategies in Retirement Portfolios

Asset allocation models maintain a fixed mix of stocks, bonds, and cash tailored to an investor's risk tolerance, providing consistent exposure to assets throughout retirement. Glide path investing gradually shifts the portfolio from higher-risk equities to lower-risk bonds as retirement approaches, aiming to reduce volatility and preserve capital. Effective risk management in retirement portfolios balances growth potential with capital protection by integrating these strategies to adapt to changing market conditions and individual longevity risk.

Pros and Cons of Asset Allocation Models

Asset Allocation Models offer a fixed investment strategy based on an investor's risk tolerance and time horizon, providing simplicity and ease of management throughout retirement. However, these models may lack flexibility in adjusting to market fluctuations or changing financial goals, potentially exposing retirees to suboptimal risk levels. The rigid nature of fixed asset allocation can sometimes result in missed opportunities for growth or increased vulnerability during market downturns.

Advantages and Disadvantages of Glide Path Investing

Glide path investing systematically adjusts asset allocation by gradually shifting from higher-risk equities to lower-risk bonds as retirement approaches, reducing portfolio volatility over time. Its advantages include automatic risk reduction and simplicity, making it easy for retirees to maintain a balanced portfolio aligned with their age or time horizon. However, disadvantages involve a lack of customization for individual risk tolerance and financial goals, potentially leading to suboptimal returns or excessive conservatism during market fluctuations.

Customizing Retirement Portfolios: Which Approach Fits You?

Asset allocation models provide a fixed mix of assets tailored to risk tolerance and time horizon, offering stability throughout retirement planning. Glide path investing gradually shifts asset allocation from higher-risk equities to safer bonds as retirement approaches, reducing volatility over time. Customizing retirement portfolios depends on individual financial goals, risk appetite, and expected retirement date, making a hybrid approach suitable for many investors.

Impact on Retirement Income and Longevity

Asset allocation models prioritize a fixed mix of stocks, bonds, and cash to balance risk and return, aiming to sustain retirement income over a long horizon. Glide path investing gradually shifts asset allocation from higher-risk equities to more conservative bonds as retirement approaches, reducing volatility and preserving capital for income longevity. Research shows glide path strategies can better manage sequence-of-returns risk, enhancing the probability of maintaining income throughout retirement.

Factors to Consider When Choosing an Investment Strategy

When choosing between an Asset Allocation Model and Glide Path Investing for retirement, investors should evaluate risk tolerance, time horizon, and income needs. Asset Allocation Models offer flexibility with periodic rebalancing tailored to current market conditions, while Glide Path Investing automatically adjusts portfolio risk as retirement approaches. Consideration of market volatility, expected return rates, and individual financial goals is essential for optimal retirement portfolio performance.

Asset Allocation Model vs Glide Path: Which Is Better for Your Retirement?

The Asset Allocation Model focuses on maintaining a fixed percentage of stocks, bonds, and cash tailored to an investor's risk tolerance, providing stability and consistent risk management throughout retirement. Glide Path Investing gradually shifts the portfolio from higher-risk assets to safer investments over time, aiming to reduce volatility as retirement approaches. Choosing between these strategies depends on individual goals and risk preferences, with Asset Allocation offering a steady approach while Glide Path adapts dynamically to age-based risk reduction.

Related Important Terms

Dynamic Asset Allocation Algorithms

Dynamic Asset Allocation Algorithms adjust portfolio weights in real-time based on market conditions, offering a more responsive strategy compared to the traditional Glide Path Investing, which gradually shifts asset allocation toward safer investments as retirement approaches. This adaptive approach maximizes growth potential while managing risk, aligning investment decisions with evolving economic indicators and individual retirement goals.

Personalized Glide Path Optimization

Personalized glide path optimization tailors asset allocation over time based on individual risk tolerance, investment horizon, and retirement goals, contrasting with traditional static asset allocation models that maintain fixed proportions. This dynamic approach adjusts equity and bond weightings to balance growth and risk, enhancing retirement portfolio resilience and income stability.

Goal-Based Retirement Buckets

Goal-based retirement buckets segment assets according to specific financial objectives, enhancing clarity and purpose in the allocation process compared to traditional asset allocation models. Glide path investing gradually adjusts portfolio risk by reducing equities exposure as retirement nears, but incorporating goal-based buckets allows for tailored investment strategies aligned with distinct time horizons and spending needs.

Adaptive Risk Profiling

Asset Allocation Models provide a fixed strategy of diversifying investments based on risk tolerance at retirement, while Glide Path Investing gradually shifts asset allocation from higher to lower risk as retirees age. Adaptive Risk Profiling enhances these approaches by dynamically adjusting asset allocation in response to changing market conditions and individual financial goals, promoting more resilient retirement portfolios.

Sequence of Return Buffering

Sequence of return buffering is more effectively managed by glide path investing, which gradually shifts asset allocation from aggressive equities to conservative bonds as retirement nears, reducing volatility risk. An asset allocation model maintains a fixed or static mix of assets, potentially exposing retirees to higher sequence of returns risk during market downturns early in retirement.

Time-Varying Portfolio Construction

Time-varying portfolio construction in retirement emphasizes dynamic asset allocation models that adjust investments based on evolving market conditions and individual risk tolerance rather than fixed glide path investing, which follows a predetermined, decreasing equity exposure over time. This approach enhances retirement outcomes by optimizing risk-return trade-offs through continuous portfolio rebalancing, reflecting changing economic environments and personal financial needs.

Machine-Learning-driven Asset Mix

Machine-learning-driven asset allocation models dynamically adjust investment portfolios based on real-time market data and individual risk profiles, offering personalized strategies for retirement planning. Unlike traditional glide path investing, which follows a predetermined asset mix adjustment over time, machine learning optimizes asset allocation to potentially enhance returns and manage risk more effectively throughout retirement.

Volatility-Managed Glide Paths

Volatility-managed glide paths dynamically adjust asset allocation based on market turbulence, reducing equity exposure during high volatility periods to protect retirement portfolios. This approach contrasts with traditional asset allocation models by emphasizing risk mitigation over time, aiming for smoother returns and enhanced capital preservation throughout retirement.

Longevity Tail Hedging

Asset Allocation Models emphasize a fixed distribution of equities, bonds, and cash tailored to risk tolerance, while Glide Path Investing gradually shifts allocations toward more conservative assets as retirement approaches. Longevity tail hedging integrates dynamic strategies to protect against outliving assets, enhancing traditional models by addressing extreme longevity risks in retirement portfolios.

Hybrid Allocation-Glide Path Strategies

Hybrid allocation-glide path strategies combine the stability of fixed asset allocation models with the dynamic risk reduction of glide path investing, adjusting portfolio exposure to equities and bonds as retirement approaches. This blended approach aims to optimize growth potential early on while gradually minimizing risk, enhancing retirement income security through a balanced, time-sensitive investment framework.

Asset Allocation Model vs Glide Path Investing for retirement Infographic

moneydiff.com

moneydiff.com