Compound interest accelerates retirement growth by reinvesting earnings to generate exponential returns over time, maximizing the power of accumulated interest on both principal and previous interest. The dividend snowball strategy enhances income by consistently reinvesting dividends to buy more shares, creating a growing stream of passive income that compounds through stock accumulation. Combining compound interest with dividend reinvestment can significantly boost retirement portfolios by blending steady income generation with exponential growth potential.

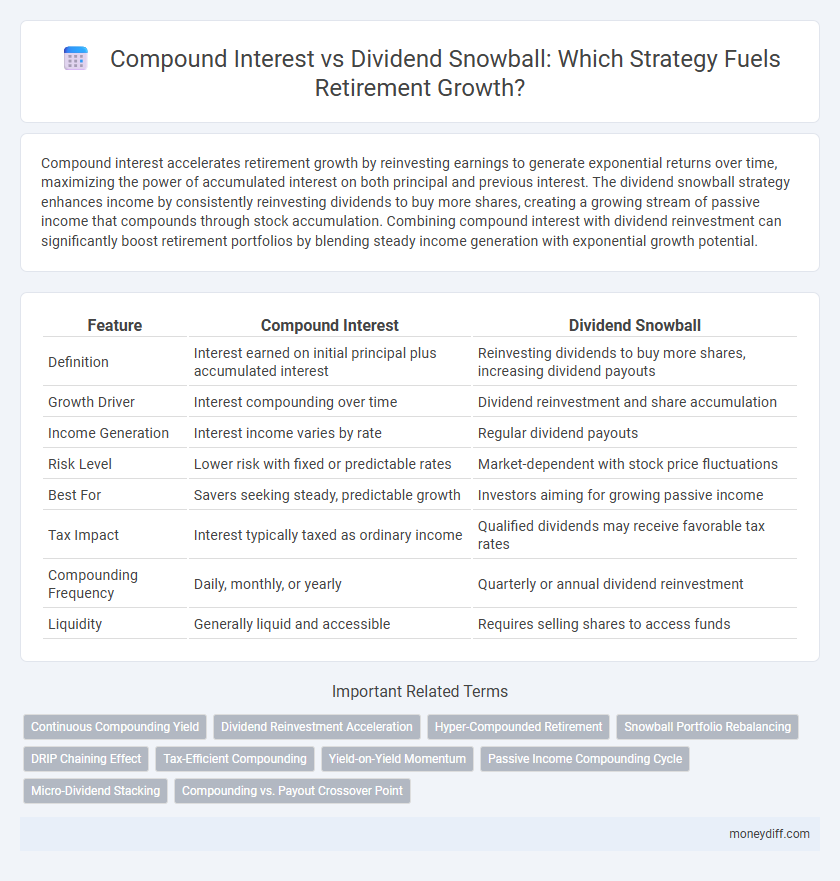

Table of Comparison

| Feature | Compound Interest | Dividend Snowball |

|---|---|---|

| Definition | Interest earned on initial principal plus accumulated interest | Reinvesting dividends to buy more shares, increasing dividend payouts |

| Growth Driver | Interest compounding over time | Dividend reinvestment and share accumulation |

| Income Generation | Interest income varies by rate | Regular dividend payouts |

| Risk Level | Lower risk with fixed or predictable rates | Market-dependent with stock price fluctuations |

| Best For | Savers seeking steady, predictable growth | Investors aiming for growing passive income |

| Tax Impact | Interest typically taxed as ordinary income | Qualified dividends may receive favorable tax rates |

| Compounding Frequency | Daily, monthly, or yearly | Quarterly or annual dividend reinvestment |

| Liquidity | Generally liquid and accessible | Requires selling shares to access funds |

Understanding Compound Interest for Retirement

Compound interest accelerates retirement growth by reinvesting earnings, allowing your initial investment to generate returns on both the principal and accumulated interest over time. Understanding compound interest helps investors appreciate how even small contributions can exponentially increase their retirement savings through consistent growth and compounding cycles. This powerful mechanism often outpaces dividend snowball strategies by maximizing growth on the total portfolio value rather than solely relying on dividend payouts for reinvestment.

What Is the Dividend Snowball Strategy?

The dividend snowball strategy involves reinvesting dividends earned from stocks to purchase more shares, accelerating portfolio growth through compounding returns. Unlike simple compound interest, which grows based on initial principal and accumulated interest, the dividend snowball leverages continuous dividend reinvestment to exponentially increase income streams over time. This method enhances retirement growth by building a self-sustaining income source that compounds as more shares generate higher dividends.

Key Differences: Compound Interest vs. Dividend Growth

Compound interest accelerates retirement savings by reinvesting earned interest, resulting in exponential growth on both principal and accumulated interest. Dividend snowball focuses on increasing income by reinvesting dividends to purchase more shares, benefiting from rising dividend payouts and share price appreciation over time. Key differences lie in compound interest compounding returns on total capital, while dividend growth compounds income streams, each playing distinct roles in retirement portfolio growth.

Pros and Cons of Compound Interest in Retirement Planning

Compound interest accelerates retirement growth by reinvesting earnings, enabling exponential wealth accumulation over time. Its main advantage lies in the power of time, making early contributions significantly more valuable, but it requires disciplined, long-term investment without frequent withdrawals to maximize benefits. A key drawback is its sensitivity to market volatility and inflation, which can erode purchasing power and reduce real returns during retirement.

Advantages and Drawbacks of the Dividend Snowball Approach

The Dividend Snowball approach leverages reinvested dividends to create a growing income stream, offering the advantage of compounding cash flow even in volatile markets. This method provides predictable, cash-based returns that can be less dependent on capital gains, which appeals to retirees seeking steady income. However, the approach may result in slower overall portfolio growth compared to pure compound interest strategies due to dividend yield variability and market fluctuations.

Calculating Retirement Growth: Compound Interest Examples

Calculating retirement growth through compound interest involves reinvesting earnings to generate exponentially increasing returns over time, significantly enhancing the retirement corpus. For example, a $10,000 investment at a 7% annual compound interest rate grows to approximately $76,123 over 30 years, illustrating the power of compounding. Compared to the dividend snowball method, compound interest provides predictable growth by continuously compounding the principal and accumulated interest.

Measuring Returns: Dividend Reinvestment Performance

Measuring returns in retirement growth highlights the impact of dividend reinvestment performance, which often outpaces simple compound interest due to the accelerating effect of dividends on total portfolio value. Dividend snowball strategies leverage reinvested dividends to purchase more shares, creating a powerful feedback loop that enhances long-term wealth accumulation. Tracking dividend reinvestment rates and yield fluctuations offers a more dynamic understanding of growth compared to static compound interest calculations.

Risk Factors: Which Strategy Is Safer for Retirees?

Compound interest offers a more predictable growth trajectory by reinvesting earnings to generate exponential returns over time, lowering exposure to market volatility compared to dividend snowball strategies. Dividend snowball approaches, while potentially providing higher income through increasing dividend payouts, risk instability due to market fluctuations and dividend cuts, posing greater uncertainty for retirees reliant on steady cash flow. Evaluating risk tolerance and income needs is crucial, with compound interest generally deemed safer for preserving capital and ensuring consistent retirement growth.

Combining Compound Interest and Dividend Snowball

Combining compound interest with a dividend snowball strategy significantly accelerates retirement portfolio growth by reinvesting dividends to purchase additional shares, which then generate more dividends and interest over time. This synergy maximizes total returns through exponential growth, leveraging both the compounding of interest and the scaling effect of dividend reinvestments. Investors benefit from a steadily increasing income stream while their principal investment appreciates, enhancing long-term retirement wealth accumulation.

Choosing the Best Strategy for Your Retirement Goals

Compound interest accelerates retirement growth by reinvesting earned interest, creating exponential wealth over time through consistent contributions. Dividend snowball focuses on reinvesting dividends to steadily increase income streams, ideal for retirees seeking passive cash flow. Selecting the optimal strategy depends on factors like risk tolerance, investment horizon, and desired retirement income stability.

Related Important Terms

Continuous Compounding Yield

Continuous compounding yield accelerates retirement growth by reinvesting earnings instantly, resulting in exponential accumulation compared to traditional compound interest. While dividend snowball leverages regular dividend reinvestments to build wealth over time, continuous compounding optimizes returns through uninterrupted growth, maximizing the final retirement portfolio value.

Dividend Reinvestment Acceleration

Dividend reinvestment acceleration leverages the power of compound interest by consistently reinvesting dividends, resulting in exponential portfolio growth over time. Unlike simple compound interest, the dividend snowball effect amplifies returns as each reinvested dividend generates more income, creating a self-reinforcing cycle crucial for maximizing retirement savings.

Hyper-Compounded Retirement

Hyper-compounded retirement growth leverages the exponential power of compound interest, where reinvested earnings generate earnings themselves, accelerating wealth accumulation over time. Unlike the dividend snowball method that focuses on steadily increasing dividend payouts, compound interest multiplies the entire investment value, delivering superior long-term retirement nest egg growth through consistently reinvested returns.

Snowball Portfolio Rebalancing

Dividend snowball strategies amplify retirement growth by reinvesting dividends to purchase additional shares, accelerating portfolio expansion through compounding returns. Regular portfolio rebalancing ensures optimal asset allocation, reduces risk, and enhances long-term compounding benefits compared to traditional compound interest growth.

DRIP Chaining Effect

The DRIP (Dividend Reinvestment Plan) chaining effect accelerates retirement growth by automatically reinvesting dividends to purchase more shares, compounding returns faster than simple interest accumulation. Unlike compound interest that grows primarily from principal and interest rate, the dividend snowball leverages increasing share count and dividend payouts, maximizing portfolio expansion through repeated reinvestment cycles.

Tax-Efficient Compounding

Tax-efficient compounding leverages compound interest by reinvesting earnings in tax-advantaged accounts, maximizing growth without frequent tax drag. Dividend snowball strategies can enhance retirement portfolios by steadily increasing dividend payouts, but tax inefficiencies may reduce overall compounding benefits compared to tax-optimized compound interest growth.

Yield-on-Yield Momentum

Compound interest accelerates retirement growth by continuously earning returns on both principal and accumulated interest, creating exponential yield-on-yield momentum. Dividend snowball strategies enhance this effect by reinvesting increasing dividend payouts, generating a compounding yield that magnifies portfolio expansion over time.

Passive Income Compounding Cycle

Compound interest accelerates retirement growth by reinvesting earnings to generate exponential returns on the initial principal, while dividend snowball leverages recurring dividend payouts to steadily increase passive income streams. The passive income compounding cycle in dividend snowball strategies enhances portfolio value and cash flow over time, creating a self-sustaining growth mechanism ideal for long-term retirement wealth accumulation.

Micro-Dividend Stacking

Micro-dividend stacking leverages frequent, small dividend payments reinvested to accelerate retirement portfolio growth, often surpassing traditional compound interest through continuous income layering. This strategy creates a dividend snowball effect, where incremental dividends generate additional shares that produce exponential income streams, optimizing long-term wealth accumulation.

Compounding vs. Payout Crossover Point

Compound interest accelerates retirement growth by reinvesting earnings, creating exponential asset appreciation over time, while the dividend snowball strategy generates regular income through accumulating payouts that eventually surpass reinvested interest returns. The payout crossover point marks when dividend distributions exceed compounded interest gains, signaling a shift from growth accumulation to income-focused retirement funding.

Compound Interest vs Dividend Snowball for retirement growth Infographic

moneydiff.com

moneydiff.com