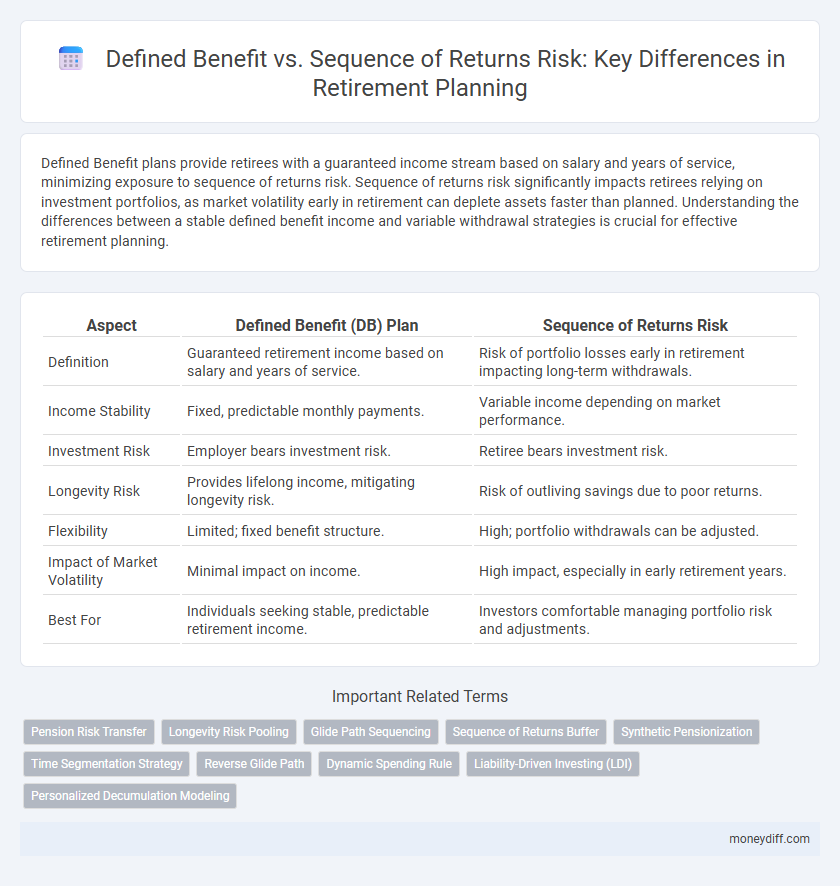

Defined Benefit plans provide retirees with a guaranteed income stream based on salary and years of service, minimizing exposure to sequence of returns risk. Sequence of returns risk significantly impacts retirees relying on investment portfolios, as market volatility early in retirement can deplete assets faster than planned. Understanding the differences between a stable defined benefit income and variable withdrawal strategies is crucial for effective retirement planning.

Table of Comparison

| Aspect | Defined Benefit (DB) Plan | Sequence of Returns Risk |

|---|---|---|

| Definition | Guaranteed retirement income based on salary and years of service. | Risk of portfolio losses early in retirement impacting long-term withdrawals. |

| Income Stability | Fixed, predictable monthly payments. | Variable income depending on market performance. |

| Investment Risk | Employer bears investment risk. | Retiree bears investment risk. |

| Longevity Risk | Provides lifelong income, mitigating longevity risk. | Risk of outliving savings due to poor returns. |

| Flexibility | Limited; fixed benefit structure. | High; portfolio withdrawals can be adjusted. |

| Impact of Market Volatility | Minimal impact on income. | High impact, especially in early retirement years. |

| Best For | Individuals seeking stable, predictable retirement income. | Investors comfortable managing portfolio risk and adjustments. |

Understanding Defined Benefit Plans

Defined Benefit Plans guarantee a fixed, predictable monthly income in retirement based on salary and years of service, providing retirees financial security regardless of market fluctuations. These plans reduce the risk associated with Sequence of Returns Risk, which can significantly impact portfolios relying on market performance during retirement withdrawals. Understanding how Defined Benefit Plans insulate retirees from market volatility helps clarify their value compared to investment-dependent retirement strategies.

What is Sequence of Returns Risk?

Sequence of returns risk refers to the potential negative impact of poor investment returns early in retirement, which can significantly reduce the longevity of a defined benefit plan or retirement savings. This risk is critical for retirees relying on systematic withdrawals, as consecutive negative returns may deplete funds faster than anticipated, jeopardizing long-term financial security. Managing sequence of returns risk involves strategies like diversification, dynamic withdrawal rates, or incorporating guaranteed income sources to mitigate the uncertainty of market fluctuations.

Income Stability: Defined Benefit vs Sequence of Returns

Defined Benefit plans provide predictable and stable retirement income by guaranteeing fixed payments based on salary and years of service, thus minimizing income volatility. In contrast, retirement income influenced by the Sequence of Returns risk can fluctuate significantly due to market performance variability during withdrawal phases, potentially jeopardizing long-term financial security. Understanding the impact of market timing on portfolio withdrawals emphasizes the importance of risk management strategies to protect income stability in retirement.

Investment Risk in Retirement Planning

Defined Benefit plans provide guaranteed lifetime income, reducing investment risk by transferring it to the employer, unlike reliance on Sequence of Returns risk which affects portfolio withdrawals during retirement market volatility. Sequence of Returns risk can significantly impact the sustainability of retirement savings, as poor market performance early in retirement can deplete funds faster despite average long-term returns. Effective retirement planning must balance the certainty of Defined Benefit income with strategies to mitigate Sequence of Returns risk in investment portfolios.

Longevity Protection: Which Approach Wins?

Defined Benefit plans offer superior longevity protection by guaranteeing a fixed income for life, reducing the risk of outliving assets. Sequence of returns risk in accumulation-phase strategies can deplete retirement funds unpredictably, especially during market downturns early in retirement. Therefore, a Defined Benefit pension provides a more reliable and secure income stream for retirees concerned with longevity risk.

Flexibility and Control Over Retirement Funds

Defined Benefit plans offer limited flexibility and control over retirement funds as payouts are predetermined, ensuring a fixed income regardless of market fluctuations. Sequence of Returns risk is more relevant for individuals managing their own retirement savings, where market volatility can significantly impact the sustainability of withdrawals. Managing a sequence of returns requires active decisions on asset allocation and withdrawal timing to optimize fund longevity and maintain financial security.

Inflation Impact on Defined Benefits and Investment Portfolios

Inflation significantly erodes the purchasing power of fixed income streams from Defined Benefit plans, making them less reliable over long retirements without adequate cost-of-living adjustments. Conversely, investment portfolios are vulnerable to sequence of returns risk, where poor market performance early in retirement combined with inflation can drastically reduce the sustainability of withdrawals. Understanding the interplay between inflation, fixed benefits, and market volatility is crucial for effective retirement income planning.

Payout Predictability in Retirement

Defined Benefit plans offer predictable, guaranteed lifetime income based on salary and years of service, providing retirees with stable payout certainty. In contrast, Sequence of Returns risk impacts withdrawals from investment portfolios, causing variability in retirement income depending on market performance during early retirement years. Understanding the difference in payout predictability between these two retirement options is crucial for effective financial planning and risk management.

Real-Life Scenarios: Defined Benefit vs Sequence of Returns

Defined benefit plans provide retirees with predictable income regardless of market volatility, shielding them from sequence of returns risk that can severely impact retirees relying on withdrawals from investment portfolios. Real-life scenarios highlight how retirees dependent on defined contribution plans may face reduced income or depleted savings if poor market returns occur early in retirement, while defined benefit recipients maintain stable cash flow. This stability makes defined benefit plans particularly valuable for managing longevity and market risks in retirement planning.

Choosing the Right Strategy for Your Retirement Goals

Choosing the right retirement strategy requires understanding how a defined benefit plan guarantees a fixed income, reducing exposure to sequence of returns risk that can deplete retirement savings during market downturns. Unlike defined contribution plans, defined benefit plans provide predictable cash flow, offering financial stability regardless of market volatility. Evaluating personal risk tolerance, expected lifespan, and income needs will guide whether relying on a defined benefit or managing sequence of returns risk with diversified investments aligns best with your retirement goals.

Related Important Terms

Pension Risk Transfer

Defined Benefit plans provide guaranteed lifetime income, minimizing sequence of returns risk by transferring investment and longevity risk to the pension sponsor. Pension Risk Transfer solutions, such as annuities, further protect retirees from market volatility and sequence of returns risk by locking in predictable income streams.

Longevity Risk Pooling

Defined Benefit plans mitigate longevity risk pooling by providing retirees a guaranteed lifetime income regardless of sequence of returns, whereas sequence of returns risk significantly impacts retirement outcomes in individual account plans without pooling. Longevity risk pooling in Defined Benefit pensions allows for more stable withdrawal rates, reducing the adverse effects of market volatility during retirement.

Glide Path Sequencing

Glide path sequencing in retirement focuses on adjusting asset allocation to mitigate the sequence of returns risk inherent in defined benefit plans. By strategically decreasing equity exposure as retirees age, it helps preserve capital and ensures stable income streams throughout retirement.

Sequence of Returns Buffer

A Sequence of Returns Buffer is a crucial strategy in managing retirement income to protect against market volatility during the early years of withdrawal, which can disproportionately impact the longevity of a Defined Benefit plan's assets. By allocating a portion of the portfolio to low-risk, liquid investments, retirees can reduce the risk of depleting funds when market returns are negative.

Synthetic Pensionization

Synthetic pensionization replicates the steady income stream of a defined benefit plan by strategically managing withdrawals to mitigate sequence of returns risk during retirement. This approach uses a combination of bond ladders, annuities, and dynamic withdrawal strategies to create predictable cash flow, ensuring portfolio longevity despite market volatility.

Time Segmentation Strategy

The Time Segmentation Strategy in retirement planning separates investment portfolios into distinct segments to mitigate the Sequence of Returns Risk, ensuring that the defined benefit streams remain intact during market volatility. This approach leverages the predictability of Defined Benefit pensions while strategically managing withdrawal timing to protect nest egg longevity.

Reverse Glide Path

A Reverse Glide Path strategy allocates more assets to equities as retirees age, counteracting Sequence of Returns risk by harnessing higher growth potential later in retirement. This approach contrasts with traditional Defined Benefit plans, which provide fixed payouts, offering stability without exposure to market volatility that can impact withdrawal rates.

Dynamic Spending Rule

Dynamic Spending Rule adjusts withdrawals in retirement based on portfolio performance to mitigate risks posed by an unfavorable sequence of returns, unlike traditional Defined Benefit plans that provide fixed, predictable income. This adaptive strategy helps sustain retirement savings by reducing withdrawal amounts after market downturns, preserving capital and prolonging portfolio longevity.

Liability-Driven Investing (LDI)

Liability-Driven Investing (LDI) in defined benefit plans prioritizes matching assets with future pension liabilities to mitigate sequence of returns risk, ensuring stable payouts regardless of market volatility. By focusing on long-term liability cash flows, LDI strategies reduce exposure to timing of returns, enhancing the plan's ability to meet retirement obligations consistently.

Personalized Decumulation Modeling

Personalized decumulation modeling integrates defined benefit plans with sequence of returns risk to optimize retirement income sustainability by tailoring withdrawal strategies according to individual market exposure and longevity risk. This approach enhances retirement security by balancing guaranteed income streams from defined benefits against fluctuating investment returns, reducing the impact of market volatility on portfolio depletion.

Defined Benefit vs Sequence of Returns for retirement. Infographic

moneydiff.com

moneydiff.com