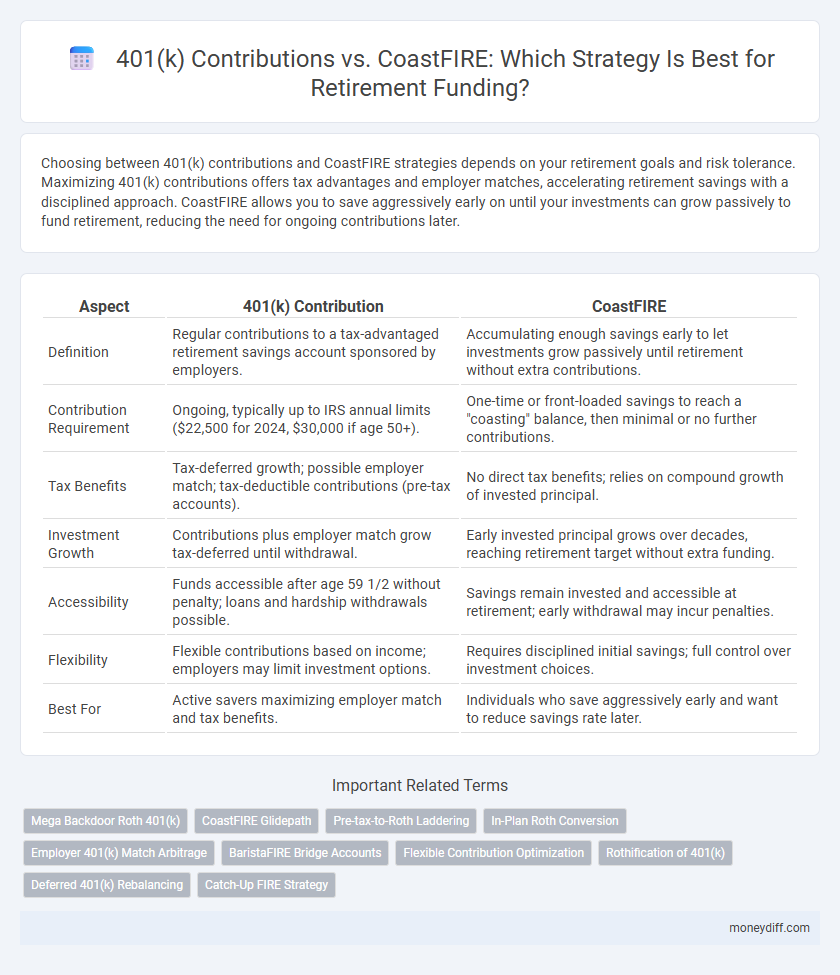

Choosing between 401(k) contributions and CoastFIRE strategies depends on your retirement goals and risk tolerance. Maximizing 401(k) contributions offers tax advantages and employer matches, accelerating retirement savings with a disciplined approach. CoastFIRE allows you to save aggressively early on until your investments can grow passively to fund retirement, reducing the need for ongoing contributions later.

Table of Comparison

| Aspect | 401(k) Contribution | CoastFIRE |

|---|---|---|

| Definition | Regular contributions to a tax-advantaged retirement savings account sponsored by employers. | Accumulating enough savings early to let investments grow passively until retirement without extra contributions. |

| Contribution Requirement | Ongoing, typically up to IRS annual limits ($22,500 for 2024, $30,000 if age 50+). | One-time or front-loaded savings to reach a "coasting" balance, then minimal or no further contributions. |

| Tax Benefits | Tax-deferred growth; possible employer match; tax-deductible contributions (pre-tax accounts). | No direct tax benefits; relies on compound growth of invested principal. |

| Investment Growth | Contributions plus employer match grow tax-deferred until withdrawal. | Early invested principal grows over decades, reaching retirement target without extra funding. |

| Accessibility | Funds accessible after age 59 1/2 without penalty; loans and hardship withdrawals possible. | Savings remain invested and accessible at retirement; early withdrawal may incur penalties. |

| Flexibility | Flexible contributions based on income; employers may limit investment options. | Requires disciplined initial savings; full control over investment choices. |

| Best For | Active savers maximizing employer match and tax benefits. | Individuals who save aggressively early and want to reduce savings rate later. |

Understanding 401k Contributions: The Basics

401k contributions allow employees to save for retirement with pre-tax income, reducing taxable income and enabling compound growth over time. Employers often offer matching contributions, enhancing savings and accelerating retirement fund accumulation. Understanding contribution limits and vesting schedules is essential for maximizing the benefits of a 401k plan in comparison to strategies like CoastFIRE.

What is CoastFIRE? A Modern Retirement Strategy

CoastFIRE is a modern retirement strategy where individuals prioritize early saving until their investments naturally grow to cover retirement expenses without additional contributions, leveraging compound interest over time. Unlike traditional 401(k) contributions that require continuous input, CoastFIRE allows savers to "coast" toward retirement by stopping new investments once a sufficient nest egg is established. This approach emphasizes the power of early investment growth, enabling financial independence through minimal future contributions while still benefiting from tax advantages in retirement accounts.

Comparing Growth: 401k Returns vs. CoastFIRE Plans

401k contributions typically benefit from tax advantages and employer matches, leading to compounded growth averaging 7-8% annually over decades. CoastFIRE strategies emphasize early investing to let retirement savings grow passively, relying on market returns to reach financial independence without additional contributions later. Comparing growth, 401k plans offer disciplined, steady accumulation while CoastFIRE leverages time and compounding in low-contribution phases, both aiming to maximize retirement funds but through different cash flow approaches.

Contribution Limits: Maximizing Your 401k vs. CoastFIRE Targets

Maximizing your 401k contributions leverages IRS annual limits--$23,000 for those aged 50 and above in 2024--to boost tax-advantaged retirement savings aggressively. CoastFIRE emphasizes early, sufficient investment growth allowing future retirement expenses to be covered without additional contributions, focusing on reaching a target nest egg early. Balancing the $22,500 standard contribution limit with CoastFIRE's target portfolio growth enables optimized long-term retirement funding strategies.

Tax Advantages: 401k Benefits vs. CoastFIRE Flexibility

401(k) plans offer significant tax advantages by allowing contributions to grow tax-deferred until withdrawal, reducing taxable income during high-earning years and maximizing compound growth. CoastFIRE emphasizes flexibility by prioritizing early investment and lower ongoing contributions, often utilizing taxable accounts that offer capital gains tax rates and no withdrawal restrictions. Balancing 401(k) benefits with CoastFIRE strategies can optimize tax efficiency while providing investment control during retirement planning.

Withdrawal Rules: 401k Penalties vs. CoastFIRE Freedom

401(k) contributions grow tax-deferred but withdrawals before age 59 1/2 typically incur a 10% penalty plus income tax, limiting early access to funds. CoastFIRE strategies rely on accumulating enough savings early to let investments grow without additional contributions, enabling tax-efficient withdrawals from taxable accounts without penalties. Understanding these withdrawal rules is critical for optimizing retirement funding flexibility and minimizing costly penalties.

Risk Factors: Market Volatility for 401k and CoastFIRE

401k contributions are subject to market volatility, which can significantly impact the balance due to fluctuating stock and bond values, posing a risk to retirement funds. CoastFIRE strategies mitigate this risk by allowing early contributions to grow over time, requiring less aggressive investing later and reducing exposure to market downturns during critical retirement phases. Both approaches demand careful assessment of market conditions and personal risk tolerance to optimize retirement funding outcomes.

Early Retirement: CoastFIRE Potential vs. 401k Restrictions

Maximizing a 401k contribution offers tax advantages but imposes penalties and restrictions on withdrawals before age 59 1/2, limiting flexibility for early retirement. CoastFIRE leverages early aggressive saving and investment growth to reach a self-sustaining portfolio balance, enabling financial independence without ongoing contributions. Prioritizing CoastFIRE strategies can empower earlier retirement timelines by avoiding the withdrawal constraints associated with 401k plans.

Balancing 401k with CoastFIRE for Optimal Retirement Funding

Balancing 401k contributions with a CoastFIRE strategy optimizes retirement funding by leveraging tax-advantaged growth and early financial independence. Strategic 401k contributions enhance compound growth potential while CoastFIRE focuses on accumulated savings sufficient to cover future living expenses, allowing flexibility in retirement timing. Integrating both approaches maximizes asset diversification, reduces withdrawal risks, and supports a secure, adaptable retirement plan.

Which is Right For You: Choosing Between 401k and CoastFIRE

Choosing between 401(k) contributions and CoastFIRE depends on your financial goals and risk tolerance. A 401(k) offers tax advantages and employer matching, making it a disciplined, long-term savings tool ideal for steady retirement funding. CoastFIRE requires early and substantial investment growth to cover future expenses, appealing to those seeking financial independence with flexible work options before traditional retirement age.

Related Important Terms

Mega Backdoor Roth 401(k)

Maximizing a Mega Backdoor Roth 401(k) allows high-income earners to contribute up to $43,500 beyond regular 401(k) limits, accelerating tax-free retirement savings compared to traditional 401(k) contributions. This strategy complements CoastFIRE by boosting retirement funds earlier, enabling individuals to meet their financial independence goals without sacrificing current lifestyle.

CoastFIRE Glidepath

Maximizing 401k contributions provides consistent tax-advantaged growth, yet the CoastFIRE glidepath strategy enables early retirement by front-loading investments to reach a financial independence threshold, after which minimal contributions sustain growth until retirement. The CoastFIRE approach emphasizes building a substantial nest egg early, allowing reduced savings rates later while relying on compounded growth within tax-efficient accounts like 401ks.

Pre-tax-to-Roth Laddering

Maximizing retirement savings through pre-tax 401k contributions combined with Roth laddering strategies enhances tax efficiency and withdrawal flexibility in CoastFIRE planning. This approach leverages tax-deferred growth and gradual tax-free Roth conversions, minimizing tax burdens during early retirement phases.

In-Plan Roth Conversion

In-plan Roth conversions within a 401(k) allow retirees to strategically shift pre-tax contributions into Roth accounts, potentially reducing future taxable income and enhancing tax-free withdrawal options compared to the CoastFIRE approach, which emphasizes minimal contributions and letting investments grow passively. Maximizing in-plan Roth conversions can optimize retirement funding by balancing tax diversification and accelerating the compounding of tax-free earnings, making it a powerful tool for those aiming to retire early with a more flexible tax strategy.

Employer 401(k) Match Arbitrage

Employer 401(k) match arbitrage maximizes retirement contributions by capturing free money from matching programs, significantly amplifying savings growth compared to self-funding CoastFIRE strategies. Leveraging employer matches accelerates portfolio accumulation, reducing the time needed to reach CoastFIRE financial independence thresholds while minimizing out-of-pocket investment risks.

BaristaFIRE Bridge Accounts

BaristaFIRE bridge accounts offer a flexible strategy to fund early retirement by supplementing traditional 401k contributions with part-time income and lower withdrawal rates before full CoastFIRE status is reached. Utilizing BaristaFIRE accounts helps maintain cash flow without tapping into retirement funds prematurely, optimizing long-term savings growth and tax advantages.

Flexible Contribution Optimization

Maximizing retirement funding through flexible contribution optimization involves comparing 401(k) contributions with CoastFIRE strategies, where 401(k) offers tax-advantaged growth and employer matching, while CoastFIRE emphasizes early investing with minimal ongoing contributions. Strategic allocation between these approaches enhances compound growth potential and aligns with individual cash flow variability, optimizing long-term retirement readiness.

Rothification of 401(k)

Rothification of a 401(k) enhances retirement funding by allowing tax-free withdrawals, making it a strategic complement to CoastFIRE, which emphasizes early financial independence with minimal ongoing contributions. Maximizing Roth 401(k) contributions leverages tax-free growth and withdrawal flexibility, optimizing long-term retirement savings while maintaining CoastFIRE's goal of achieving financial freedom through early investment.

Deferred 401(k) Rebalancing

Deferred 401(k) rebalancing strategically adjusts asset allocation to optimize growth while managing risk over time, enhancing retirement funding compared to CoastFIRE's focus on early investment with minimal future contributions. By periodically realigning investments within a 401(k), savers can better capture market upside and protect gains, ensuring a well-balanced portfolio that supports long-term retirement goals.

Catch-Up FIRE Strategy

Maximizing 401(k) contributions with catch-up provisions accelerates retirement savings growth through tax advantages and compound interest, essential for the CoastFIRE strategy where early investments grow passively to fund later retirement. Catch-Up FIRE leverages this by boosting contributions in later working years, allowing individuals to "coast" into retirement once the nest egg reaches a self-sustaining growth trajectory.

401k Contribution vs CoastFIRE for retirement funding Infographic

moneydiff.com

moneydiff.com