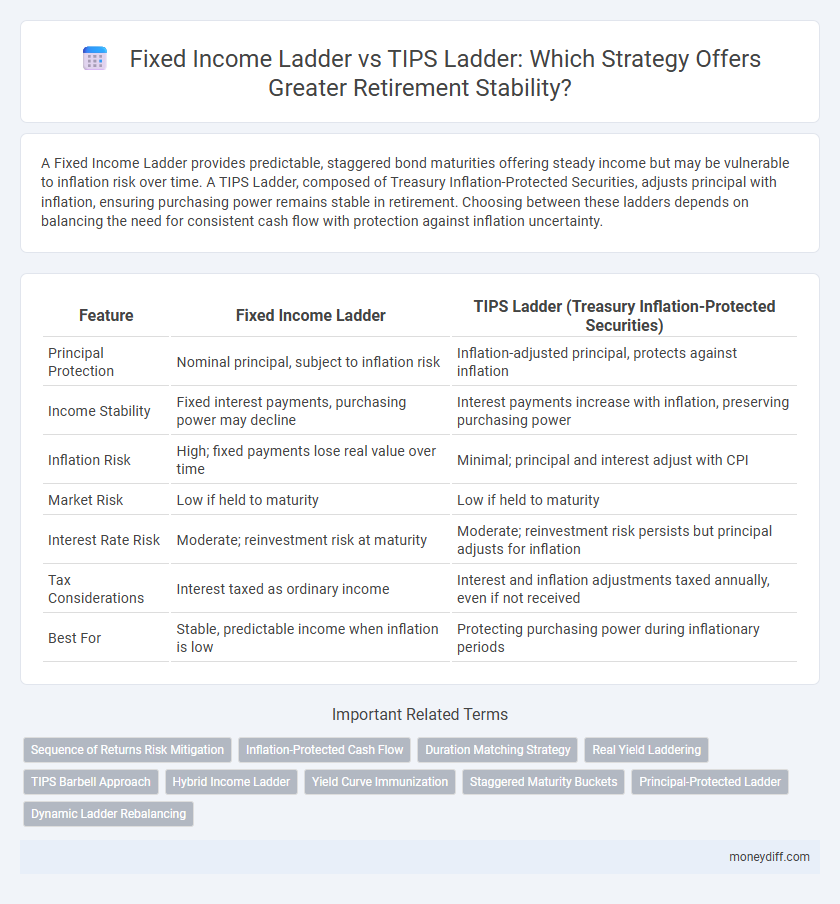

A Fixed Income Ladder provides predictable, staggered bond maturities offering steady income but may be vulnerable to inflation risk over time. A TIPS Ladder, composed of Treasury Inflation-Protected Securities, adjusts principal with inflation, ensuring purchasing power remains stable in retirement. Choosing between these ladders depends on balancing the need for consistent cash flow with protection against inflation uncertainty.

Table of Comparison

| Feature | Fixed Income Ladder | TIPS Ladder (Treasury Inflation-Protected Securities) |

|---|---|---|

| Principal Protection | Nominal principal, subject to inflation risk | Inflation-adjusted principal, protects against inflation |

| Income Stability | Fixed interest payments, purchasing power may decline | Interest payments increase with inflation, preserving purchasing power |

| Inflation Risk | High; fixed payments lose real value over time | Minimal; principal and interest adjust with CPI |

| Market Risk | Low if held to maturity | Low if held to maturity |

| Interest Rate Risk | Moderate; reinvestment risk at maturity | Moderate; reinvestment risk persists but principal adjusts for inflation |

| Tax Considerations | Interest taxed as ordinary income | Interest and inflation adjustments taxed annually, even if not received |

| Best For | Stable, predictable income when inflation is low | Protecting purchasing power during inflationary periods |

Understanding Fixed Income Ladders in Retirement

A Fixed Income Ladder in retirement involves purchasing bonds or CDs with staggered maturities to provide predictable income and reduce reinvestment risk. This strategy enhances cash flow stability by ensuring that investments mature regularly, allowing retirees to reinvest at current interest rates or access funds as needed. Compared to TIPS ladders, which offer inflation protection, fixed income ladders prioritize steady, fixed returns, making them suitable for retirees seeking predictable income streams without inflation adjustments.

What Are TIPS Ladders and How Do They Work?

TIPS ladders consist of Treasury Inflation-Protected Securities structured to mature at staggered intervals, providing inflation-adjusted income and principal protection to safeguard retirees' purchasing power. Each bond in a TIPS ladder resets its principal based on the Consumer Price Index, ensuring consistent real returns that help maintain financial stability throughout retirement. This approach contrasts with fixed income ladders by directly addressing inflation risk, making TIPS ladders a strategic choice for preserving sustainable income in inflationary environments.

Inflation Protection: TIPS vs. Traditional Fixed Income

TIPS ladders provide superior inflation protection by adjusting principal with the Consumer Price Index, ensuring retirees maintain purchasing power during inflationary periods. In contrast, traditional fixed income ladders offer predictable coupon payments but are vulnerable to inflation eroding real returns over time. Balancing TIPS with fixed income instruments can enhance retirement portfolio stability by combining inflation-adjusted income with fixed cash flow certainty.

Income Predictability with Fixed Income Ladders

Fixed Income Ladders provide retirement income predictability by staggering bond maturities, ensuring a consistent cash flow to cover living expenses. Unlike TIPS Ladders, which protect against inflation but have variable returns, Fixed Income Ladders offer stable, predetermined interest payments, enhancing financial planning certainty. This stability is crucial for retirees seeking reliable income without the volatility tied to inflation adjustments.

Risk Comparison: Fixed Income Ladder vs. TIPS Ladder

A Fixed Income Ladder offers predictable income through staggered bond maturities but carries interest rate and inflation risk, potentially eroding purchasing power over time. In contrast, a TIPS Ladder provides inflation-protected returns by adjusting principal with the Consumer Price Index, significantly reducing inflation risk while maintaining steady income streams. Investors seeking retirement stability often favor TIPS Ladders for their ability to preserve real value, whereas Fixed Income Ladders may be preferred in low-inflation environments due to generally higher nominal yields.

Building a Laddered Portfolio: Steps and Strategies

Building a laddered portfolio for retirement stability involves systematically purchasing fixed income securities with staggered maturities to manage interest rate risk and provide consistent cash flow. Utilizing a Fixed Income Ladder with bonds maturing at regular intervals enhances predictability, while incorporating a TIPS Ladder protects against inflation by adjusting principal values based on the Consumer Price Index. Combining these strategies ensures a diversified and resilient income stream, balancing safety, yield, and inflation protection throughout retirement.

Tax Implications for Fixed Income and TIPS Ladders

Fixed Income Ladders typically generate taxable interest income subject to ordinary income tax rates, potentially increasing tax liability during retirement, whereas TIPS Ladders offer inflation-protected principal and interest, with the inflation adjustments taxed annually as ordinary income despite no cash distribution. Tax deferral opportunities exist with tax-advantaged accounts for both ladders, but investors in taxable accounts must carefully manage the phantom income from TIPS inflation adjustments to avoid unexpected tax burdens. Evaluating the after-tax yield and tax brackets is critical when choosing between Fixed Income and TIPS Ladders to optimize retirement cash flow stability.

Rebalancing Retirement Ladders Over Time

Rebalancing retirement ladders, whether Fixed Income or TIPS-based, is essential for maintaining income stability and managing inflation risk throughout retirement. Fixed Income ladders offer predictable cash flows but may lose purchasing power over time, while TIPS ladders adjust principal with inflation, providing real income growth. Regularly reviewing and adjusting the allocation between these ladders ensures that retirees can balance the need for income certainty with inflation protection to preserve long-term financial security.

Suitability: Which Ladder is Best for Your Retirement Goals?

A Fixed Income Ladder offers predictable income streams by investing in bonds with staggered maturities, ideal for retirees seeking stability and consistent cash flow. A TIPS Ladder provides inflation-protected returns, preserving purchasing power during rising inflation, making it suitable for those prioritizing inflation risk mitigation. Choosing the best ladder depends on individual retirement goals, risk tolerance, and the need for income predictability versus inflation protection.

Real-Life Examples: Fixed Income vs. TIPS Ladder in Action

A Fixed Income Ladder offers predictable income streams by investing in staggered maturities of bonds, providing retirees with stability and capital preservation in low-interest environments. Conversely, a TIPS Ladder adjusts principal and interest payments with inflation, maintaining purchasing power but exposing investors to fluctuating income levels during deflationary periods. Real-life comparisons reveal retirees using Fixed Income Ladders enjoy consistent cash flow, while those with TIPS Ladders benefit from inflation protection, crucial during periods of rising consumer prices.

Related Important Terms

Sequence of Returns Risk Mitigation

A Fixed Income Ladder provides predictable cash flows by staggering bond maturities, reducing exposure to interest rate fluctuations but remaining vulnerable to inflation, while a TIPS Ladder offers inflation-protected principal and interest, effectively mitigating Sequence of Returns Risk through adjusted income in retirement. Combining these strategies can enhance portfolio resilience by balancing stable nominal returns with inflation-hedged growth, ensuring steady retirement income despite market volatility.

Inflation-Protected Cash Flow

A Fixed Income Ladder provides predictable, stable cash flow through staggered bond maturities but may lose purchasing power during inflationary periods. In contrast, a TIPS Ladder offers inflation-protected cash flow by adjusting principal with the Consumer Price Index, ensuring real income stability and preserved retirement purchasing power.

Duration Matching Strategy

A Fixed Income Ladder offers predictable cash flows through staggered bond maturities, providing steady income but exposing retirees to inflation risk. The TIPS Ladder employs Treasury Inflation-Protected Securities to maintain purchasing power by adjusting principal with inflation, enhancing duration matching to better align portfolio cash flows with retirement spending needs.

Real Yield Laddering

Fixed Income Ladder provides predictable nominal returns through staggered bond maturities, whereas TIPS Ladder offers inflation-protected principal with real yield certainty, enhancing retirement income stability. Real Yield Laddering through TIPS helps preserve purchasing power and manage inflation risk more effectively during retirement.

TIPS Barbell Approach

The TIPS Barbell Approach combines short- and long-term Treasury Inflation-Protected Securities to balance inflation protection with income stability, outperforming traditional Fixed Income Ladders by mitigating interest rate risk and preserving purchasing power. This strategy enhances retirement portfolio resilience through consistent, inflation-adjusted cash flows, crucial for long-term financial security.

Hybrid Income Ladder

A hybrid income ladder combines the stability of a fixed income ladder with the inflation protection of a TIPS ladder, offering retirees a balanced approach to managing interest rate risk and purchasing power over time. This strategy enhances retirement income stability by diversifying between predictable coupon payments from fixed bonds and inflation-adjusted returns from Treasury Inflation-Protected Securities (TIPS).

Yield Curve Immunization

A Fixed Income Ladder offers predictable cash flows by investing in bonds of varying maturities, providing stability through yield curve immunization against interest rate fluctuations. In contrast, a TIPS Ladder not only ensures principal protection against inflation but also aligns returns with real interest rates, enhancing purchasing power and retirement income reliability.

Staggered Maturity Buckets

A Fixed Income Ladder offers predictable cash flows through staggered maturity buckets, providing reliable income stability during retirement by systematically reinvesting principal upon each bond's maturity. TIPS Ladder similarly structures staggered maturities but adds inflation protection by adjusting principal and interest payments with the Consumer Price Index, ensuring real purchasing power is maintained throughout retirement.

Principal-Protected Ladder

A Principal-Protected Ladder using fixed income investments offers retirees predictable income streams and capital preservation by staggering bond maturities, minimizing interest rate risk and ensuring liquidity. In contrast, a TIPS Ladder adds inflation protection through Treasury Inflation-Protected Securities, but principal fluctuations may introduce variability, making fixed income ladders preferable for retirees prioritizing income stability and principal safety.

Dynamic Ladder Rebalancing

Dynamic ladder rebalancing in Fixed Income Ladder strategies enhances retirement stability by adjusting maturities to optimize yield and manage interest rate risk, while TIPS Ladder approaches offer inflation-protected cash flow but require rebalancing to maintain real return. Incorporating dynamic rebalancing into either Fixed Income or TIPS ladders ensures consistent income streams that adapt to market changes, preserving purchasing power and reducing portfolio volatility during retirement.

Fixed Income Ladder vs TIPS Ladder for retirement stability Infographic

moneydiff.com

moneydiff.com