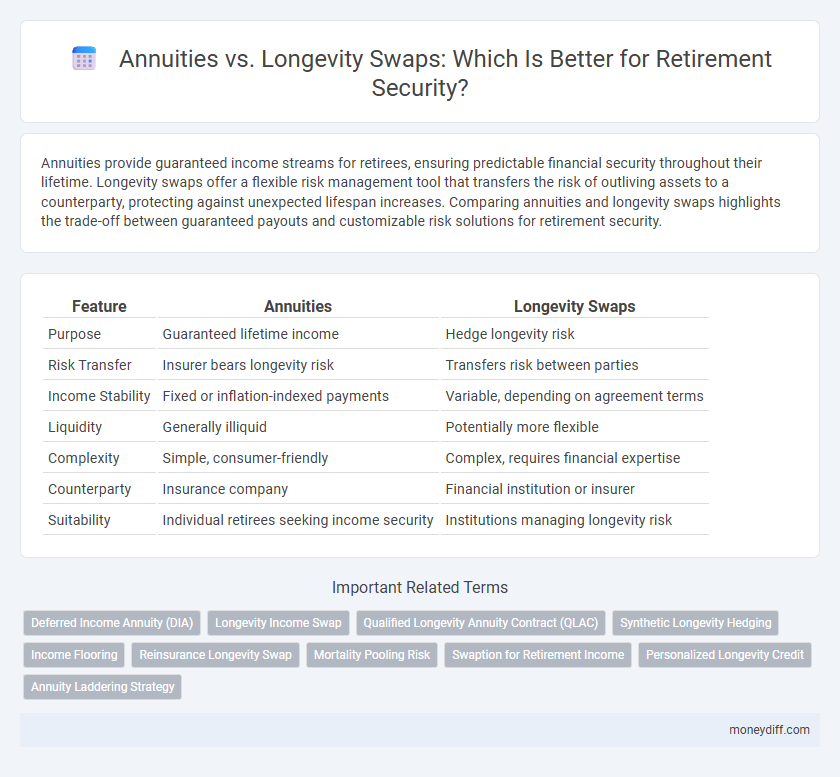

Annuities provide guaranteed income streams for retirees, ensuring predictable financial security throughout their lifetime. Longevity swaps offer a flexible risk management tool that transfers the risk of outliving assets to a counterparty, protecting against unexpected lifespan increases. Comparing annuities and longevity swaps highlights the trade-off between guaranteed payouts and customizable risk solutions for retirement security.

Table of Comparison

| Feature | Annuities | Longevity Swaps |

|---|---|---|

| Purpose | Guaranteed lifetime income | Hedge longevity risk |

| Risk Transfer | Insurer bears longevity risk | Transfers risk between parties |

| Income Stability | Fixed or inflation-indexed payments | Variable, depending on agreement terms |

| Liquidity | Generally illiquid | Potentially more flexible |

| Complexity | Simple, consumer-friendly | Complex, requires financial expertise |

| Counterparty | Insurance company | Financial institution or insurer |

| Suitability | Individual retirees seeking income security | Institutions managing longevity risk |

Understanding Annuities and Longevity Swaps

Annuities provide retirees with a guaranteed income stream based on pooled longevity risk, ensuring predictable cash flow throughout retirement. Longevity swaps transfer the risk of retirees living longer than expected from insurers or pension funds to capital market investors through customized derivative contracts. Understanding the structural differences and risk management features of annuities versus longevity swaps is essential for optimizing retirement security and mitigating longevity risk.

Key Differences Between Annuities and Longevity Swaps

Annuities provide guaranteed income streams for life by transferring longevity risk to insurance companies, while longevity swaps enable pension funds to hedge this risk through customized financial contracts without immediate cash transfers. Annuities typically involve upfront premiums and offer predictable payouts, whereas longevity swaps involve periodic payments based on actual survival rates, allowing more flexibility but also requiring sophisticated management. The choice between annuities and longevity swaps depends on risk tolerance, liquidity needs, and the ability to manage complex financial instruments for retirement security.

How Annuities Provide Retirement Income Security

Annuities offer guaranteed lifetime income by converting a lump sum into periodic payments, protecting retirees from outliving their savings. They provide financial stability by mitigating longevity risk and market volatility, ensuring consistent cash flow regardless of economic conditions. Unlike longevity swaps, annuities are more accessible to individual retirees seeking predictable income streams in retirement.

The Mechanics of Longevity Swaps in Retirement Planning

Longevity swaps are financial derivatives that transfer the risk of retirees living longer than expected from pension funds or insurers to counterparties, ensuring predictable payout streams. These swaps involve exchanging fixed payments for variable payments linked to actual longevity experience, effectively hedging against longevity risk. By matching liabilities with longevity-adjusted cash flows, retirees gain enhanced retirement security through more stable income over uncertain lifespans.

Advantages of Annuities for Retirees

Annuities provide retirees with guaranteed lifelong income, reducing the risk of outliving their savings and offering financial stability throughout retirement. These products are often backed by insurance companies, ensuring reliable payments regardless of market fluctuations. Their structured payouts simplify budgeting, which enhances peace of mind for retirees focused on managing longevity risk.

Benefits and Risks of Longevity Swaps

Longevity swaps offer retirement security by transferring longevity risk from pension plans to investors, providing predictable cash flows and reducing funding volatility. The benefits include enhanced risk management and potentially improved financial stability for retirees, while risks involve counterparty default and market liquidity concerns. Evaluating the contractual complexity and regulatory environment is crucial before integrating longevity swaps into a retirement strategy.

Cost Considerations: Annuities vs Longevity Swaps

Annuities typically involve higher upfront costs and embedded fees, which can reduce overall retirement income, whereas longevity swaps often offer more cost-efficient risk transfer by directly aligning payouts with actual lifespan without insurance company overheads. However, longevity swaps require sophisticated financial expertise and a counterparty willing to assume longevity risk, potentially adding complexity and indirect costs. Careful cost analysis between fixed annuity premiums and the variable pricing structures of longevity swaps is crucial for optimizing retirement security strategies.

Suitability: Who Should Choose Annuities or Longevity Swaps?

Annuities offer guaranteed lifetime income and are suitable for retirees seeking financial stability without market risk. Longevity swaps cater to institutional investors managing large pension funds who prefer customized risk transfer to hedge longevity risk. Individuals prioritizing simplicity and predictable cash flow should opt for annuities, while entities with advanced risk management capabilities benefit more from longevity swaps.

Integrating Annuities and Longevity Swaps in a Retirement Portfolio

Integrating annuities and longevity swaps in a retirement portfolio enhances security by balancing guaranteed income with longevity risk management. Annuities provide steady, inflation-protected payouts, while longevity swaps transfer longevity risk to counterparties, mitigating the financial impact of retirees living longer than expected. Combining both instruments optimizes cash flow stability and risk diversification, ensuring sustained retirement income.

Making the Right Choice for Lifelong Financial Security

Annuities provide guaranteed income streams for life, reducing the risk of outliving assets by transferring longevity risk to insurers. Longevity swaps offer a customizable mechanism for pension funds to hedge against the financial uncertainty of beneficiaries living longer than expected. Selecting between annuities and longevity swaps depends on individual risk tolerance, desired flexibility, and financial goals to ensure lifelong retirement security.

Related Important Terms

Deferred Income Annuity (DIA)

Deferred Income Annuities (DIAs) provide a guaranteed income stream starting at a future retirement date, offering retirees protection against outliving their savings by locking in lifetime payments based on longevity risk pooling. Unlike longevity swaps, which are complex financial instruments used by institutions to hedge pension liabilities, DIAs are accessible consumer products that directly enhance retirement security through predictable, inflation-adjusted income.

Longevity Income Swap

Longevity Income Swaps offer retirees a customizable solution by transferring longevity risk to financial institutions, providing stable income streams that adjust based on actual lifespan. Unlike traditional annuities, Longevity Income Swaps can better align retirement payouts with individual life expectancy, reducing the risk of outliving assets.

Qualified Longevity Annuity Contract (QLAC)

Qualified Longevity Annuity Contracts (QLACs) provide a tax-advantaged way to secure guaranteed lifetime income, effectively mitigating the risk of outliving retirement savings. Unlike longevity swaps that transfer longevity risk to insurers through complex derivatives, QLACs offer a simpler, government-sanctioned option within retirement plans, enhancing retirement security by locking in deferred income streams while delaying required minimum distributions.

Synthetic Longevity Hedging

Synthetic longevity hedging through longevity swaps offers retirees a tailored risk management strategy by transferring longevity risk to counterparties, ensuring predictable retirement income despite uncertain lifespan. Unlike traditional annuities, these financial instruments provide flexibility and potentially lower costs, enhancing long-term retirement security for sophisticated investors and pension funds.

Income Flooring

Annuities provide a guaranteed income floor by converting retirement savings into a steady stream of payments, ensuring lifetime income stability. Longevity swaps mitigate longevity risk by transferring it to a counterparty, offering flexible income solutions but lacking the automatic income floor annuities guarantee.

Reinsurance Longevity Swap

Reinsurance longevity swaps offer a strategic approach for pension funds and insurers to mitigate longevity risk by transferring it to reinsurers, ensuring stable payouts despite increasing life expectancies. Unlike traditional annuities, these swaps enhance retirement security by stabilizing funding ratios and reducing the financial volatility associated with uncertain retiree lifespans.

Mortality Pooling Risk

Annuities mitigate mortality pooling risk by pooling longevity risk among a broad group of retirees, ensuring stable retirement income regardless of individual lifespan. Longevity swaps transfer mortality risk to capital markets or counterparties, offering customizable hedging but potentially exposing retirees to counterparty default risk and requiring sophisticated risk management.

Swaption for Retirement Income

Swaptions in retirement income planning provide retirees with flexible options to secure guaranteed cash flows against longevity risk, allowing for tailored hedging strategies unlike traditional annuities that offer fixed payouts. By utilizing swaptions, retirees can optimize income streams based on market expectations and lifespan uncertainties, enhancing overall retirement security through customizable and potentially cost-effective risk management.

Personalized Longevity Credit

Personalized longevity credits embedded in longevity swaps offer tailored retirement security by adjusting payouts based on individual lifespan risk, outperforming traditional annuities in flexibility and potential returns. This customization enhances financial resilience against outliving savings, providing retirees with optimized income streams aligned to their unique longevity profiles.

Annuity Laddering Strategy

Annuity laddering strategy enhances retirement security by spreading investments across multiple annuities with staggered start dates, providing a steady income stream and mitigating longevity risk more effectively than a single lump-sum annuity purchase. This approach offers greater flexibility and liquidity compared to longevity swaps, which are complex financial instruments typically suited for institutional investors.

Annuities vs Longevity Swaps for retirement security. Infographic

moneydiff.com

moneydiff.com