Choosing between a Traditional IRA and a Backdoor Roth IRA for retirement savings depends on income levels and tax strategies. Traditional IRAs offer tax-deferred growth with potential tax-deductible contributions, benefiting those seeking immediate tax relief. Backdoor Roth IRAs enable high-income earners to bypass income limits and secure tax-free growth and withdrawals in retirement.

Table of Comparison

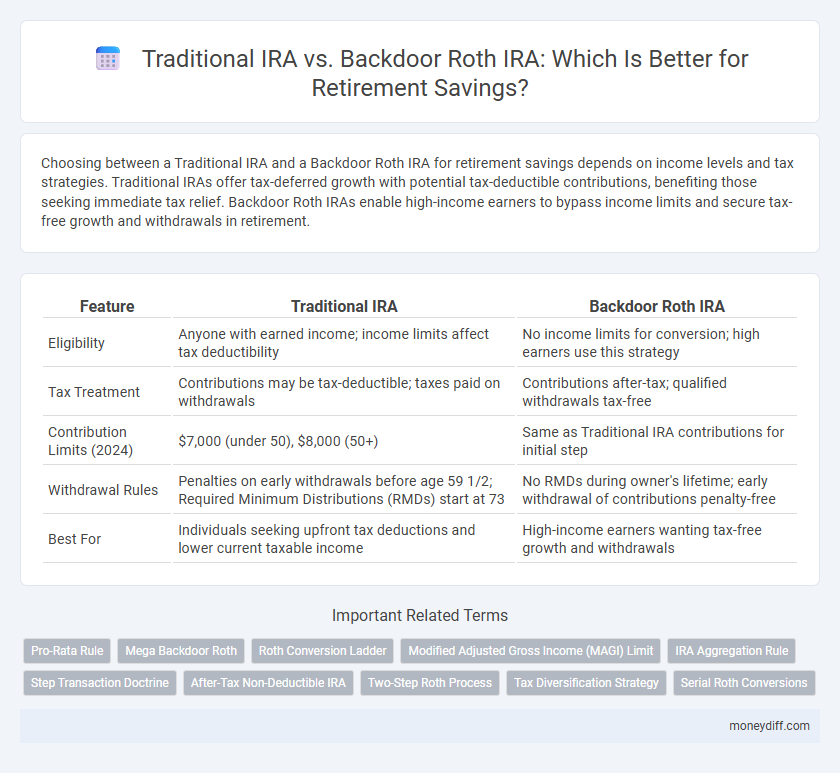

| Feature | Traditional IRA | Backdoor Roth IRA |

|---|---|---|

| Eligibility | Anyone with earned income; income limits affect tax deductibility | No income limits for conversion; high earners use this strategy |

| Tax Treatment | Contributions may be tax-deductible; taxes paid on withdrawals | Contributions after-tax; qualified withdrawals tax-free |

| Contribution Limits (2024) | $7,000 (under 50), $8,000 (50+) | Same as Traditional IRA contributions for initial step |

| Withdrawal Rules | Penalties on early withdrawals before age 59 1/2; Required Minimum Distributions (RMDs) start at 73 | No RMDs during owner's lifetime; early withdrawal of contributions penalty-free |

| Best For | Individuals seeking upfront tax deductions and lower current taxable income | High-income earners wanting tax-free growth and withdrawals |

Overview: Understanding Traditional IRA and Backdoor Roth

Traditional IRAs offer tax-deferred growth with contributions potentially tax-deductible depending on income and participation in employer plans, ideal for pre-tax retirement savings. Backdoor Roth IRAs provide a strategic way for high-income earners to convert non-deductible Traditional IRA contributions into Roth IRAs, allowing tax-free growth and tax-free withdrawals in retirement. Understanding contribution limits, income eligibility, and tax implications is crucial for optimizing retirement savings through these accounts.

Eligibility Criteria for Traditional IRA vs Backdoor Roth

Traditional IRA eligibility allows contributions regardless of income, but tax deductibility phases out for high earners with workplace retirement plans. Backdoor Roth IRAs require income too high for direct Roth contributions, enabling high earners to bypass limits by converting non-deductible Traditional IRA funds. Understanding income thresholds and workplace plan status is crucial for maximizing tax advantages in retirement savings strategies.

Tax Implications: Contributions and Withdrawals

Traditional IRA contributions are often tax-deductible, reducing taxable income in the contribution year, but withdrawals are taxed as ordinary income during retirement. Backdoor Roth IRA contributions use after-tax dollars, offering no immediate tax deduction, yet qualified withdrawals and earnings are tax-free, providing long-term tax advantages. Understanding these tax implications helps optimize retirement savings strategies based on individual income levels and future tax expectations.

Income Limits: Who Qualifies for Each Option?

Traditional IRAs have no income limits for contributions, allowing anyone with earned income to contribute and potentially deduct those contributions on their tax returns, depending on participation in an employer retirement plan. Roth IRAs impose income limits, disqualifying high earners from contributing directly, which is where the Backdoor Roth IRA becomes a valuable strategy by converting traditional IRA funds into a Roth IRA regardless of income. High-income earners, typically above $153,000 for singles and $228,000 for married couples filing jointly in 2024, can leverage the Backdoor Roth to bypass Roth IRA income restrictions while enjoying tax-free growth and withdrawals.

Contribution Limits for Traditional IRA and Backdoor Roth

Traditional IRAs have an annual contribution limit of $6,500 for individuals under 50, with an additional $1,000 catch-up contribution allowed for those 50 and older. The Backdoor Roth IRA utilizes these Traditional IRA contribution limits as a basis for a non-deductible contribution, which is then converted to a Roth IRA, bypassing the income restrictions typically applied to Roth contributions. Understanding these contribution limits is crucial for optimizing retirement savings strategies and maximizing tax advantages.

Conversion Process: How the Backdoor Roth Works

The Backdoor Roth IRA involves making a non-deductible contribution to a Traditional IRA followed by a conversion to a Roth IRA, bypassing income limits imposed on direct Roth contributions. During the conversion process, taxes are owed on any earnings and pre-tax amounts in the Traditional IRA, but the converted funds then grow tax-free within the Roth IRA. This strategy enables high-income earners to benefit from Roth IRA advantages, such as tax-free withdrawals and no required minimum distributions.

Required Minimum Distributions (RMDs) Comparison

Traditional IRAs require account holders to begin taking Required Minimum Distributions (RMDs) starting at age 73, based on the IRS life expectancy tables, which can impact long-term growth potential by depleting retirement savings annually. Backdoor Roth IRAs, created through non-deductible contributions to a Traditional IRA followed by a conversion, do not have RMD requirements during the account holder's lifetime, allowing tax-free growth and withdrawals. This key difference makes Backdoor Roth IRAs a strategic option for those seeking to maximize tax-free accumulation and maintain control over retirement assets without mandatory distributions.

Growth Potential and Investment Flexibility

Traditional IRAs offer tax-deferred growth, allowing investments to compound without annual taxation, which can enhance long-term retirement savings. Backdoor Roth IRAs provide tax-free growth and withdrawals, increasing overall growth potential, especially for high-income earners who exceed Roth IRA contribution limits. Investment flexibility in both accounts depends on the custodian, but Roth IRAs generally offer more freedom for penalty-free withdrawals and diverse investment options.

Penalties and Early Withdrawal Rules

Traditional IRAs impose a 10% penalty on withdrawals taken before age 59 1/2 unless qualifying exceptions apply, with mandatory minimum distributions starting at age 73. Backdoor Roth IRAs allow tax-free withdrawals of contributions at any time without penalties, while earnings withdrawn before age 59 1/2 and before a five-year holding period incur taxes and penalties. Understanding these rules is essential for maximizing retirement savings and avoiding costly penalties.

Choosing the Best Option for Your Retirement Goals

Choosing between a Traditional IRA and a Backdoor Roth IRA depends on your current tax bracket and future income expectations, as Traditional IRAs offer tax-deferred growth while Backdoor Roth IRAs provide tax-free withdrawals. High earners benefit from the Backdoor Roth strategy by bypassing income limits and maximizing tax-free retirement income. Evaluating your retirement timeline, expected tax rate changes, and contribution limits ensures optimal growth and tax efficiency in your retirement portfolio.

Related Important Terms

Pro-Rata Rule

The Pro-Rata Rule affects the conversion of Traditional IRAs to Roth IRAs by requiring all IRA balances to be considered when calculating taxable income, which can increase tax liability during a Backdoor Roth conversion. Understanding this rule is crucial for strategizing retirement savings to minimize taxes and maximize growth potential between Traditional and Backdoor Roth IRA options.

Mega Backdoor Roth

Mega Backdoor Roth contributions allow individuals to convert after-tax 401(k) savings into a Roth IRA, significantly increasing retirement savings beyond traditional Roth IRA limits. This strategy offers higher contribution limits than Traditional IRA or standard Backdoor Roth options, making it ideal for high-income earners seeking tax-free growth and withdrawals in retirement.

Roth Conversion Ladder

The Traditional IRA allows tax-deductible contributions with tax-deferred growth, while the Backdoor Roth enables high-income earners to bypass Roth IRA income limits by converting Traditional IRA funds into Roth assets. Utilizing a Roth Conversion Ladder strategy minimizes taxes by spreading conversions over several years, providing early tax-free access to retirement funds without penalties.

Modified Adjusted Gross Income (MAGI) Limit

Traditional IRA contributions offer tax-deferred growth but have no income limits for contributions, although deductibility phases out starting at a Modified Adjusted Gross Income (MAGI) of $73,000 for single filers and $116,000 for joint filers in 2024. Backdoor Roth IRAs bypass the MAGI limit for Roth contributions, allowing high-income earners above the $153,000 single or $228,000 joint filer Roth IRA MAGI cap to convert traditional IRA funds to Roth status, enabling tax-free growth and withdrawals.

IRA Aggregation Rule

The IRA Aggregation Rule requires that all Traditional IRAs be considered as one combined account for tax purposes when performing conversions or distributions, impacting the effectiveness of the Backdoor Roth strategy by potentially increasing tax liability if pre-tax funds exist. Choosing between a Traditional IRA and a Backdoor Roth depends on current tax brackets, future tax expectations, and the presence of existing IRA balances subject to aggregation rules.

Step Transaction Doctrine

The Step Transaction Doctrine can challenge the use of backdoor Roth IRAs by treating multiple steps as a single transaction, potentially reclassifying contributions and triggering taxes or penalties. Understanding this IRS principle is crucial for retirement savers choosing between a Traditional IRA and backdoor Roth strategy to ensure compliance and optimize tax outcomes.

After-Tax Non-Deductible IRA

After-tax non-deductible IRAs serve as the foundation for Backdoor Roth IRAs, allowing high-income earners to contribute beyond traditional Roth income limits by converting these funds tax-free later. Unlike traditional IRAs that offer immediate tax deductions, after-tax contributions grow tax-deferred, and strategic conversion to a Roth IRA enables tax-free withdrawals during retirement.

Two-Step Roth Process

The Two-Step Roth Process involves first making nondeductible contributions to a Traditional IRA and then converting those funds to a Roth IRA, enabling high-income earners to bypass income limits associated with direct Roth IRA contributions. This strategy allows for tax-free growth and tax-free withdrawals in retirement, maximizing long-term savings potential despite current income restrictions.

Tax Diversification Strategy

Traditional IRAs offer tax-deferred growth by allowing pre-tax contributions and taxable withdrawals in retirement, while Backdoor Roth IRAs enable after-tax contributions to grow tax-free and be withdrawn tax-free. Combining both accounts creates a tax diversification strategy that provides flexibility in managing taxable income during retirement.

Serial Roth Conversions

Serial Roth conversions in retirement savings enable high-income earners to systematically move funds from a Traditional IRA to a Roth IRA, bypassing income limits on direct Roth contributions. This strategy leverages tax diversification by converting pre-tax assets into tax-free growth potential, optimizing long-term retirement wealth accumulation and minimizing required minimum distributions.

Traditional IRA vs Backdoor Roth for retirement savings. Infographic

moneydiff.com

moneydiff.com