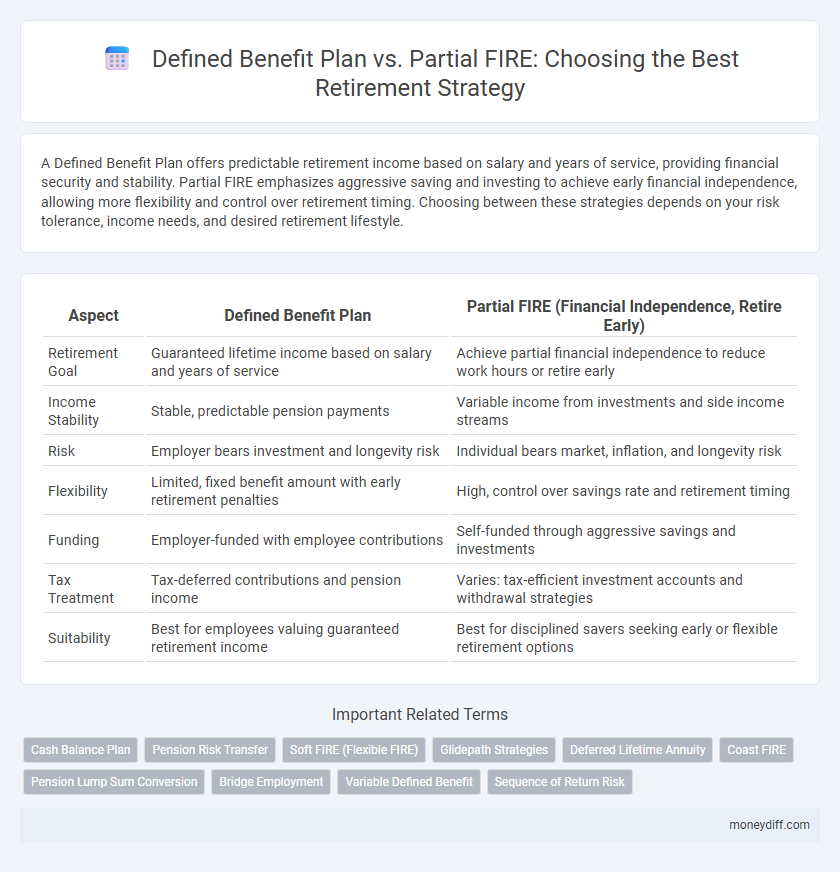

A Defined Benefit Plan offers predictable retirement income based on salary and years of service, providing financial security and stability. Partial FIRE emphasizes aggressive saving and investing to achieve early financial independence, allowing more flexibility and control over retirement timing. Choosing between these strategies depends on your risk tolerance, income needs, and desired retirement lifestyle.

Table of Comparison

| Aspect | Defined Benefit Plan | Partial FIRE (Financial Independence, Retire Early) |

|---|---|---|

| Retirement Goal | Guaranteed lifetime income based on salary and years of service | Achieve partial financial independence to reduce work hours or retire early |

| Income Stability | Stable, predictable pension payments | Variable income from investments and side income streams |

| Risk | Employer bears investment and longevity risk | Individual bears market, inflation, and longevity risk |

| Flexibility | Limited, fixed benefit amount with early retirement penalties | High, control over savings rate and retirement timing |

| Funding | Employer-funded with employee contributions | Self-funded through aggressive savings and investments |

| Tax Treatment | Tax-deferred contributions and pension income | Varies: tax-efficient investment accounts and withdrawal strategies |

| Suitability | Best for employees valuing guaranteed retirement income | Best for disciplined savers seeking early or flexible retirement options |

Understanding Defined Benefit Plans: A Retirement Pillar

Defined Benefit Plans guarantee a fixed pension payout based on salary and years of service, offering predictable retirement income and reducing longevity risk. These plans are employer-funded and managed, providing financial security without the need for individual investment decisions. Unlike Partial FIRE strategies that rely on personal savings growth, Defined Benefit Plans serve as a stable retirement pillar, ensuring steady cash flow throughout retirement.

Partial FIRE: What It Means for Modern Retirement

Partial FIRE emphasizes financial independence by achieving enough savings to cover essential expenses, allowing flexible retirement timelines without fully exiting the workforce. Unlike traditional Defined Benefit Plans that guarantee fixed pensions based on tenure and salary, Partial FIRE focuses on investment returns and lifestyle adjustments to sustain retirement income. This approach offers modern retirees greater control over wealth accumulation and spending, adapting to changing economic conditions and personal goals.

Comparing Stability: Defined Benefit Plans vs Partial FIRE

Defined Benefit Plans offer predictable, stable income streams based on salary and years of service, providing financial security throughout retirement. Partial FIRE (Financial Independence, Retire Early) relies on a combination of investment returns and controlled expenses, which can be subject to market volatility and economic fluctuations. Stability in retirement is generally higher with Defined Benefit Plans due to guaranteed payouts, whereas Partial FIRE requires ongoing financial management and risk tolerance.

Flexibility and Control: Which Retirement Path Wins?

Defined Benefit Plans offer guaranteed income but limit flexibility and control over investment choices, often locking retirees into predetermined payout structures. Partial FIRE emphasizes personal control and adaptability by combining part-time work or side income with investment growth, allowing tailored adjustments to lifestyle and savings strategies. Flexibility and control heavily favor Partial FIRE, providing retirees with dynamic options suited to changing financial needs and goals.

Evaluating Long-Term Financial Security

Defined Benefit Plans provide guaranteed lifelong income based on salary and years of service, offering predictable financial security. Partial FIRE combines aggressive savings with moderate early retirement, allowing flexibility but requiring careful investment management to sustain long-term funds. Evaluating long-term financial security involves assessing the stability of pension benefits versus the risks and growth potential of self-directed partial FIRE strategies.

Income Predictability: Guaranteed Pension vs Partial Withdrawals

Defined Benefit Plans provide a predictable, guaranteed pension income based on salary and years of service, ensuring financial stability during retirement. Partial Financial Independence, Retire Early (FIRE) strategies rely on systematic withdrawals from investment portfolios, which can vary with market performance and carry withdrawal risks. Income predictability is higher in Defined Benefit Plans, while Partial FIRE offers flexibility but greater exposure to market volatility.

Tax Implications in Defined Benefit and Partial FIRE Strategies

Defined Benefit Plans offer predictable, taxable retirement income often taxed as ordinary income upon distribution, with limited flexibility on tax timing. Partial FIRE strategies leverage tax-advantaged accounts like Roth IRAs and HSAs to optimize tax-free or tax-deferred growth, enabling strategic withdrawals to minimize tax burden. Analyzing tax brackets and timing distributions in both approaches is crucial for maximizing after-tax retirement income.

Risk Management in Retirement Planning

Defined Benefit Plans provide guaranteed income streams, minimizing longevity and market risks by ensuring predictable retirement payouts. Partial FIRE strategies involve accumulating significant savings and partial financial independence, but they expose retirees to market volatility and sequence of returns risk without guaranteed income. Effective retirement planning must balance the security of Defined Benefit Plans with the flexibility of Partial FIRE, employing risk management techniques such as diversification and withdrawal rate optimization.

Lifestyle Considerations: Full Pension vs Early Partial Retirement

Defined Benefit Plans provide a guaranteed, lifelong pension ensuring stable income for retirees, supporting traditional retirement lifestyles focused on financial security and healthcare coverage. Partial FIRE (Financial Independence, Retire Early) emphasizes early retirement by accumulating sufficient assets to cover reduced work hours or part-time engagement, allowing for greater lifestyle flexibility but requiring careful management of investment risk and healthcare expenses. Evaluating lifestyle goals, risk tolerance, and desired retirement age is crucial when choosing between full pension benefits and the autonomy offered by partial early retirement.

Choosing the Right Strategy for Your Retirement Goals

Choosing the right retirement strategy depends on personal financial goals, risk tolerance, and desired lifestyle. A Defined Benefit Plan offers guaranteed income based on salary and years of service, providing stability and predictability for long-term retirees. Partial FIRE (Financial Independence, Retire Early) emphasizes aggressive saving and investment to achieve early financial independence while maintaining flexibility, often appealing to those seeking control over retirement timing and portfolio growth.

Related Important Terms

Cash Balance Plan

A Cash Balance Plan, a type of Defined Benefit Plan, guarantees a specified retirement benefit based on a preset formula, providing predictable income and tax advantages compared to the flexible but less certain Partial FIRE strategy. This plan offers higher contribution limits and employer funding, making it ideal for maximizing retirement savings while securing a stable cash flow in retirement.

Pension Risk Transfer

Defined Benefit Plans provide guaranteed lifetime income with employer-managed pension risk transfer, reducing retirees' exposure to market volatility and longevity risk. Partial FIRE strategies require individuals to self-manage investments and retirement timing, increasing personal risk but offering greater flexibility and potential early withdrawal options.

Soft FIRE (Flexible FIRE)

Soft FIRE offers flexible retirement timing and spending by gradually reducing work hours and drawing from a mix of partial savings and income streams, unlike Defined Benefit Plans which provide a fixed pension based on salary and years of service. This flexibility in Soft FIRE allows retirees to tailor their lifestyle and financial needs more dynamically while leveraging partial financial independence.

Glidepath Strategies

Defined Benefit Plans provide a predictable retirement income through a fixed glidepath ensuring stable payouts, while Partial FIRE strategies emphasize aggressive savings and investment glidepaths to achieve early financial independence with flexible income targets. Optimizing glidepath strategies in both approaches hinges on balancing risk tolerance, expected returns, and time horizon to maximize retirement goal attainment.

Deferred Lifetime Annuity

A Defined Benefit Plan guarantees a fixed lifetime income based on salary and years of service, providing financial security without market risk, while Partial FIRE emphasizes early asset accumulation and phased retirement, relying heavily on Deferred Lifetime Annuities to secure predictable post-retirement cash flow. Deferred Lifetime Annuities optimize retirement income by converting accumulated savings into guaranteed payments starting at a later age, mitigating longevity risk and complementing Partial FIRE strategies.

Coast FIRE

A defined benefit plan guarantees a fixed retirement income based on salary and years of service, providing financial stability, whereas Partial FIRE, especially Coast FIRE, emphasizes early savings with minimal contributions later, allowing investments to grow independently until retirement. Coast FIRE enables individuals to stop aggressive saving once a sufficient retirement nest egg is accumulated while relying on investment growth and defined benefit plans to supplement income.

Pension Lump Sum Conversion

Choosing between a Defined Benefit Plan and Partial FIRE hinges on the Pension Lump Sum Conversion option; converting a pension to a lump sum allows for greater control over investments but requires disciplined management to ensure retirement income sustainability. Defined Benefit Plans guarantee predictable monthly payments based on salary and service years, while Partial FIRE combines targeted savings with strategic withdrawals to accelerate financial independence without fully relying on traditional pension income.

Bridge Employment

Defined Benefit Plans provide guaranteed lifetime income based on salary and years of service, offering financial stability during retirement, while Partial FIRE emphasizes achieving partial financial independence to enable bridge employment--part-time or contract work that supplements income before full retirement. Bridge employment helps individuals gradually transition by maintaining cash flow and delaying full pension withdrawals, optimizing both income streams for a secure retirement strategy.

Variable Defined Benefit

Variable Defined Benefit plans provide a guaranteed retirement income that adjusts based on investment performance, offering more flexibility than traditional fixed plans. Partial FIRE strategies prioritize aggressive savings and investment to achieve financial independence faster but lack the steady income security of Variable Defined Benefit pensions.

Sequence of Return Risk

Defined Benefit Plans provide predictable, lifetime income that mitigates Sequence of Return Risk by ensuring steady payouts regardless of market fluctuations. Partial FIRE strategies, relying on investment withdrawals, expose retirees to greater Sequence of Return Risk due to market volatility impacting portfolio sustainability.

Defined Benefit Plan vs Partial FIRE for retirement goal Infographic

moneydiff.com

moneydiff.com