Annuities offer a guaranteed, steady income stream for retirement, providing financial security and reducing the risk of outliving your savings. BaristaFIRE combines partial retirement income from a part-time job with investment withdrawals, creating flexibility and potential growth while maintaining lifestyle engagement. Choosing between annuities and BaristaFIRE depends on your desired balance between income stability, risk tolerance, and personal fulfillment in retirement.

Table of Comparison

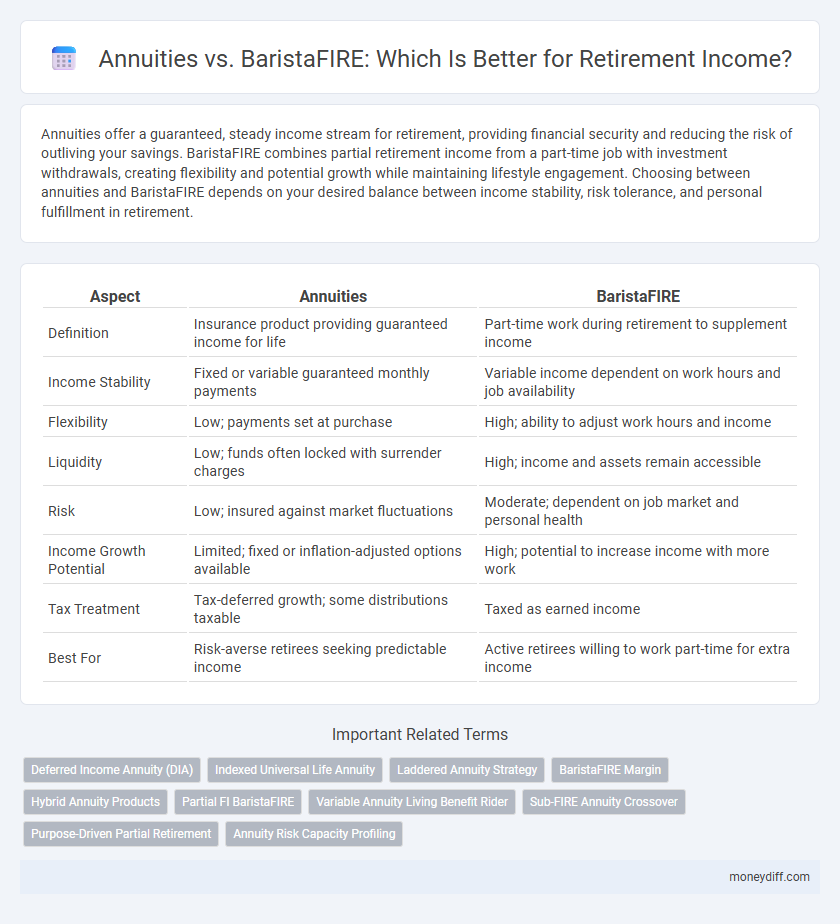

| Aspect | Annuities | BaristaFIRE |

|---|---|---|

| Definition | Insurance product providing guaranteed income for life | Part-time work during retirement to supplement income |

| Income Stability | Fixed or variable guaranteed monthly payments | Variable income dependent on work hours and job availability |

| Flexibility | Low; payments set at purchase | High; ability to adjust work hours and income |

| Liquidity | Low; funds often locked with surrender charges | High; income and assets remain accessible |

| Risk | Low; insured against market fluctuations | Moderate; dependent on job market and personal health |

| Income Growth Potential | Limited; fixed or inflation-adjusted options available | High; potential to increase income with more work |

| Tax Treatment | Tax-deferred growth; some distributions taxable | Taxed as earned income |

| Best For | Risk-averse retirees seeking predictable income | Active retirees willing to work part-time for extra income |

Understanding Annuities as a Retirement Income Strategy

Annuities provide a guaranteed income stream during retirement by converting a lump sum into periodic payments, reducing longevity risk. Fixed, variable, and indexed annuities offer varying levels of risk and return, catering to different investor preferences and financial goals. Understanding the terms, fees, and tax implications of annuities is essential when comparing them to BaristaFIRE strategies, which combine part-time work with investment income for flexible retirement funding.

What Is BaristaFIRE and How Does It Work?

BaristaFIRE is a retirement strategy combining part-time work with traditional savings to generate steady income while delaying full retirement. Unlike annuities, which provide guaranteed fixed payments through an insurance contract, BaristaFIRE relies on balancing reduced work hours with ongoing earnings and investment growth. This approach offers flexibility and potential tax advantages by allowing retirees to maintain some income without fully drawing from retirement accounts.

Key Differences Between Annuities and BaristaFIRE

Annuities provide a guaranteed stream of income backed by insurance companies, offering financial security with predictable payouts but often lack flexibility and liquidity. BaristaFIRE combines partial retirement with part-time work, enhancing income through active engagement while maintaining lifestyle flexibility and potential social benefits. Key differences include the trade-off between guaranteed, passive income in annuities versus the dynamic, potentially variable earnings and lifestyle adaptability found in BaristaFIRE strategies.

Pros and Cons of Annuities for Retirement Security

Annuities provide guaranteed lifetime income, offering financial stability and protection against market volatility during retirement. However, they often come with high fees, limited liquidity, and complex terms that may reduce overall returns. While annuities ensure consistent cash flow, they lack the flexibility and potential growth opportunities found in alternative strategies like the BaristaFIRE approach, which combines part-time work with investment income.

Benefits and Challenges of Pursuing BaristaFIRE

BaristaFIRE offers flexibility by combining part-time work with reduced expenses to achieve early retirement goals, providing steady income without fully relying on savings like traditional annuities. This approach benefits those seeking a gradual transition and maintaining social engagement, but challenges include job availability, potential income variability, and the need for careful budgeting to balance work and leisure. Unlike annuities that guarantee fixed payments, BaristaFIRE requires ongoing effort and adaptability to market conditions and personal health.

Flexibility in Retirement: Annuities vs BaristaFIRE

Annuities provide a structured, guaranteed income stream but often lack flexibility due to fixed payout schedules and penalties for early withdrawal. BaristaFIRE combines part-time work with investment income, offering greater control over cash flow and spending, allowing retirees to adjust income sources based on evolving financial needs. The adaptability of BaristaFIRE supports a dynamic retirement lifestyle, contrasting with the rigid nature of traditional annuity contracts.

Income Stability: Which Option Provides More Reliability?

Annuities offer guaranteed income streams backed by insurance companies, ensuring predictable and stable payments throughout retirement, which appeals to risk-averse individuals seeking financial security. BaristaFIRE combines part-time work with investment income, providing flexible but variable cash flow that depends on job availability and market performance, leading to less predictable income. For retirees prioritizing income stability, annuities typically provide a more reliable and consistent source of funds compared to the fluctuating earnings from BaristaFIRE strategies.

Risk Factors: Managing Uncertainty in Retirement Planning

Annuities provide guaranteed income streams, reducing longevity and market risks by transferring investment risk to insurance companies, but may lack liquidity and flexibility. BaristaFIRE relies on part-time work during retirement, introducing employment and income variability, which requires careful planning to manage potential income gaps. Balancing the stability of annuities with the adaptability of BaristaFIRE strategies helps mitigate uncertainty in retirement income planning.

Suitability: Who Should Choose Annuities or BaristaFIRE?

Annuities suit individuals seeking guaranteed, steady income streams and risk mitigation during retirement, particularly those with low risk tolerance or limited investment experience. BaristaFIRE appeals to those desiring flexible part-time work to supplement retirement income while maintaining engagement and social interaction, ideal for active retirees who value control over their schedule. Evaluating personal financial goals, risk tolerance, and lifestyle preferences helps determine whether annuities or BaristaFIRE best align with sustainable retirement income strategies.

Making the Right Choice: Factors to Consider for Your Retirement Future

Choosing between annuities and BaristaFIRE for retirement income depends on risk tolerance, income stability, and lifestyle goals. Annuities provide guaranteed, predictable cash flow, ideal for those prioritizing financial security without market volatility. BaristaFIRE, combining part-time work with investment withdrawals, offers flexible income and potential growth but requires active management and lifestyle adjustments.

Related Important Terms

Deferred Income Annuity (DIA)

Deferred Income Annuities (DIAs) provide guaranteed lifetime income starting at a future date, offering retirees financial stability and protection against longevity risk. Unlike the BaristaFIRE approach, which relies on part-time work to supplement income, DIAs ensure predictable cash flow without market volatility, ideal for securing essential retirement expenses.

Indexed Universal Life Annuity

Indexed Universal Life Annuities provide a tax-advantaged, flexible retirement income option with potential for cash value growth tied to market indexes, offering downside protection unlike traditional annuities. BaristaFIRE, combining partial early retirement with part-time work, contrasts with annuities by emphasizing active income streams over guaranteed lifetime payouts in retirement financial planning.

Laddered Annuity Strategy

Laddered annuity strategy involves purchasing multiple annuities with staggered start dates to provide consistent retirement income and reduce interest rate risk, contrasting with BaristaFIRE which combines part-time work and investing for flexible income streams. This approach ensures predictable cash flow and longevity protection, appealing to retirees seeking stable, guaranteed income without reliance on continued employment.

BaristaFIRE Margin

BaristaFIRE offers a flexible retirement income strategy by combining part-time work with investment withdrawals, optimizing the BaristaFIRE margin to reduce financial risk and increase cash flow stability. Unlike fixed annuities, BaristaFIRE leverages market growth potential while maintaining a safety net through continued earnings, enhancing overall income resilience in retirement.

Hybrid Annuity Products

Hybrid annuity products combine guaranteed income streams with investment growth potential, offering retirees stability alongside market-linked returns. This approach contrasts with BaristaFIRE, which relies on part-time work for supplemental income and lacks the predictability and longevity guarantees inherent in hybrid annuities.

Partial FI BaristaFIRE

Partial FI BaristaFIRE blends continued part-time income with strategic savings withdrawals, offering flexible retirement funding without fully relying on annuities. Annuities provide guaranteed lifetime income but lack the adaptability and potential growth that Partial FI BaristaFIRE strategies leverage for sustainable, semi-retired lifestyles.

Variable Annuity Living Benefit Rider

Variable Annuity Living Benefit Riders provide guaranteed income streams during retirement, offering protection against market volatility and longevity risk, which contrasts with BaristaFIRE's flexible approach relying on part-time work to supplement savings. These riders are particularly valuable for retirees seeking stable income without the uncertainty of labor income, blending investment growth potential with downside protection.

Sub-FIRE Annuity Crossover

Sub-FIRE annuity crossover strategies balance the guaranteed income from fixed annuities with the flexible, part-time earnings typical of BaristaFIRE, optimizing cash flow during early retirement phases. Integrating a conservative annuity portfolio with supplemental barista-style work reduces market risk while maintaining lifestyle flexibility and sustaining income streams before full Social Security benefits commence.

Purpose-Driven Partial Retirement

Annuities provide a guaranteed income stream designed for long-term financial security, making them ideal for individuals seeking stability in Purpose-Driven Partial Retirement; BaristaFIRE, on the other hand, offers flexibility by combining part-time work with investment income, allowing retirees to maintain purpose and engagement while supplementing their retirement funds. Choosing between annuities and BaristaFIRE depends on preferences for income certainty versus lifestyle flexibility in retirement income planning.

Annuity Risk Capacity Profiling

Annuity risk capacity profiling evaluates an individual's ability to withstand financial risks within fixed income products, ensuring a stable retirement income through guaranteed payouts. Unlike BaristaFIRE, which relies on part-time work to supplement income, annuities offer predictable cash flow but require careful assessment of risk tolerance, longevity, and liquidity needs.

Annuities vs BaristaFIRE for retirement income Infographic

moneydiff.com

moneydiff.com