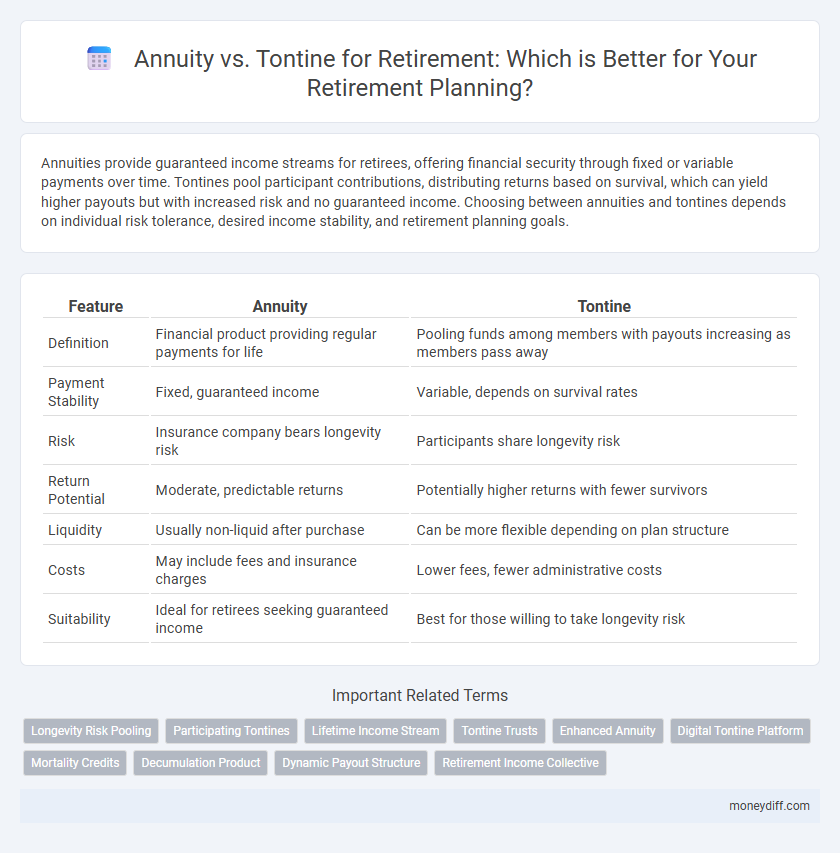

Annuities provide guaranteed income streams for retirees, offering financial security through fixed or variable payments over time. Tontines pool participant contributions, distributing returns based on survival, which can yield higher payouts but with increased risk and no guaranteed income. Choosing between annuities and tontines depends on individual risk tolerance, desired income stability, and retirement planning goals.

Table of Comparison

| Feature | Annuity | Tontine |

|---|---|---|

| Definition | Financial product providing regular payments for life | Pooling funds among members with payouts increasing as members pass away |

| Payment Stability | Fixed, guaranteed income | Variable, depends on survival rates |

| Risk | Insurance company bears longevity risk | Participants share longevity risk |

| Return Potential | Moderate, predictable returns | Potentially higher returns with fewer survivors |

| Liquidity | Usually non-liquid after purchase | Can be more flexible depending on plan structure |

| Costs | May include fees and insurance charges | Lower fees, fewer administrative costs |

| Suitability | Ideal for retirees seeking guaranteed income | Best for those willing to take longevity risk |

Understanding Annuities and Tontines

Annuities offer retirees a guaranteed stream of income funded by an insurance company, providing financial security and predictable payouts based on factors like age and life expectancy. Tontines pool funds from multiple participants, distributing income only to surviving members, which eliminates insurer risk but relies on longevity pooling. Understanding the structural differences between annuities and tontines helps retirees choose between guaranteed income or potentially higher, but less certain, returns linked to survival.

Key Differences Between Annuities and Tontines

Annuities provide guaranteed periodic payments funded by an individual's premiums and managed by an insurance company, offering predictable income and principal protection. Tontines pool contributions from participants into a shared fund, redistributing payouts among survivors and eliminating guarantees, which increases potential returns but also risk. The key differences include payout certainty, risk distribution, and the role of insurance backing.

How Annuities Work in Retirement Planning

Annuities in retirement planning provide a guaranteed stream of income by converting a lump sum into periodic payments, typically through fixed or variable contracts with insurance companies. They offer protection against longevity risk by ensuring steady cash flow regardless of lifespan, making them appealing for retirees seeking financial security. Unlike tontines, annuities rely on professional management and regulatory frameworks to mitigate risks and deliver predictable payouts.

The Revival of Tontines in Modern Finance

Tontines, a centuries-old pooling mechanism, are experiencing a revival in modern finance as an alternative to traditional annuities for retirement income. Unlike annuities, which provide fixed payouts often guaranteed by insurers, tontines distribute benefits based on the survival of participants, potentially offering higher returns with lower fees and reduced insurer risk. Financial innovators and retirees seek tontines for their ability to combine longevity pooling with investment growth, making them a compelling option in the evolving retirement landscape.

Risk and Reward: Comparing Annuity and Tontine Payouts

Annuities provide guaranteed, fixed payouts that minimize longevity risk by ensuring a steady income stream regardless of lifespan, making them a low-risk option for retirees. Tontines pool participants' funds with payouts increasing as members pass away, offering potentially higher rewards but exposing individuals to mortality risk and payout variability. Choosing between annuity and tontine payouts requires balancing the security of predictable income against the chance of greater returns tied to collective survival probabilities.

Longevity Risk: Managed by Annuity or Tontine?

Annuities provide a guaranteed income stream for life, effectively managing longevity risk by pooling funds to cover payouts regardless of lifespan. Tontines distribute funds based on survivor shares, incentivizing longevity but exposing participants to variable income dependent on group mortality. Comparing both, annuities offer predictable risk mitigation, while tontines balance risk and reward through mortality-based cash flow adjustments.

Cost and Fees: Annuities versus Tontines

Annuities typically involve higher upfront costs and ongoing management fees, reducing overall retirement income compared to tontines, which often have lower expenses due to their simplified structure and shared-risk model. Annuity providers charge administrative fees, mortality and expense risk charges, and profit margins, whereas tontines distribute pooled funds among survivors without guaranteed payouts or complex fees. Investors should weigh these cost differences carefully, as lower fees in tontines can enhance net returns but come with less predictability than annuities.

Flexibility and Liquidity in Retirement Income Products

Annuities generally provide guaranteed income streams but often lack flexibility and liquidity, as funds are typically locked in for the contract term. Tontines offer more adaptability with potential for higher returns and the ability to adjust payouts based on surviving members, enhancing flexibility in retirement planning. However, tontine liquidity can vary, requiring careful evaluation of withdrawal options compared to the fixed structure of annuities.

Which Option Suits Your Retirement Goals: Annuity or Tontine?

Annuities provide guaranteed lifetime income with predictable payments, making them suitable for retirees seeking financial security and stability. Tontines pool participants' funds, offering potentially higher returns but with payment amounts that increase as members pass away, appealing to those willing to assume longevity risk for greater rewards. Evaluating your risk tolerance, income needs, and desire for guaranteed vs. variable payouts will help determine the best option for your retirement goals.

Making the Right Choice: Expert Tips for Retirees

Choosing between an annuity and a tontine for retirement hinges on balancing guaranteed income against potential returns linked to group longevity. Experts advise retirees to assess factors like personal health, risk tolerance, and the financial stability of providers when evaluating annuities, while considering the shared pooling benefits and inherent risks of tontines. Prioritizing personalized financial goals and consulting with a retirement planner can ensure the optimal income strategy for long-term financial security.

Related Important Terms

Longevity Risk Pooling

Annuities provide guaranteed lifetime income by pooling longevity risk among retirees, ensuring stable payments regardless of lifespan. Tontines offer a collective risk-sharing structure where payouts increase for surviving members, aligning incentives but lacking regulatory guarantees found in traditional annuities.

Participating Tontines

Participating tontines offer retirees a pooled investment structure where participants share longevity risk and benefit from surviving members' gains, providing potentially higher returns compared to traditional annuities. Unlike fixed annuities, participating tontines adjust payouts based on the group's mortality experience and investment performance, aligning incentives and enhancing retirement income sustainability.

Lifetime Income Stream

Annuities offer a guaranteed lifetime income stream by pooling premiums and providing fixed or variable payments, ensuring financial stability during retirement. Tontines, meanwhile, distribute payouts only among surviving members, potentially increasing income as participants pass away but lacking guaranteed lifelong payments.

Tontine Trusts

Tontine trusts offer a unique retirement income solution by pooling participants' funds, where payouts increase for surviving members as others pass away, enhancing longevity risk protection without relying on traditional insurance guarantees. Unlike annuities that provide fixed payments, tontine trusts can deliver potentially higher returns through shared mortality credits, making them an efficient alternative for sustainable retirement income.

Enhanced Annuity

Enhanced annuities provide higher retirement income by offering increased payouts to individuals with specific health conditions or lifestyle factors, differentiating them from traditional tontine schemes that pool funds among participants without personalized risk adjustments. These tailored annuities optimize retirement income by leveraging medical underwriting to maximize benefits, offering a more secure and customized financial solution compared to the collective risk-sharing model of tontines.

Digital Tontine Platform

A Digital Tontine Platform offers a modern alternative to traditional annuities by pooling retirement funds digitally, enabling participants to share investment risks and receive payouts based on group longevity without fixed guarantees. This innovative approach maximizes returns through collective risk-sharing while reducing administrative costs and increasing transparency compared to conventional annuity products.

Mortality Credits

Mortality credits in annuities provide retirees with guaranteed income by pooling longevity risk and redistributing funds from deceased members, whereas tontines offer similar benefits through collective risk-sharing but without insurer guarantees, often resulting in higher potential payouts based on survival probabilities. Annuities provide stability via fixed payments backed by insurers, while tontines leverage mortality credits more flexibly, rewarding survivors with larger shares as mortality rates change over time.

Decumulation Product

Annuities provide retirees with guaranteed, steady income streams by pooling funds and transferring longevity risk to insurers, ensuring predictable decumulation of retirement savings. Tontines, contrastingly, distribute payouts based on surviving participants, offering potential higher returns but with inherent longevity risk shared among members, making them a less conventional decumulation product.

Dynamic Payout Structure

Dynamic payout structures in annuities provide guaranteed, predictable income streams throughout retirement, adapting to market performance with fixed or inflation-linked adjustments. Tontines offer variable payouts based on participant longevity and fund performance, potentially increasing income for survivors but lacking guaranteed minimum returns.

Retirement Income Collective

Annuities provide guaranteed retirement income with insurance company backing, ensuring predictable payouts but often come with higher fees and less flexibility. Tontines, as a Retirement Income Collective, pool participants' contributions to offer potentially higher, experience-based returns by redistributing shares of deceased members' income, promoting longevity risk sharing and collective wealth growth.

Annuity vs tontine for retirement. Infographic

moneydiff.com

moneydiff.com