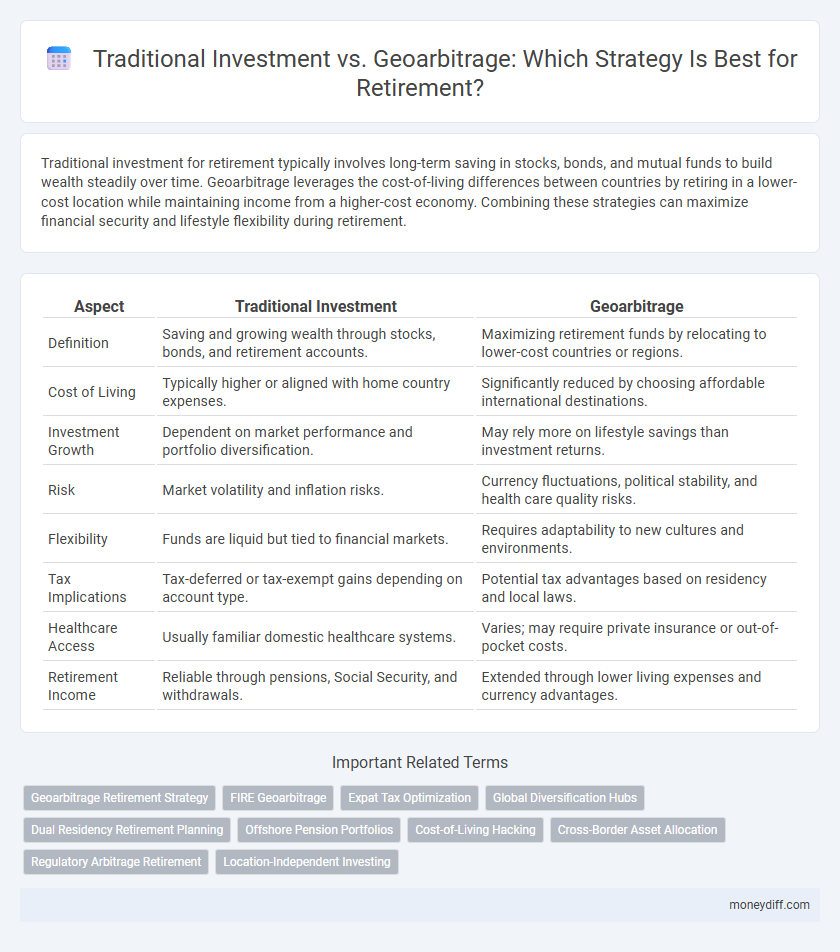

Traditional investment for retirement typically involves long-term saving in stocks, bonds, and mutual funds to build wealth steadily over time. Geoarbitrage leverages the cost-of-living differences between countries by retiring in a lower-cost location while maintaining income from a higher-cost economy. Combining these strategies can maximize financial security and lifestyle flexibility during retirement.

Table of Comparison

| Aspect | Traditional Investment | Geoarbitrage |

|---|---|---|

| Definition | Saving and growing wealth through stocks, bonds, and retirement accounts. | Maximizing retirement funds by relocating to lower-cost countries or regions. |

| Cost of Living | Typically higher or aligned with home country expenses. | Significantly reduced by choosing affordable international destinations. |

| Investment Growth | Dependent on market performance and portfolio diversification. | May rely more on lifestyle savings than investment returns. |

| Risk | Market volatility and inflation risks. | Currency fluctuations, political stability, and health care quality risks. |

| Flexibility | Funds are liquid but tied to financial markets. | Requires adaptability to new cultures and environments. |

| Tax Implications | Tax-deferred or tax-exempt gains depending on account type. | Potential tax advantages based on residency and local laws. |

| Healthcare Access | Usually familiar domestic healthcare systems. | Varies; may require private insurance or out-of-pocket costs. |

| Retirement Income | Reliable through pensions, Social Security, and withdrawals. | Extended through lower living expenses and currency advantages. |

Understanding Traditional Investment Strategies for Retirement

Traditional investment strategies for retirement typically involve diversified portfolios of stocks, bonds, and mutual funds designed to balance risk and growth over time, leveraging compound interest and tax-advantaged accounts like 401(k)s and IRAs. Understanding asset allocation and the importance of rebalancing can optimize retirement savings growth while mitigating market volatility. These strategies emphasize long-term planning and steady contributions to ensure sufficient funds are available during retirement years.

What Is Geoarbitrage and How Does It Work?

Geoarbitrage involves leveraging the cost-of-living differences between locations to maximize retirement savings by earning income or accessing pensions from high-cost areas while residing in lower-cost regions. This strategy enables retirees to stretch their retirement funds further compared to traditional investments that rely solely on market returns and accumulated wealth. By relocating to countries or cities with significantly lower expenses, retirees can maintain or even elevate their quality of life, optimizing financial resources without increasing risk exposure.

Comparing Risk Profiles: Traditional Investment vs. Geoarbitrage

Traditional investment retirement strategies often involve stock, bond, and mutual fund portfolios with market volatility and economic downturn risks. Geoarbitrage relies on relocating to lower-cost regions, reducing living expenses while maintaining income, but introduces risks related to political stability, currency fluctuations, and local economic conditions. Evaluating risk profiles requires balancing market exposure from traditional investments against geopolitical and lifestyle uncertainties inherent in geoarbitrage approaches.

Cost of Living Differences: Key to Geoarbitrage Success

Traditional investment strategies for retirement focus on accumulating assets in high-cost regions, often limiting purchasing power due to elevated living expenses. Geoarbitrage leverages cost of living differences by relocating retirees to lower-expense areas, maximizing wealth preservation and enhancing lifestyle quality. Understanding regional price variations in housing, healthcare, and daily expenses is crucial for optimizing retirement income through geoarbitrage.

Potential Returns: Traditional Investments Versus Geoarbitrage

Traditional investments such as stocks, bonds, and mutual funds typically offer steady potential returns influenced by market performance and economic conditions, often averaging around 6-8% annually over the long term. Geoarbitrage leverages cost-of-living differences by relocating to lower-expense regions, effectively increasing disposable income and enhancing retirement purchasing power without requiring high investment returns. Combining traditional investment growth with strategic geoarbitrage can maximize retirement funds, balancing financial growth with cost-effective living.

Tax Implications of Traditional Investment and Geoarbitrage

Traditional investments in retirement accounts like 401(k)s and IRAs offer tax-deferred growth but require paying taxes upon withdrawal, potentially increasing tax liability during retirement. Geoarbitrage leverages living in low-tax or no-tax countries to reduce or eliminate income tax on retirement income, maximizing after-tax savings. Understanding local tax treaties, residency rules, and reporting requirements is crucial for retirees pursuing geoarbitrage to avoid unexpected tax penalties.

Lifestyle Flexibility: Relocating vs. Staying Put for Retirement

Traditional investment strategies often prioritize accumulating wealth through stocks, bonds, and retirement accounts while maintaining a fixed geographic location, which can limit lifestyle flexibility in retirement. Geoarbitrage leverages cost-of-living differences by relocating to lower-expense regions, enhancing retirement income's purchasing power and providing greater freedom in lifestyle choices. Retirees embracing geoarbitrage experience diversified cultural exposure and potential for improved quality of life without significantly altering their portfolio risk profiles.

Diversification Strategies in Both Approaches

Traditional investment strategies for retirement emphasize diversifying across asset classes such as stocks, bonds, and mutual funds to manage risk and optimize returns. Geoarbitrage as a retirement strategy involves spreading investments and living expenses across different geographic regions to capitalize on cost-of-living disparities and currency advantages. Combining asset diversification with geoarbitrage can enhance portfolio resilience and increase retirement income stability by mitigating market and regional economic volatility.

Challenges and Barriers to Successful Geoarbitrage

Traditional investments offer stability through diversified portfolios and consistent returns but may face limitations like inflation risk and market volatility. Geoarbitrage involves relocating to lower-cost regions to maximize retirement funds, yet challenges include legal complexities, cultural adaptation, and fluctuating exchange rates. Successful geoarbitrage requires thorough research on local healthcare, residency regulations, and long-term cost sustainability to avoid unforeseen financial and lifestyle barriers.

Which Retirement Strategy Aligns with Your Financial Goals?

Traditional investment strategies, such as contributing to 401(k) plans and IRAs, focus on building wealth through consistent market growth and tax advantages over time. Geoarbitrage leverages geographic cost-of-living differences by relocating to lower-expense countries or regions, enabling retirees to stretch their savings further. Choosing between these strategies depends on your financial goals, risk tolerance, and lifestyle preferences, with traditional investments offering long-term growth stability and geoarbitrage providing immediate spending power enhancement.

Related Important Terms

Geoarbitrage Retirement Strategy

Geoarbitrage retirement strategy leverages cost-of-living differences by relocating to lower-expense regions, maximizing retirement savings and enhancing purchasing power. This approach outperforms traditional investment methods by enabling retirees to stretch fixed incomes further without relying solely on market returns.

FIRE Geoarbitrage

FIRE geoarbitrage leverages relocating to lower-cost regions to accelerate wealth accumulation by minimizing living expenses while maintaining investment contributions, unlike traditional investments that primarily depend on market returns within fixed high-cost areas. This strategy maximizes retirement fund longevity and purchasing power by exploiting regional economic disparities, making it a potent approach for achieving early financial independence and retire early goals.

Expat Tax Optimization

Traditional investment strategies for retirement focus on accumulating assets within tax-advantaged accounts like 401(k)s and IRAs, but often face high taxation on withdrawals and limited flexibility abroad. Geoarbitrage leverages living in low-tax or tax-friendly countries to optimize retirement income, reducing global tax burdens and enhancing purchasing power through strategic expatriation and residency planning.

Global Diversification Hubs

Traditional investment strategies often rely heavily on domestic assets, limiting exposure to diverse global markets that can mitigate risk and enhance growth opportunities. Geoarbitrage, by leveraging cost-of-living differences in global diversification hubs such as Lisbon, Mexico City, and Chiang Mai, allows retirees to stretch retirement savings while accessing international financial markets for better portfolio diversification.

Dual Residency Retirement Planning

Dual residency retirement planning leverages traditional investments such as stocks, bonds, and retirement accounts alongside geoarbitrage strategies that capitalize on cost-of-living differentials between countries. Combining diversified portfolio growth with relocation to lower-expense regions enhances financial sustainability and tax efficiency during retirement.

Offshore Pension Portfolios

Traditional investments in retirement typically rely on domestic stocks and bonds, which may be subject to higher taxes and limited diversification. Offshore pension portfolios leverage geoarbitrage by investing in global markets with favorable tax regimes and currency advantages, enhancing growth potential and retirement income security.

Cost-of-Living Hacking

Traditional investment strategies for retirement focus on maximizing returns through diversified portfolios of stocks, bonds, and mutual funds, but geoarbitrage emphasizes reducing expenses by relocating to low-cost regions to stretch retirement savings. Cost-of-living hacking via geoarbitrage can significantly enhance financial independence, enabling retirees to maintain or improve their lifestyle on reduced retirement funds compared to relying solely on conventional investment growth.

Cross-Border Asset Allocation

Cross-border asset allocation leverages geoarbitrage by diversifying investments across countries with varying economic conditions, enhancing retirement portfolios beyond traditional domestic-focused strategies. Utilizing international assets can optimize currency exposure, tax efficiency, and growth potential, offering retirees a strategic advantage over conventional investment approaches limited to a single market.

Regulatory Arbitrage Retirement

Regulatory arbitrage in retirement leverages differences in international tax laws and retirement account rules to optimize pension withdrawals and reduce tax liabilities, often creating significant financial advantages over traditional investment strategies confined to domestic regulations. Geoarbitrage enables retirees to relocate to countries with favorable regulatory environments and lower living costs, maximizing retirement income efficiency beyond conventional retirement investment returns.

Location-Independent Investing

Traditional investments rely on asset performance and market growth, while geoarbitrage leverages cost-of-living differences by choosing affordable locations to maximize retirement income. Location-independent investing emphasizes flexibility and financial efficiency by combining remote work or passive income streams with strategic relocation to low-cost regions.

Traditional investment vs Geoarbitrage for retirement. Infographic

moneydiff.com

moneydiff.com