Traditional IRAs offer tax-deferred growth with contributions potentially tax-deductible, making them ideal for reducing taxable income during working years. Backdoor Roth IRAs provide a strategic way to contribute to a Roth IRA despite income limits, allowing for tax-free growth and withdrawals in retirement. Choosing between the two depends on current and anticipated future tax rates, as well as eligibility to contribute directly to a Roth IRA.

Table of Comparison

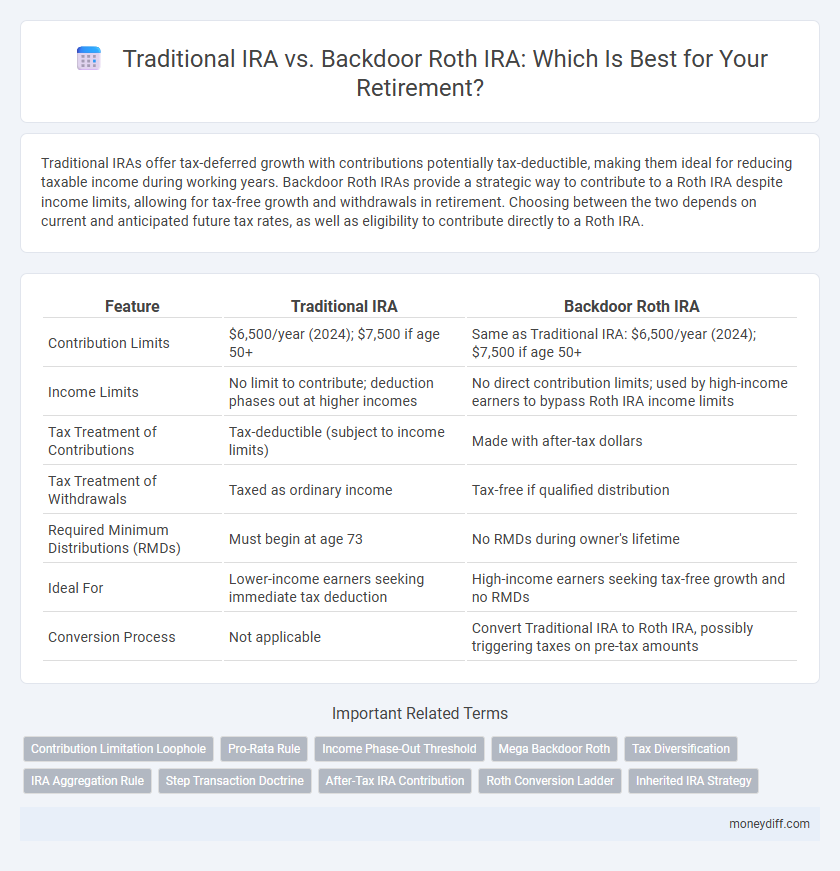

| Feature | Traditional IRA | Backdoor Roth IRA |

|---|---|---|

| Contribution Limits | $6,500/year (2024); $7,500 if age 50+ | Same as Traditional IRA: $6,500/year (2024); $7,500 if age 50+ |

| Income Limits | No limit to contribute; deduction phases out at higher incomes | No direct contribution limits; used by high-income earners to bypass Roth IRA income limits |

| Tax Treatment of Contributions | Tax-deductible (subject to income limits) | Made with after-tax dollars |

| Tax Treatment of Withdrawals | Taxed as ordinary income | Tax-free if qualified distribution |

| Required Minimum Distributions (RMDs) | Must begin at age 73 | No RMDs during owner's lifetime |

| Ideal For | Lower-income earners seeking immediate tax deduction | High-income earners seeking tax-free growth and no RMDs |

| Conversion Process | Not applicable | Convert Traditional IRA to Roth IRA, possibly triggering taxes on pre-tax amounts |

Understanding Traditional IRA: Key Features

Traditional IRA offers tax-deferred growth on contributions, allowing individuals to lower their taxable income in the contribution year. Contributions may be tax-deductible depending on income level and participation in an employer-sponsored retirement plan. Withdrawals during retirement are taxed as ordinary income, making it essential to understand distribution rules and required minimum distributions (RMDs) starting at age 73.

What Is a Backdoor Roth IRA?

A Backdoor Roth IRA is a strategy that allows high-income earners to bypass income limits for Roth IRA contributions by first making a nondeductible contribution to a Traditional IRA and then converting those funds to a Roth IRA. This approach provides the benefits of tax-free growth and tax-free withdrawals in retirement, which are not directly accessible due to income restrictions on Roth IRA contributions. The Backdoor Roth IRA is particularly advantageous for individuals seeking to maximize tax-advantaged retirement savings despite earning above the Roth IRA income limits.

Eligibility Criteria: Traditional IRA vs Backdoor Roth IRA

Traditional IRA eligibility allows individuals under 70 1/2 with earned income to contribute annually up to the IRS limit, regardless of income level, though tax deductibility phases out at higher incomes if covered by a workplace retirement plan. Backdoor Roth IRA is designed for high-income earners who exceed Roth IRA income limits, enabling contributions through a non-deductible Traditional IRA followed by a Roth conversion. Unlike the Traditional IRA, the Backdoor Roth method circumvents income restrictions, making it a strategic option for maximizing tax-advantaged retirement savings.

Contribution Limits and Rules

Traditional IRA contributions are limited to $6,500 annually for individuals under 50 and $7,500 for those 50 and older, with tax-deductible options based on income and participation in employer plans. Backdoor Roth IRA contributions follow the same limits but involve making nondeductible Traditional IRA contributions that are converted to a Roth IRA, bypassing income limits for Roth contributions. Both options require adherence to specific IRS rules on contribution timing, income eligibility, and required minimum distributions for Traditional IRAs starting at age 73.

Tax Benefits: Comparing Traditional IRA and Backdoor Roth IRA

Traditional IRAs offer tax-deferred growth with contributions often tax-deductible, reducing taxable income in the contribution year. Backdoor Roth IRAs provide no upfront tax deduction but enable tax-free growth and tax-free qualified withdrawals, ideal for high earners exceeding Roth IRA income limits. Comparing tax benefits hinges on immediate tax savings versus long-term tax-free income, with Backdoor Roth IRAs advantageous for those expecting higher retirement tax rates.

Withdrawals and Required Minimum Distributions (RMDs)

Traditional IRAs require withdrawals to begin at age 73 due to Required Minimum Distributions (RMDs), which are taxable as ordinary income and impact retirement cash flow planning. Backdoor Roth IRAs, created by converting Traditional IRA contributions to a Roth, are exempt from RMDs during the account holder's lifetime, allowing for more flexible withdrawal timing and potential tax-free growth. Understanding these differences helps optimize tax strategies and maximize retirement savings longevity.

Impact on Retirement Income Planning

Traditional IRAs offer tax-deferred growth with contributions often tax-deductible, reducing current taxable income but requiring mandatory withdrawals after age 73, which can increase taxable income during retirement. Backdoor Roth IRAs involve making non-deductible contributions to a Traditional IRA and then converting to a Roth IRA, allowing for tax-free withdrawals without required minimum distributions, providing greater flexibility in retirement income planning. Choosing between these options impacts the timing and tax treatment of retirement income, influencing strategies for tax bracket management and legacy planning.

Pros and Cons of Traditional IRA

Traditional IRAs offer tax-deductible contributions, allowing investors to lower their taxable income while their investments grow tax-deferred until withdrawal, which can be beneficial for those seeking immediate tax relief. However, withdrawals are taxed as ordinary income, and required minimum distributions (RMDs) begin at age 73, reducing flexibility in retirement fund management. Contributions to Traditional IRAs are limited by income and participation in employer plans, which may restrict higher earners from fully benefiting from this account type.

Pros and Cons of Backdoor Roth IRA

The Backdoor Roth IRA enables high-income earners to bypass income limits and enjoy tax-free growth and withdrawals, making it a valuable retirement planning tool. However, the process involves complex steps including nondeductible contributions and potential tax implications during the conversion, which can complicate tax filings. This strategy lacks creditor protection compared to some other retirement accounts and requires careful planning to maximize long-term benefits.

Choosing the Best Option for Your Retirement Strategy

Traditional IRAs offer tax-deductible contributions and tax-deferred growth, making them ideal for individuals seeking immediate tax benefits and lower taxable income during their working years. Backdoor Roth IRAs provide a strategic advantage for high-income earners who exceed Roth IRA contribution limits, enabling tax-free growth and tax-free withdrawals in retirement after converting nondeductible Traditional IRA contributions. Assessing your current tax bracket, future income expectations, and retirement goals helps determine whether the Traditional IRA's upfront tax relief or the Backdoor Roth IRA's long-term tax-free benefits align best with your retirement strategy.

Related Important Terms

Contribution Limitation Loophole

Traditional IRA contributions face income limits for tax deductibility, while the Backdoor Roth IRA leverages a contribution limitation loophole allowing high earners to bypass Roth IRA income restrictions by converting nondeductible Traditional IRA contributions into a Roth IRA. This strategic use of the loophole enables higher-income individuals to maximize retirement savings with tax-free growth and withdrawals, despite direct Roth IRA contribution limits.

Pro-Rata Rule

The Pro-Rata Rule affects Backdoor Roth IRA conversions by requiring taxes to be paid proportionally on all pre-tax IRA funds, complicating tax strategies for individuals with existing Traditional IRA balances. This rule often makes direct Traditional IRA contributions followed by conversions less tax-efficient compared to Roth contributions allowed by income limits.

Income Phase-Out Threshold

Traditional IRA contributions can be fully deductible regardless of income, but tax benefits phase out for active participants in employer plans above $73,000 to $83,000 (single) or $116,000 to $136,000 (married filing jointly) in 2024. Backdoor Roth IRA contributions bypass income phase-out limits entirely, allowing high earners above $153,000 (single) or $228,000 (married filing jointly) to convert Traditional IRAs to Roth IRAs and benefit from tax-free growth and withdrawals.

Mega Backdoor Roth

The Mega Backdoor Roth IRA enables high-income earners to contribute up to $66,000 annually through after-tax 401(k) contributions followed by in-service rollovers, significantly exceeding traditional IRA contribution limits. This strategy leverages higher contribution caps compared to the standard $6,500 limit of Traditional IRAs and the income restrictions of Roth IRAs, maximizing tax-advantaged retirement savings.

Tax Diversification

Traditional IRA contributions offer tax-deferred growth with potential upfront tax deductions, while Backdoor Roth IRA allows tax-free withdrawals in retirement by converting nondeductible contributions, enhancing tax diversification. Utilizing both accounts balances tax liability by providing flexibility to manage taxable income and withdrawals during retirement years.

IRA Aggregation Rule

The IRA Aggregation Rule mandates that when calculating the tax on a Backdoor Roth IRA conversion, all traditional, SEP, and SIMPLE IRAs are combined, potentially increasing taxable income if pre-tax funds exist. Understanding this rule is crucial for retirement planning, as it affects the tax benefits of converting traditional IRA balances into a Roth IRA.

Step Transaction Doctrine

The Step Transaction Doctrine scrutinizes Traditional IRA to Backdoor Roth IRA conversions to determine if the process is a series of prearranged steps aimed at circumventing tax laws, potentially disallowing tax benefits if deemed abusive. Understanding IRS interpretations and maintaining proper separation between contributions and conversions is crucial to withstand challenges under this doctrine in retirement planning.

After-Tax IRA Contribution

After-tax IRA contributions in a Traditional IRA allow for nondeductible funding that can be converted to a Roth IRA via the Backdoor Roth strategy, enabling tax-free growth and withdrawals. This approach benefits high-income earners who exceed Roth IRA income limits, leveraging the pro-rata rule to minimize tax liability on conversions.

Roth Conversion Ladder

The Roth Conversion Ladder enables gradual tax-free withdrawals from a converted Traditional IRA to a Roth IRA, optimizing long-term retirement income and minimizing tax impact. Utilizing backdoor Roth IRA contributions coupled with strategic conversions allows high earners to bypass income limits, maximizing tax-advantaged growth and withdrawal flexibility.

Inherited IRA Strategy

Inherited IRA strategy differs significantly between Traditional IRAs and Backdoor Roth IRAs, as beneficiaries of Traditional IRAs must pay income taxes on distributions, whereas Backdoor Roth IRAs offer tax-free growth and distributions, providing more favorable tax advantages for heirs. Utilizing a Backdoor Roth IRA can maximize retirement inheritance benefits by enabling tax-free transfers and avoiding required minimum distributions (RMDs) that are mandatory for Traditional IRAs.

Traditional IRA vs Backdoor Roth IRA for retirement. Infographic

moneydiff.com

moneydiff.com