Deferred compensation plans offer tax-deferred growth, allowing contributions to reduce taxable income today and grow until withdrawal, which benefits those expecting to be in a lower tax bracket in retirement. Roth Snowball strategies prioritize after-tax contributions that grow tax-free, enabling tax-free withdrawals and potentially higher net income in retirement for younger investors or those expecting higher future taxes. Choosing between the two depends on current tax rates, expected retirement income, and individual financial goals.

Table of Comparison

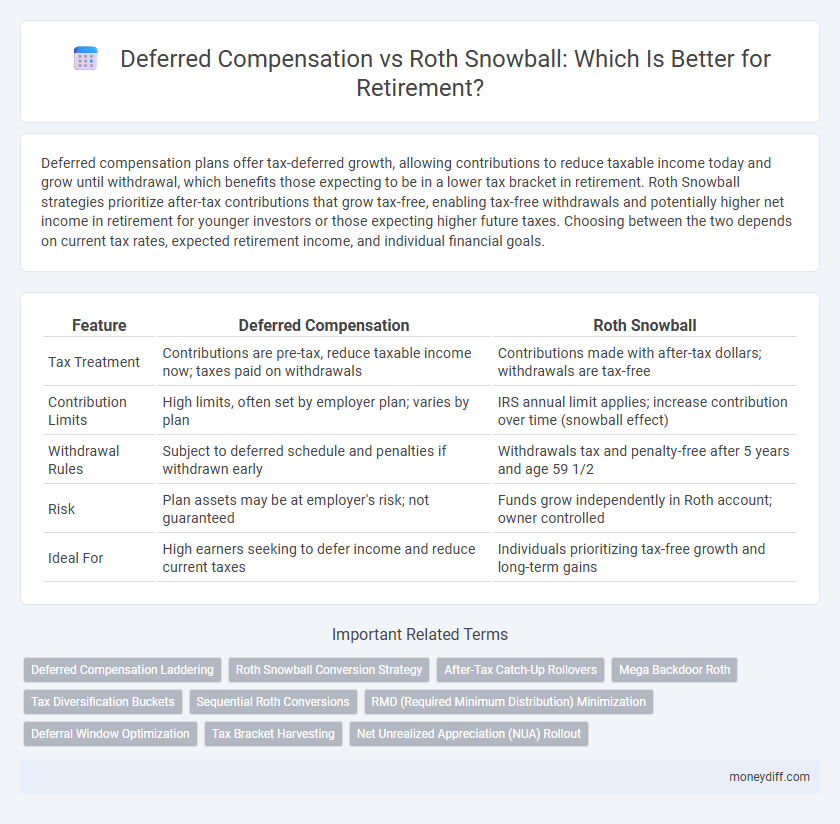

| Feature | Deferred Compensation | Roth Snowball |

|---|---|---|

| Tax Treatment | Contributions are pre-tax, reduce taxable income now; taxes paid on withdrawals | Contributions made with after-tax dollars; withdrawals are tax-free |

| Contribution Limits | High limits, often set by employer plan; varies by plan | IRS annual limit applies; increase contribution over time (snowball effect) |

| Withdrawal Rules | Subject to deferred schedule and penalties if withdrawn early | Withdrawals tax and penalty-free after 5 years and age 59 1/2 |

| Risk | Plan assets may be at employer's risk; not guaranteed | Funds grow independently in Roth account; owner controlled |

| Ideal For | High earners seeking to defer income and reduce current taxes | Individuals prioritizing tax-free growth and long-term gains |

Understanding Deferred Compensation Plans

Deferred compensation plans allow employees to postpone a portion of their income to a future date, typically retirement, offering tax deferral advantages until distributions are made. These plans can complement Roth Snowball strategies, where after-tax contributions grow tax-free, by providing diversification in tax treatment and withdrawal flexibility. Understanding the differences in contribution limits, tax implications, and distribution rules is crucial for optimizing retirement income streams.

What is the Roth Snowball Strategy?

The Roth Snowball strategy involves prioritizing contributions to Roth retirement accounts after maximizing employer-matched deferred compensation plans, allowing for tax-free growth and withdrawals in retirement. This method accelerates the building of a tax-advantaged retirement fund by stacking Roth contributions once all employer matches are secured. The Roth Snowball strategy is particularly effective for individuals expecting higher tax rates in the future, leveraging post-tax investments to maximize long-term retirement income.

Key Differences Between Deferred Comp and Roth Snowball

Deferred Compensation plans allow employees to postpone a portion of their income until retirement, benefiting from tax-deferred growth, whereas Roth Snowball strategies prioritize after-tax contributions, enabling tax-free withdrawals in retirement. Deferred Comp contributions lower taxable income during working years but are taxed upon withdrawal, while Roth Snowball investments grow tax-free, providing potential long-term tax advantages. The key difference lies in tax treatment timing and withdrawal flexibility, with Deferred Comp emphasizing current tax deferral and Roth Snowball focusing on tax-free retirement income.

Tax Implications: Deferred Comp vs Roth Snowball

Deferred compensation plans offer tax deferral on contributions and earnings until withdrawal, typically at retirement when your income tax rate may be lower, reducing overall tax liability. In contrast, Roth Snowball contributions are made with after-tax dollars, providing tax-free growth and tax-free withdrawals in retirement, which can be advantageous if you expect higher tax rates later. Evaluating current versus future tax brackets is critical in choosing between Deferred Comp and Roth Snowball strategies to optimize retirement tax efficiency.

Contribution Limits and Flexibility

Deferred Compensation plans allow higher contribution limits compared to Roth Snowball strategies, often exceeding $20,500 annually, enabling more significant tax-deferred growth. Roth Snowball contributions are limited by Roth IRA caps, currently $6,500 per year, but offer tax-free withdrawals and greater flexibility in access to contributions. Deferred Comp plans may restrict early withdrawals with penalties, whereas Roth Snowball funds can be accessed penalty-free after five years, providing enhanced liquidity for retirement planning.

Withdrawal Rules and Penalties

Deferred Compensation plans typically impose penalties and income taxes on withdrawals made before age 59 1/2, with required minimum distributions starting at age 73, while Roth Snowball accounts allow for tax-free withdrawals of contributions at any time and tax-free earnings withdrawals after age 59 1/2 and a five-year holding period. Early withdrawals from Deferred Comp are often subject to a 10% IRS penalty plus ordinary income tax, whereas Roth Snowball early earnings withdrawals may incur taxes and penalties unless they qualify for specific exceptions. Understanding these withdrawal rules and potential penalties is critical for optimizing retirement income strategy and minimizing tax liabilities.

Risk Management in Deferred Comp and Roth Snowball

Deferred compensation plans offer structured risk management by allowing tax-deferred growth and employer contributions, helping to mitigate market volatility over time. Roth Snowball strategies emphasize after-tax contributions, providing tax-free withdrawals and reducing long-term tax risk while accelerating debt repayment priorities. Balancing Deferred Comp with Roth Snowball enhances diversification in tax treatment and risk exposure for a more resilient retirement portfolio.

Employer Matching and Benefits

Employer matching contributions in Deferred Compensation plans significantly enhance retirement savings by providing additional, non-taxable funds that grow tax-deferred, unlike Roth Snowball contributions, which are made with after-tax dollars and grow tax-free. Deferred Comp plans often allow higher contribution limits and immediate employer matches, maximizing long-term growth potential through compounding on both employee and employer contributions. Roth Snowball strategies offer tax diversification and tax-free withdrawals in retirement, but lack the immediate employer matching benefits that can accelerate retirement nest egg growth in Deferred Compensation plans.

Scenario Analysis: Which Fits Your Retirement Goals?

Deferred compensation plans provide tax-deferred growth, reducing taxable income during high-earning years and potentially lowering tax brackets in retirement, while Roth Snowball strategies offer tax-free withdrawals by paying taxes upfront on contributions. Scenario analysis reveals Deferred Comp suits individuals anticipating lower future tax rates or seeking immediate tax savings, whereas Roth Snowball benefits those expecting higher tax rates or desiring tax diversification. Aligning choice with your retirement income projections, tax rate expectations, and liquidity needs ensures optimized wealth accumulation and distribution strategies.

Choosing the Best Option for Your Retirement Portfolio

Deferred compensation plans allow high earners to reduce taxable income by deferring salary and investment earnings until retirement, offering potential tax advantages if you expect lower rates later. Roth Snowball strategies involve contributing after-tax dollars to Roth accounts, enabling tax-free growth and withdrawals, ideal for those anticipating higher future tax brackets. Evaluating your current tax rate, projected retirement income, and long-term growth potential is essential to selecting the optimal blend for a balanced retirement portfolio.

Related Important Terms

Deferred Compensation Laddering

Deferred compensation laddering enables retirees to strategically access funds over time, minimizing tax impact and maximizing cash flow stability compared to the Roth Snowball approach. By deferring income and staggering withdrawals, individuals can optimize tax brackets and enhance retirement income flexibility.

Roth Snowball Conversion Strategy

The Roth Snowball Conversion Strategy accelerates retirement savings growth by systematically converting traditional deferred compensation into Roth accounts, leveraging tax-free growth and compounding. This approach potentially reduces future tax liabilities, enhances estate planning flexibility, and maximizes after-tax retirement income compared to deferring compensation without conversions.

After-Tax Catch-Up Rollovers

After-tax catch-up rollovers in deferred compensation plans allow high earners to transfer excess contributions into Roth accounts, enabling tax-free growth and withdrawals during retirement. Comparing this strategy to a Roth Snowball approach highlights the benefits of maximizing after-tax contributions now to leverage compounding gains and reduce future tax liabilities.

Mega Backdoor Roth

Mega Backdoor Roth strategies maximize retirement savings by enabling after-tax contributions to 401(k) plans, which can then be converted to Roth IRAs, allowing for tax-free growth and withdrawals. Deferred compensation plans provide tax deferral on income until retirement, but combining Mega Backdoor Roth contributions with Roth Snowball tactics leverages higher contribution limits and accelerates tax-free compounding, optimizing long-term retirement wealth.

Tax Diversification Buckets

Deferred Compensation plans provide tax-deferred growth, allowing contributions to reduce taxable income during high-earning years and create a tax-efficient income stream in retirement. Roth Snowball strategies focus on after-tax contributions, enabling tax-free withdrawals and offering a complementary tax diversification bucket that reduces future tax uncertainty.

Sequential Roth Conversions

Sequential Roth conversions optimize retirement savings by systematically moving funds from a deferred compensation plan into a Roth account, leveraging tax diversification and potential tax-free growth. This strategy contrasts with the Roth Snowball approach by prioritizing targeted tax planning to minimize tax brackets impact during retirement distributions.

RMD (Required Minimum Distribution) Minimization

Deferred Compensation plans allow for significant tax deferral and can reduce RMD obligations by delaying taxable distributions until retirement, whereas the Roth Snowball strategy minimizes RMD impact entirely since Roth IRAs are not subject to RMDs during the owner's lifetime. Utilizing Deferred Comp alongside Roth conversions can optimize retirement income by balancing RMD minimization and tax-free growth.

Deferral Window Optimization

Maximizing retirement savings requires optimizing the deferral window by strategically balancing Deferred Compensation plans, which offer tax-deferred growth and employer match benefits, with Roth Snowball contributions that provide tax-free withdrawals and compound growth opportunities. Leveraging the deferral window effectively enhances after-tax retirement income by synchronizing pre-tax deferrals with post-tax Roth contributions, aligning with individual tax brackets and retirement timelines.

Tax Bracket Harvesting

Deferred Compensation plans allow high-income earners to lower their current taxable income by deferring salary into a tax-deferred account, enabling strategic tax bracket harvesting by withdrawing funds in lower brackets during retirement. Roth Snowball involves converting portions of deferred compensation into Roth accounts, paying taxes upfront at a lower rate, and benefiting from tax-free growth and withdrawals, optimizing tax bracket management over time.

Net Unrealized Appreciation (NUA) Rollout

Net Unrealized Appreciation (NUA) rollout in deferred compensation plans allows retirees to transfer employer stock to a taxable brokerage account, paying taxes only on the cost basis while deferring taxes on appreciation until sale, optimizing tax efficiency compared to Roth Snowball strategies that involve paying taxes upfront for tax-free growth. Utilizing NUA can significantly reduce tax liability during retirement distributions by leveraging capital gains rates, whereas Roth Snowball prioritizes tax-free withdrawals but may result in higher immediate tax costs.

Deferred Comp vs Roth Snowball for retirement. Infographic

moneydiff.com

moneydiff.com