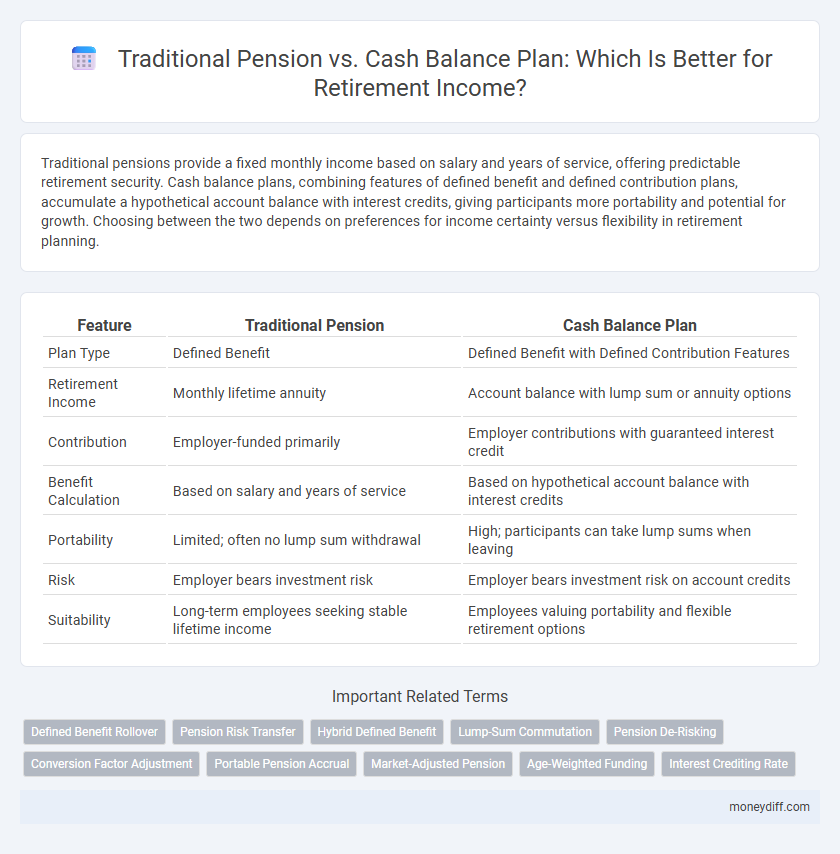

Traditional pensions provide a fixed monthly income based on salary and years of service, offering predictable retirement security. Cash balance plans, combining features of defined benefit and defined contribution plans, accumulate a hypothetical account balance with interest credits, giving participants more portability and potential for growth. Choosing between the two depends on preferences for income certainty versus flexibility in retirement planning.

Table of Comparison

| Feature | Traditional Pension | Cash Balance Plan |

|---|---|---|

| Plan Type | Defined Benefit | Defined Benefit with Defined Contribution Features |

| Retirement Income | Monthly lifetime annuity | Account balance with lump sum or annuity options |

| Contribution | Employer-funded primarily | Employer contributions with guaranteed interest credit |

| Benefit Calculation | Based on salary and years of service | Based on hypothetical account balance with interest credits |

| Portability | Limited; often no lump sum withdrawal | High; participants can take lump sums when leaving |

| Risk | Employer bears investment risk | Employer bears investment risk on account credits |

| Suitability | Long-term employees seeking stable lifetime income | Employees valuing portability and flexible retirement options |

Understanding Traditional Pension Plans

Traditional pension plans provide retirees with a guaranteed monthly income based on salary history and years of service, ensuring predictable and stable retirement cash flow. These defined benefit plans are funded by employers who assume the investment risk and are responsible for managing the plan's assets. Understanding the formula for calculating pension benefits and vesting schedules is essential for maximizing retirement income from traditional pension plans.

What Is a Cash Balance Plan?

A Cash Balance Plan is a type of defined benefit retirement plan that combines features of both traditional pensions and defined contribution plans, offering participants a hypothetical account that grows annually by a guaranteed interest rate and employer contributions. Unlike traditional pensions that calculate benefits based on salary and years of service, Cash Balance Plans provide clearer, portable retirement benefits expressed as account balances. These plans appeal to employers seeking predictable funding and employees wanting more transparent, individualized retirement income projections.

Key Differences Between Traditional and Cash Balance Plans

Traditional pension plans guarantee a fixed monthly retirement income based on salary and years of service, offering predictable benefits with longevity risk borne by the employer. Cash balance plans resemble defined contribution plans, providing an individual account balance that grows annually by employer contributions and interest credits, allowing more portability and clearer account valuation. Key differences include the benefit calculation method, funding structure, and potential for participant control over the retirement savings.

How Retirement Incomes Are Calculated

Traditional pension plans calculate retirement income based on a formula considering years of service, salary history, and a fixed accrual rate, providing predictable monthly payments for life. Cash balance plans credit a participant's account annually with a set percentage of their pay plus interest credits, resembling defined contribution plans but guaranteeing a minimum growth rate. This method results in a lump sum balance at retirement, which can be converted to an annuity or taken as a rollover distribution.

Portability: Which Plan Offers More Flexibility?

Traditional pensions typically lack portability, as benefits are often tied to a single employer, limiting flexibility when changing jobs. Cash balance plans provide enhanced portability by allowing participants to receive a lump-sum value that can be rolled over into an IRA or new employer's plan. This portability makes cash balance plans more adaptable for workers with multiple employers throughout their careers.

Investment Risks and Guarantees Compared

Traditional pension plans offer guaranteed lifetime benefits with minimal investment risk for participants, as employers bear the responsibility of funding and managing investments. Cash balance plans blend features of defined benefit and defined contribution plans, presenting investment risk primarily to the employer while providing participants with an account balance that grows at a predetermined interest credit rate. The predictable benefit structure of traditional pensions contrasts with the potentially fluctuating cash balance accounts, but both generally shield employees from direct investment risk exposure.

Employer Contributions: What to Expect

Traditional pension plans typically provide employer contributions based on a fixed formula tied to employees' salary and years of service, ensuring predictable retirement income. Cash balance plans register employer contributions as a defined percentage of pay, credited with a guaranteed interest rate, offering more transparency and portability. Employers generally contribute more consistently to cash balance plans, which can benefit employees who change jobs frequently or seek clearer value of their retirement benefits.

Tax Implications for Each Plan

Traditional pensions provide taxable income upon distribution, typically subject to ordinary income tax rates, with tax deferral until retirement. Cash Balance Plans allow tax-deferred growth of contributions and earnings, but withdrawals are also taxed as ordinary income, often offering more flexibility in lump-sum distributions. Understanding the tax treatment of each plan is crucial for optimizing retirement income and managing tax liabilities effectively.

Choosing the Right Plan for Your Retirement Goals

Traditional pensions provide a fixed monthly income based on salary and years of service, offering predictable retirement security. Cash Balance Plans blend features of defined benefit and defined contribution plans, allowing for portable retirement savings with potential for higher returns. Evaluating your retirement timeline, risk tolerance, and income needs helps determine which plan aligns best with your financial goals.

Transitioning from Traditional Pension to Cash Balance Plan

Transitioning from a Traditional Pension to a Cash Balance Plan involves shifting from a defined benefit structure, where retirement income is based on salary and years of service, to a hybrid model combining features of defined benefit and defined contribution plans. Cash Balance Plans credit a participant's account with a set percentage of their yearly compensation plus interest credits, offering more portability and clarity in retirement savings. Employers benefit by gaining predictable funding requirements while employees enjoy increased flexibility in managing their retirement income streams.

Related Important Terms

Defined Benefit Rollover

A Traditional Pension offers guaranteed lifetime income based on salary and years of service, while a Cash Balance Plan credits a hypothetical account with a fixed interest rate, providing flexibility with a defined benefit rollover. Defined Benefit Rollovers allow participants to transfer pension benefits into an IRA or another qualified plan, enhancing control over retirement income and investment choices.

Pension Risk Transfer

Traditional pension plans expose employers to longevity and investment risks, whereas cash balance plans mitigate these concerns by converting pension promises into defined account balances, facilitating pension risk transfer. This shift enables companies to offload future liabilities and provides participants with clearer, portable retirement benefits.

Hybrid Defined Benefit

A Hybrid Defined Benefit plan combines features of both Traditional Pension and Cash Balance Plans, offering a secure retirement income with predictable payouts alongside the potential for portability and individual account growth. This plan structure maximizes retirement security by blending lifetime income guarantees of defined benefits with the flexibility and transparency of cash balance components.

Lump-Sum Commutation

Traditional pensions typically provide a fixed monthly retirement income based on salary and years of service, with limited options for lump-sum commutation. Cash balance plans, however, accumulate a hypothetical account balance that participants can often convert into a lump-sum payment, offering greater flexibility in retirement income choices.

Pension De-Risking

Traditional pension plans guarantee a fixed retirement income based on salary and years of service, posing longevity and investment risks to employers. Cash balance plans reduce these risks by combining elements of defined benefit and defined contribution plans, providing guaranteed returns with more predictable employer liabilities for pension de-risking.

Conversion Factor Adjustment

Traditional pensions use a fixed conversion factor based on age and actuarial assumptions to determine retirement income, often leading to predictable but less flexible benefits. Cash balance plans adjust the conversion factor regularly to reflect interest credits and account balances, offering a more dynamic and potentially higher retirement income tailored to market performance.

Portable Pension Accrual

Traditional pensions offer fixed retirement income but lack portability, limiting access when changing employers. Cash balance plans provide portable pension accrual, allowing employees to transfer benefits and maintain retirement savings across jobs.

Market-Adjusted Pension

Traditional pensions offer a fixed retirement income based on salary and years of service, providing predictable yet potentially lower returns in volatile markets. Cash balance plans feature market-adjusted pensions linked to an account balance with guaranteed minimum interest credits, blending defined benefit security with the growth potential of defined contributions.

Age-Weighted Funding

Age-weighted funding in traditional pension plans allocates contributions based on an employee's age and salary, typically benefiting older workers by accelerating their retirement savings. Cash balance plans use a similar age-weighted approach but offer the transparency of defined contributions with guaranteed interest credits, making them attractive for employers seeking predictable funding and employees valuing retirement income clarity.

Interest Crediting Rate

Traditional Pension plans provide a fixed interest crediting rate based on a predetermined formula tied to salary and service years, ensuring predictable retirement income. Cash Balance Plans credit interest at a variable rate, often linked to market indices or a fixed rate set by the employer, offering potential growth but with more fluctuation in retirement benefits.

Traditional Pension vs Cash Balance Plan for retirement income. Infographic

moneydiff.com

moneydiff.com