Choosing between Social Security benefits and geo-arbitrage for retirement depends on individual financial goals and lifestyle preferences. Social Security offers a reliable, government-backed income stream providing stability, while geo-arbitrage involves relocating to lower-cost regions to stretch retirement savings further. Leveraging geo-arbitrage can significantly reduce living expenses, but incorporating Social Security ensures consistent cash flow regardless of geographic changes.

Table of Comparison

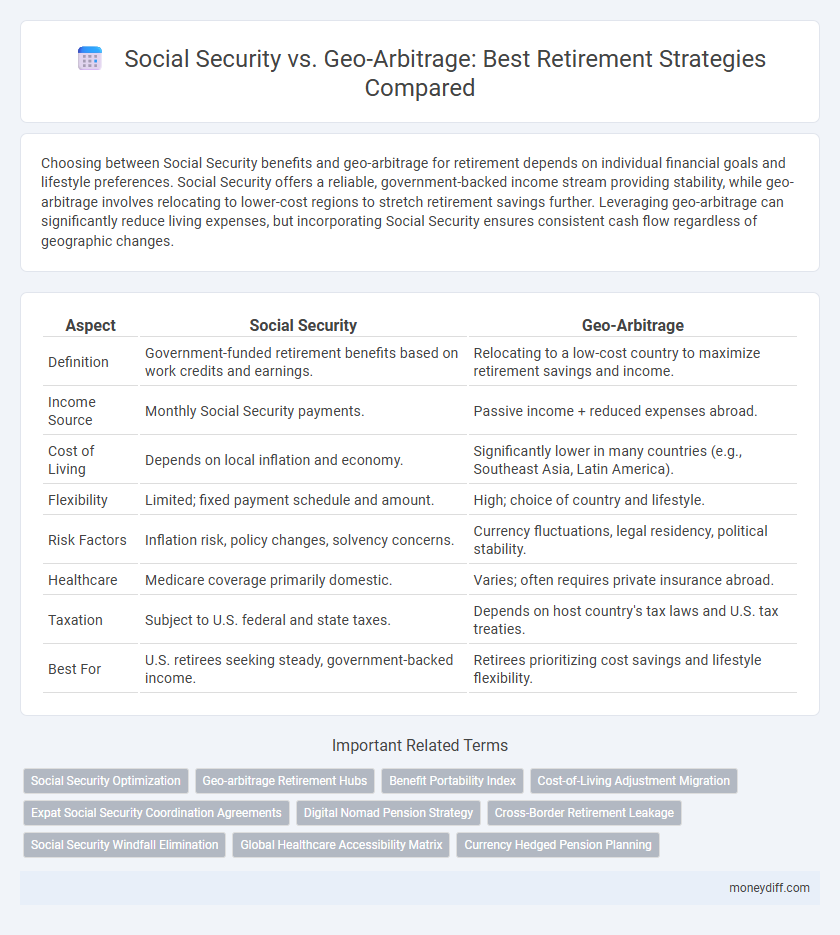

| Aspect | Social Security | Geo-Arbitrage |

|---|---|---|

| Definition | Government-funded retirement benefits based on work credits and earnings. | Relocating to a low-cost country to maximize retirement savings and income. |

| Income Source | Monthly Social Security payments. | Passive income + reduced expenses abroad. |

| Cost of Living | Depends on local inflation and economy. | Significantly lower in many countries (e.g., Southeast Asia, Latin America). |

| Flexibility | Limited; fixed payment schedule and amount. | High; choice of country and lifestyle. |

| Risk Factors | Inflation risk, policy changes, solvency concerns. | Currency fluctuations, legal residency, political stability. |

| Healthcare | Medicare coverage primarily domestic. | Varies; often requires private insurance abroad. |

| Taxation | Subject to U.S. federal and state taxes. | Depends on host country's tax laws and U.S. tax treaties. |

| Best For | U.S. retirees seeking steady, government-backed income. | Retirees prioritizing cost savings and lifestyle flexibility. |

Understanding Social Security: The Basics for Retirees

Social Security provides a steady income stream based on lifetime earnings and work credits, crucial for financial stability in retirement. Benefits vary depending on the age of claim, with full retirement age typically between 66 and 67, and early claims reducing monthly payments. Understanding eligibility, benefit calculations, and coordination with other income sources is essential to maximize Social Security's role in retirement planning, especially when considering geo-arbitrage strategies.

Geo-arbitrage Defined: Leveraging Location for Retirement Savings

Geo-arbitrage involves strategically relocating to lower-cost regions to maximize retirement savings by reducing living expenses while maintaining income from higher-cost areas. This approach allows retirees to stretch Social Security benefits and other fixed incomes further, enhancing financial security and quality of life. Leveraging location-based cost differences can significantly impact retirement planning beyond traditional Social Security reliance.

Cost of Living: Domestic vs International Retirement Options

Domestic retirement relying on Social Security often faces higher costs of living, including healthcare and housing, which can erode fixed income value over time. International retirement options through geo-arbitrage offer significantly lower living expenses in countries like Mexico, Thailand, or Portugal, allowing retirees to stretch Social Security benefits further. Careful analysis of currency stability, local inflation rates, and healthcare quality is essential when comparing cost of living between domestic and international retirement destinations.

Social Security Benefits: Eligibility and Maximization Strategies

Social Security benefits provide a crucial income stream for retirees, with eligibility starting at age 62 and full benefits available between ages 66 and 70 depending on birth year. Maximizing benefits involves delaying claims to increase monthly payments, leveraging spousal and survivor benefits, and understanding the impact of early withdrawal penalties and taxation thresholds. Careful planning around work history and benefit coordination can significantly enhance retirement income security.

Geo-arbitrage Hotspots: Top Countries for Affordable Retirement

Geo-arbitrage leverages cost-of-living differences to stretch retirement savings, with top countries for affordable retirement including Mexico, Portugal, and Malaysia, where lower housing, healthcare, and daily expenses maximize Social Security benefits. These hotspots offer retirees a high quality of life, favorable tax policies, and access to expat communities, making them ideal for those seeking financial efficiency. By combining Social Security income with strategic relocation to geo-arbitrage destinations, retirees can significantly enhance their financial security and lifestyle sustainability.

Healthcare Considerations: Social Security vs Overseas Coverage

Social Security offers reliable healthcare through Medicare for retirees in the United States, ensuring access to comprehensive medical services and prescription drug coverage. In contrast, geo-arbitrage strategies often involve relocating to countries with lower living costs but varying levels of healthcare quality and availability, potentially requiring private insurance or out-of-pocket expenses. Careful evaluation of healthcare infrastructure, insurance options, and potential language barriers is crucial when considering overseas retirement to maintain adequate medical care and financial security.

Tax Implications of Social Security and Living Abroad

Social Security benefits are subject to federal income tax, with up to 85% taxable depending on combined income levels, which impacts net retirement income. Living abroad can introduce additional tax complexities, including foreign tax credits and compliance with the Foreign Account Tax Compliance Act (FATCA). Geo-arbitrage leverages lower cost-of-living countries to stretch retirement savings but requires careful planning to navigate both U.S. taxation on Social Security and potential double taxation treaties.

Lifestyle Factors: Quality of Life in Geo-arbitrage Destinations

Geo-arbitrage destinations often offer a higher quality of life for retirees due to lower living costs, better climate, and access to diverse cultural experiences. Social Security benefits can stretch further in countries with affordable healthcare, housing, and recreational activities, enhancing daily comfort and overall well-being. Choosing a location with stable infrastructure and safety also significantly impacts lifestyle satisfaction during retirement.

Risks and Challenges: Social Security Dependence vs Geo-arbitrage Moves

Relying solely on Social Security for retirement income poses risks such as potential benefit reductions, inflation impacts, and government policy changes. Geo-arbitrage, while offering cost-of-living advantages by relocating to lower-expense regions, presents challenges like currency fluctuations, legal residency requirements, and varying healthcare quality. Balancing Social Security benefits with geo-arbitrage strategies requires careful assessment of financial stability, political risks, and long-term sustainability.

Building a Balanced Retirement Plan: Combining Social Security and Geo-arbitrage

Maximizing retirement income involves combining Social Security benefits with geo-arbitrage strategies to stretch savings further by relocating to lower-cost regions. Social Security provides a guaranteed, inflation-adjusted income stream, while geo-arbitrage leverages differences in living expenses globally to enhance purchasing power. Integrating these approaches creates a balanced retirement plan that diversifies income sources and optimizes financial security.

Related Important Terms

Social Security Optimization

Maximizing Social Security benefits through strategic claim timing and earnings record optimization can significantly enhance retirement income security. Combining this approach with geo-arbitrage, such as relocating to lower-cost areas, further amplifies financial stability but prioritizing Social Security optimization ensures a reliable foundation for long-term retirement sustainability.

Geo-arbitrage Retirement Hubs

Geo-arbitrage retirement hubs like Panama City, Chiang Mai, and Lisbon offer significantly lower living costs compared to many U.S. cities, enabling retirees to stretch their Social Security benefits further. These locations provide quality healthcare, favorable tax policies, and vibrant expat communities, making them attractive alternatives for maximizing retirement income through geographic cost differentials.

Benefit Portability Index

The Benefit Portability Index measures how effectively Social Security benefits can be utilized across different geographic locations, highlighting that retirees leveraging geo-arbitrage in low-cost areas maximize the real value of their fixed benefits. This index underscores the strategic advantage of relocating to regions with lower living expenses to optimize Social Security income during retirement.

Cost-of-Living Adjustment Migration

Cost-of-Living Adjustment (COLA) migration leverages Social Security benefits by relocating retirees to areas with lower living costs, effectively increasing their purchasing power. Comparing Social Security fixed income with geo-arbitrage strategies highlights how retirees can maximize retirement funds by choosing destinations offering the best COLA impact and affordable housing.

Expat Social Security Coordination Agreements

Expat Social Security Coordination Agreements streamline benefit claims and prevent double taxation for retirees living abroad, making these treaties essential for maximizing retirement income through Geo-arbitrage. Understanding the specific provisions between the U.S. and host countries ensures eligibility and optimized Social Security benefits while leveraging lower living costs internationally.

Digital Nomad Pension Strategy

Maximizing retirement income through Social Security benefits offers stable, inflation-adjusted payments, yet integrating a geo-arbitrage strategy enables digital nomads to significantly stretch pension funds by relocating to countries with lower living costs. Combining Social Security with targeted geo-arbitrage destinations like Southeast Asia or Eastern Europe optimizes long-term financial sustainability and lifestyle flexibility for retirees embracing a digital nomad pension strategy.

Cross-Border Retirement Leakage

Cross-border retirement leakage significantly impacts Social Security benefits when retirees move to countries with less favorable tax treaties, reducing overall income stability. Geo-arbitrage strategies must consider bilateral agreements to optimize Social Security payouts and mitigate benefit erosion due to international tax and residency complexities.

Social Security Windfall Elimination

The Social Security Windfall Elimination Provision (WEP) reduces benefits for retirees who receive pensions from employment not covered by Social Security, significantly impacting those relying on geo-arbitrage strategies in retirement. Understanding the nuances of WEP is crucial for optimizing retirement income, especially when considering relocation to lower-cost areas to stretch Social Security benefits.

Global Healthcare Accessibility Matrix

Social Security provides a fixed income stream that can be supplemented by geo-arbitrage strategies leveraging lower-cost countries with high Global Healthcare Accessibility Matrix scores, enhancing retirement affordability and medical service quality. Retirees tapping into these regions benefit from advanced healthcare infrastructure and reduced living expenses, optimizing both financial security and health outcomes globally.

Currency Hedged Pension Planning

Currency hedged pension planning enhances retirement security by protecting Social Security benefits from foreign exchange volatility during geo-arbitrage. Leveraging currency hedging strategies ensures stable purchasing power when accessing retirement income across different currencies.

Social Security vs Geo-arbitrage for retirement. Infographic

moneydiff.com

moneydiff.com