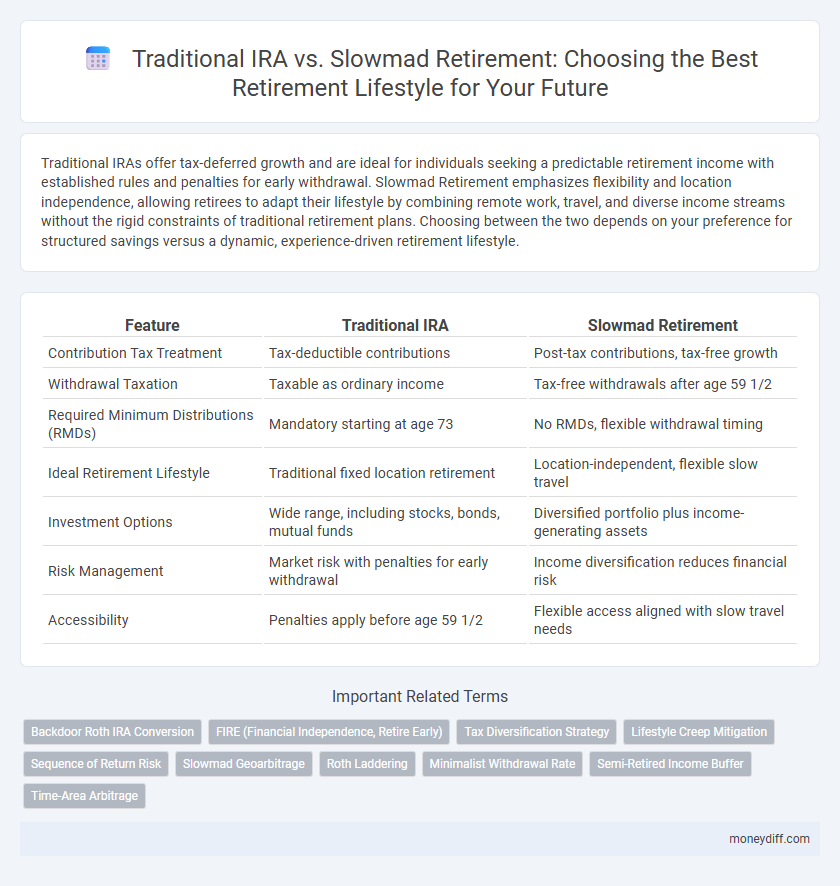

Traditional IRAs offer tax-deferred growth and are ideal for individuals seeking a predictable retirement income with established rules and penalties for early withdrawal. Slowmad Retirement emphasizes flexibility and location independence, allowing retirees to adapt their lifestyle by combining remote work, travel, and diverse income streams without the rigid constraints of traditional retirement plans. Choosing between the two depends on your preference for structured savings versus a dynamic, experience-driven retirement lifestyle.

Table of Comparison

| Feature | Traditional IRA | Slowmad Retirement |

|---|---|---|

| Contribution Tax Treatment | Tax-deductible contributions | Post-tax contributions, tax-free growth |

| Withdrawal Taxation | Taxable as ordinary income | Tax-free withdrawals after age 59 1/2 |

| Required Minimum Distributions (RMDs) | Mandatory starting at age 73 | No RMDs, flexible withdrawal timing |

| Ideal Retirement Lifestyle | Traditional fixed location retirement | Location-independent, flexible slow travel |

| Investment Options | Wide range, including stocks, bonds, mutual funds | Diversified portfolio plus income-generating assets |

| Risk Management | Market risk with penalties for early withdrawal | Income diversification reduces financial risk |

| Accessibility | Penalties apply before age 59 1/2 | Flexible access aligned with slow travel needs |

Understanding Traditional IRA Basics

Traditional IRAs allow individuals to contribute pre-tax income, enabling tax-deferred growth until withdrawals begin at retirement age, typically 59 1/2. Contributions may be tax-deductible depending on income and participation in employer-sponsored plans, enhancing overall retirement savings efficiency. Understanding Traditional IRA rules, including required minimum distributions at age 73 and early withdrawal penalties, is crucial for effective retirement lifestyle planning compared to more flexible options like Slowmad Retirement strategies.

What is Slowmad Retirement?

Slowmad Retirement is a lifestyle combining remote work and travel, allowing retirees to explore global cultures while maintaining income streams. Unlike a Traditional IRA, which focuses on tax-advantaged retirement savings, Slowmad Retirement emphasizes flexibility, diverse experiences, and continuous engagement through location-independent work. This approach supports a dynamic retirement lifestyle blending financial security with personal freedom and adventure.

Tax Benefits of a Traditional IRA

Traditional IRAs offer significant tax benefits by allowing contributions to be tax-deductible, reducing taxable income in the contribution year. Earnings within a Traditional IRA grow tax-deferred until withdrawal, which typically occurs during retirement when the account holder may be in a lower tax bracket. This tax advantage helps individuals optimize retirement savings and potentially maximize after-tax income compared to other retirement lifestyle options like Slowmad Retirement.

Flexibility in Slowmad Retirement Income

Slowmad Retirement offers greater flexibility in income distribution compared to a Traditional IRA, allowing retirees to adapt withdrawals based on lifestyle needs rather than fixed rules. Unlike Traditional IRAs, which impose mandatory withdrawal schedules starting at age 73, Slowmad plans enable customizable income streams without rigid age constraints. This flexibility supports retirees seeking dynamic, location-independent living while managing tax implications and cash flow effectively.

Withdrawal Rules: Traditional IRA vs Slowmad Approach

Traditional IRAs require mandatory minimum distributions starting at age 73, which may limit flexibility in retirement income planning, while the Slowmad Retirement approach emphasizes geographic arbitrage and lifestyle adjustments allowing more fluid and personalized withdrawal strategies. Traditional IRA withdrawals before age 59 1/2 typically incur penalties and taxes, whereas Slowmad strategies prioritize tax-efficient income streams and flexibility in timing to optimize retirement funds. Understanding these contrasting withdrawal rules is crucial for retirees seeking maximum control over their financial independence and lifestyle sustainability.

Lifestyle Costs: Fixed vs Nomadic Retirement

Traditional IRA retirement planning often assumes fixed lifestyle costs tied to a stable home and community, making budgeting more predictable through consistent expenses such as housing, utilities, and local taxes. In contrast, Slowmad Retirement embraces a nomadic lifestyle, with variable costs driven by travel, accommodations, and diverse local economies, requiring adaptable financial strategies and flexible withdrawal plans. Understanding the differences in lifestyle costs between fixed residency and nomadic living is crucial for optimizing retirement savings and ensuring sustainable income streams.

Investment Strategies for Traditional IRA Holders

Traditional IRA holders benefit from a diversified investment strategy emphasizing tax-deferred growth through a balanced portfolio of stocks, bonds, and mutual funds tailored for long-term wealth accumulation. Slowmad Retirement encourages adopting flexibility by integrating passive income sources and alternative investments to complement traditional IRA assets. Strategic asset allocation and periodic portfolio rebalancing enhance risk management and optimize returns for a secure and sustainable retirement lifestyle.

Managing Healthcare in Slowmad Retirement

Managing healthcare in a Slowmad retirement requires flexible healthcare plans that accommodate location changes, unlike the fixed coverage often associated with a Traditional IRA. Slowmads benefit from international health insurance policies tailored for global mobility, offering extensive coverage across multiple countries. Prioritizing access to quality healthcare services and emergency care coverage is crucial for maintaining wellness throughout a nomadic retirement lifestyle.

Risk Factors: Traditional IRA Compared to Slowmad Living

Traditional IRAs expose retirees to market volatility and tax rate uncertainty during withdrawals, increasing financial risk in retirement. Slowmad retirement, blending location independence with diverse income streams, mitigates risks by leveraging cost-of-living arbitrage and flexible lifestyle adjustments. Prioritizing cash flow diversification and geographic mobility reduces dependence on traditional retirement accounts and enhances long-term financial resilience.

Choosing the Right Retirement Path for Your Goals

Traditional IRAs offer tax-deferred growth and potential tax deductions, making them suitable for individuals seeking a predictable, long-term retirement savings strategy. Slowmad Retirement emphasizes flexibility and location-independent living, aligning with retirees prioritizing travel and lifestyle freedom. Choosing the right retirement path depends on your financial goals, risk tolerance, and desired retirement lifestyle, balancing stability with personal fulfillment.

Related Important Terms

Backdoor Roth IRA Conversion

Traditional IRAs provide tax-deferred growth with contributions often tax-deductible, but withdrawals are taxed as ordinary income. Slowmad Retirement strategies leverage Backdoor Roth IRA conversions to bypass income limits, enabling tax-free growth and withdrawals, optimizing retirement lifestyle flexibility and long-term tax efficiency.

FIRE (Financial Independence, Retire Early)

Traditional IRAs offer tax-deferred growth and potential tax deductions, making them a reliable option for steady retirement savings but with required minimum distributions starting at age 73. Slowmad Retirement, emphasizing flexible digital nomad lifestyles combined with FIRE strategies, prioritizes diversified income streams and geo-arbitrage, enabling earlier retirement with location-independent income sources.

Tax Diversification Strategy

Traditional IRAs offer tax-deferred growth with contributions often tax-deductible, creating potential tax liabilities upon withdrawal, whereas Slowmad Retirement emphasizes a tax diversification strategy by combining multiple income sources across different tax treatments, such as taxable, tax-deferred, and tax-free accounts, to optimize retirement income and reduce overall tax burden. Employing Slowmad's approach can provide greater flexibility in managing tax brackets throughout retirement compared to relying solely on a Traditional IRA.

Lifestyle Creep Mitigation

A Traditional IRA provides tax-deferred growth but may encourage lifestyle creep due to required minimum distributions after age 73, increasing taxable income and potentially leading to higher spending. In contrast, the Slowmad Retirement approach emphasizes disciplined spending and location-independent living, effectively mitigating lifestyle creep by maintaining lower fixed costs and promoting intentional financial choices.

Sequence of Return Risk

Traditional IRA investments face significant Sequence of Return Risk, where early market downturns can drastically reduce retirement income sustainability. Slowmad Retirement strategies emphasize diversified income sources and flexible withdrawal plans to mitigate this risk, enhancing long-term financial stability during retirement.

Slowmad Geoarbitrage

Traditional IRAs offer tax-deferred retirement savings with contributions possibly tax-deductible, but their fixed withdrawal rules limit geographic flexibility. Slowmad retirement leverages geoarbitrage by relocating to lower-cost countries, maximizing purchasing power and lifestyle quality while using diversified savings beyond traditional IRAs for enhanced financial freedom.

Roth Laddering

Traditional IRA contributions are typically tax-deductible, but distributions during retirement are taxed as ordinary income, whereas Slowmad Retirement emphasizes Roth laddering, converting funds into Roth IRAs over time to maximize tax-free withdrawals and enhance long-term retirement cash flow management. Roth laddering enables strategic tax diversification and reduces required minimum distributions, offering greater flexibility and financial control for retirees pursuing a location-independent lifestyle.

Minimalist Withdrawal Rate

Traditional IRA withdrawals follow the required minimum distributions (RMD) rules, potentially increasing taxable income and influencing the withdrawal rate during retirement. The Slowmad Retirement strategy emphasizes a minimalist withdrawal rate, prioritizing frugality and flexibility to extend portfolio longevity without mandatory distributions.

Semi-Retired Income Buffer

Traditional IRAs offer tax-deferred growth and penalty-free withdrawals after age 59 1/2, providing a reliable income source during full retirement years. In contrast, the Slowmad Retirement approach prioritizes a flexible, semi-retired income buffer by combining diversified income streams and part-time work to maintain lifestyle quality and financial security.

Time-Area Arbitrage

Traditional IRA offers tax-deferred growth and potential tax deductions, but may limit flexibility in withdrawals and geographic lifestyle choices. Slowmad Retirement leverages Time-Area Arbitrage by optimizing living costs through relocation to lower-expense regions, maximizing retirement funds and enhancing quality of life.

Traditional IRA vs Slowmad Retirement for retirement lifestyle Infographic

moneydiff.com

moneydiff.com