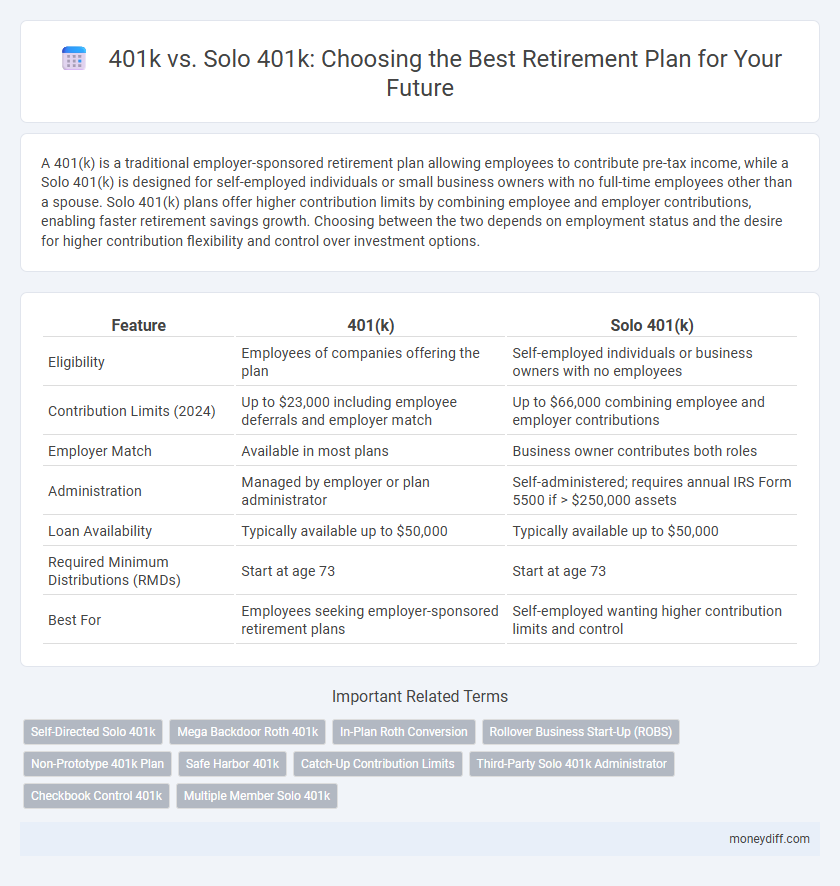

A 401(k) is a traditional employer-sponsored retirement plan allowing employees to contribute pre-tax income, while a Solo 401(k) is designed for self-employed individuals or small business owners with no full-time employees other than a spouse. Solo 401(k) plans offer higher contribution limits by combining employee and employer contributions, enabling faster retirement savings growth. Choosing between the two depends on employment status and the desire for higher contribution flexibility and control over investment options.

Table of Comparison

| Feature | 401(k) | Solo 401(k) |

|---|---|---|

| Eligibility | Employees of companies offering the plan | Self-employed individuals or business owners with no employees |

| Contribution Limits (2024) | Up to $23,000 including employee deferrals and employer match | Up to $66,000 combining employee and employer contributions |

| Employer Match | Available in most plans | Business owner contributes both roles |

| Administration | Managed by employer or plan administrator | Self-administered; requires annual IRS Form 5500 if > $250,000 assets |

| Loan Availability | Typically available up to $50,000 | Typically available up to $50,000 |

| Required Minimum Distributions (RMDs) | Start at age 73 | Start at age 73 |

| Best For | Employees seeking employer-sponsored retirement plans | Self-employed wanting higher contribution limits and control |

Understanding 401k and Solo 401k: Key Differences

A 401(k) is an employer-sponsored retirement plan allowing employees to contribute pre-tax income, with employer matching often included, while a Solo 401(k) targets self-employed individuals and business owners without full-time employees, offering higher contribution limits. Solo 401(k) plans allow both employee and employer contributions, enabling savings of up to $66,000 in 2024, compared to the standard 401(k) contribution limit of $23,000 for employees under 50. Understanding contribution limits, eligibility rules, and administrative requirements is essential for choosing between a traditional 401(k) and a Solo 401(k) to maximize retirement savings effectively.

Eligibility Requirements: Who Qualifies for Each Option?

Eligibility requirements for a traditional 401(k) typically include full-time employees working for companies that offer the plan, while Solo 401(k) accounts are designed exclusively for self-employed individuals or small business owners with no full-time employees other than a spouse. Solo 401(k) plans allow self-employed persons, freelancers, and contractors to contribute both as employee and employer, enabling higher contribution limits compared to standard 401(k) options. Understanding these distinctions ensures individuals select the most suitable retirement savings plan based on employment status and business structure.

Contribution Limits: Maximizing Your Retirement Savings

A Solo 401(k) offers significantly higher contribution limits than a traditional 401(k), allowing self-employed individuals to contribute both as an employee and employer, reaching up to $66,000 in 2024 or $73,500 if age 50 or older. Traditional 401(k) plans have lower contribution caps, typically maxing out at $22,500 for employee contributions with a combined employer match that can increase total savings. Maximizing contributions through a Solo 401(k) can accelerate retirement savings growth, especially for small business owners and independent contractors.

Employer Contributions: What’s Available in Each Plan

Employer contributions in a traditional 401(k) can include matching contributions up to a certain percentage of the employee's salary, typically capped by plan rules and IRS limits. In contrast, a Solo 401(k) allows self-employed individuals to contribute both as an employee and employer, enabling higher total contributions by combining salary deferrals and profit-sharing contributions. The Solo 401(k) can potentially offer greater retirement savings due to these combined employer and employee contribution options under IRS contribution limits.

Investment Options: Diversifying Your 401k vs Solo 401k

A Solo 401k typically offers a broader range of investment options, including individual stocks, bonds, mutual funds, ETFs, and real estate, providing greater flexibility for diversification compared to a traditional 401k, which often limits choices to a curated menu of mutual funds. Diversifying your retirement portfolio through a Solo 401k can enhance risk management and growth potential by capitalizing on varied asset classes tailored to solo entrepreneurs or self-employed individuals. Traditional 401k plans, tied to employer offerings, may lack access to alternative investments like real estate or private equity that are accessible within Solo 401k structures.

Tax Advantages: Deferring Taxes for Greater Growth

A Solo 401(k) offers higher contribution limits compared to a traditional 401(k), enabling greater tax deferral and enhanced compound growth potential. Contributions to both plans grow tax-deferred until withdrawal, but the Solo 401(k) allows self-employed individuals to contribute as both employee and employer, maximizing tax-advantaged savings. This tax-deferral strategy helps reduce current taxable income while accelerating retirement fund accumulation.

Flexibility and Plan Control: Managing Your Retirement Funds

Solo 401(k) plans offer greater flexibility and control compared to traditional 401(k)s, allowing self-employed individuals to make higher contribution limits through both employee and employer contributions. Participants can choose diverse investment options, including stocks, bonds, and real estate, tailoring their portfolio to personal retirement goals. This autonomy enables proactive management of retirement funds, optimizing growth potential and tax advantages.

Fees and Costs: Comparing Administrative Expenses

Solo 401(k) plans typically have lower administrative fees compared to traditional 401(k) plans because they serve self-employed individuals or business owners without full-time employees, reducing complexity and associated costs. Traditional 401(k) plans often incur higher fees due to employer-related expenses, including recordkeeping, compliance, and third-party administration services. Evaluating fee structures, account maintenance charges, and investment expenses is crucial for choosing between a Solo 401(k) and a traditional 401(k) to optimize retirement savings growth.

Rollover and Withdrawal Rules: Accessing Your Money

A traditional 401(k) allows for rollovers from other qualified plans and typically permits penalty-free withdrawals starting at age 59 1/2, with required minimum distributions (RMDs) beginning at age 73. The Solo 401(k), designed for self-employed individuals, also supports rollovers and offers similar withdrawal rules but provides greater flexibility for early distributions without penalties under certain conditions. Understanding the specific rollover procedures and withdrawal regulations in each plan is crucial for maximizing retirement savings and minimizing tax liabilities.

Choosing the Right Plan: 401k vs Solo 401k for Your Retirement Strategy

Choosing between a traditional 401(k) and a Solo 401(k) hinges on your employment status and business structure; a Solo 401(k) offers higher contribution limits and greater control for self-employed individuals or small business owners without full-time employees. The standard 401(k) suits employees seeking employer-matched contributions and streamlined payroll deductions, while a Solo 401(k) allows for both employee and employer contributions, maximizing retirement savings potential. Evaluating your income, business size, and retirement goals ensures selection of the most tax-efficient plan to optimize long-term financial growth.

Related Important Terms

Self-Directed Solo 401k

A Self-Directed Solo 401k offers greater investment flexibility compared to a traditional 401k, allowing control over alternative assets such as real estate, private equity, and cryptocurrencies. Designed for self-employed individuals, this retirement plan enables higher contribution limits and tax advantages, optimizing retirement savings growth.

Mega Backdoor Roth 401k

The Solo 401(k) stands out for high-income earners seeking to maximize retirement savings through the Mega Backdoor Roth strategy, allowing after-tax contributions up to $66,000 in 2024, which can be converted to a Roth account for tax-free growth. In contrast, a traditional 401(k) limits contributions to $22,500 plus a $7,500 catch-up for those over 50, offering less flexibility for aggressive Roth conversions and after-tax contributions.

In-Plan Roth Conversion

In-plan Roth conversions allow participants to convert traditional 401(k) funds to Roth accounts within the same plan, providing tax-free growth and withdrawals during retirement. Solo 401(k) plans uniquely offer greater flexibility for self-employed individuals to execute in-plan Roth conversions, optimizing long-term tax strategies.

Rollover Business Start-Up (ROBS)

A 401k allows for traditional retirement savings, while a Solo 401k is designed for self-employed individuals seeking higher contribution limits and control. Rollover Business Start-Up (ROBS) enables entrepreneurs to invest eligible 401k funds into a new business without tax penalties or early withdrawal fees.

Non-Prototype 401k Plan

A Non-Prototype 401(k) Plan offers greater customization and flexibility compared to traditional 401(k) and Solo 401(k) plans, making it ideal for business owners seeking tailored retirement solutions beyond standard templates. Unlike Solo 401(k)s, which cater exclusively to self-employed individuals or business owners without full-time employees, Non-Prototype 401(k) Plans can accommodate multiple employees while providing advanced plan design options and potentially enhanced fiduciary protections.

Safe Harbor 401k

Safe Harbor 401(k) plans offer employers a streamlined option with mandatory employer contributions that automatically satisfy IRS nondiscrimination tests, making them beneficial for small businesses compared to Solo 401(k) plans designed for self-employed individuals without employees. The Safe Harbor 401(k) ensures higher contribution limits and predictable tax advantages, facilitating robust retirement savings while avoiding complex annual compliance testing.

Catch-Up Contribution Limits

The catch-up contribution limit for a standard 401(k) in 2024 is $7,500 for participants aged 50 and older, while Solo 401(k) plans allow the same catch-up contribution but benefit from potentially higher overall contribution limits due to combined employee and employer contributions. Solo 401(k) participants can leverage catch-up contributions alongside employer profit-sharing, enabling greater retirement savings flexibility for self-employed individuals.

Third-Party Solo 401k Administrator

A Third-Party Solo 401k Administrator streamlines account management by handling compliance, reporting, and IRS filings for self-employed individuals, ensuring the Solo 401k meets regulatory standards. This service contrasts with standard 401k plans by offering tailored support for high-contribution limits and flexibility in retirement investments, optimizing retirement savings for business owners without employees.

Checkbook Control 401k

Checkbook Control 401k, a type of Solo 401k, offers unparalleled flexibility by allowing investors direct access to retirement funds for investments without custodian approval. This structure enables control over diverse assets like real estate and private equity, making it a powerful tool for self-directed retirement planning compared to traditional 401k plans.

Multiple Member Solo 401k

A Multiple Member Solo 401(k) allows business partners or spouses actively involved in the business to contribute, combining the benefits of traditional 401(k) plans with increased contribution limits and simpler administration specifically designed for closely held companies. This plan maximizes retirement savings by enabling higher elective deferrals and profit-sharing contributions compared to standard 401(k) options, making it an optimal choice for small partnerships seeking tax-efficient retirement strategies.

401k vs Solo 401k for retirement. Infographic

moneydiff.com

moneydiff.com