Standard annuities provide a fixed income stream during retirement, reducing the uncertainty of market fluctuations. Sequence of return risk planning addresses the timing of investment returns, safeguarding retirement portfolios from early negative returns that could deplete savings faster. Combining both strategies can enhance financial security by balancing guaranteed income with adaptable market risk management.

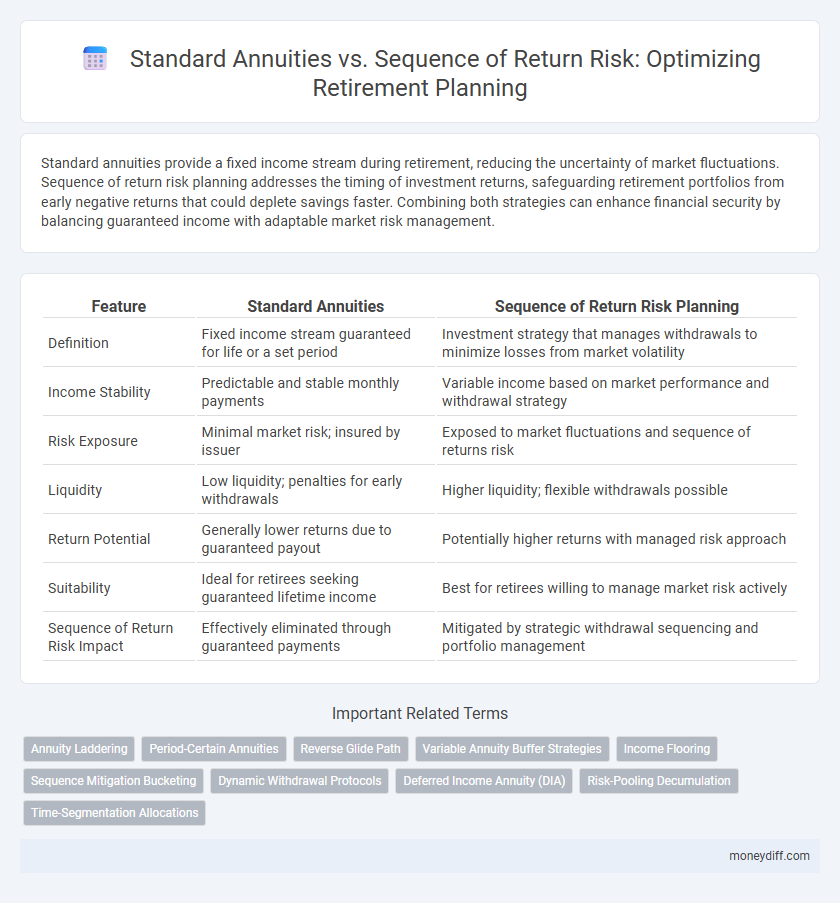

Table of Comparison

| Feature | Standard Annuities | Sequence of Return Risk Planning |

|---|---|---|

| Definition | Fixed income stream guaranteed for life or a set period | Investment strategy that manages withdrawals to minimize losses from market volatility |

| Income Stability | Predictable and stable monthly payments | Variable income based on market performance and withdrawal strategy |

| Risk Exposure | Minimal market risk; insured by issuer | Exposed to market fluctuations and sequence of returns risk |

| Liquidity | Low liquidity; penalties for early withdrawals | Higher liquidity; flexible withdrawals possible |

| Return Potential | Generally lower returns due to guaranteed payout | Potentially higher returns with managed risk approach |

| Suitability | Ideal for retirees seeking guaranteed lifetime income | Best for retirees willing to manage market risk actively |

| Sequence of Return Risk Impact | Effectively eliminated through guaranteed payments | Mitigated by strategic withdrawal sequencing and portfolio management |

Introduction: Navigating Retirement Income Strategies

Standard annuities provide retirees with a guaranteed income stream, mitigating longevity risk by ensuring stable payments regardless of market fluctuations. Sequence of return risk planning emphasizes managing the timing and order of investment returns to protect retirement portfolios from early losses that can significantly reduce income sustainability. Balancing annuity products with strategies addressing sequence of return risk can optimize financial security throughout retirement.

Understanding Standard Annuities: Fixed Income for Life

Standard annuities provide retirees with a guaranteed fixed income stream for life, reducing exposure to sequence of return risk during market downturns. These financial products convert a lump sum into steady payments, offering stability and predictable cash flow regardless of market volatility. Choosing standard annuities can help ensure consistent retirement income without depleting principal prematurely.

What is Sequence of Return Risk in Retirement?

Sequence of return risk in retirement refers to the danger that poor investment returns early in the withdrawal phase can significantly reduce a retiree's portfolio value, increasing the likelihood of outliving their savings. Unlike standard annuities, which provide guaranteed income regardless of market fluctuations, managing sequence of return risk requires careful withdrawal strategies and diversified asset allocation to mitigate volatility impact. Understanding this risk is crucial for retirees to maintain sustainable income and financial security throughout retirement.

Comparing Predictability: Annuities vs Investment Withdrawals

Standard annuities provide predictable, guaranteed income streams throughout retirement, effectively eliminating sequence of return risk by locking in fixed payments. In contrast, investment withdrawals expose retirees to sequence of return risk, where negative market returns early in retirement can significantly reduce portfolio longevity and income stability. Annuities offer stability and peace of mind, while investment withdrawals require careful planning and market timing to manage unpredictable returns.

Longevity Protection: How Annuities Mitigate Financial Risk

Standard annuities provide guaranteed lifelong income, effectively protecting retirees from longevity risk by ensuring payments continue regardless of market fluctuations or lifespan. Sequence of return risk planning relies heavily on investment returns, which can be unpredictable and jeopardize portfolio sustainability during market downturns. By mitigating exposure to market volatility, annuities offer a stable financial foundation for retirees seeking dependable income over extended retirement horizons.

Sequence of Return Risk: Impact on Retirement Portfolio Longevity

Sequence of return risk significantly impacts retirement portfolio longevity by causing poor portfolio performance during early withdrawal phases, potentially depleting funds faster than expected. Standard annuities provide predictable income streams that mitigate this risk by guaranteeing payments regardless of market fluctuations. Incorporating annuities in retirement planning offers a strategic hedge against sequence of return risk, enhancing financial security during retirement.

Flexibility and Liquidity: Pros and Cons of Standard Annuities

Standard annuities provide predictable income streams but often lack flexibility, limiting access to lump sums or adjustments based on changing financial needs. Their illiquid nature means funds are typically locked in, restricting the ability to respond to market fluctuations or emergencies during retirement. In contrast, sequence of return risk planning emphasizes maintaining liquidity and adaptable withdrawal strategies to mitigate market downturn impacts.

Customizing Withdrawals: Strategies to Counter Sequence Risk

Customizing withdrawals in retirement plans helps counteract sequence of return risk by adjusting withdrawal amounts based on market performance, preserving portfolio longevity. Dynamic withdrawal strategies, such as variable withdrawals tied to portfolio value or inflation adjustments, reduce the likelihood of depleting assets during market downturns. Compared to fixed standard annuities, these personalized strategies offer flexibility, optimizing withdrawal rates to better align with changing economic conditions and individual retirement goals.

Assessing Costs: Fees, Inflation, and Opportunity Trade-offs

Standard annuities provide predictable income streams but often come with higher fees and limited flexibility, which can erode purchasing power when inflation rises. Sequence of return risk planning involves managing portfolio withdrawals to minimize losses during market downturns, preserving capital but requiring careful attention to market timing and opportunity costs. Comparing both approaches requires assessing fee structures, inflation protection, and the trade-offs between guaranteed income versus potential for higher long-term growth.

Choosing the Right Approach: Aligning Options with Retirement Goals

Standard annuities provide guaranteed, consistent income streams that mitigate sequence of return risk by ensuring payments regardless of market fluctuations, making them suitable for retirees prioritizing stability. Sequence of return risk planning involves strategies like dynamic withdrawal rates or diversification to adapt income based on market performance, aligning with retirees seeking flexibility and potential growth. Selecting between standard annuities and sequence of return risk planning depends on individual retirement goals, risk tolerance, and the need for predictable cash flow versus market-responsive income.

Related Important Terms

Annuity Laddering

Annuity laddering effectively mitigates sequence of return risk in retirement by diversifying payout start dates, ensuring stable income even during market downturns. Standard annuities provide consistent payments but lack flexibility, whereas laddered structures balance liquidity and longevity risk through staggered income streams.

Period-Certain Annuities

Period-certain annuities provide guaranteed income for a fixed term, reducing exposure to sequence of return risk by ensuring payments regardless of market fluctuations. Unlike standard annuities that may depend on lifespan, period-certain annuities offer predictable retirement cash flow, enhancing financial stability during market volatility.

Reverse Glide Path

Standard annuities provide guaranteed income streams, mitigating longevity risk, while sequence of return risk planning focuses on managing portfolio withdrawals during market volatility. The Reverse Glide Path strategy gradually shifts asset allocation from higher-risk equities to lower-risk bonds in retirement, adapting to market conditions to reduce withdrawal rate vulnerability.

Variable Annuity Buffer Strategies

Variable annuity buffer strategies mitigate sequence of return risk in retirement by absorbing initial market losses, providing a protective buffer that enhances portfolio stability compared to standard fixed annuities. These strategies allow retirees to benefit from market upside potential while safeguarding against downturns, optimizing income sustainability and reducing the risk of early portfolio depletion.

Income Flooring

Standard annuities provide guaranteed income streams that effectively establish an income floor, protecting retirees from sequence of return risk by ensuring consistent payouts regardless of market volatility. In contrast, relying solely on portfolio withdrawals exposes retirees to the risk of depletion during market downturns, underscoring the importance of integrating annuities to stabilize retirement income.

Sequence Mitigation Bucketing

Sequence of return risk planning mitigates retirement portfolio volatility by dividing assets into buckets aligned with time horizons, ensuring short-term liquidity needs are met with stable investments while long-term funds remain invested for growth. This bucketing strategy reduces the impact of market downturns early in retirement, unlike standard annuities that offer fixed payouts without addressing market variability.

Dynamic Withdrawal Protocols

Dynamic withdrawal protocols adjust retirement income based on market performance to mitigate sequence of return risk more effectively than standard annuities, which provide fixed payments regardless of investment conditions. These protocols optimize portfolio longevity by scaling withdrawals in response to volatile returns, enhancing financial sustainability during retirement.

Deferred Income Annuity (DIA)

Deferred Income Annuities (DIAs) provide guaranteed lifetime income starting at a future date, offering strong protection against Sequence of Return Risk by securing stable cash flow regardless of market downturns. Unlike standard annuities that may begin payments immediately, DIAs allow capital to grow tax-deferred and align income streams with retirement timing, enhancing long-term financial security.

Risk-Pooling Decumulation

Standard annuities provide a guaranteed income stream by pooling longevity risk among retirees, effectively mitigating sequence of return risk during decumulation phases. In contrast, planning for sequence of return risk without risk-pooling strategies exposes retirees to higher variability in income and potential early depletion of assets.

Time-Segmentation Allocations

Time-segmentation allocations in retirement planning mitigate sequence of return risk by dividing assets into short, intermediate, and long-term categories, ensuring stable income despite market volatility. Standard annuities provide guaranteed lifetime income but lack flexibility, whereas time-segmented strategies optimize withdrawal timing and asset growth to protect portfolio longevity.

Standard annuities vs Sequence of Return Risk Planning for retirement. Infographic

moneydiff.com

moneydiff.com