Roth conversion can help mitigate sequence of returns risk by allowing retirees to pay taxes on converted amounts during years with lower market volatility, preserving tax-free growth in future years. By strategically timing Roth conversions, retirees optimize tax exposure and reduce the impact of market downturns on withdrawal strategies. This approach balances tax efficiency with retirement income stability, enhancing the sustainability of retirement portfolios.

Table of Comparison

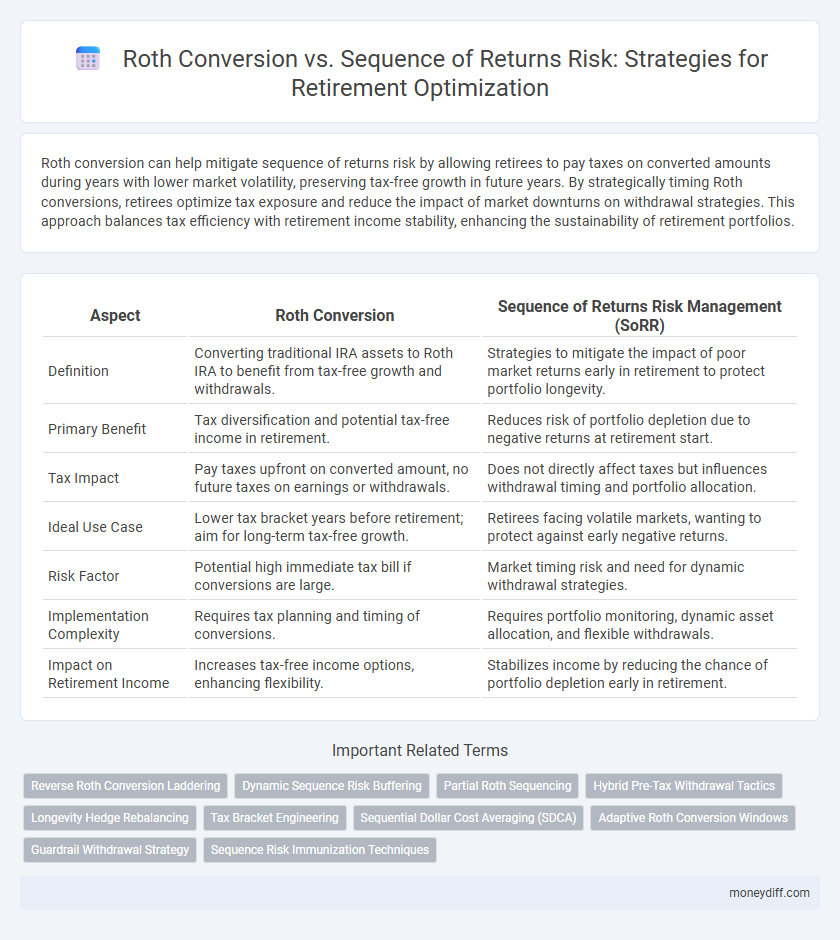

| Aspect | Roth Conversion | Sequence of Returns Risk Management (SoRR) |

|---|---|---|

| Definition | Converting traditional IRA assets to Roth IRA to benefit from tax-free growth and withdrawals. | Strategies to mitigate the impact of poor market returns early in retirement to protect portfolio longevity. |

| Primary Benefit | Tax diversification and potential tax-free income in retirement. | Reduces risk of portfolio depletion due to negative returns at retirement start. |

| Tax Impact | Pay taxes upfront on converted amount, no future taxes on earnings or withdrawals. | Does not directly affect taxes but influences withdrawal timing and portfolio allocation. |

| Ideal Use Case | Lower tax bracket years before retirement; aim for long-term tax-free growth. | Retirees facing volatile markets, wanting to protect against early negative returns. |

| Risk Factor | Potential high immediate tax bill if conversions are large. | Market timing risk and need for dynamic withdrawal strategies. |

| Implementation Complexity | Requires tax planning and timing of conversions. | Requires portfolio monitoring, dynamic asset allocation, and flexible withdrawals. |

| Impact on Retirement Income | Increases tax-free income options, enhancing flexibility. | Stabilizes income by reducing the chance of portfolio depletion early in retirement. |

Understanding Roth Conversions: A Retirement Planning Tool

Roth conversions enable retirees to transfer funds from traditional IRAs to Roth IRAs, allowing tax-free growth and withdrawals, which can reduce future tax liabilities and enhance retirement income flexibility. Managing sequence of returns risk involves strategically converting during market downturns to lock in lower tax rates and maximize tax diversification. Understanding the interplay between Roth conversions and sequence of returns risk is crucial for optimizing retirement portfolios and ensuring sustainable income.

What Is Sequence of Returns Risk in Retirement?

Sequence of returns risk in retirement refers to the danger that poor investment returns early in retirement can significantly reduce the longevity of a retiree's portfolio, even if average returns are strong over time. Managing this risk involves strategies like Roth conversion, which can create tax-efficient income sources and provide flexibility in withdrawal sequencing to mitigate the impact of negative market fluctuations. Optimal retirement planning integrates sequence of returns risk assessment with tax-efficient asset allocation to enhance portfolio sustainability.

Comparing Tax Strategies: Roth Conversions vs. Traditional Withdrawals

Roth conversions strategically reduce future tax liabilities by shifting assets into a tax-free growth environment, mitigating sequence of returns risk during retirement. Traditional withdrawals maintain tax-deferred growth but expose retirees to higher taxes and market volatility affecting taxable income annually. Comparing these strategies, Roth conversions offer long-term tax efficiency and greater withdrawal flexibility, while traditional withdrawals may preserve liquidity but increase exposure to tax rate fluctuations and investment downturns.

How Sequence of Returns Risk Impacts Retirement Income

Sequence of returns risk significantly influences retirement income by affecting the value of retirement accounts during withdrawal phases, where negative market returns early in retirement can deplete savings faster than anticipated. Roth conversions can help manage this risk by allowing retirees to pay taxes on converted funds during lower-income years, thereby reducing required minimum distributions that exacerbate sequence risk. Strategic Roth conversions increase tax diversification and provide more control over taxable income, mitigating the adverse effects of market volatility on retirement income stability.

Timing Roth Conversions to Mitigate Market Uncertainty

Timing Roth conversions during market downturns can significantly reduce tax liabilities by converting assets at lower valuations, enhancing long-term tax-free growth. Strategic conversion sequencing mitigates sequence of returns risk by preserving taxable accounts for market recovery, while maximizing the tax efficiency of retirement withdrawals. Utilizing market volatility windows to execute conversions optimizes retirement income and safeguards portfolio sustainability.

Integrating Roth Accounts to Buffer Sequence of Returns Risk

Integrating Roth accounts into retirement portfolios can effectively buffer sequence of returns risk by providing tax-free withdrawal flexibility during market downturns. Roth conversions diversify tax exposure, allowing retirees to strategically withdraw from tax-deferred and Roth accounts to minimize taxable income spikes and preserve portfolio longevity. This approach enhances retirement optimization by stabilizing cash flow and reducing the impact of negative market sequences on overall retirement savings.

Case Studies: Optimizing Retirement with Roth Conversions

Case studies demonstrate that Roth conversions can strategically reduce sequence of returns risk by locking in tax-free growth during market downturns, enhancing long-term retirement sustainability. Retirees who convert traditional IRAs to Roth IRAs during periods of lower income or market dips often experience improved portfolio resilience and reduced taxable withdrawals in critical years. Optimizing retirement plans with targeted Roth conversions aligns tax planning with market cycles, improving overall wealth preservation and income stability.

Managing Required Minimum Distributions Through Roth Strategies

Managing Required Minimum Distributions (RMDs) through Roth conversion strategies helps retirees minimize tax liabilities by transferring funds from traditional IRAs to Roth IRAs, where withdrawals are tax-free and RMDs are not required during the account owner's lifetime. This approach reduces the impact of sequence of returns risk by allowing greater flexibility in withdrawal timing and preserving more assets for growth during market downturns. Implementing Roth conversions strategically can optimize retirement income, enhance portfolio longevity, and improve overall tax efficiency.

Tax-Efficient Withdrawal Sequences for Longevity

Tax-efficient withdrawal sequences that incorporate Roth conversions can significantly mitigate sequence of returns risk by reducing the required minimum distributions and lowering taxable income during market downturns. Strategically converting traditional IRA assets to Roth accounts in lower-income years enhances control over future tax liabilities, preserving portfolio longevity and maximizing after-tax retirement income. Integrating Roth conversions with a carefully planned withdrawal order prioritizes tax-free growth, improving retirement optimization by balancing growth potential and tax efficiency over an extended retirement horizon.

Building a Resilient Retirement Plan: Roth Conversion and Risk Management

Roth conversion strategically shifts taxable retirement funds into tax-free accounts, reducing future tax liabilities and enhancing withdrawal flexibility during market downturns. Managing sequence of returns risk involves careful asset allocation and withdrawal strategies to protect nest eggs from the detrimental impact of early retirement market volatility. Combining Roth conversions with sequence of returns risk management builds a resilient retirement plan by balancing tax efficiency and portfolio stability.

Related Important Terms

Reverse Roth Conversion Laddering

Reverse Roth conversion laddering mitigates sequence of returns risk by strategically converting Roth IRA funds back to traditional IRAs during market downturns, preserving tax efficiency and enhancing retirement portfolio flexibility. This approach allows retirees to time tax liabilities, manage taxable income, and optimize withdrawal sequencing, ultimately reducing the impact of market volatility on retirement income sustainability.

Dynamic Sequence Risk Buffering

Dynamic Sequence Risk Buffering strategically utilizes Roth conversions to manage withdrawals during market downturns, minimizing Sequence of Returns Risk by reducing taxable income and preserving tax-deferred assets. This approach enhances retirement portfolio resilience by dynamically adjusting conversion amounts based on market performance, optimizing tax efficiency and sustainable income.

Partial Roth Sequencing

Partial Roth Conversion strategically mitigates Sequence of Returns Risk by enabling retirees to convert select portions of traditional IRA assets to Roth accounts during market downturns, preserving tax efficiency and growth potential. This approach balances tax liabilities over time while providing flexibility to withdraw from tax-free Roth funds during adverse market sequences, optimizing retirement income sustainability.

Hybrid Pre-Tax Withdrawal Tactics

Hybrid pre-tax withdrawal tactics combine Roth conversion strategies with sequence of returns risk management to optimize retirement withdrawals by balancing taxable income and preserving tax-advantaged growth. This approach strategically times Roth conversions during lower-income years to minimize taxes while using pre-tax funds to cushion market volatility, enhancing portfolio longevity.

Longevity Hedge Rebalancing

Implementing a Roth conversion strategy during retirement optimizes tax diversification and mitigates sequence of returns risk by enabling a longevity hedge rebalancing approach, which adjusts asset withdrawals to sustain portfolio growth over extended lifespans. Strategic Roth conversions reduce required minimum distributions, enhancing flexibility and preserving capital to combat market volatility and support long-term retirement spending.

Tax Bracket Engineering

Roth conversions strategically manage tax bracket engineering by shifting taxable income to lower brackets during retirement, reducing long-term tax liabilities and mitigating sequence of returns risk's impact on withdrawal sustainability. Proper timing of Roth conversions optimizes tax efficiency, enhances portfolio longevity, and preserves wealth by minimizing taxes when market volatility threatens retirement income.

Sequential Dollar Cost Averaging (SDCA)

Roth conversion strategies can complement Sequential Dollar Cost Averaging (SDCA) by gradually shifting taxable assets into tax-free growth, reducing tax drag during volatile market periods. Implementing SDCA mitigates sequence of returns risk by systematically allocating withdrawals or conversions over time, smoothing the impact of market fluctuations on retirement portfolio longevity.

Adaptive Roth Conversion Windows

Adaptive Roth Conversion Windows strategically time conversions based on market performance to minimize tax impact and enhance retirement income sustainability. This approach mitigates Sequence of Returns Risk by converting assets during market downturns, locking in lower tax rates and preserving portfolio value.

Guardrail Withdrawal Strategy

A Roth Conversion strategically reduces taxable income in retirement, complementing the Guardrail Withdrawal Strategy by providing tax-diversified income sources that mitigate Sequence of Returns Risk during market downturns. Implementing this combination enhances portfolio longevity and maintains withdrawal flexibility, crucial for optimizing sustainable retirement income.

Sequence Risk Immunization Techniques

Sequence risk immunization techniques, such as dynamic withdrawal strategies and bucket approaches, help protect retirement portfolios from early market downturns by adjusting spending and asset allocation in response to market conditions. These methods can be more effective than Roth conversions alone in managing withdrawal longevity and preserving capital during volatile periods.

Roth Conversion vs Sequence of Returns Risk Management for retirement optimization Infographic

moneydiff.com

moneydiff.com