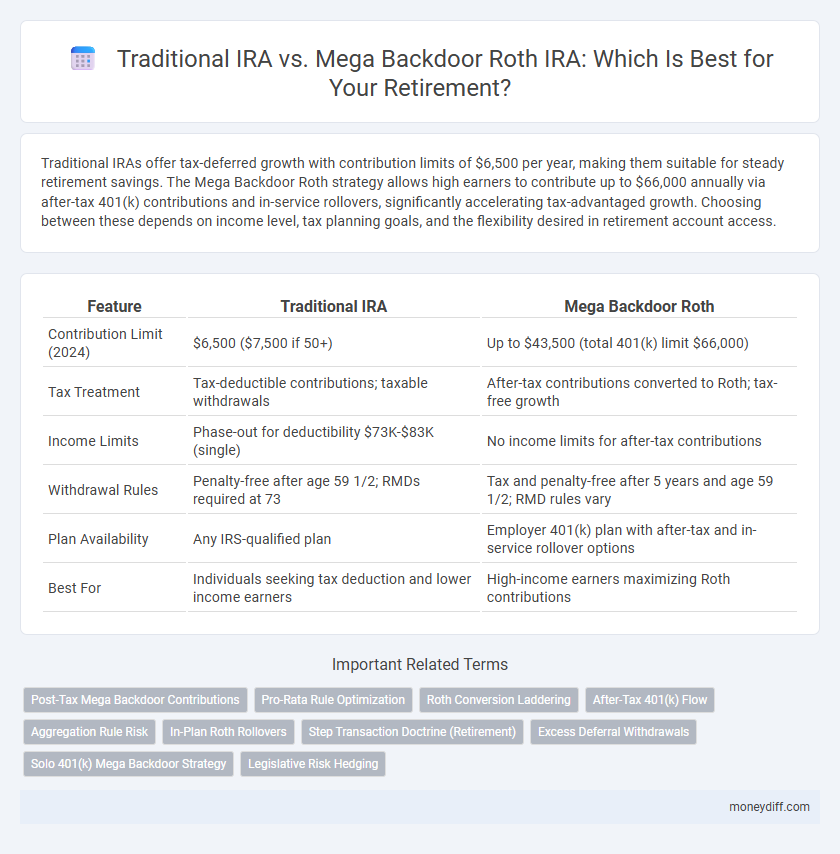

Traditional IRAs offer tax-deferred growth with contribution limits of $6,500 per year, making them suitable for steady retirement savings. The Mega Backdoor Roth strategy allows high earners to contribute up to $66,000 annually via after-tax 401(k) contributions and in-service rollovers, significantly accelerating tax-advantaged growth. Choosing between these depends on income level, tax planning goals, and the flexibility desired in retirement account access.

Table of Comparison

| Feature | Traditional IRA | Mega Backdoor Roth |

|---|---|---|

| Contribution Limit (2024) | $6,500 ($7,500 if 50+) | Up to $43,500 (total 401(k) limit $66,000) |

| Tax Treatment | Tax-deductible contributions; taxable withdrawals | After-tax contributions converted to Roth; tax-free growth |

| Income Limits | Phase-out for deductibility $73K-$83K (single) | No income limits for after-tax contributions |

| Withdrawal Rules | Penalty-free after age 59 1/2; RMDs required at 73 | Tax and penalty-free after 5 years and age 59 1/2; RMD rules vary |

| Plan Availability | Any IRS-qualified plan | Employer 401(k) plan with after-tax and in-service rollover options |

| Best For | Individuals seeking tax deduction and lower income earners | High-income earners maximizing Roth contributions |

Understanding Traditional IRA: Basics and Benefits

Traditional IRAs offer tax-deferred growth, allowing contributions to reduce taxable income, which benefits individuals seeking immediate tax relief. Contributions can be tax-deductible depending on income level and participation in employer plans, enhancing retirement savings potential. Withdrawals during retirement are taxed as ordinary income, providing a structured approach to long-term wealth accumulation.

What is a Mega Backdoor Roth IRA?

A Mega Backdoor Roth IRA allows high-income earners to contribute significantly more to their Roth IRA through after-tax 401(k) contributions and in-service rollovers, bypassing traditional income limits. Unlike a Traditional IRA, which has annual contribution caps and potential tax deductions, the Mega Backdoor option can enable contributions of up to $66,000 (2024 limit) in a tax-advantaged manner. This strategy maximizes retirement savings by combining the tax-free growth benefits of a Roth IRA with the higher contribution limits of employer-sponsored plans.

Contribution Limits: Traditional IRA vs Mega Backdoor

Traditional IRAs have a contribution limit of $6,500 per year for individuals under 50 and $7,500 for those 50 or older as of 2024. Mega Backdoor Roth contributions, facilitated through after-tax 401(k) contributions and in-service rollovers, can allow savers to contribute up to $66,000 annually, including employer matches and pre-tax contributions. This substantial difference makes the Mega Backdoor Roth a powerful strategy for high-income earners aiming to maximize their retirement savings beyond the Traditional IRA limits.

Tax Advantages and Implications

Traditional IRAs offer tax-deductible contributions and tax-deferred growth, allowing investors to lower taxable income during their earning years while paying taxes upon withdrawal in retirement. The Mega Backdoor Roth strategy enables after-tax contributions to a 401(k) to be converted into a Roth account, providing tax-free growth and withdrawals, although it requires high contribution limits and employer plan compatibility. Understanding these tax implications helps optimize retirement savings by balancing immediate tax deductions against potential tax-free income in retirement.

Eligibility Requirements Explained

Traditional IRA eligibility requires individuals to have earned income under age 73 with no mandatory minimum contributions; income limits affect tax-deductibility based on participation in employer retirement plans. The Mega Backdoor Roth strategy involves high-income individuals making after-tax contributions to a 401(k) plan and then converting those funds to a Roth IRA, bypassing standard Roth contribution limits. Understanding employer plan rules and contribution caps is essential to maximize retirement savings through these distinct vehicles.

Withdrawal Rules and Penalties

Traditional IRA withdrawals before age 59 1/2 typically incur a 10% early withdrawal penalty plus income tax on the amount withdrawn, with exceptions for certain circumstances like first-time home purchases or qualified education expenses. The Mega Backdoor Roth, involving after-tax 401(k) contributions rolled into a Roth IRA, offers tax-free withdrawals of both contributions and earnings after age 59 1/2, without required minimum distributions (RMDs). Early withdrawals from Mega Backdoor Roth accounts may forfeit earnings tax advantages and potentially trigger penalties, making adherence to qualified distribution rules essential for maximizing retirement benefits.

Investment Options and Flexibility

A Traditional IRA offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, providing retirees with diversified portfolio flexibility. The Mega Backdoor Roth strategy, facilitated through after-tax 401(k) contributions, allows for higher contribution limits but typically restricts investments to the plan's available options, which may be more limited than those in an IRA. Investors seeking maximum control over asset allocation often favor Traditional IRAs for their broader investment choices, while those aiming to maximize tax-advantaged contributions might prioritize the Mega Backdoor Roth despite its potential investment limitations.

Long-Term Growth Potential Comparison

Traditional IRAs offer tax-deferred growth with annual contribution limits of $6,500 (or $7,500 if age 50 or older) as of 2024, making them accessible for long-term retirement savings. Mega Backdoor Roth IRAs enable significantly higher after-tax contributions--up to $66,000 annually through 401(k) plans--allowing for accelerated compounding and tax-free withdrawals, which can greatly enhance long-term growth potential. The larger contribution capacity and tax-free growth of the Mega Backdoor Roth strategy generally provide a superior advantage for maximizing retirement savings over multiple decades.

Suitability: Which Is Best for Your Retirement Plan?

Traditional IRAs offer tax-deferred growth and are suitable for individuals seeking straightforward retirement savings with annual contribution limits of $6,500 in 2024. Mega Backdoor Roth IRAs enable significantly higher after-tax contributions through 401(k) plans, ideal for high-income earners aiming to maximize retirement tax advantages beyond standard limits. Choosing between them depends on income level, employer plan options, and long-term tax strategy to optimize retirement savings.

Key Considerations Before Choosing Your IRA Path

Evaluate your current income, contribution limits, and tax bracket before selecting between a Traditional IRA and Mega Backdoor Roth IRA to maximize tax advantages and retirement savings. Traditional IRAs offer tax-deferred growth with income-based deduction eligibility, while Mega Backdoor Roth allows significant after-tax contributions and tax-free growth, beneficial for high-income earners seeking larger retirement balances. Consider employer plan availability, contribution limits (up to $66,000 in 2024 for Mega Backdoor Roth), and your long-term withdrawal strategy to optimize retirement outcomes.

Related Important Terms

Post-Tax Mega Backdoor Contributions

Post-Tax Mega Backdoor Contributions allow higher savings limits by enabling after-tax contributions well beyond the standard Traditional IRA limits, facilitating significant tax-deferred growth within a 401(k) plan. Unlike Traditional IRAs, which have annual contribution limits of $6,500 (in 2024) and potential income-based restrictions on tax deductibility, Mega Backdoor Roth contributions can exceed $66,000 total annual additions, maximizing retirement account growth potential.

Pro-Rata Rule Optimization

Maximizing retirement savings through a Mega Backdoor Roth IRA often requires careful Pro-Rata Rule optimization to minimize tax liabilities on pre-tax and after-tax contributions within Traditional IRAs. Strategic conversion timing and source segregation can significantly reduce taxable income, leveraging the Mega Backdoor method over the more restrictive Traditional IRA contributions.

Roth Conversion Laddering

Traditional IRAs offer tax-deferred growth with mandatory distributions after age 72, while Mega Backdoor Roth strategies enable high after-tax 401(k) contributions converted to Roth accounts, facilitating faster tax-free withdrawals through Roth conversion laddering. Using Roth conversion laddering, investors can systematically convert portions of Traditional IRA or after-tax 401(k) balances into Roth IRAs over several years, reducing tax impact and creating a sequence of penalty-free, tax-free withdrawals before retirement age.

After-Tax 401(k) Flow

The After-Tax 401(k) flow enables high-income earners to contribute significantly more than traditional IRA limits by allowing post-tax contributions to grow tax-deferred, which can then be rolled over into a Roth IRA for tax-free withdrawals. This strategy contrasts with the Traditional IRA's contribution limits and tax deductions, offering enhanced retirement savings potential through the Mega Backdoor Roth conversion.

Aggregation Rule Risk

Traditional IRAs face aggregation rule risk, which can complicate rollover and tax treatment when combining multiple IRAs upon retirement. Mega Backdoor Roth contributions, executed through after-tax 401(k) plans, may bypass some aggregation risks by maintaining separate account types, providing more flexibility in tax planning.

In-Plan Roth Rollovers

In-plan Roth rollovers allow workers to convert pre-tax retirement savings into tax-free growth within the same employer plan, providing flexibility beyond traditional IRAs. Compared to Mega Backdoor Roth contributions, these rollovers can simplify tax planning by enabling incremental tax-free accumulation without the need to withdraw and re-contribute funds externally.

Step Transaction Doctrine (Retirement)

The Step Transaction Doctrine scrutinizes the separation of actions in Traditional IRA and Mega Backdoor Roth strategies to prevent tax avoidance by treating multiple steps as a single transaction. Properly structuring contributions and conversions under IRS guidelines ensures compliance and maximizes tax-advantaged retirement savings without triggering unintended tax liabilities.

Excess Deferral Withdrawals

Traditional IRA excess deferral withdrawals incur income tax and a 6% penalty if not corrected by the tax filing deadline, while Mega Backdoor Roth contributions avoid penalties on excess amounts as they are after-tax contributions allowing higher annual limits up to $66,000 in 2024. Managing excess deferrals in Traditional IRAs requires timely withdrawal to minimize penalties, whereas Mega Backdoor Roth strategies leverage employer 401(k) plans to maximize tax-advantaged retirement savings without immediate withdrawal constraints.

Solo 401(k) Mega Backdoor Strategy

The Solo 401(k) Mega Backdoor strategy allows high-income earners to contribute up to $66,000 annually, substantially exceeding Traditional IRA limits, by utilizing after-tax contributions and in-service rollovers to Roth accounts. This approach maximizes retirement savings potential and tax diversification, offering greater flexibility and growth opportunities compared to the Traditional IRA's $6,500 annual contribution cap and income-based deduction restrictions.

Legislative Risk Hedging

Traditional IRAs offer established tax advantages but face potential legislative risks such as changing contribution limits or tax treatment, whereas Mega Backdoor Roth strategies, leveraging after-tax 401(k) contributions and in-plan conversions, can mitigate those risks by maximizing tax-advantaged growth and offering greater flexibility in future withdrawals. Diversifying retirement savings between these vehicles helps hedge against regulatory changes impacting tax codes or retirement account rules.

Traditional IRA vs Mega Backdoor for retirement. Infographic

moneydiff.com

moneydiff.com