Target-date funds offer a hands-off approach by automatically adjusting asset allocation based on a retirement timeline, providing diversification and risk management tailored to age. Thematic investing allows for targeted exposure to specific sectors or trends, offering potential higher returns but with increased volatility and risk. Investors should balance the steady growth and risk mitigation of target-date funds with the focused, growth-oriented opportunities found in thematic investing to align with their retirement goals.

Table of Comparison

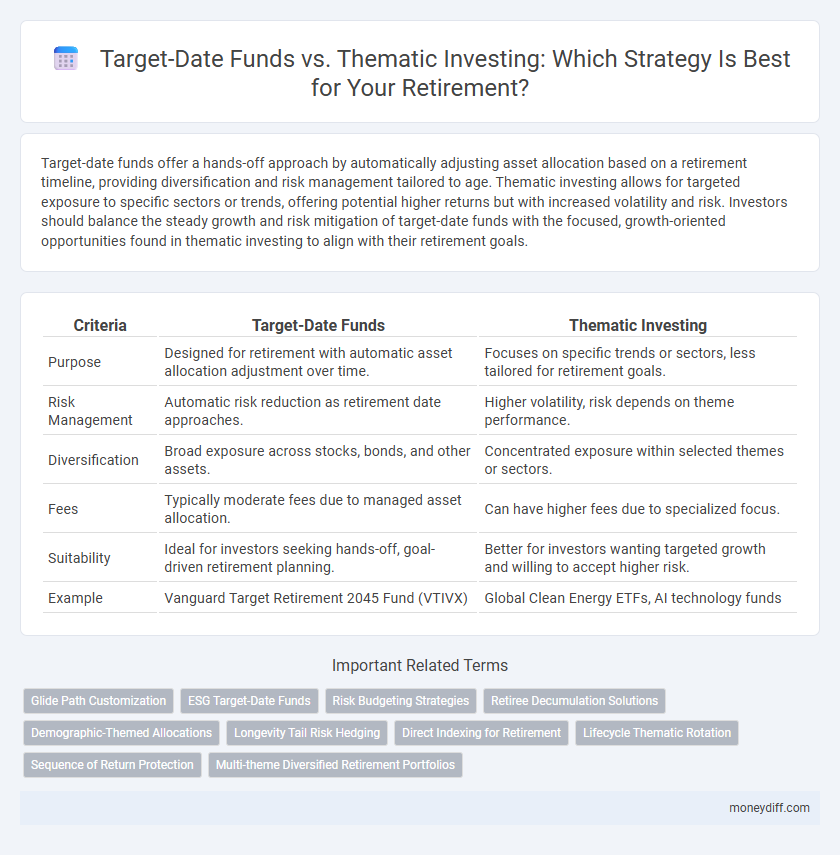

| Criteria | Target-Date Funds | Thematic Investing |

|---|---|---|

| Purpose | Designed for retirement with automatic asset allocation adjustment over time. | Focuses on specific trends or sectors, less tailored for retirement goals. |

| Risk Management | Automatic risk reduction as retirement date approaches. | Higher volatility, risk depends on theme performance. |

| Diversification | Broad exposure across stocks, bonds, and other assets. | Concentrated exposure within selected themes or sectors. |

| Fees | Typically moderate fees due to managed asset allocation. | Can have higher fees due to specialized focus. |

| Suitability | Ideal for investors seeking hands-off, goal-driven retirement planning. | Better for investors wanting targeted growth and willing to accept higher risk. |

| Example | Vanguard Target Retirement 2045 Fund (VTIVX) | Global Clean Energy ETFs, AI technology funds |

Understanding Target-Date Funds: A Retirement Solution

Target-date funds offer a diversified portfolio that automatically adjusts asset allocation based on the investor's projected retirement date, aiming to reduce risk as retirement approaches. These funds typically include a mix of stocks, bonds, and cash equivalents, tailored to shift towards more conservative investments over time. Target-date funds provide a hands-off, professionally managed retirement solution that simplifies investment decisions compared to thematic investing, which involves selecting specific sectors or trends and may carry higher volatility and risk.

Thematic Investing Explained: Aligning Values and Growth

Thematic investing for retirement centers on aligning portfolio choices with personal values and long-term growth trends, targeting sectors such as clean energy, technology innovation, or healthcare advancements. Unlike target-date funds, which automatically adjust risk based on retirement timeline, thematic investing empowers retirees to actively pursue emerging opportunities that resonate with their ethical priorities and market potential. This strategy offers a personalized approach to retirement planning, emphasizing targeted exposure over broad diversification.

Key Differences Between Target-Date Funds and Thematic Investing

Target-date funds automatically adjust asset allocation based on a specified retirement year, prioritizing risk reduction as the target date approaches, making them suitable for hands-off investors seeking diversified, time-sensitive portfolios. Thematic investing focuses on specific sectors or trends, such as clean energy or technology, offering potential for higher returns but with increased volatility and concentration risk. Understanding these key differences helps retirees balance growth potential with risk tolerance in their retirement planning.

Risk Management: Stability vs. Opportunity

Target-date funds prioritize risk management through automatic asset allocation adjustments, gradually shifting from higher-risk equities to more stable bonds as retirement approaches, providing investors with consistent stability. Thematic investing offers greater opportunity by concentrating on specific sectors or trends, allowing for higher potential returns but with increased volatility and less risk mitigation. Balancing these approaches depends on an individual's risk tolerance and retirement timeline, where target-date funds ensure steady growth, while thematic investments seek amplified gains amidst market fluctuations.

Portfolio Diversification: Which Approach Wins?

Target-date funds offer broad portfolio diversification by automatically adjusting asset allocation based on an investor's retirement timeline, reducing risk as the target date nears. Thematic investing, while potentially providing higher returns through focused exposure to specific sectors or trends, often lacks the built-in diversification of target-date funds and carries greater volatility. For retirement portfolios prioritizing balanced risk management and diversification, target-date funds generally provide a more stable approach.

Performance Trends: Historical Returns Comparison

Target-date funds have demonstrated steady historical returns by automatically adjusting asset allocation toward lower risk as retirement approaches, typically yielding average annual returns between 4% and 8% over 10- to 20-year periods. Thematic investing, focusing on sectors like technology or renewable energy, has shown higher volatility with potential for both above-average gains and significant losses, producing annual returns ranging from -5% to 15% depending on market cycles and theme popularity. Historical data suggests target-date funds offer more consistent performance for retirement portfolios, while thematic investing carries greater risk and reward variability.

Assessing Fees and Costs for Retirement Investors

Target-date funds typically charge management fees ranging from 0.10% to 0.75%, bundled with automatic asset allocation adjustments targeting retirement dates, providing a cost-effective, hands-off approach for investors. Thematic investing often incurs higher expenses due to focused sector investments and active management, with fees sometimes exceeding 1%, reflecting specialized research and transaction costs. Retirement investors should assess expense ratios, advisory fees, and potential fund turnover to evaluate the long-term impact on portfolio growth and retirement income stability.

Customization vs. Automation: Control Over Your Retirement

Target-date funds offer automated asset allocation that adjusts risk based on your expected retirement year, providing a hands-off approach ideally suited for investors seeking simplicity. Thematic investing allows for greater customization, enabling retirees to tailor their portfolios according to specific sectors or trends they believe will perform well, which introduces more control but also requires active management. Balancing automation and customization involves evaluating your comfort with investment decisions and your desire for a personalized retirement strategy.

Suitability: Matching Investment Strategies to Retirement Goals

Target-date funds offer a diversified, time-based approach that automatically adjusts risk exposure as retirement nears, making them suitable for investors seeking a hands-off strategy aligned with their retirement timeline. Thematic investing allows retirees to focus on specific industries or trends, such as technology or sustainability, providing potential for higher growth but with increased volatility and risk. Matching investment strategies to retirement goals requires evaluating risk tolerance, investment horizon, and the need for income stability versus growth potential.

Making the Right Choice: Which Strategy Fits Your Retirement Plan?

Target-date funds automatically adjust asset allocation to reduce risk as the retirement date approaches, making them ideal for investors seeking a hands-off, diversified approach aligned with their retirement timeline. Thematic investing targets specific trends or sectors, offering higher growth potential but with increased volatility, suited for retirees willing to actively manage their portfolios and embrace risk. Evaluating risk tolerance, investment horizon, and retirement goals is crucial in choosing between the steady glide path of target-date funds and the dynamic opportunities of thematic investing.

Related Important Terms

Glide Path Customization

Target-date funds offer a pre-set glide path designed to reduce risk gradually as retirement approaches, optimizing portfolio allocation automatically based on age. Thematic investing for retirement allows customized glide path adjustments to focus on specific sectors or trends, providing greater flexibility but requiring active management and risk assessment.

ESG Target-Date Funds

ESG target-date funds combine the strategic asset allocation of traditional target-date funds with environmental, social, and governance criteria, aligning retirement investments with sustainable and ethical objectives. This approach offers diversification and automatic rebalancing tailored to retirement timelines while emphasizing responsible investing principles.

Risk Budgeting Strategies

Target-date funds offer systematic risk budgeting by automatically adjusting asset allocation to reduce exposure as the retirement date nears, providing a diversified and time-sensitive investment approach. Thematic investing targets specific sectors or trends, which can increase volatility and risk, requiring more active risk management to align with individual retirement goals and risk tolerance.

Retiree Decumulation Solutions

Target-date funds offer a diversified, age-adjusted asset allocation designed to reduce portfolio risk as retirees approach and enter retirement, making them ideal decumulation solutions for predictable income needs. Thematic investing targets specific sectors or trends, potentially boosting growth but increasing volatility and risk, which may challenge consistent withdrawal strategies during the critical decumulation phase.

Demographic-Themed Allocations

Target-date funds automatically adjust their asset allocation to reduce risk as the retirement date approaches, offering a time-based investment strategy, while thematic investing, particularly demographic-themed allocations, targets investments based on population trends such as aging populations or urbanization, aiming to capitalize on long-term societal shifts. Demographic-themed allocations can provide tailored exposure to sectors poised for growth due to changing population dynamics, potentially enhancing retirement portfolio diversification compared to the broad approach of target-date funds.

Longevity Tail Risk Hedging

Target-date funds automatically adjust asset allocation to reduce Longevity Tail Risk by shifting toward conservative investments as retirement approaches, while thematic investing requires active selection of sectors or trends that can hedge against extended lifespan uncertainties. Hedging Longevity Tail Risk effectively involves balancing the systematic glide path of target-date funds with the growth potential of thematic investments tailored to demographic and healthcare innovations.

Direct Indexing for Retirement

Target-date funds provide automated, age-based asset allocation designed to adjust risk over time, whereas thematic investing focuses on specific sectors or trends that align with an investor's values or market outlook. Direct indexing for retirement enhances portfolio customization by allowing investors to replicate an index while incorporating tax-loss harvesting and personalized ESG criteria, offering a strategic edge in managing retirement wealth.

Lifecycle Thematic Rotation

Lifecycle Thematic Rotation integrates target-date fund strategies with thematic investing by adjusting asset allocation based on retirement timelines and evolving market trends, optimizing returns and managing risk throughout the investor's lifecycle. This approach leverages dynamic sector rotations aligned with thematic opportunities, enhancing portfolio diversification and growth potential compared to traditional target-date funds.

Sequence of Return Protection

Target-date funds offer built-in sequence of return protection by automatically adjusting asset allocation to become more conservative as retirement nears, reducing market volatility risk. Thematic investing lacks this dynamic rebalancing, exposing retirees to higher sequence of return risk due to concentrated bets in specific sectors or trends.

Multi-theme Diversified Retirement Portfolios

Target-date funds provide automatic asset allocation adjustments based on retirement timelines, offering a hands-off approach, while thematic investing enables tailored exposure to specific sectors or trends but requires active management. Multi-theme diversified retirement portfolios blend these strategies by incorporating various investment themes to optimize growth potential and risk management for long-term retirement goals.

Target-date funds vs thematic investing for retirement. Infographic

moneydiff.com

moneydiff.com