Annuities provide guaranteed lifelong income with options for fixed or variable returns, offering financial stability in retirement. Qualified Longevity Annuity Contracts (QLACs) delay income payments until advanced age, helping manage longevity risk and spare more assets for earlier years. Choosing between annuities and QLACs depends on retirement goals, risk tolerance, and the need for immediate versus future income security.

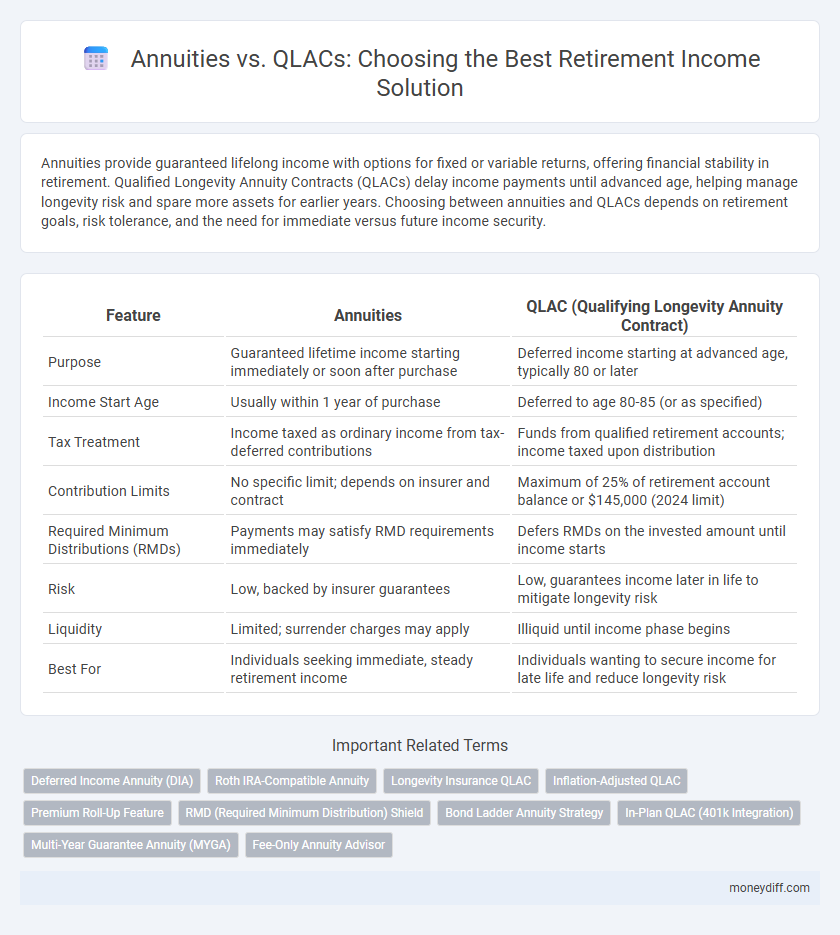

Table of Comparison

| Feature | Annuities | QLAC (Qualifying Longevity Annuity Contract) |

|---|---|---|

| Purpose | Guaranteed lifetime income starting immediately or soon after purchase | Deferred income starting at advanced age, typically 80 or later |

| Income Start Age | Usually within 1 year of purchase | Deferred to age 80-85 (or as specified) |

| Tax Treatment | Income taxed as ordinary income from tax-deferred contributions | Funds from qualified retirement accounts; income taxed upon distribution |

| Contribution Limits | No specific limit; depends on insurer and contract | Maximum of 25% of retirement account balance or $145,000 (2024 limit) |

| Required Minimum Distributions (RMDs) | Payments may satisfy RMD requirements immediately | Defers RMDs on the invested amount until income starts |

| Risk | Low, backed by insurer guarantees | Low, guarantees income later in life to mitigate longevity risk |

| Liquidity | Limited; surrender charges may apply | Illiquid until income phase begins |

| Best For | Individuals seeking immediate, steady retirement income | Individuals wanting to secure income for late life and reduce longevity risk |

Understanding Annuities: Key Features and Benefits

Annuities provide a reliable income stream during retirement through fixed or variable payments, ensuring financial stability. They offer benefits such as tax deferral on earnings, protection from market volatility, and options for lifetime payouts. Key features include surrender charges, income riders, and guaranteed minimum income benefits that cater to diverse retirement needs.

What Is a QLAC? Definition and Core Advantages

A Qualified Longevity Annuity Contract (QLAC) is a type of deferred income annuity purchased within a qualified retirement plan or IRA designed to provide guaranteed lifetime income starting at an advanced age, typically around 80 or 85. QLACs help retirees manage longevity risk by ensuring a steady income stream later in life while allowing most of their retirement assets to remain invested and grow tax-deferred. Core advantages include the ability to exclude the QLAC's value from required minimum distribution (RMD) calculations up to a set limit, preserving retirement savings and improving financial security in advanced age.

How Annuities and QLACs Generate Retirement Income

Annuities generate retirement income by providing a guaranteed stream of payments based on either a lump-sum premium or ongoing contributions, often starting immediately or at a future date. Qualified Longevity Annuity Contracts (QLACs) are a subset of deferred annuities purchased within qualified retirement accounts that begin payouts at an advanced age, typically around 80 or 85, to mitigate the risk of outliving assets. Both instruments convert retirement savings into predictable income, with annuities offering more flexibility in payout timing and QLACs specifically designed to delay withdrawals and reduce required minimum distribution (RMD) impact.

Comparing Payout Structures: Annuities vs QLAC

Annuities offer a guaranteed income stream for life or a fixed period, with flexible payout options including immediate or deferred distributions. Qualified Longevity Annuity Contracts (QLACs) specifically provide deferred income starting at age 85, designed to hedge longevity risk within qualified retirement accounts. While annuities provide consistent cash flow earlier in retirement, QLACs focus on long-term income security, helping retirees manage the risk of outliving their savings.

Tax Considerations: Annuities versus QLACs

Annuities are fully taxable as ordinary income upon distribution, resulting in potentially higher tax burdens during retirement, whereas Qualified Longevity Annuity Contracts (QLACs) allow deferral of Required Minimum Distributions (RMDs) up to age 85, reducing taxable income in early retirement years. QLACs provide a tax-efficient strategy by delaying income and spreading taxation over a longer period, while annuities often generate consistent taxable income starting immediately. Understanding differing tax treatments and RMD rules is crucial for optimizing retirement income streams and minimizing tax liabilities.

Longevity Protection: Which Option Shields Against Outliving Savings?

Annuities provide guaranteed lifetime income, effectively shielding retirees from longevity risk by ensuring consistent payments regardless of lifespan. Qualified Longevity Annuity Contracts (QLACs) offer delayed income starting at an advanced age, optimizing tax advantages while protecting against outliving savings through deferred, inflation-adjusted payouts. Choosing between annuities and QLACs depends on balancing immediate income needs with long-term longevity protection strategies.

Flexibility and Liquidity: Evaluating Your Choices

Annuities typically offer steady, guaranteed income but often come with limited flexibility and restricted access to principal funds, affecting liquidity. Qualified Longevity Annuity Contracts (QLACs) delay payouts until later retirement years, providing a strategic way to secure income longevity while allowing more immediate access to other retirement assets. Evaluating your retirement income choices requires balancing the predictability of annuities against the liquidity benefits and deferred payout structure of QLACs.

Suitability: Who Should Consider Annuities or a QLAC?

Annuities are suitable for retirees seeking guaranteed lifetime income and protection against market volatility, especially those without sufficient pension benefits or other stable income sources. Qualified Longevity Annuity Contracts (QLACs) appeal to individuals looking to hedge longevity risk by deferring income until advanced ages, such as 80 or later, within tax-advantaged retirement accounts. Those with moderate savings aiming to balance liquidity and predictability may find QLACs more appropriate, while individuals prioritizing immediate income security often prefer traditional annuities.

Costs, Fees, and Hidden Charges to Watch Out For

Annuities often come with higher costs, including administrative fees, mortality and expense risk charges, and surrender penalties that can erode retirement income. QLACs (Qualified Longevity Annuity Contracts) typically have lower fees and fewer hidden charges, offering a cost-effective solution by deferring income until advanced age and eliminating some investment risks. Retirement savers should carefully compare fee structures to avoid unexpected expenses that reduce their guaranteed income streams.

Making the Right Choice: Factors to Guide Your Decision

Evaluating annuities versus Qualified Longevity Annuity Contracts (QLACs) depends heavily on your income needs, risk tolerance, and retirement timeline. Annuities provide immediate or near-term income streams, ideal for those seeking consistent cash flow, while QLACs defer payments to later in life, serving as a hedge against outliving your assets. Consider factors such as current age, life expectancy, portfolio diversification, and the desire for inflation protection to make an informed decision tailored to your long-term financial security.

Related Important Terms

Deferred Income Annuity (DIA)

Deferred Income Annuities (DIAs) offer guaranteed lifetime income starting at a future date, providing retirees with predictable cash flow and protection against outliving their savings, whereas Qualified Longevity Annuity Contracts (QLACs) are a type of DIA specifically designed for qualified retirement plans with contribution limits and mandatory deferral periods. DIAs provide flexibility in payout timing and investment amounts, making them a strategic tool for retirement income planning compared to the more restrictive QLACs.

Roth IRA-Compatible Annuity

Roth IRA-compatible annuities provide tax-free growth and withdrawals, making them an effective tool for generating steady retirement income without triggering required minimum distributions (RMDs). Qualified Longevity Annuity Contracts (QLACs) postpone RMDs until age 85 but are generally funded with pre-tax assets, whereas Roth IRA annuities enhance tax diversification and flexible legacy planning.

Longevity Insurance QLAC

Qualified Longevity Annuity Contracts (QLACs) provide a strategic option for securing lifetime income later in retirement, offering protection against outliving traditional annuity payouts. Unlike conventional annuities, QLACs delay distributions until ages 80-85, enhancing guaranteed income streams while satisfying IRS contribution limits, making them ideal for longevity risk management.

Inflation-Adjusted QLAC

Inflation-adjusted Qualified Longevity Annuity Contracts (QLACs) offer a unique advantage by providing a steady income stream that increases with inflation, preserving purchasing power throughout retirement. Unlike traditional fixed annuities, inflation-adjusted QLACs help mitigate the risk of rising living costs, ensuring retirees maintain financial stability over the long term.

Premium Roll-Up Feature

The Premium Roll-Up feature in Qualified Longevity Annuity Contracts (QLACs) enhances retirement income by allowing premiums to grow at a guaranteed rate before payout begins, unlike traditional annuities which typically start income immediately without premium accumulation. This feature enables retirees to increase their future income stream, making QLACs a strategic option for managing longevity risk and ensuring stable retirement cash flow.

RMD (Required Minimum Distribution) Shield

Qualified Longevity Annuity Contracts (QLACs) provide a strategic advantage by deferring a portion of retirement assets from Required Minimum Distributions (RMDs), effectively shielding funds from early withdrawal and reducing taxable income. In contrast, traditional annuities typically do not offer RMD deferral, resulting in immediate RMD obligations and potentially higher tax liabilities during retirement years.

Bond Ladder Annuity Strategy

The Bond Ladder Annuity Strategy combines the stability of annuities with the flexibility of bond ladders, providing predictable retirement income by staggering bond maturities to match income needs. Unlike QLACs that defer income start dates, this approach offers phased payouts aligned with portfolio liquidity, enhancing income certainty while managing interest rate risk.

In-Plan QLAC (401k Integration)

In-plan QLACs integrated within 401(k) plans provide a strategic option to defer required minimum distributions while offering guaranteed lifetime income, enhancing retirement income stability. Unlike traditional annuities, these policies allow tax deferral on premiums up to 25% of the account balance or $145,000, making them a flexible and tax-efficient tool for income sequencing in retirement portfolios.

Multi-Year Guarantee Annuity (MYGA)

Multi-Year Guarantee Annuities (MYGAs) provide a fixed interest rate for a set period, offering predictable retirement income with low risk. Compared to Qualified Longevity Annuity Contracts (QLACs), MYGAs allow earlier access to funds and flexible payout options, making them suitable for retirees seeking steady growth and guaranteed income without deferring distributions until advanced age.

Fee-Only Annuity Advisor

Fee-only annuity advisors help retirees compare annuities and Qualified Longevity Annuity Contracts (QLACs) by evaluating cost structures, surrender charges, and payout guarantees tailored to individual retirement income needs. Their expertise ensures transparent fee disclosures and objective analysis, optimizing retirement income strategies without conflicts of interest inherent in commission-based sales.

Annuities vs QLAC for retirement income. Infographic

moneydiff.com

moneydiff.com