The 401k offers a traditional tax-deferred retirement savings option with higher contribution limits, making it ideal for building a substantial nest egg through employer matches and pre-tax contributions. The Mega Backdoor Roth allows for after-tax contributions that can be converted to a Roth account, enabling tax-free growth and withdrawals in retirement, which is advantageous for high earners seeking to maximize tax diversification. Choosing between the two strategies depends on current tax rates, income level, and long-term retirement goals to optimize savings and minimize tax burdens.

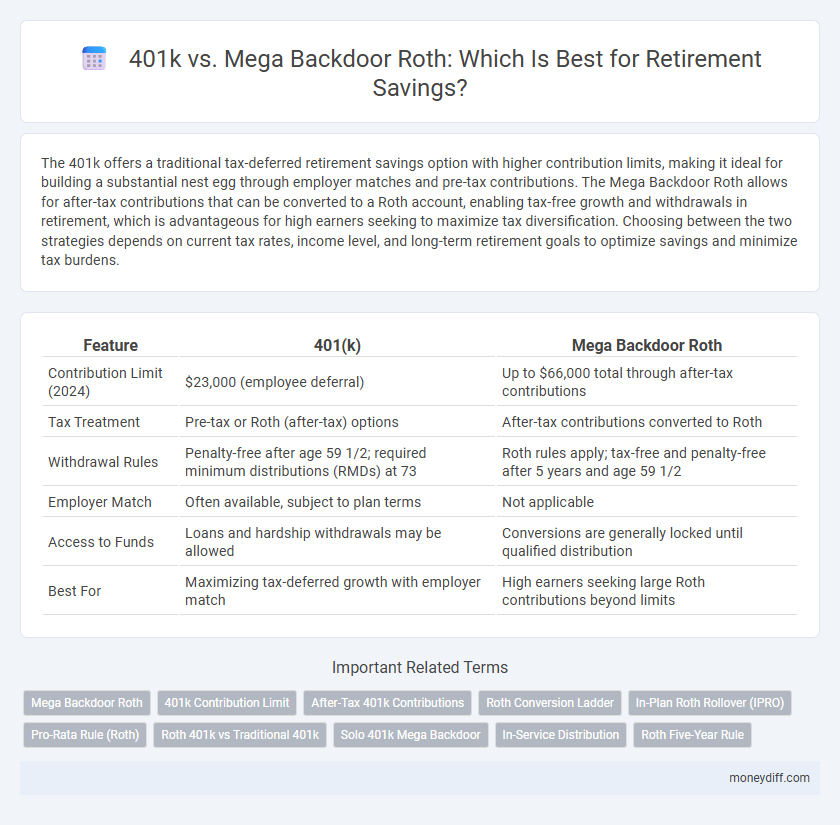

Table of Comparison

| Feature | 401(k) | Mega Backdoor Roth |

|---|---|---|

| Contribution Limit (2024) | $23,000 (employee deferral) | Up to $66,000 total through after-tax contributions |

| Tax Treatment | Pre-tax or Roth (after-tax) options | After-tax contributions converted to Roth |

| Withdrawal Rules | Penalty-free after age 59 1/2; required minimum distributions (RMDs) at 73 | Roth rules apply; tax-free and penalty-free after 5 years and age 59 1/2 |

| Employer Match | Often available, subject to plan terms | Not applicable |

| Access to Funds | Loans and hardship withdrawals may be allowed | Conversions are generally locked until qualified distribution |

| Best For | Maximizing tax-deferred growth with employer match | High earners seeking large Roth contributions beyond limits |

Understanding the Basics: 401(k) vs Mega Backdoor Roth

A 401(k) plan allows employees to contribute pre-tax income up to $22,500 annually (in 2024), with employer matching often enhancing savings. The Mega Backdoor Roth strategy enables after-tax contributions beyond the standard limit, potentially up to $66,000 total, which can then be converted to a Roth account for tax-free growth. Understanding the differences in contribution limits, tax treatment, and withdrawal rules is essential for maximizing retirement savings and optimizing tax benefits.

Key Differences Between 401(k) and Mega Backdoor Roth

A 401(k) allows employees to contribute pre-tax income up to the annual IRS limit ($22,500 for 2024), reducing taxable income now, while a Mega Backdoor Roth leverages after-tax contributions beyond this limit up to a combined total of $66,000, enabling significant Roth contributions. Unlike traditional 401(k) withdrawals, which are taxed as ordinary income during retirement, Mega Backdoor Roth funds grow tax-free and can be withdrawn tax-free, offering substantial tax advantages. The key difference lies in the contribution limits, tax treatment, and withdrawal benefits, making the Mega Backdoor Roth ideal for high earners looking to maximize tax-advantaged retirement savings.

Contribution Limits: Maximizing Retirement Savings

The 401(k) plan offers an annual contribution limit of $22,500 for 2024, with an additional $7,500 catch-up contribution for those aged 50 and above, enabling substantial tax-advantaged growth. The Mega Backdoor Roth strategy allows after-tax contributions up to the overall limit of $66,000 (or $73,500 with catch-up), significantly enhancing the potential for tax-free retirement savings by utilizing in-plan Roth conversions. Maximizing retirement savings requires leveraging both the traditional 401(k) limits and the Mega Backdoor Roth's higher contribution capacity where eligible, optimizing long-term financial security.

Tax Advantages: Pre-Tax vs After-Tax Strategies

The 401(k) plan leverages pre-tax contributions, reducing taxable income now and deferring taxes until withdrawal, which is beneficial for those expecting lower tax rates in retirement. In contrast, the Mega Backdoor Roth involves after-tax contributions that grow tax-free and allow for tax-free withdrawals, offering significant advantages if tax rates rise in the future. Choosing between these strategies depends on anticipated tax brackets and desired flexibility for tax-free income during retirement.

Eligibility Requirements for Each Option

401(k) plans require employees to have earned income and be offered the plan by their employer, with a usual minimum age of 21 and one year of service for eligibility. The Mega Backdoor Roth strategy depends on having a 401(k) plan that allows after-tax contributions and in-service rollovers, typically available to highly compensated employees with sufficient salary deferral limits. Understanding these eligibility requirements is crucial for maximizing retirement savings through either standard 401(k) contributions or the Mega Backdoor Roth option.

Growth Potential: Compound Interest Comparison

A 401(k) offers strong compound interest growth through tax-deferred contributions, allowing investments to grow uninterrupted until withdrawal. The Mega Backdoor Roth enables after-tax contributions to be converted to a Roth account, maximizing tax-free growth potential and compounding over time. Comparing both, the Mega Backdoor Roth typically provides greater long-term growth due to the benefit of tax-free compound interest on larger contribution amounts.

Withdrawals: Rules and Penalties Explained

Withdrawals from a 401(k) before age 59 1/2 typically incur a 10% early withdrawal penalty plus ordinary income tax, whereas Mega Backdoor Roth contributions grow tax-free with qualified withdrawals allowed after age 59 1/2 without penalties or taxes. The 401(k) imposes required minimum distributions (RMDs) starting at age 73, while Roth IRAs funded via a Mega Backdoor Roth strategy have no RMD requirements during the account holder's lifetime. Understanding these rules is crucial to optimizing tax efficiency and liquidity in long-term retirement planning.

Employer Support and Plan Availability

Employer support for 401k plans is widespread, with many companies offering automatic contributions, matching funds, and tax advantages that enhance retirement savings. Mega Backdoor Roth contributions depend heavily on an employer's specific plan design, limiting availability to firms that allow after-tax contributions and in-service rollovers. Employees seeking higher contribution limits and tax-free growth must verify their company's plan features to determine eligibility for Mega Backdoor Roth strategies.

Long-Term Financial Impact on Retirement

A 401(k) offers tax-deferred growth with higher contribution limits, maximizing pre-tax savings and employer match opportunities, which can significantly enhance long-term retirement wealth. The Mega Backdoor Roth strategy allows after-tax contributions to be converted into Roth accounts, resulting in tax-free growth and withdrawals, potentially providing greater tax diversification and savings in retirement. Evaluating both approaches based on projected income, tax brackets, and retirement goals can optimize overall financial outcomes and maximize retirement portfolio growth.

Choosing the Right Strategy: 401(k) or Mega Backdoor Roth

Choosing between a 401(k) and a Mega Backdoor Roth depends on individual income, contribution limits, and tax strategy preferences. A 401(k) offers traditional pre-tax contributions with potential employer matching, while the Mega Backdoor Roth allows high-income earners to maximize after-tax contributions and convert them to tax-free Roth funds. Evaluating current tax brackets, future income expectations, and flexibility needs can optimize long-term retirement savings growth.

Related Important Terms

Mega Backdoor Roth

The Mega Backdoor Roth allows high-income earners to contribute up to $66,000 annually in after-tax dollars to their 401(k), then convert to a Roth IRA, significantly exceeding standard 401(k) contribution limits and enabling accelerated tax-free growth. This strategy enhances retirement savings by maximizing contributions and expanding tax diversification beyond the $22,500 pre-tax or Roth 401(k) limit.

401k Contribution Limit

The 401k contribution limit for 2024 is $23,000, including employee deferrals and employer matching, while the Mega Backdoor Roth strategy leverages after-tax contributions up to the combined total annual limit of $66,000 for enhanced tax-advantaged growth. Utilizing the Mega Backdoor Roth allows savers to exceed standard 401k limits by rolling over after-tax contributions into a Roth IRA, maximizing retirement savings potential.

After-Tax 401k Contributions

After-Tax 401k Contributions enable high earners to maximize retirement savings beyond standard limits by allowing contributions up to IRS-defined limits, which can subsequently be converted to a Roth IRA via the Mega Backdoor Roth strategy, facilitating tax-free growth and withdrawals. This approach offers greater flexibility and higher contribution ceilings compared to traditional 401k deferrals, making it a powerful tool for long-term wealth accumulation and tax optimization in retirement planning.

Roth Conversion Ladder

A 401k offers tax-deferred growth with higher contribution limits, while the Mega Backdoor Roth enables after-tax contributions that can be converted into a Roth, maximizing tax-free withdrawals in retirement. The Roth Conversion Ladder strategy accelerates access to Roth funds by systematically converting non-Roth assets, reducing tax impact and enhancing long-term retirement savings flexibility.

In-Plan Roth Rollover (IPRO)

In-Plan Roth Rollover (IPRO) enables employees to convert pre-tax 401(k) balances into a Roth account within the same plan, offering tax-free growth potential similar to a Mega Backdoor Roth but without the need for after-tax contributions. IPRO simplifies tax management by allowing immediate taxation upon rollover, making it a strategic option for high-income earners seeking to maximize tax-advantaged retirement savings beyond traditional 401(k) limits.

Pro-Rata Rule (Roth)

The Pro-Rata Rule impacts Mega Backdoor Roth conversions by requiring the aggregation of all IRA balances to determine the taxable portion of the conversion, potentially increasing tax liability. Unlike a standard 401(k) to Roth rollover, the Pro-Rata Rule complicates the tax benefits of Mega Backdoor Roth strategies for those with pre-tax IRA funds.

Roth 401k vs Traditional 401k

Roth 401(k) contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement, whereas Traditional 401(k) contributions reduce taxable income upfront but incur taxes on withdrawals. Choosing between Roth and Traditional 401(k) depends on current versus anticipated future tax rates, with Roth 401(k) benefiting those expecting higher taxes in retirement.

Solo 401k Mega Backdoor

The Solo 401k Mega Backdoor Roth strategy allows high-income self-employed individuals to contribute up to $66,000 annually, significantly exceeding traditional 401k limits and enabling substantial tax-advantaged growth. By utilizing after-tax contributions combined with in-service rollovers to a Roth account, this approach maximizes retirement savings flexibility and accelerates tax-free compounding.

In-Service Distribution

In-service distributions from a Mega Backdoor Roth allow high-income earners to contribute after-tax dollars beyond standard 401(k) limits and convert them tax-free, significantly boosting retirement savings potential. Unlike a traditional 401(k), which restricts contributions and taxable growth, the Mega Backdoor Roth strategy offers enhanced tax advantages and greater flexibility for long-term wealth accumulation.

Roth Five-Year Rule

The 401(k) Roth option allows tax-free growth and withdrawals after age 59 1/2, but Roth contributions are subject to the five-year rule, meaning earnings are tax-free only if the account is held for five years. In contrast, the Mega Backdoor Roth enables higher after-tax contributions converted to Roth, accelerating retirement savings without resetting the five-year clock, making it a powerful strategy for early tax-free withdrawals.

401k vs Mega Backdoor Roth for retirement savings Infographic

moneydiff.com

moneydiff.com