Net worth measures the total value of an individual's or company's assets minus liabilities, reflecting financial health and investment potential. Carbon net worth integrates environmental impact by accounting for carbon emissions associated with those assets, providing a more holistic view for sustainable investing. Prioritizing carbon net worth allows investors to align portfolios with climate goals while maintaining economic value.

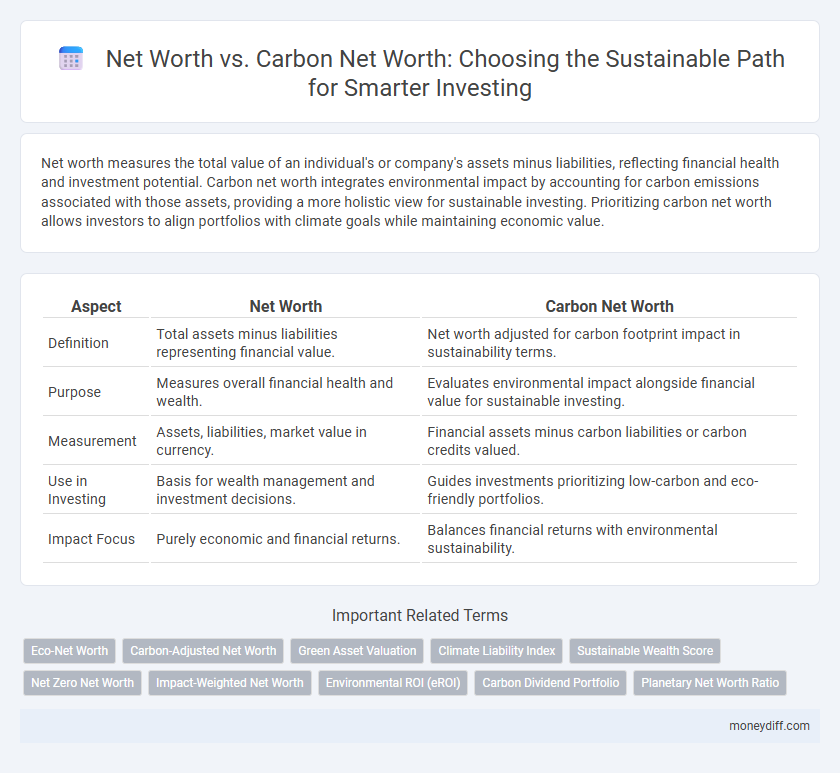

Table of Comparison

| Aspect | Net Worth | Carbon Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities representing financial value. | Net worth adjusted for carbon footprint impact in sustainability terms. |

| Purpose | Measures overall financial health and wealth. | Evaluates environmental impact alongside financial value for sustainable investing. |

| Measurement | Assets, liabilities, market value in currency. | Financial assets minus carbon liabilities or carbon credits valued. |

| Use in Investing | Basis for wealth management and investment decisions. | Guides investments prioritizing low-carbon and eco-friendly portfolios. |

| Impact Focus | Purely economic and financial returns. | Balances financial returns with environmental sustainability. |

Understanding Traditional Net Worth: A Financial Snapshot

Traditional net worth represents the difference between total assets and liabilities, providing a financial snapshot of an individual's or organization's economic value at a specific time. It quantifies monetary wealth through cash, investments, property, and debts, serving as a primary indicator of financial health. Unlike carbon net worth, which factors in environmental impact and sustainability metrics, traditional net worth focuses solely on financial metrics without accounting for carbon emissions or ecological footprint.

Defining Carbon Net Worth: Measuring Environmental Impact

Carbon net worth quantifies a company's environmental impact by accounting for the total greenhouse gas emissions associated with its assets and operations. Unlike traditional net worth, which measures financial value, carbon net worth integrates carbon liabilities and environmental costs to evaluate sustainability performance. This metric enables investors to assess long-term risks and opportunities related to climate change and drives more informed decisions toward sustainable investing.

The Intersection of Wealth and Sustainability

Net worth reflects an individual or entity's total financial assets minus liabilities, while carbon net worth quantifies the environmental impact through carbon emissions embedded in those assets. Sustainable investing requires assessing both financial value and carbon net worth to align wealth growth with climate goals. Integrating these metrics reveals opportunities to enhance portfolios by reducing carbon footprints without compromising economic returns.

Calculating Your Carbon Net Worth: Key Metrics

Calculating your carbon net worth involves quantifying the total greenhouse gas emissions linked to your personal or portfolio assets, measured in metric tons of CO2 equivalent. Key metrics include your carbon footprint, carbon intensity per dollar invested, and net carbon emissions offset through sustainable investments or carbon credits. Comparing traditional net worth with carbon net worth offers a holistic view of both financial value and environmental impact, essential for aligning investments with sustainability goals.

Why Investors Should Consider Both Net Worths

Investors should consider both traditional net worth and carbon net worth to gain a comprehensive understanding of their financial and environmental impact. Evaluating carbon net worth helps identify the carbon footprint embedded in investment portfolios, enabling better alignment with sustainability goals and regulatory demands. Incorporating both metrics drives more informed decisions that balance financial growth with responsible environmental stewardship.

Sustainable Investing: Aligning Financial and Carbon Goals

Net worth in sustainable investing extends beyond traditional financial metrics to include carbon net worth, reflecting a portfolio's environmental impact alongside monetary value. Investors prioritize assets that balance positive financial returns with reduced carbon footprints, enhancing long-term sustainability. Integrating carbon net worth metrics enables more informed decisions that align investment strategies with global climate goals and responsible stewardship.

Tools and Strategies for Tracking Carbon Net Worth

Advanced tools like carbon footprint calculators and sustainability performance dashboards are essential for accurately tracking carbon net worth in sustainable investing portfolios. Strategies include integrating environmental, social, and governance (ESG) metrics with financial net worth assessments to provide a holistic view of asset sustainability. Real-time data analytics and blockchain technology enhance transparency and reliability in measuring carbon emissions and offsets linked to investment holdings.

Balancing Financial Growth with Carbon Reduction

Balancing financial growth with carbon reduction requires assessing both net worth and carbon net worth to create sustainable investment portfolios. Net worth reflects an individual or company's total financial assets, while carbon net worth measures the environmental impact by quantifying carbon emissions associated with investments. Integrating carbon net worth into investment decisions promotes capital allocation towards low-carbon assets, driving financial returns alongside measurable reductions in carbon footprints.

Case Studies: Successful Integration of Net Worth and Carbon Metrics

Case studies demonstrate how leading sustainable investment firms integrate net worth and carbon net worth metrics to optimize portfolio performance and environmental impact. Companies like BlackRock and Generation Investment Management leverage these combined metrics to balance financial returns with carbon reduction targets, enhancing both shareholder value and sustainability credentials. This dual-metric approach provides a comprehensive framework for investors aiming to achieve long-term financial growth while contributing to climate goals.

The Future of Wealth: Merging Financial and Environmental Value

Net worth traditionally measures an individual's or organization's financial assets minus liabilities, providing a snapshot of economic standing. Carbon net worth integrates environmental impact by quantifying carbon emissions tied to those assets, offering a holistic view crucial for sustainable investing. This fusion of financial and environmental value signifies the future of wealth, where investment decisions prioritize long-term ecological stability alongside monetary growth.

Related Important Terms

Eco-Net Worth

Eco-Net Worth integrates traditional net worth with environmental impact metrics, quantifying an individual's or corporation's financial assets alongside their carbon footprint and ecological contributions. Prioritizing Eco-Net Worth supports sustainable investing by aligning financial growth with carbon reduction goals and long-term environmental stewardship.

Carbon-Adjusted Net Worth

Carbon-Adjusted Net Worth incorporates carbon liabilities by subtracting estimated costs from traditional net worth, providing a more accurate measure of a company's long-term value in sustainable investing. This metric enables investors to assess financial health while accounting for environmental impact, guiding capital allocation towards low-carbon and environmentally responsible assets.

Green Asset Valuation

Net worth in sustainable investing extends beyond financial assets to include Carbon Net Worth, which quantifies the environmental impact of a portfolio by valuing carbon-related risks and opportunities through Green Asset Valuation methodologies. Green Asset Valuation integrates carbon emissions data and climate-related financial disclosures to assess the true economic and ecological value of assets, guiding investors toward low-carbon, high-sustainability investments.

Climate Liability Index

Net worth measures an individual's or company's total assets minus liabilities, while carbon net worth adjusts this by accounting for the environmental impact and associated climate risks embedded in carbon emissions. The Climate Liability Index quantifies these risks by assigning a financial value to potential climate-related liabilities, enabling investors to integrate sustainability and exposure to future climate policies into traditional net worth evaluations.

Sustainable Wealth Score

Net worth measures total assets minus liabilities, but carbon net worth evaluates environmental impact by accounting for carbon emissions embedded in investments, providing a more comprehensive assessment for sustainable investing. The Sustainable Wealth Score integrates both financial value and carbon footprint, enabling investors to balance economic growth with ecological responsibility.

Net Zero Net Worth

Net Zero Net Worth integrates traditional net worth calculations with carbon net worth metrics, quantifying an individual's or company's financial assets alongside their carbon emissions footprint to promote sustainable investing. This approach prioritizes balancing economic value with environmental impact, enabling investors to optimize asset portfolios for both financial growth and alignment with global Net Zero carbon reduction goals.

Impact-Weighted Net Worth

Impact-Weighted Net Worth quantifies the environmental and social impacts of a company's assets, integrating carbon liabilities and sustainability factors into traditional financial metrics. This holistic approach to net worth enables investors to assess true economic value while guiding capital towards sustainable, low-carbon investments.

Environmental ROI (eROI)

Net worth measures total assets minus liabilities, while carbon net worth quantifies the environmental impact of those assets, essential for evaluating sustainable investing. Focusing on Environmental ROI (eROI) reveals how investments yield ecological benefits relative to carbon emissions, optimizing long-term value creation in green portfolios.

Carbon Dividend Portfolio

Net worth reflects an individual's or entity's total assets minus liabilities, while carbon net worth incorporates the environmental impact of investments by factoring in carbon emissions. The Carbon Dividend Portfolio targets sustainable investing by prioritizing companies with lower carbon net worth, thereby aligning financial growth with environmental responsibility.

Planetary Net Worth Ratio

Planetary Net Worth Ratio measures a company's net worth against its carbon net worth to evaluate sustainability impact, reflecting both financial health and environmental liabilities. This ratio helps investors prioritize firms that balance economic value creation with significant carbon reduction efforts, driving responsible investment decisions.

Net worth vs Carbon net worth for sustainable investing Infographic

moneydiff.com

moneydiff.com