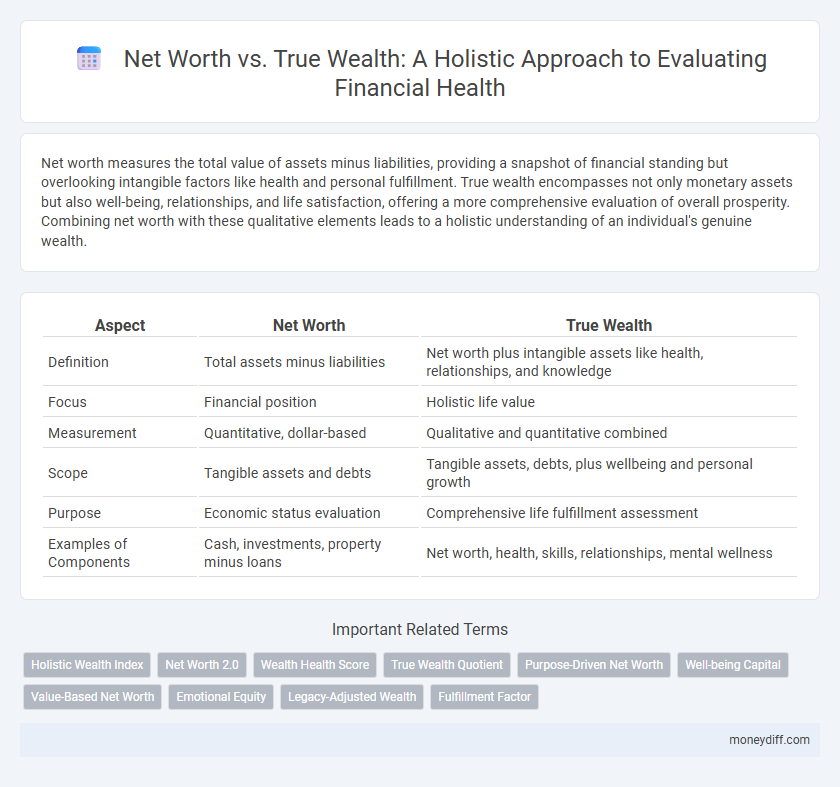

Net worth measures the total value of assets minus liabilities, providing a snapshot of financial standing but overlooking intangible factors like health and personal fulfillment. True wealth encompasses not only monetary assets but also well-being, relationships, and life satisfaction, offering a more comprehensive evaluation of overall prosperity. Combining net worth with these qualitative elements leads to a holistic understanding of an individual's genuine wealth.

Table of Comparison

| Aspect | Net Worth | True Wealth |

|---|---|---|

| Definition | Total assets minus liabilities | Net worth plus intangible assets like health, relationships, and knowledge |

| Focus | Financial position | Holistic life value |

| Measurement | Quantitative, dollar-based | Qualitative and quantitative combined |

| Scope | Tangible assets and debts | Tangible assets, debts, plus wellbeing and personal growth |

| Purpose | Economic status evaluation | Comprehensive life fulfillment assessment |

| Examples of Components | Cash, investments, property minus loans | Net worth, health, skills, relationships, mental wellness |

Understanding Net Worth: The Basics

Net worth represents the total value of an individual's assets minus liabilities, providing a quantitative snapshot of financial standing. True wealth extends beyond net worth by encompassing intangible factors such as health, relationships, and personal fulfillment, offering a holistic evaluation of overall well-being. Understanding net worth basics is essential for informed financial planning, but integrating true wealth perspectives ensures balanced and meaningful life assessments.

Defining True Wealth: Beyond the Numbers

True wealth transcends net worth by encompassing emotional well-being, meaningful relationships, and personal fulfillment alongside financial assets. While net worth quantifies tangible financial value through assets minus liabilities, true wealth integrates intangible elements that contribute to overall life satisfaction. Evaluating holistic wealth requires balancing measurable economic indicators with qualitative factors such as health, happiness, and purpose.

Key Differences: Net Worth vs True Wealth

Net worth quantifies financial assets minus liabilities, offering a snapshot of economic value, while true wealth encompasses intangible factors like health, happiness, social connections, and personal fulfillment. Net worth focuses on measurable monetary resources, but true wealth integrates emotional well-being, life satisfaction, and quality of relationships for a holistic evaluation. Understanding key differences between net worth and true wealth enables more comprehensive assessments beyond balance sheets to include overall life prosperity.

Financial Health vs Holistic Well-being

Net worth quantifies financial health by calculating the difference between assets and liabilities, serving as a key indicator of monetary stability. True wealth encompasses holistic well-being, integrating physical health, emotional fulfillment, social connections, and financial security to provide a comprehensive evaluation of an individual's overall prosperity. Focusing solely on net worth overlooks critical dimensions of life satisfaction and personal development that contribute to true wealth.

Assets, Liabilities, and Life Satisfaction

Net worth measures financial assets minus liabilities, providing a snapshot of monetary standing but omitting intangible aspects like life satisfaction and personal well-being. True wealth incorporates both net worth and qualitative factors such as health, relationships, and overall happiness to offer a holistic evaluation of an individual's prosperity. Assessing assets, liabilities, and life satisfaction together ensures a comprehensive understanding of financial and emotional well-being.

Measuring Success: Quantitative vs Qualitative Metrics

Net worth provides a quantitative measure of financial success by calculating the total assets minus liabilities, while true wealth encompasses qualitative factors such as emotional well-being, personal fulfillment, and social connections. Holistic evaluation of success requires integrating both tangible financial metrics and intangible life satisfaction indicators to capture a complete picture of prosperity. Prioritizing only net worth can overlook key dimensions of true wealth that contribute to long-term happiness and sustainable success.

The Role of Mindset in Wealth Creation

Net worth quantifies financial assets minus liabilities, but true wealth encompasses emotional well-being, relationships, and personal fulfillment. A growth mindset fosters resilience and proactive financial habits, driving sustainable wealth creation beyond mere numbers. Emphasizing mindset shifts the focus from accumulation to meaningful prosperity, integrating mental and material dimensions in holistic wealth evaluation.

Long-term Security vs Short-term Riches

Net worth reflects the quantifiable assets and liabilities at a given time, offering a snapshot of financial health, while true wealth encompasses long-term security, including intangible factors like emotional well-being, relationships, and personal fulfillment. Evaluating net worth alone may emphasize short-term riches but overlooks sustainable income streams, resilience against economic volatility, and holistic life satisfaction. Prioritizing true wealth encourages strategies that balance asset growth with enduring stability and comprehensive well-being for lasting prosperity.

Integrating Values with Financial Planning

Net worth quantifies financial assets minus liabilities, emphasizing monetary value, while true wealth encompasses intangible elements such as personal values, relationships, and well-being. Integrating individual values with financial planning fosters holistic evaluation by aligning investment strategies with long-term life goals and ethical priorities. This comprehensive approach enhances not only financial stability but also overall life satisfaction and purpose.

Practical Steps for Holistic Wealth Evaluation

Evaluating net worth provides a snapshot of financial assets minus liabilities, but true wealth encompasses intangible factors like health, relationships, and personal fulfillment. Practical steps for holistic wealth evaluation include tracking financial metrics alongside physical well-being, emotional satisfaction, and time freedom. Incorporating tools such as journaling wellness habits, setting life satisfaction goals, and regularly reviewing both monetary and non-monetary wealth indicators ensures a comprehensive view of true wealth beyond mere net worth calculations.

Related Important Terms

Holistic Wealth Index

The Holistic Wealth Index incorporates financial assets, social connections, physical health, and environmental capital to provide a comprehensive evaluation that transcends traditional net worth calculations. This approach captures true wealth by integrating tangible and intangible factors, offering a multidimensional measure of an individual's overall well-being and sustainable prosperity.

Net Worth 2.0

Net Worth 2.0 incorporates tangible and intangible assets, debt, and human capital to provide a holistic evaluation beyond traditional net worth measures focused solely on financial assets. This comprehensive approach enables clearer insights into true wealth by accounting for future earning potential, social capital, and personal well-being factors.

Wealth Health Score

Net worth quantifies total financial assets minus liabilities, offering a snapshot of monetary value, while true wealth encompasses intangible factors such as health, relationships, and personal fulfillment, providing a holistic evaluation of an individual's overall prosperity. The Wealth Health Score integrates financial metrics with wellness indicators to deliver a comprehensive assessment of both economic stability and life quality.

True Wealth Quotient

True Wealth Quotient (TWQ) offers a comprehensive assessment of financial health by incorporating assets, liabilities, personal well-being, and sustainable growth factors beyond traditional net worth calculations. Evaluating TWQ provides a holistic perspective that balances monetary value with long-term financial stability, emotional fulfillment, and social impact.

Purpose-Driven Net Worth

Purpose-driven net worth integrates financial assets with meaningful impact, offering a holistic evaluation of true wealth that transcends mere monetary value. This approach aligns personal values and social contributions with asset accumulation, redefining wealth as a measure of life purpose and legacy.

Well-being Capital

Net worth quantifies financial assets minus liabilities, but true wealth encompasses Well-being Capital, integrating physical health, emotional resilience, social connections, and environmental quality for a holistic evaluation. Prioritizing Well-being Capital alongside net worth offers a comprehensive understanding of sustainable prosperity and life satisfaction.

Value-Based Net Worth

Value-Based Net Worth integrates tangible assets with intangible factors such as personal well-being, social impact, and sustainable practices, providing a holistic evaluation beyond traditional financial net worth. This approach emphasizes long-term economic resilience and meaningful wealth by aligning financial metrics with individual values and societal contributions.

Emotional Equity

Net worth quantifies financial assets minus liabilities, but true wealth encompasses Emotional Equity--the value derived from relationships, personal fulfillment, and mental well-being--offering a holistic evaluation of an individual's overall prosperity. Prioritizing Emotional Equity alongside net worth leads to a more balanced and meaningful measure of wealth beyond monetary metrics alone.

Legacy-Adjusted Wealth

Net worth quantifies an individual's financial assets minus liabilities, while True Wealth incorporates non-financial factors, emphasizing Legacy-Adjusted Wealth which accounts for wealth's sustainable impact across generations. This holistic evaluation captures both tangible capital and the enduring value passed on, reflecting deeper financial health and intergenerational prosperity.

Fulfillment Factor

Net worth quantifies financial assets and liabilities, but true wealth encompasses the Fulfillment Factor, integrating emotional well-being, life satisfaction, and purposeful living for a holistic evaluation. Focusing solely on financial metrics overlooks intangible elements that significantly contribute to genuine wealth and long-term happiness.

Net worth vs True wealth for holistic evaluation Infographic

moneydiff.com

moneydiff.com