Net worth represents the total value of all your assets minus liabilities, providing a comprehensive snapshot of your financial health. Liquid net worth, however, focuses solely on assets that can be quickly converted into cash without significant loss, such as savings accounts and stocks. Understanding the difference helps prioritize financial planning by highlighting accessible funds for emergencies and immediate expenses.

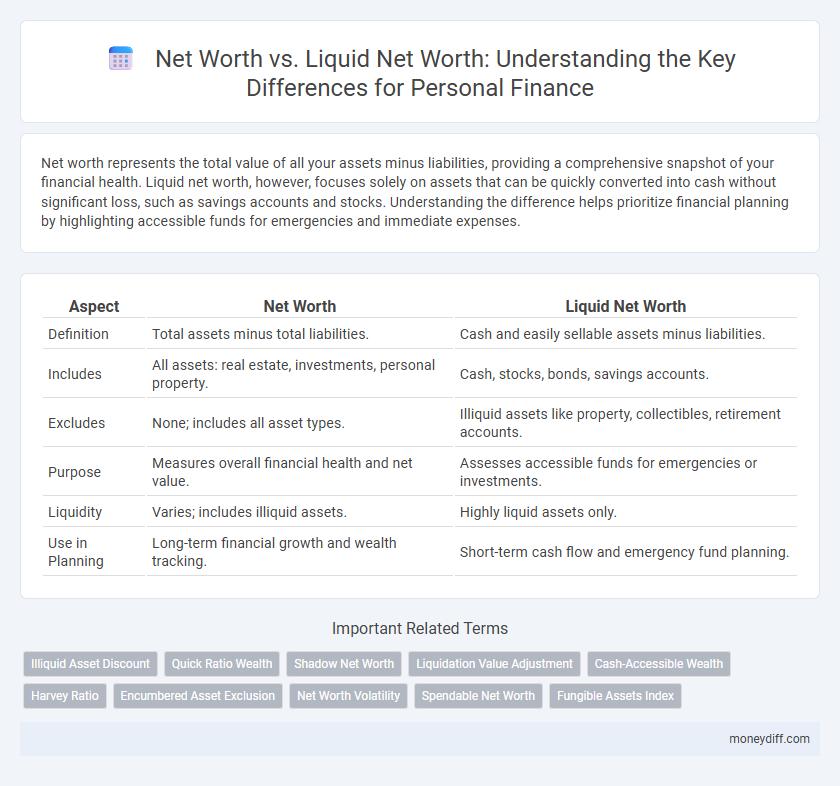

Table of Comparison

| Aspect | Net Worth | Liquid Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities. | Cash and easily sellable assets minus liabilities. |

| Includes | All assets: real estate, investments, personal property. | Cash, stocks, bonds, savings accounts. |

| Excludes | None; includes all asset types. | Illiquid assets like property, collectibles, retirement accounts. |

| Purpose | Measures overall financial health and net value. | Assesses accessible funds for emergencies or investments. |

| Liquidity | Varies; includes illiquid assets. | Highly liquid assets only. |

| Use in Planning | Long-term financial growth and wealth tracking. | Short-term cash flow and emergency fund planning. |

Understanding Net Worth: The Basics

Net worth represents the total value of all assets owned, including real estate, investments, and personal property, minus any liabilities such as loans and credit card debt. Liquid net worth specifically measures the portion of assets readily convertible to cash without significant loss, like checking accounts, savings, and marketable securities. Understanding the difference between net worth and liquid net worth is crucial for accurate financial planning and assessing immediate financial flexibility.

What Is Liquid Net Worth?

Liquid net worth refers to the portion of an individual's total net worth that is readily accessible in cash or can be quickly converted to cash without significant loss of value. Unlike total net worth, which includes illiquid assets like real estate and retirement accounts, liquid net worth emphasizes financial flexibility and immediate purchasing power. Understanding liquid net worth is essential for effective personal finance management, emergency planning, and short-term investment opportunities.

Key Differences Between Net Worth and Liquid Net Worth

Net worth represents the total value of all assets minus liabilities, encompassing real estate, investments, and personal possessions, while liquid net worth includes only assets easily convertible to cash without significant loss in value. Key differences lie in liquidity and accessibility; liquid net worth provides a clearer picture of available funds for emergencies or immediate expenses compared to the broader, less liquid net worth. Understanding these distinctions helps individuals make informed financial decisions and better manage cash flow and investment strategies.

How to Calculate Your Net Worth

Calculate your net worth by subtracting total liabilities from total assets, including real estate, investments, and personal property. Liquid net worth focuses on assets readily convertible to cash, such as checking accounts, savings accounts, and marketable securities, excluding illiquid items like property and retirement accounts. Tracking both net worth and liquid net worth provides a comprehensive view of financial health and liquidity for effective personal finance management.

How to Calculate Your Liquid Net Worth

Liquid net worth is calculated by subtracting all liquid liabilities from liquid assets, which include cash, checking and savings accounts, stocks, bonds, and other easily convertible investments. Unlike total net worth, which considers all assets including real estate and retirement accounts, liquid net worth focuses solely on assets that can be quickly accessed or sold without significant loss of value. To determine your liquid net worth, sum the values of your liquid assets and then deduct any short-term debts or obligations.

Why Liquid Net Worth Matters in Personal Finance

Liquid net worth reflects the readily accessible cash and assets that can be quickly converted to cash, playing a crucial role in managing emergencies and immediate expenses. Unlike total net worth, which includes illiquid assets such as real estate and retirement accounts, liquid net worth provides a realistic picture of financial flexibility and short-term financial health. Prioritizing liquid net worth enables better cash flow management, quicker investment opportunities, and enhanced financial security in personal finance planning.

When to Focus on Net Worth vs. Liquid Net Worth

Net worth represents the total value of all assets minus liabilities, offering a comprehensive snapshot of overall financial health, while liquid net worth focuses exclusively on assets that can be quickly converted to cash, such as savings accounts and marketable securities. Prioritize net worth when evaluating long-term financial goals like retirement planning or home equity growth, as it accounts for illiquid assets like property and retirement accounts. Shift focus to liquid net worth when facing short-term financial needs or emergency planning, ensuring sufficient accessible funds to cover unexpected expenses without disrupting investment strategies.

Impact of Assets on Net Worth and Liquidity

Assets such as real estate and retirement accounts significantly boost net worth but often lack immediate liquidity, creating a gap between net worth and liquid net worth. Liquid net worth, comprised of cash, stocks, and other easily convertible investments, directly impacts an individual's ability to cover short-term expenses and emergencies. Balancing high-value illiquid assets with sufficient liquid assets ensures financial stability and flexibility in personal finance management.

Strategies to Improve Liquid Net Worth

Improving liquid net worth requires focusing on increasing cash savings, investing in highly liquid assets like money market funds, and reducing liabilities with high-interest rates. Prioritizing emergency funds and regularly reallocating portfolio assets toward liquid investments enhances financial flexibility for unexpected expenses. Consistent monitoring and minimizing illiquid holdings such as real estate or retirement accounts ensure faster access to funds and better cash flow management.

Net Worth vs. Liquid Net Worth: Which Metric to Prioritize?

Net worth represents the total value of all assets minus liabilities, providing a comprehensive snapshot of personal financial health. Liquid net worth focuses on assets that can be quickly converted to cash, such as savings, stocks, and bonds, excluding illiquid items like real estate or retirement accounts. Prioritizing liquid net worth offers a clearer picture of immediate financial flexibility and emergency fund availability, while net worth is essential for long-term wealth assessment.

Related Important Terms

Illiquid Asset Discount

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically accounts for assets that can be quickly converted to cash without significant loss. Illiquid asset discount reflects the reduced value attributed to assets such as real estate or private equity, recognizing their limited marketability and the time required to convert them into liquid funds.

Quick Ratio Wealth

Quick Ratio Wealth emphasizes liquid net worth by measuring assets easily convertible to cash against immediate liabilities, offering a clear snapshot of personal financial health. Unlike total net worth, which includes illiquid assets like real estate, this ratio provides a more accurate assessment of short-term financial stability and liquidity.

Shadow Net Worth

Shadow Net Worth represents the portion of an individual's net worth that is illiquid or not easily accessible, such as real estate equity, private investments, and retirement accounts, contrasting with Liquid Net Worth which includes cash and assets quickly convertible to cash. Understanding Shadow Net Worth is crucial for comprehensive personal finance planning, as it influences long-term wealth stability and liquidity management.

Liquidation Value Adjustment

Liquid net worth represents the portion of total net worth that can be quickly converted into cash without significant loss of value, emphasizing assets with high liquidity such as cash, stocks, and savings. Liquidation value adjustment accounts for potential discounts or costs incurred when converting illiquid assets like real estate or private equity into cash, providing a more accurate measure of accessible financial resources in personal finance.

Cash-Accessible Wealth

Net worth represents the total value of all assets minus liabilities, encompassing illiquid items like real estate and retirement accounts, while liquid net worth specifically measures cash-accessible wealth readily available for immediate expenses or investments. Focusing on liquid net worth provides a clearer picture of financial flexibility and emergency readiness by highlighting funds that can be quickly converted to cash without penalties or delays.

Harvey Ratio

Net worth represents the total value of personal assets minus liabilities, while liquid net worth specifically measures cash or assets easily converted to cash, crucial for evaluating financial flexibility. The Harvey Ratio, used in personal finance, assesses risk-adjusted returns by comparing expected portfolio gains to downside risk, helping individuals optimize asset allocation between net and liquid net worth for improved financial stability.

Encumbered Asset Exclusion

Net worth calculates total assets minus liabilities, including encumbered assets like mortgaged properties, while liquid net worth excludes encumbered assets to reflect readily accessible funds for immediate use. Focusing on encumbered asset exclusion gives a clearer picture of financial liquidity and solvency in personal finance.

Net Worth Volatility

Net worth volatility measures fluctuations in the total value of assets minus liabilities, while liquid net worth focuses solely on easily accessible cash or assets convertible to cash without significant loss. High net worth volatility often indicates exposure to less liquid or more volatile investments, impacting financial stability and liquidity planning.

Spendable Net Worth

Spendable net worth represents the portion of total net worth that is readily accessible as liquid assets, excluding illiquid investments like real estate or retirement accounts. Focusing on spendable net worth provides a clear picture of immediate financial flexibility and available cash for emergencies, purchases, or investments in personal finance planning.

Fungible Assets Index

Net worth measures the total value of all personal assets minus liabilities, while liquid net worth specifically considers assets that can be quickly converted to cash without significant loss, emphasizing the Fungible Assets Index as a key metric for assessing liquidity and financial flexibility. Understanding the Fungible Assets Index helps individuals optimize investment strategies and maintain sufficient access to funds for emergencies or opportunities.

Net worth vs Liquid net worth for personal finance. Infographic

moneydiff.com

moneydiff.com