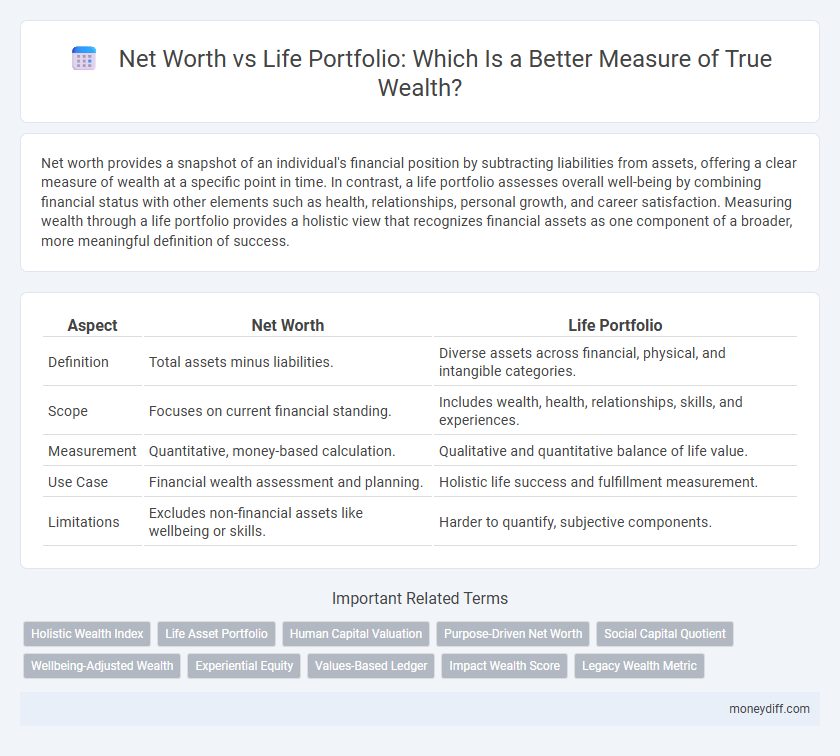

Net worth provides a snapshot of an individual's financial position by subtracting liabilities from assets, offering a clear measure of wealth at a specific point in time. In contrast, a life portfolio assesses overall well-being by combining financial status with other elements such as health, relationships, personal growth, and career satisfaction. Measuring wealth through a life portfolio provides a holistic view that recognizes financial assets as one component of a broader, more meaningful definition of success.

Table of Comparison

| Aspect | Net Worth | Life Portfolio |

|---|---|---|

| Definition | Total assets minus liabilities. | Diverse assets across financial, physical, and intangible categories. |

| Scope | Focuses on current financial standing. | Includes wealth, health, relationships, skills, and experiences. |

| Measurement | Quantitative, money-based calculation. | Qualitative and quantitative balance of life value. |

| Use Case | Financial wealth assessment and planning. | Holistic life success and fulfillment measurement. |

| Limitations | Excludes non-financial assets like wellbeing or skills. | Harder to quantify, subjective components. |

Understanding Net Worth: A Traditional Approach

Net worth, calculated as the difference between total assets and liabilities, serves as a traditional benchmark for measuring individual wealth. Unlike a life portfolio, which encompasses intangible assets such as skills, relationships, and personal growth, net worth provides a quantifiable snapshot of financial standing at a given time. This conventional metric remains crucial for assessing financial health, creditworthiness, and long-term wealth accumulation strategies.

What Is a Life Portfolio?

A Life Portfolio encompasses all assets that contribute to an individual's overall well-being and future wealth, including financial investments, human capital, and social relationships. Unlike net worth, which focuses solely on financial assets minus liabilities, a Life Portfolio provides a holistic view of one's true wealth by integrating income potential, health, education, and community support. This comprehensive approach enables better long-term financial planning and personal development strategies.

Key Differences Between Net Worth and Life Portfolio

Net worth quantifies an individual's financial value by subtracting total liabilities from total assets, providing a snapshot of current economic standing. Life portfolio encompasses a broader spectrum, integrating financial assets, human capital, relationships, health, and personal growth to reflect overall life wealth and potential. Unlike net worth, which is purely monetary, a life portfolio offers a holistic approach to measuring true wealth across multiple dimensions.

The Limitations of Net Worth as a Wealth Metric

Net worth, calculated as total assets minus liabilities, offers a static snapshot but fails to capture dynamic aspects like income streams, human capital, and future earning potential essential for comprehensive wealth measurement. Life portfolio encompasses a broader spectrum including financial capital, social capital, health, and skills, thus providing a more holistic view of an individual's true economic value and resilience. Relying solely on net worth overlooks critical intangible assets and lifecycle variations that influence long-term financial stability and wellbeing.

Holistic Wealth Measurement: Why Life Portfolio Matters

Net worth captures financial assets minus liabilities but overlooks non-financial elements crucial for comprehensive wealth assessment. A life portfolio integrates financial resources, health, relationships, skills, and personal growth, offering a holistic view of true wealth. Measuring wealth through a life portfolio supports balanced decision-making and sustainable long-term prosperity.

Components Included in a Life Portfolio

A life portfolio encompasses a broader range of assets compared to net worth, including financial wealth, human capital, social capital, and physical assets. Human capital reflects future earning potential, while social capital involves valuable relationships and networks contributing to overall wealth. Physical assets such as health and skills are integral, making a life portfolio a more comprehensive measure of true wealth beyond mere financial net worth.

Calculating Your Net Worth vs Life Portfolio Value

Calculating your net worth involves summing total assets such as cash, investments, real estate, and deducting liabilities like loans and mortgages, providing a snapshot of financial standing at a specific point. In contrast, evaluating your life portfolio value considers not only financial assets but also intangible elements like skills, relationships, and experiences that contribute to long-term wealth and personal fulfillment. Focusing solely on net worth overlooks holistic wealth measurement, whereas integrating a life portfolio offers a comprehensive view of overall value and potential growth.

Impact on Financial Planning: Net Worth vs Life Portfolio

Net worth provides a snapshot of an individual's financial position by subtracting liabilities from assets, serving as a critical metric for budgeting and debt management. In contrast, a life portfolio encompasses broader dimensions such as career goals, health, and personal values, offering a holistic approach to wealth measurement that influences long-term financial planning and risk management. Integrating both metrics allows for a comprehensive strategy that balances tangible assets with qualitative factors essential for sustainable financial well-being.

Which Metric Reflects True Wealth?

Net worth quantifies tangible and financial assets minus liabilities, providing a snapshot of immediate financial standing. Life portfolio expands beyond net worth by incorporating intangible assets such as skills, health, relationships, and personal growth, reflecting long-term wealth and well-being. Measuring true wealth requires balancing these metrics, recognizing net worth's focus on financial capital and life portfolio's holistic perspective on personal value.

Choosing the Right Approach for Your Wealth Journey

Net worth provides a snapshot of an individual's financial position by subtracting liabilities from assets, offering a clear measurement of current wealth. Life portfolio, on the other hand, encompasses a broader perspective including non-financial assets such as health, relationships, and personal fulfillment, reflecting overall life value. Selecting the right approach involves aligning measurement methods with personal goals and priorities to create a comprehensive strategy for long-term wealth and well-being.

Related Important Terms

Holistic Wealth Index

The Holistic Wealth Index integrates net worth with life portfolio elements such as health, relationships, and personal growth to provide a comprehensive measurement of overall wealth. This approach offers a broader perspective than traditional net worth by capturing non-financial assets that contribute to long-term well-being and financial security.

Life Asset Portfolio

Life Asset Portfolio provides a comprehensive approach to wealth measurement by encompassing tangible and intangible assets such as skills, experiences, relationships, and personal well-being beyond traditional financial net worth calculations. This holistic perspective captures both economic value and intrinsic personal growth, offering a more accurate representation of overall wealth and long-term financial stability.

Human Capital Valuation

Human capital valuation integrates skills, experience, and earning potential into wealth measurement, complementing traditional net worth calculations centered on assets and liabilities. Life portfolio analysis expands this approach by quantifying intangible assets, emphasizing holistic financial planning beyond mere asset accumulation.

Purpose-Driven Net Worth

Purpose-driven net worth measures wealth by aligning financial assets with personal values and long-term goals, emphasizing meaningful impact rather than mere asset accumulation. This approach integrates life portfolio elements--such as health, relationships, and personal fulfillment--offering a holistic view of true wealth beyond traditional net worth calculations.

Social Capital Quotient

Net worth provides a snapshot of financial assets and liabilities, while Life Portfolio wealth measurement encompasses a broader view, including Social Capital Quotient (SCQ), which quantifies the value derived from social relationships and networks. Incorporating SCQ highlights the impact of social connections on overall wealth, recognizing that trust, influence, and community engagement contribute significantly to long-term financial and personal success.

Wellbeing-Adjusted Wealth

Wellbeing-Adjusted Wealth expands traditional net worth by integrating financial assets with health, social connections, and personal fulfillment metrics, providing a holistic measure of an individual's true wealth. This life portfolio approach captures not only monetary value but also the quality of life factors that drive sustainable wellbeing and long-term prosperity.

Experiential Equity

Experiential Equity emphasizes the value of accumulated life experiences, personal growth, and skills as integral components of wealth beyond traditional net worth metrics. Measuring wealth through a Life Portfolio incorporates both financial assets and experiential equity, offering a comprehensive view of an individual's true economic and personal capital.

Values-Based Ledger

Net worth measures financial assets minus liabilities, focusing on monetary value, whereas a Values-Based Ledger within a Life Portfolio incorporates personal values, social impact, and non-financial assets for a holistic wealth assessment. This approach captures emotional well-being, relationships, and contributions to community, offering a comprehensive view beyond traditional net worth metrics.

Impact Wealth Score

Impact Wealth Score offers a more comprehensive metric than traditional net worth by incorporating social, environmental, and financial assets into wealth measurement. This holistic Life Portfolio approach reflects true wealth through impact investments, philanthropic activities, and sustainable assets, providing a multidimensional view beyond mere monetary value.

Legacy Wealth Metric

Legacy Wealth Metric integrates net worth and life portfolio by quantifying not only financial assets but also the impact of intangible assets such as skills, relationships, and experiences, offering a comprehensive wealth measurement. This approach surpasses traditional net worth calculations by emphasizing sustainable, multi-generational value aligned with long-term life goals and family legacy.

Net worth vs Life portfolio for wealth measurement. Infographic

moneydiff.com

moneydiff.com