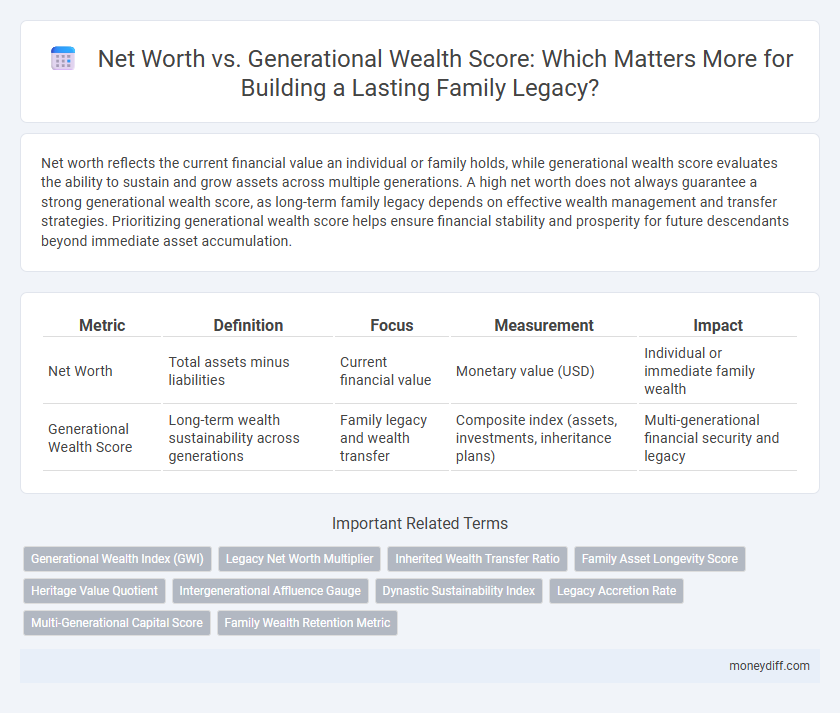

Net worth reflects the current financial value an individual or family holds, while generational wealth score evaluates the ability to sustain and grow assets across multiple generations. A high net worth does not always guarantee a strong generational wealth score, as long-term family legacy depends on effective wealth management and transfer strategies. Prioritizing generational wealth score helps ensure financial stability and prosperity for future descendants beyond immediate asset accumulation.

Table of Comparison

| Metric | Definition | Focus | Measurement | Impact |

|---|---|---|---|---|

| Net Worth | Total assets minus liabilities | Current financial value | Monetary value (USD) | Individual or immediate family wealth |

| Generational Wealth Score | Long-term wealth sustainability across generations | Family legacy and wealth transfer | Composite index (assets, investments, inheritance plans) | Multi-generational financial security and legacy |

Understanding Net Worth: The Basics

Net worth represents the total value of an individual's assets minus liabilities, serving as a snapshot of financial health. Generational wealth score measures the ability to pass wealth across multiple generations, reflecting long-term financial stability and family legacy. Understanding net worth is essential for building generational wealth by managing assets, debts, and investments strategically to ensure lasting family prosperity.

Defining Generational Wealth Score

Generational Wealth Score measures a family's ability to transfer assets, financial stability, and economic influence across multiple generations, reflecting long-term legacy beyond immediate net worth. It incorporates factors such as asset diversification, estate planning, education, and entrepreneurial ventures that sustain wealth growth over time. This score provides a more comprehensive perspective on enduring family prosperity compared to a snapshot of net worth alone.

Net Worth vs Generational Wealth: Key Differences

Net worth measures an individual's current financial assets minus liabilities, providing a snapshot of personal wealth at a given time. Generational wealth score evaluates the ability of a family to sustain and grow assets across multiple generations, emphasizing long-term financial stability and legacy building. Key differences lie in the time horizon and purpose: net worth focuses on immediate financial value, while generational wealth prioritizes enduring wealth transfer and family legacy preservation.

Measuring Family Financial Health

Net worth provides a snapshot of an individual's or family's current financial position, calculated by subtracting liabilities from assets. Generational wealth score evaluates the sustainability and transferability of assets across multiple generations, reflecting long-term family financial health and legacy preservation. Measuring both metrics together offers a comprehensive view of a family's financial stability and potential for enduring wealth.

Assessing Long-Term Wealth Transfer

Assessing long-term wealth transfer requires a clear distinction between net worth and generational wealth score, with net worth representing the current financial snapshot and generational wealth score evaluating the potential for sustained wealth across multiple family generations. Effective transfer strategies emphasize asset diversification, estate planning, and education to preserve family legacy and maximize generational wealth score. Tracking these metrics enables families to identify gaps in wealth preservation and implement practices that support enduring financial security.

Strategies to Boost Net Worth and Legacy

Maximizing net worth through diversified investments and consistent savings lays a strong foundation for generational wealth and enduring family legacy. Utilizing tax-efficient strategies, estate planning, and trusts ensures the wealth is preserved and effectively transferred across generations. Financial education and family governance structures empower heirs to consistently grow and protect the accumulated assets, enhancing both net worth and the legacy score.

Tools for Tracking Generational Wealth Score

Tools for tracking generational wealth score offer detailed insights into a family's net worth trajectory over multiple generations, enabling precise measurement of financial growth and sustainability. Platforms like wealth management software and specialized legacy tracking apps analyze assets, liabilities, and investment performance to quantify generational wealth preservation and expansion. Incorporating these tools helps families make informed decisions to maintain and enhance their long-term financial legacy.

Pitfalls in Building Family Wealth

Net worth often provides a snapshot of current financial status, but generational wealth score measures the sustainability of assets passed down over time, highlighting potential pitfalls such as inadequate estate planning and asset dissolution. Families face challenges like poor wealth diversification and lack of financial education, which can erode legacy value despite high net worth. Prioritizing long-term wealth protection strategies helps prevent the depletion of family legacy across generations.

The Role of Assets in Legacy Planning

Assets play a critical role in legacy planning by serving as the foundation for building both net worth and generational wealth score, directly influencing a family's long-term financial stability. Tangible assets such as real estate, investments, and business equity contribute significantly to net worth, while diversified assets can enhance the generational wealth score by ensuring value preservation and growth across generations. Effective management and strategic allocation of these assets maximize wealth transfer efficiency and secure a lasting family legacy.

Creating a Blueprint for Family Financial Success

Net worth provides a snapshot of an individual's current financial standing, while the generational wealth score measures the enduring financial impact across family generations, emphasizing legacy sustainability. Creating a blueprint for family financial success involves strategic asset management, multi-generational investment planning, and wealth transfer mechanisms to maximize growth and preservation. This approach ensures that financial resources not only grow but also support long-term family prosperity beyond immediate net worth metrics.

Related Important Terms

Generational Wealth Index (GWI)

The Generational Wealth Index (GWI) provides a comprehensive measurement of a family's long-term financial health, surpassing net worth by emphasizing wealth transfer efficiency, asset diversification, and intergenerational growth. Higher GWI scores correlate with sustained wealth preservation across generations, highlighting the importance of strategic estate planning and financial education for securing a lasting family legacy.

Legacy Net Worth Multiplier

Legacy Net Worth Multiplier measures how effectively a family's net worth translates into lasting generational wealth by evaluating the growth and preservation of assets across multiple generations. A higher Legacy Net Worth Multiplier indicates a stronger family legacy, reflecting successful wealth management strategies that sustain and amplify financial resources over time.

Inherited Wealth Transfer Ratio

Inherited Wealth Transfer Ratio critically influences generational wealth scores by quantifying the efficiency of asset transmission across family lines. High transfer ratios correlate with sustained net worth growth and stronger family legacy preservation over multiple generations.

Family Asset Longevity Score

Family Asset Longevity Score measures the durability of net worth across generations, reflecting how effectively a family's wealth sustains and grows over time. This score outperforms traditional generational wealth metrics by emphasizing asset preservation, strategic investment, and wealth transfer mechanisms that secure long-term family legacy.

Heritage Value Quotient

The Heritage Value Quotient (HVQ) offers a nuanced measurement of generational wealth by quantifying the preservation and growth of family legacy beyond mere net worth, emphasizing the sustainability of assets and cultural capital. Unlike traditional net worth assessments, HVQ integrates long-term wealth transmission factors, ensuring a more comprehensive evaluation of a family's enduring financial and heritage impact.

Intergenerational Affluence Gauge

The Intergenerational Affluence Gauge measures a family's generational wealth score by evaluating assets, investments, and financial behaviors passed down alongside net worth, highlighting the sustainability of long-term family legacy. This metric prioritizes not only current financial standing but also wealth retention and growth across multiple generations.

Dynastic Sustainability Index

The Dynastic Sustainability Index measures the capacity of a family's net worth to generate and preserve wealth across multiple generations, highlighting long-term financial resilience rather than short-term asset accumulation. Families with a high Dynastic Sustainability Index demonstrate superior generational wealth scores, indicating robust strategies in wealth transfer, investment diversification, and governance that ensure enduring family legacy.

Legacy Accretion Rate

Legacy Accretion Rate quantifies the growth velocity of generational wealth by measuring the increase in net worth transferred across family generations. A higher Legacy Accretion Rate indicates effective wealth preservation and accumulation strategies, ensuring sustained financial legacy beyond a single lifetime.

Multi-Generational Capital Score

The Multi-Generational Capital Score measures the ability of a family's net worth to be preserved and grown across multiple generations, emphasizing sustainable wealth transfer and long-term financial resilience. This metric outperforms traditional net worth assessments by accounting for factors like intergenerational asset diversification, legacy investments, and wealth stewardship strategies critical for enduring family legacy.

Family Wealth Retention Metric

Family Wealth Retention Metric assesses the efficiency of converting net worth into enduring generational wealth by measuring the percentage of family assets preserved and grown across multiple generations. High scores indicate successful legacy planning and wealth transfer strategies that sustain and enhance family financial health over time.

Net worth vs Generational wealth score for family legacy. Infographic

moneydiff.com

moneydiff.com