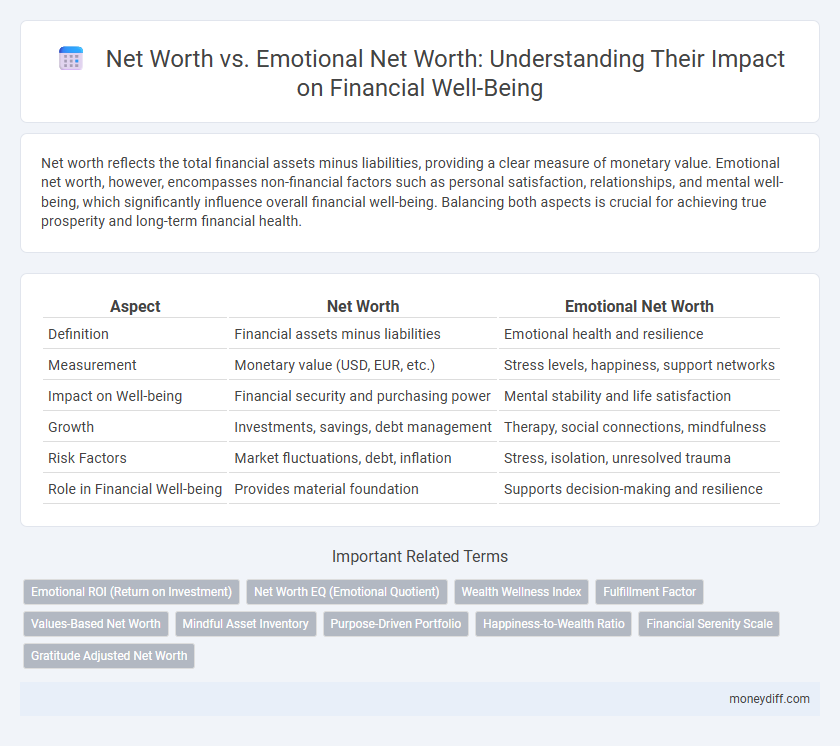

Net worth reflects the total financial assets minus liabilities, providing a clear measure of monetary value. Emotional net worth, however, encompasses non-financial factors such as personal satisfaction, relationships, and mental well-being, which significantly influence overall financial well-being. Balancing both aspects is crucial for achieving true prosperity and long-term financial health.

Table of Comparison

| Aspect | Net Worth | Emotional Net Worth |

|---|---|---|

| Definition | Financial assets minus liabilities | Emotional health and resilience |

| Measurement | Monetary value (USD, EUR, etc.) | Stress levels, happiness, support networks |

| Impact on Well-being | Financial security and purchasing power | Mental stability and life satisfaction |

| Growth | Investments, savings, debt management | Therapy, social connections, mindfulness |

| Risk Factors | Market fluctuations, debt, inflation | Stress, isolation, unresolved trauma |

| Role in Financial Well-being | Provides material foundation | Supports decision-making and resilience |

Understanding Net Worth: The Financial Basics

Net worth represents the total value of an individual's assets minus liabilities, serving as a fundamental indicator of financial health. Emotional net worth reflects personal satisfaction and mental well-being related to financial decisions, influencing long-term economic stability. Recognizing both financial net worth and emotional net worth provides a holistic approach to achieving sustainable financial well-being.

Defining Emotional Net Worth: Beyond the Numbers

Emotional net worth encompasses an individual's psychological and emotional well-being related to their financial status, going beyond traditional financial net worth that measures assets minus liabilities. It includes factors like financial confidence, stress levels, and satisfaction with one's financial decisions, which significantly impact overall financial well-being. Understanding emotional net worth provides a holistic view of wealth, emphasizing mental health and personal fulfillment alongside monetary value.

Net Worth vs Emotional Net Worth: Key Differences

Net worth quantifies financial assets and liabilities, providing a clear measure of an individual's economic standing, while emotional net worth reflects intangible values such as happiness, self-esteem, and personal relationships. Financial well-being depends not only on accumulating assets but also on maintaining emotional resilience and psychological satisfaction. Understanding the difference between net worth and emotional net worth helps create balanced goals that support both material success and mental wellness.

How Emotional Well-being Impacts Financial Health

Emotional well-being significantly influences financial health by affecting decision-making, stress management, and risk tolerance, which directly impact net worth accumulation. Strong emotional resilience enables more disciplined saving habits and better handling of financial setbacks, enhancing overall financial stability. Conversely, poor emotional health can lead to impulsive spending and avoidance of financial planning, undermining long-term net worth growth.

The Interconnection Between Money and Emotions

Net worth represents the financial value of assets minus liabilities, while emotional net worth reflects an individual's psychological and emotional relationship with money. Understanding the interconnection between money and emotions is crucial for holistic financial well-being, as emotional attitudes can significantly influence spending, saving, and investment decisions. Balancing both aspects leads to healthier financial habits and a more stable overall sense of security.

Assessing Your Net Worth: Tools and Techniques

Assessing your net worth involves calculating the total value of assets minus liabilities, using tools like spreadsheets, financial apps, or professional financial advisors to obtain an accurate picture of your financial standing. Emotional net worth, reflecting satisfaction and security with your finances, can be evaluated through self-assessment questionnaires and stress-level tracking related to money management. Combining quantitative net worth analysis with qualitative emotional net worth assessment provides a comprehensive approach to financial well-being.

Measuring Your Emotional Net Worth: Strategies and Tips

Measuring your emotional net worth involves assessing your sense of happiness, resilience, and personal fulfillment alongside financial assets and liabilities. Strategies include journaling your emotional experiences, seeking feedback from trusted individuals, and reflecting on how life events impact your mental and emotional health. Prioritizing emotional well-being enhances overall financial decision-making and long-term stability by balancing tangible wealth with psychological resilience.

Improving Financial Well-being Through Emotional Awareness

Emotional net worth, encompassing self-worth and emotional resilience, plays a crucial role in improving financial well-being by influencing spending habits and long-term financial decisions. Recognizing the connection between emotional health and net worth helps individuals develop healthier money management practices that align with their values and reduce impulsive financial behaviors. Enhancing emotional awareness fosters stronger financial discipline, leading to sustainable wealth accumulation and overall life satisfaction.

Balancing Financial Goals with Emotional Satisfaction

Balancing financial goals with emotional net worth is essential for holistic financial well-being, as net worth measures tangible assets minus liabilities, while emotional net worth reflects personal fulfillment and stress levels related to finances. Prioritizing both can lead to informed decision-making that supports long-term wealth growth and emotional stability. Integrating strategies such as mindful spending, investing in experiences, and setting realistic savings targets enhances overall satisfaction without sacrificing financial security.

Creating a Holistic Approach to Wealth and Happiness

Net worth, representing the total financial assets minus liabilities, provides a quantitative measure of financial health, while emotional net worth reflects one's psychological well-being and resilience in managing financial stress. Integrating emotional net worth into financial planning creates a holistic approach that balances material wealth with mental and emotional fulfillment. This synergy enhances overall financial well-being by fostering sustainable wealth management strategies and promoting a positive mindset toward money and life satisfaction.

Related Important Terms

Emotional ROI (Return on Investment)

Emotional net worth, reflecting the quality of personal relationships and mental well-being, often delivers a higher Emotional ROI than traditional financial net worth by fostering resilience and long-term happiness. Prioritizing emotional assets can amplify overall financial well-being through reduced stress and improved decision-making.

Net Worth EQ (Emotional Quotient)

Net Worth EQ (Emotional Quotient) enhances financial well-being by integrating emotional intelligence with traditional net worth, enabling individuals to make balanced decisions that reflect both monetary value and personal fulfillment. A high Net Worth EQ correlates with improved money management skills, reduced financial stress, and long-term wealth sustainability.

Wealth Wellness Index

Net worth quantifies financial assets minus liabilities, providing a snapshot of economic stability, while emotional net worth reflects personal well-being and satisfaction related to financial decisions. The Wealth Wellness Index integrates both metrics to offer a holistic view of financial well-being, emphasizing the balance between material wealth and emotional health for sustained prosperity.

Fulfillment Factor

Net worth measures financial assets minus liabilities, but emotional net worth reflects personal fulfillment and psychological wealth, which significantly impact overall financial well-being. Prioritizing the Fulfillment Factor promotes resilience and balanced decision-making, enhancing long-term satisfaction beyond mere monetary value.

Values-Based Net Worth

Values-Based Net Worth integrates personal values and emotional satisfaction into traditional net worth calculations, providing a holistic measure of financial well-being that reflects both monetary assets and emotional fulfillment. This approach enhances decision-making by aligning financial goals with individual core values, fostering sustainable wealth and improved mental health.

Mindful Asset Inventory

Mindful Asset Inventory enhances financial well-being by integrating emotional net worth with traditional net worth, recognizing the value of personal experiences, relationships, and mental health alongside monetary assets. This holistic approach enables individuals to make more balanced financial decisions, promoting long-term stability and emotional satisfaction.

Purpose-Driven Portfolio

A purpose-driven portfolio aligns financial assets with personal values to enhance both net worth and emotional net worth, fostering holistic financial well-being. Integrating purpose into investment strategies promotes sustainable wealth growth while supporting mental and emotional fulfillment.

Happiness-to-Wealth Ratio

The Happiness-to-Wealth Ratio highlights the intricate balance between tangible net worth and emotional net worth, emphasizing that financial well-being extends beyond asset accumulation to include personal fulfillment and emotional satisfaction. Understanding this ratio helps individuals optimize both material wealth and psychological happiness for a more holistic approach to prosperity.

Financial Serenity Scale

The Financial Serenity Scale measures financial well-being by balancing traditional net worth with emotional net worth, emphasizing the psychological impact of financial decisions. Emotional net worth reflects feelings of security and satisfaction, which can enhance overall financial stability beyond numerical assets and liabilities.

Gratitude Adjusted Net Worth

Gratitude Adjusted Net Worth integrates emotional well-being by quantifying the impact of gratitude on financial stability, enhancing traditional net worth metrics with psychological wealth factors. This approach offers a holistic view of financial well-being by balancing tangible assets with the intangible benefits of emotional satisfaction and contentment.

Net worth vs Emotional net worth for financial well-being. Infographic

moneydiff.com

moneydiff.com