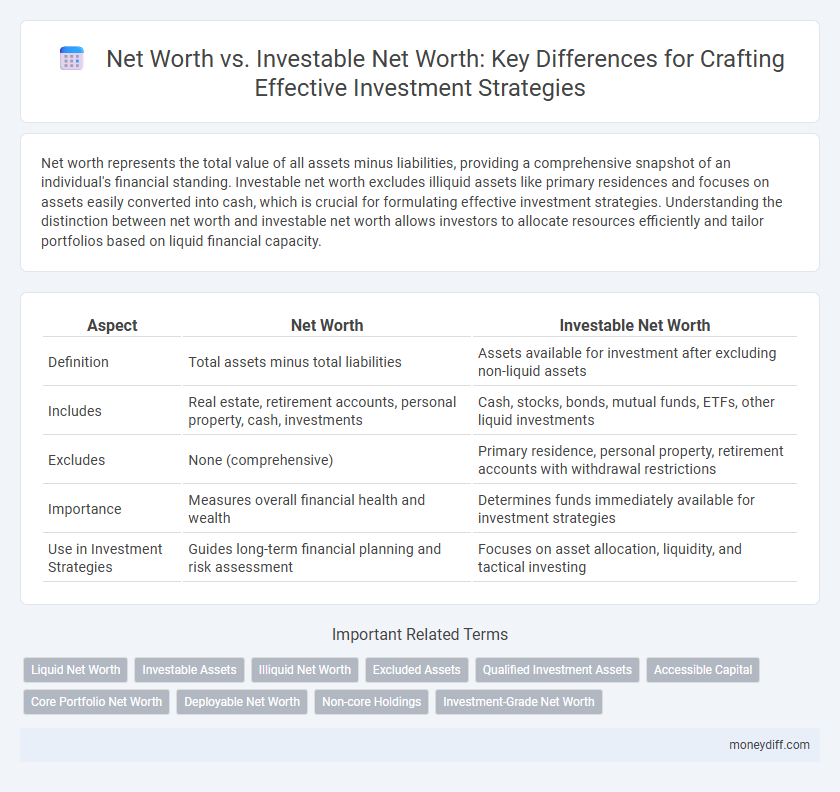

Net worth represents the total value of all assets minus liabilities, providing a comprehensive snapshot of an individual's financial standing. Investable net worth excludes illiquid assets like primary residences and focuses on assets easily converted into cash, which is crucial for formulating effective investment strategies. Understanding the distinction between net worth and investable net worth allows investors to allocate resources efficiently and tailor portfolios based on liquid financial capacity.

Table of Comparison

| Aspect | Net Worth | Investable Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Assets available for investment after excluding non-liquid assets |

| Includes | Real estate, retirement accounts, personal property, cash, investments | Cash, stocks, bonds, mutual funds, ETFs, other liquid investments |

| Excludes | None (comprehensive) | Primary residence, personal property, retirement accounts with withdrawal restrictions |

| Importance | Measures overall financial health and wealth | Determines funds immediately available for investment strategies |

| Use in Investment Strategies | Guides long-term financial planning and risk assessment | Focuses on asset allocation, liquidity, and tactical investing |

Understanding Net Worth: Definition and Components

Net worth represents the total value of an individual's assets minus liabilities, including properties, savings, investments, and debts. Investable net worth specifically refers to the portion of net worth available for investment after excluding illiquid assets like primary residences and personal belongings. Understanding the distinction between total net worth and investable net worth is crucial for developing realistic and effective investment strategies tailored to an investor's liquid resources.

What is Investable Net Worth?

Investable net worth refers to the portion of an individual's total net worth that is readily available for investment purposes, excluding non-liquid assets such as primary residences, personal property, and certain illiquid investments. This metric provides a clearer picture of the financial resources that can be actively deployed in markets, aiding in the formulation of realistic investment strategies and risk management. Investors and financial advisors prioritize investable net worth to tailor asset allocation, portfolio diversification, and liquidity planning effectively.

Key Differences Between Net Worth and Investable Net Worth

Net worth represents the total value of all assets minus liabilities, including non-liquid items like real estate and personal property, whereas investable net worth specifically refers to liquid assets available for investment purposes. Understanding the distinction is crucial for crafting effective investment strategies, as investable net worth directly impacts portfolio allocation and risk management. Investors should focus on investable net worth to gauge true investment capacity and optimize asset diversification.

Why Investable Net Worth Matters in Investment Planning

Investable net worth excludes non-liquid assets like real estate and personal property, providing a clearer picture of funds available for immediate investment opportunities. Focusing on investable net worth allows investors to develop realistic portfolio strategies aligned with accessible capital and risk tolerance. This targeted approach enhances financial planning accuracy and optimizes asset allocation for growth and liquidity needs.

Calculating Your Net Worth vs Investable Net Worth

Calculating your net worth involves summing all assets, including real estate, vehicles, and retirement accounts, then subtracting liabilities like mortgages and loans. Investable net worth focuses specifically on liquid assets available for investment, such as cash, stocks, bonds, and mutual funds, excluding non-liquid items like primary residence and personal property. Understanding the distinction between total net worth and investable net worth is crucial for developing effective investment strategies tailored to your actual available capital.

Impact of Non-Liquid Assets on Net Worth

Non-liquid assets such as real estate, private equity, and collectibles can significantly inflate an individual's net worth but hold limited immediate value for investment strategies compared to investable net worth. Investable net worth excludes these illiquid holdings, providing a clearer picture of the liquid capital available for portfolio diversification and risk management. Understanding the disproportion between total net worth and investable net worth helps in designing realistic investment plans that align with liquidity needs and financial goals.

Aligning Investment Strategies with Investable Net Worth

Investable net worth represents the portion of total net worth readily available for investment after accounting for personal liabilities and illiquid assets, directly influencing the scope and risk tolerance of investment strategies. Aligning investment strategies with investable net worth ensures optimized asset allocation by focusing on liquid resources that can actively generate returns, thereby enhancing portfolio efficiency and growth potential. Tailoring investment approaches based on investable net worth also helps maintain financial flexibility and meet short-term liquidity needs without compromising long-term wealth objectives.

Risk Assessment Based on Investable Net Worth

Investable net worth provides a more precise basis for risk assessment in investment strategies by excluding non-liquid assets like real estate and personal property. This focus allows investors to gauge their actual financial capacity to absorb losses and adjust portfolio risk accordingly. Understanding the divergence between total net worth and investable net worth is critical for tailoring risk tolerance and achieving realistic investment goals.

Portfolio Diversification: Net Worth Considerations

Portfolio diversification strategies hinge significantly on investable net worth rather than total net worth, as investable assets provide the liquid capital available for allocation across different investment vehicles. High total net worth may include illiquid assets like real estate or business equity, which are less flexible for diversification but crucial for overall financial stability. Understanding the proportion of investable net worth allows investors to optimize risk distribution and enhance portfolio resilience in varying market conditions.

Monitoring and Growing Your Investable Net Worth

Investable net worth represents the portion of your total net worth that is readily available for investment, excluding illiquid assets like real estate or personal property. Monitoring trends in your investable net worth enables precise adjustments in investment strategies, optimizing asset allocation and risk management. Regularly growing this figure through disciplined savings, portfolio diversification, and strategic asset rebalancing enhances overall financial health and long-term wealth accumulation.

Related Important Terms

Liquid Net Worth

Investable net worth crucially differs from total net worth by emphasizing liquid assets readily available for investment, excluding illiquid holdings like real estate and private equity. Focusing on liquid net worth enables precise allocation strategies, ensuring optimal asset diversification and risk management tailored to immediate market opportunities.

Investable Assets

Investable net worth refers specifically to the portion of total net worth that is liquid and accessible for investment purposes, excluding illiquid assets like real estate or personal property. Focusing on investable assets enables more precise allocation strategies and risk management tailored to available capital for maximizing portfolio growth and diversification.

Illiquid Net Worth

Investable net worth excludes illiquid net worth, such as real estate or privately held business interests, focusing on assets readily convertible to cash for immediate investments. Understanding the proportion of illiquid net worth is crucial when formulating investment strategies, as it impacts liquidity constraints and portfolio flexibility.

Excluded Assets

Investable net worth excludes non-liquid assets like primary residence, personal property, and certain retirement accounts, focusing instead on liquid and marketable assets available for investment. Understanding the distinction helps tailor investment strategies by highlighting truly accessible funds for diversification and risk management.

Qualified Investment Assets

Qualified Investment Assets represent the portion of net worth readily available for investment, excluding illiquid holdings such as primary residences and personal property. Focusing on investable net worth helps tailor investment strategies by identifying assets that can be actively deployed for portfolio growth and risk management.

Accessible Capital

Investable net worth represents the portion of total net worth available as accessible capital for investment strategies, excluding illiquid assets like real estate and personal property. Focusing on investable net worth provides a clearer view of the funds truly deployable for portfolio diversification and risk management.

Core Portfolio Net Worth

Core Portfolio Net Worth represents the portion of total net worth allocated to liquid, investable assets excluding illiquid holdings like primary residence or business equity. Investment strategies centered on Core Portfolio Net Worth optimize asset allocation and risk management by focusing on readily deployable funds that directly impact portfolio growth and diversification.

Deployable Net Worth

Deployable Net Worth represents the portion of total net worth readily available for investment after accounting for non-liquid assets and essential liabilities. Focusing on Deployable Net Worth enables more accurate investment strategies by targeting funds that can be actively allocated in diversified portfolios to maximize returns.

Non-core Holdings

Non-core holdings, often excluded from investable net worth, can significantly inflate total net worth but may not provide immediate liquidity for investment strategies. Prioritizing investable net worth, which accounts for readily accessible assets, enables more accurate allocation and risk assessment in portfolio management.

Investment-Grade Net Worth

Investment-grade net worth represents the portion of total net worth allocated to high-quality, liquid assets suitable for conservative investment strategies, distinguishing it from overall net worth which includes illiquid or non-investment assets. Focusing on investment-grade net worth enables more accurate risk assessment and portfolio allocation, optimizing investment decisions based on reliable asset valuation and market stability.

Net worth vs Investable net worth for investment strategies. Infographic

moneydiff.com

moneydiff.com