Net worth represents the total financial assets minus liabilities, offering a clear snapshot of one's economic standing. Wisdom net worth, however, incorporates financial knowledge, decision-making skills, and long-term planning into this metric, emphasizing sustainable wealth growth. Focusing on wisdom net worth enhances financial education by promoting smart investments, risk management, and informed money habits that build lasting prosperity.

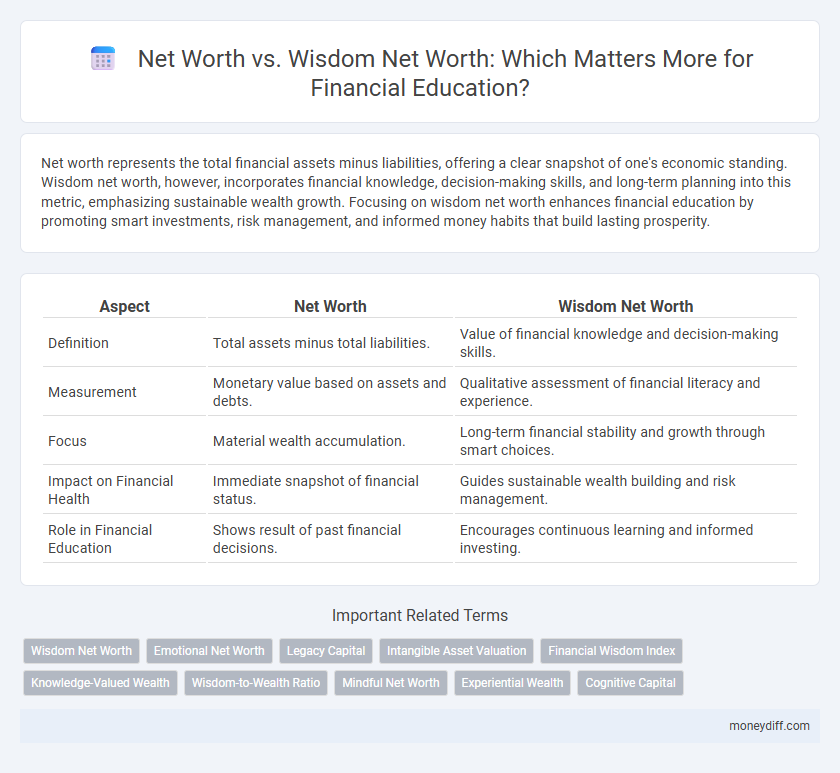

Table of Comparison

| Aspect | Net Worth | Wisdom Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities. | Value of financial knowledge and decision-making skills. |

| Measurement | Monetary value based on assets and debts. | Qualitative assessment of financial literacy and experience. |

| Focus | Material wealth accumulation. | Long-term financial stability and growth through smart choices. |

| Impact on Financial Health | Immediate snapshot of financial status. | Guides sustainable wealth building and risk management. |

| Role in Financial Education | Shows result of past financial decisions. | Encourages continuous learning and informed investing. |

Understanding Net Worth: The Basics

Net worth represents the total value of an individual's assets minus liabilities, serving as a key metric for assessing financial health. Wisdom net worth extends beyond numbers, incorporating financial knowledge, decision-making skills, and emotional intelligence to build sustainable wealth. Understanding net worth basics enables effective budgeting, debt management, and investment strategies critical for long-term financial education.

Defining Wisdom Net Worth: Beyond the Numbers

Wisdom Net Worth extends beyond traditional financial net worth by incorporating knowledge, experience, and informed decision-making into the evaluation of one's overall wealth. It reflects an individual's ability to manage resources wisely, plan for future financial stability, and adapt to changing economic conditions. This holistic approach emphasizes sustainable growth and long-term value rather than just the accumulation of assets.

Net Worth Calculation: Tools and Methods

Calculating net worth involves subtracting total liabilities from total assets, including cash, investments, real estate, and personal property, providing a snapshot of financial health. Tools like net worth calculators and financial software streamline this process by aggregating data from bank accounts, debts, and investments for accurate, real-time tracking. Understanding these methods is essential for financial education, emphasizing practical asset management over abstract wisdom in wealth building.

The Value of Financial Wisdom in Wealth Building

Financial wisdom enhances net worth by enabling informed investment decisions, effective budgeting, and risk management, which compound wealth growth over time. Building financial knowledge helps individuals avoid costly mistakes and leverage opportunities, making net worth a dynamic measure of accumulated assets rather than just static wealth. Emphasizing financial education cultivates habits that sustain and increase net worth, proving that wisdom is a crucial asset in wealth building.

Net Worth vs. Wisdom Net Worth: Key Differences

Net worth quantifies an individual's financial assets minus liabilities, providing a snapshot of monetary value, while wisdom net worth measures accumulated knowledge and experience that guides financial decisions. Unlike net worth, wisdom net worth emphasizes long-term understanding, risk management, and strategic planning to sustainably grow wealth. Balancing both net worth and wisdom net worth is essential for comprehensive financial education and lasting financial success.

How Financial Wisdom Impacts Long-Term Net Worth

Financial wisdom enhances long-term net worth by fostering disciplined saving, strategic investing, and effective risk management. Individuals who apply financial knowledge consistently build wealth through informed decisions that compound over time. This prudent behavior reduces costly mistakes and accelerates the growth of assets, elevating net worth sustainably.

Practical Strategies to Grow Your Net Worth and Wisdom

Growing your net worth requires practical strategies such as consistent saving, diversified investments, and smart debt management, which build financial stability over time. Simultaneously, enhancing financial wisdom involves understanding money management principles, recognizing market trends, and developing critical thinking to make informed decisions. Combining these approaches maximizes wealth accumulation while ensuring long-term financial health and resilience.

The Role of Mindset in Achieving Financial Wellness

Net worth measures financial assets minus liabilities, providing a snapshot of material wealth, while wisdom net worth reflects the value of knowledge and mindset in making sound financial decisions. Developing a growth mindset enhances financial education by promoting disciplined saving, strategic investing, and risk management, which are critical for long-term financial wellness. Emphasizing mindset shifts leads to sustainable wealth accumulation beyond mere monetary metrics.

Common Mistakes: Overvaluing Net Worth, Undervaluing Wisdom

Overvaluing net worth often leads individuals to equate financial success solely with asset accumulation, neglecting the critical role of financial wisdom in managing resources effectively. Undervaluing wisdom results in poor decision-making, increased debt, and missed opportunities for sustainable wealth growth despite having a high net worth. Balancing net worth with financial education and prudent money management strategies fosters long-term financial stability and resilience.

Creating a Balanced Approach: Integrating Wealth and Wisdom

Achieving lasting financial success requires balancing net worth with wisdom by combining asset growth strategies and informed decision-making skills. Prioritizing financial education enhances the ability to manage wealth responsibly, reduce risks, and adapt to economic changes. Integrating quantitative wealth metrics with qualitative insights fosters sustainable prosperity and long-term financial well-being.

Related Important Terms

Wisdom Net Worth

Wisdom Net Worth integrates financial knowledge, emotional intelligence, and decision-making skills to enhance overall wealth beyond mere monetary assets, providing a comprehensive approach to financial education. This concept emphasizes lifelong learning, strategic planning, and informed risk-taking to build sustainable prosperity and resilient financial well-being.

Emotional Net Worth

Emotional net worth, a crucial aspect of financial education, measures the value of emotional well-being and supportive relationships contributing to overall financial stability and decision-making confidence. Unlike traditional net worth, which quantifies monetary assets and liabilities, emotional net worth emphasizes resilience, self-awareness, and stress management in achieving long-term wealth and life satisfaction.

Legacy Capital

Legacy Capital emphasizes that net worth represents the quantifiable financial assets minus liabilities, while wisdom net worth reflects the value of knowledge and financial education accumulated to sustain and grow wealth. Prioritizing wisdom net worth through continuous learning enables individuals to make informed decisions, maximize legacy capital, and create enduring financial security across generations.

Intangible Asset Valuation

Net worth quantifies tangible financial assets and liabilities, while wisdom net worth captures intangible asset valuation such as knowledge, experience, and judgment that drive long-term financial success. Emphasizing intangible assets in financial education enhances decision-making and wealth-building strategies beyond conventional balance sheets.

Financial Wisdom Index

The Financial Wisdom Index measures the effective application of financial knowledge, highlighting that true net worth extends beyond assets to include informed decision-making and long-term financial planning. Individuals with a high Financial Wisdom Index tend to build sustainable wealth by balancing asset growth with financial education and strategic risk management.

Knowledge-Valued Wealth

Net worth quantifies financial assets and liabilities, reflecting material wealth, while wisdom net worth represents the accumulation of knowledge, financial literacy, and decision-making skills that enhance sustainable wealth building. Emphasizing knowledge-valued wealth drives smarter investments, risk management, and long-term financial growth beyond mere monetary metrics.

Wisdom-to-Wealth Ratio

The Wisdom-to-Wealth Ratio measures financial intelligence by comparing an individual's accumulated knowledge and sound decision-making skills against their net worth, highlighting that true financial success relies not solely on asset value but on strategic wisdom to grow and sustain wealth. Higher ratios indicate better financial education and effective money management, emphasizing the importance of continuous learning in maximizing wealth potential.

Mindful Net Worth

Mindful Net Worth emphasizes the alignment of financial assets with personal values and long-term well-being, contrasting traditional net worth calculations that focus solely on monetary wealth. Integrating wisdom into financial education encourages a holistic approach, fostering informed decisions that balance economic growth with mindful living and sustainable financial health.

Experiential Wealth

Experiential wealth emphasizes gaining knowledge through real-life financial decisions, enhancing wisdom that transcends mere net worth calculations. True financial education balances measurable net worth with experiential insights, fostering long-term wealth management and informed investment strategies.

Cognitive Capital

Net worth measures financial assets minus liabilities, reflecting material wealth, whereas Wisdom net worth emphasizes Cognitive Capital--knowledge, experience, and decision-making skills that enhance long-term financial well-being. Prioritizing Cognitive Capital in financial education cultivates strategic thinking and informed choices, driving sustainable wealth growth beyond mere monetary metrics.

Net worth vs Wisdom net worth for financial education. Infographic

moneydiff.com

moneydiff.com