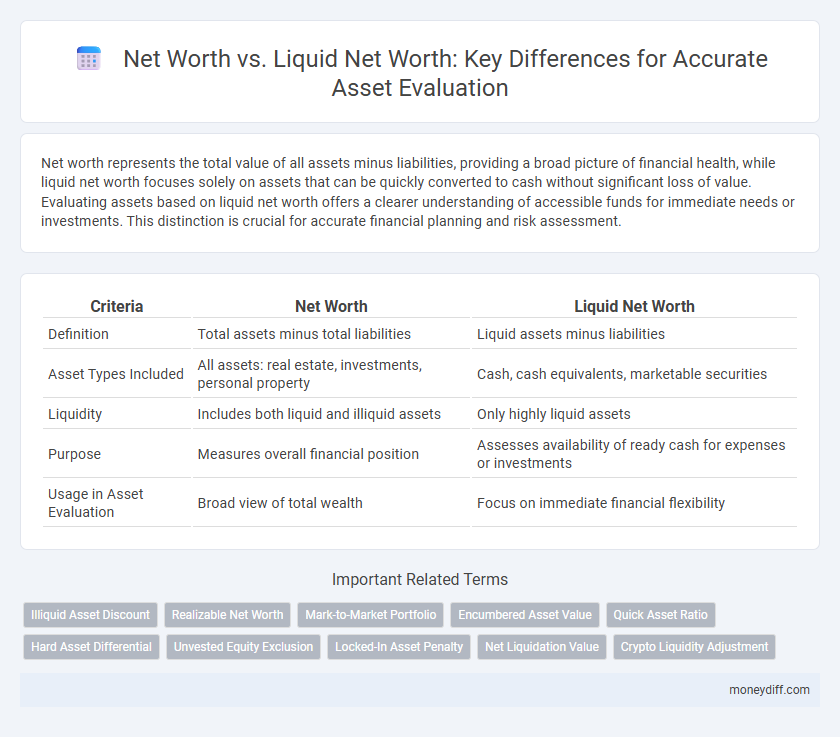

Net worth represents the total value of all assets minus liabilities, providing a broad picture of financial health, while liquid net worth focuses solely on assets that can be quickly converted to cash without significant loss of value. Evaluating assets based on liquid net worth offers a clearer understanding of accessible funds for immediate needs or investments. This distinction is crucial for accurate financial planning and risk assessment.

Table of Comparison

| Criteria | Net Worth | Liquid Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities | Liquid assets minus liabilities |

| Asset Types Included | All assets: real estate, investments, personal property | Cash, cash equivalents, marketable securities |

| Liquidity | Includes both liquid and illiquid assets | Only highly liquid assets |

| Purpose | Measures overall financial position | Assesses availability of ready cash for expenses or investments |

| Usage in Asset Evaluation | Broad view of total wealth | Focus on immediate financial flexibility |

Understanding Net Worth: Definitions and Components

Net worth represents the total value of an individual's assets minus liabilities, encompassing tangible and intangible holdings such as real estate, investments, and debts. Liquid net worth specifically measures assets readily convertible to cash, including savings accounts, stocks, and bonds, excluding illiquid assets like property or retirement accounts. Understanding the distinction between net worth and liquid net worth is essential for accurate asset evaluation and financial planning.

What Is Liquid Net Worth?

Liquid net worth refers to the portion of an individual's total net worth that is easily convertible to cash without significant loss of value, including assets like cash, checking and savings accounts, money market funds, and stocks. Unlike total net worth, which encompasses all assets such as real estate and retirement accounts, liquid net worth provides a more immediate measure of financial flexibility and available funds for emergency needs or investment opportunities. Evaluating liquid net worth is crucial for accurate asset assessment because it reflects accessible wealth rather than illiquid holdings that may require time or penalties to convert.

Key Differences Between Net Worth and Liquid Net Worth

Net worth measures the total value of all assets minus liabilities, including both liquid and illiquid assets like real estate and investments. Liquid net worth focuses solely on assets that can be quickly converted to cash, such as savings, stocks, and bonds, excluding illiquid properties. Understanding these distinctions is crucial for accurate asset evaluation and financial planning, especially when assessing immediate financial flexibility versus overall wealth.

Importance of Measuring Liquid Assets

Measuring liquid net worth is crucial for accurate asset evaluation as it reflects the readily accessible funds available for immediate use, unlike total net worth which includes illiquid assets such as real estate and retirement accounts. Liquid assets provide a clearer picture of financial flexibility and short-term solvency, essential for budgeting, investing, and emergency planning. Prioritizing liquid net worth helps individuals and investors make informed decisions by understanding the true liquidity position beyond overall asset valuation.

How to Calculate Your Net Worth

Net worth is calculated by subtracting total liabilities from total assets, providing a comprehensive snapshot of financial health. Liquid net worth refines this by including only easily accessible assets like cash, stocks, and savings, excluding illiquid items such as real estate or retirement accounts. Understanding both metrics helps evaluate true financial flexibility and guides better asset management decisions.

Calculating Liquid Net Worth: Step-by-Step

Calculating liquid net worth involves identifying all assets that can be quickly converted to cash without significant loss of value, such as checking accounts, savings accounts, stocks, and bonds. Subtract all short-term liabilities like credit card debt and outstanding loans from the total liquid assets to determine the net liquid value. This precise calculation offers a clearer picture of immediately accessible wealth compared to overall net worth, which includes illiquid assets like real estate and retirement accounts.

Why Liquid Net Worth Matters for Financial Planning

Liquid net worth represents the portion of assets readily convertible to cash without significant loss of value, providing a clearer picture of available resources for immediate financial needs or emergencies. Unlike total net worth, which includes illiquid assets like real estate or retirement accounts, liquid net worth highlights financial flexibility and short-term solvency. Evaluating liquid net worth is crucial for effective financial planning, ensuring that individuals can cover unexpected expenses and seize investment opportunities without undue reliance on credit or asset liquidation delays.

Asset Evaluation: Which Metric Should You Use?

Asset evaluation hinges on understanding the distinction between net worth and liquid net worth, with net worth encompassing total assets minus liabilities, while liquid net worth focuses solely on readily accessible assets like cash and marketable securities. Liquid net worth provides a more accurate snapshot of immediate financial flexibility, crucial for assessing short-term financial health or investment capacity. Choosing the appropriate metric depends on your evaluation goals, whether prioritizing overall wealth or liquidity for quick asset mobilization.

Strategies to Improve Liquid Net Worth

Maximizing liquid net worth requires prioritizing assets that can be quickly converted to cash without significant loss of value, such as savings accounts, money market funds, and short-term government bonds. Diversifying investments into highly liquid assets reduces risk and provides immediate access to funds for opportunities or emergencies. Regularly reviewing and reallocating resources away from illiquid holdings like real estate or private equity is essential for maintaining a balanced and accessible financial portfolio.

Net Worth vs Liquid Net Worth: Common Mistakes to Avoid

Confusing net worth with liquid net worth can lead to inaccurate asset evaluation, as net worth includes all assets and liabilities while liquid net worth focuses on assets quickly convertible to cash. Overestimating liquidity by counting illiquid assets like real estate or retirement accounts often impairs financial decision-making. Prioritizing the assessment of liquid net worth ensures more realistic planning for immediate financial needs and emergencies.

Related Important Terms

Illiquid Asset Discount

Net worth represents the total value of all assets minus liabilities, while liquid net worth considers only readily convertible assets into cash. Illiquid asset discount reflects the value reduction applied to assets that cannot be quickly sold, significantly impacting accurate net worth assessment and financial planning.

Realizable Net Worth

Realizable Net Worth represents the portion of total net worth that can be quickly converted into cash, highlighting the difference from overall net worth by focusing on liquidity and immediacy of asset availability. Evaluating assets through Realizable Net Worth offers a clearer picture of financial flexibility compared to liquid net worth, which excludes non-liquid yet valuable holdings.

Mark-to-Market Portfolio

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically measures assets that can be quickly converted to cash without significant loss of value, crucial for accurate asset evaluation in mark-to-market portfolios. Mark-to-market valuation ensures real-time reflection of portfolio value, highlighting the importance of distinguishing between overall net worth and liquid net worth for financial decision-making.

Encumbered Asset Value

Net worth includes the total value of all assets minus liabilities, while liquid net worth specifically measures assets readily convertible to cash, excluding encumbered asset value tied up in collateral or loans. Understanding encumbered asset value is crucial for accurate asset evaluation, as it highlights the portion of net worth not accessible for immediate use or liquidation.

Quick Asset Ratio

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically measures assets that can be quickly converted to cash without significant loss in value. The Quick Asset Ratio, a key financial metric, evaluates liquidity by comparing liquid assets such as cash, marketable securities, and receivables against current liabilities, providing a crucial insight for asset evaluation and short-term financial health.

Hard Asset Differential

Net worth represents the total value of all assets minus liabilities, including both liquid and illiquid holdings, while liquid net worth specifically accounts for assets that can be quickly converted to cash without significant loss. The hard asset differential highlights the disparity in valuation and liquidity between tangible assets like real estate or collectibles and liquid assets, impacting accurate asset evaluation and financial decision-making.

Unvested Equity Exclusion

Net worth represents the total value of assets minus liabilities, while liquid net worth specifically accounts for assets readily convertible to cash, excluding unvested equity which is not immediately accessible or sellable. Excluding unvested equity ensures a more accurate assessment of liquid net worth by reflecting only assets that can be utilized or liquidated without restrictions.

Locked-In Asset Penalty

Net worth includes all assets such as real estate and retirement accounts, while liquid net worth accounts only for assets readily convertible to cash, excluding locked-in assets. Locked-in asset penalty refers to the reduced valuation of inaccessible funds in retirement accounts or other restricted investments when assessing true financial liquidity.

Net Liquidation Value

Net Liquidation Value represents the market value of an individual's or company's assets if sold quickly, providing a realistic measure of liquidity compared to overall Net Worth, which includes all assets regardless of their immediate convertibility. Evaluating Net Liquidation Value offers a more accurate assessment of financial health and risk exposure by highlighting the true cash potential in asset liquidation scenarios.

Crypto Liquidity Adjustment

Net worth represents the total value of all assets minus liabilities, while liquid net worth specifically measures assets that can be quickly converted to cash, which is critical for accurate asset evaluation in volatile markets like cryptocurrency. Crypto liquidity adjustment accounts for the fluctuating liquidity and market depth of digital assets, ensuring a more realistic assessment of net worth by discounting the value of crypto holdings based on their ease of conversion and current market conditions.

Net worth vs Liquid net worth for asset evaluation. Infographic

moneydiff.com

moneydiff.com