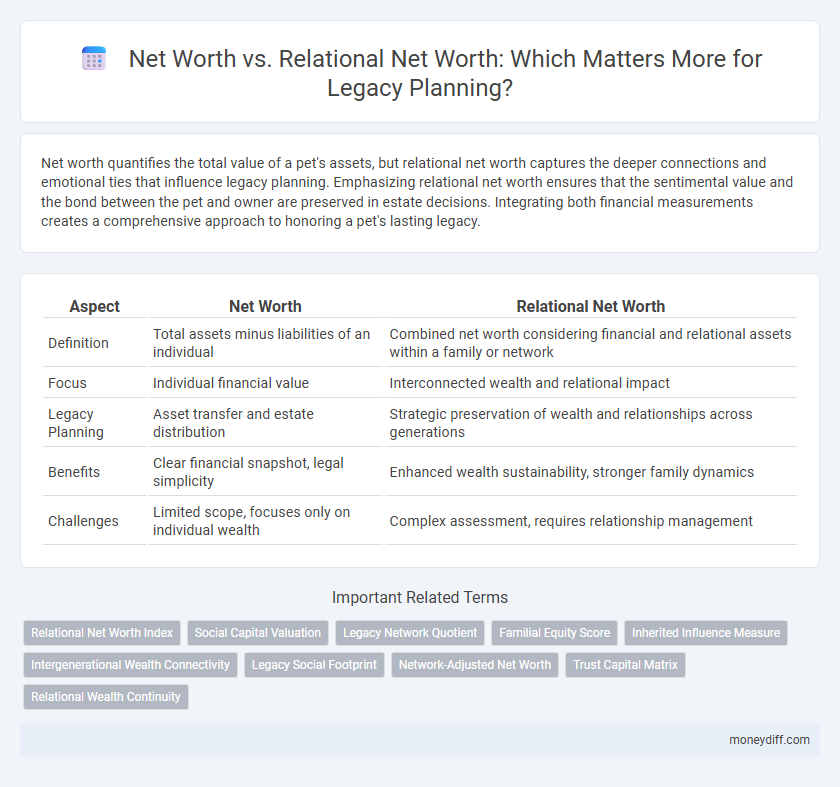

Net worth quantifies the total value of a pet's assets, but relational net worth captures the deeper connections and emotional ties that influence legacy planning. Emphasizing relational net worth ensures that the sentimental value and the bond between the pet and owner are preserved in estate decisions. Integrating both financial measurements creates a comprehensive approach to honoring a pet's lasting legacy.

Table of Comparison

| Aspect | Net Worth | Relational Net Worth |

|---|---|---|

| Definition | Total assets minus liabilities of an individual | Combined net worth considering financial and relational assets within a family or network |

| Focus | Individual financial value | Interconnected wealth and relational impact |

| Legacy Planning | Asset transfer and estate distribution | Strategic preservation of wealth and relationships across generations |

| Benefits | Clear financial snapshot, legal simplicity | Enhanced wealth sustainability, stronger family dynamics |

| Challenges | Limited scope, focuses only on individual wealth | Complex assessment, requires relationship management |

Understanding Net Worth: The Financial Perspective

Net worth represents the total value of an individual's financial assets minus liabilities, serving as a key indicator of financial health and wealth accumulation. Relational net worth extends beyond monetary assets, encompassing the value of relationships, social connections, and influence that can impact legacy planning. Prioritizing both financial net worth and relational net worth creates a comprehensive strategy for wealth preservation and intergenerational wealth transfer.

Defining Relational Net Worth in Modern Legacy Planning

Relational Net Worth in modern legacy planning quantifies the value of intangible assets such as family relationships, social capital, and emotional bonds alongside financial holdings. This approach integrates interpersonal connections and collective well-being into traditional net worth calculations, emphasizing the importance of sustaining legacy beyond monetary wealth. By prioritizing relational net worth, individuals ensure the preservation and growth of family cohesion and long-term social impact across generations.

Why Net Worth Alone Falls Short in Legacy Planning

Net worth alone falls short in legacy planning because it only quantifies tangible assets without considering relational net worth, which includes the value of family dynamics, emotional bonds, and trust that impact the successful transfer of wealth. Ignoring relational net worth can lead to conflicts, miscommunication, and the breakdown of estate intentions despite substantial financial assets. Effective legacy planning requires integrating both net worth and relational net worth to ensure wealth preservation and the fulfillment of familial and philanthropic goals.

The Value of Relationships in Wealth Transfer

Relational net worth emphasizes the impact of strong family and business relationships in legacy planning, often enhancing wealth transfer beyond mere financial assets. Establishing trust, clear communication, and shared values among heirs contributes significantly to preserving and growing net worth across generations. This approach reduces conflicts and ensures a smoother transition, maximizing the enduring value of inherited wealth.

Integrating Relational Assets into Your Legacy

Integrating relational assets into your legacy enhances the value beyond traditional net worth by emphasizing relationships, trust, and social capital passed through generations. Relational net worth captures intangible assets such as family cohesion, networks, and influence that contribute to long-term legacy planning. Prioritizing these relational assets ensures a holistic approach to wealth transfer, preserving both financial and emotional wealth for future heirs.

Measuring Relational Net Worth: Key Metrics and Indicators

Measuring relational net worth involves evaluating the quality and strength of an individual's social and familial connections, which serve as intangible assets in legacy planning. Key metrics include network size, frequency of meaningful interactions, trust levels, and influence within social circles. These indicators provide a comprehensive view of relational capital, complementing traditional financial net worth for a holistic legacy strategy.

Balancing Financial and Relational Net Worth for Generational Impact

Balancing financial net worth with relational net worth is crucial for effective legacy planning, ensuring both wealth preservation and family harmony. Financial net worth quantifies tangible assets like investments, real estate, and cash, while relational net worth emphasizes trust, communication, and shared values among heirs. Integrating these elements fosters a sustainable legacy, minimizing conflicts and maximizing long-term generational impact.

Strategies to Strengthen Relational Net Worth

Strengthening relational net worth involves fostering meaningful connections and trust among family members, advisors, and beneficiaries to support long-term legacy goals. Establishing regular communication, shared values, and collaborative decision-making processes enhances emotional wealth and ensures alignment across generations. Incorporating family governance structures and educational initiatives further solidifies relational net worth by promoting unity and collective responsibility in legacy planning.

Case Studies: Legacy Outcomes Beyond Money

Case studies in legacy planning reveal that relational net worth, which emphasizes family bonds, values, and shared experiences, often leads to more enduring and meaningful legacies compared to purely financial net worth. Families prioritizing relational net worth demonstrate stronger cohesion, intergenerational wealth transfer, and philanthropic engagement, ensuring their legacy extends beyond monetary assets. These outcomes highlight the critical role of emotional intelligence and communication in successful legacy planning, fostering resilience and purpose among heirs.

Building a Holistic Legacy Plan: Combining Assets and Relationships

Building a holistic legacy plan requires integrating net worth with relational net worth to ensure comprehensive wealth transfer. Combining tangible assets like investments, real estate, and business holdings with strong family and community relationships creates enduring value beyond financial wealth. Prioritizing both financial assets and meaningful connections maximizes the impact and sustainability of a legacy for future generations.

Related Important Terms

Relational Net Worth Index

Relational Net Worth Index quantifies the value of interpersonal connections and social networks in legacy planning, highlighting assets beyond financial statements. Incorporating relational net worth enhances comprehensive wealth strategies by preserving influence and family cohesion across generations.

Social Capital Valuation

Social Capital Valuation plays a crucial role in legacy planning by quantifying relational net worth derived from interpersonal relationships, trust, and social networks that traditional net worth calculations often overlook. Incorporating social capital into wealth assessments enhances estate strategies by recognizing intangible assets influencing future economic opportunities and family cohesion.

Legacy Network Quotient

Legacy Network Quotient (LNQ) measures the strength and value of interpersonal connections in legacy planning, surpassing traditional net worth by emphasizing relational assets over purely financial ones. Integrating LNQ into legacy strategies ensures a comprehensive approach, balancing monetary wealth with meaningful relationships to preserve and enhance long-term influence.

Familial Equity Score

Net worth quantifies an individual's total assets minus liabilities, while relational net worth incorporates the value of interpersonal relationships and social capital within legacy planning. The Familial Equity Score measures how effectively these relational assets contribute to wealth preservation and transfer across generations, optimizing legacy outcomes beyond financial metrics alone.

Inherited Influence Measure

Net worth quantifies an individual's total financial assets minus liabilities, while relational net worth evaluates the cumulative value of inherited influence within social and familial networks, crucial for legacy planning. Inherited Influence Measure captures how legacy assets extend beyond monetary value by enhancing social capital and intergenerational power dynamics.

Intergenerational Wealth Connectivity

Net worth quantifies individual financial assets and liabilities, while relational net worth emphasizes the interconnected wealth among family members, crucial for effective legacy planning. Intergenerational wealth connectivity leverages relational net worth to strengthen family ties and ensure sustainable wealth transfer across generations.

Legacy Social Footprint

Net worth measures an individual's total assets minus liabilities, while relational net worth captures the value of social connections and relationships that influence legacy planning outcomes. A strong legacy social footprint leverages relational net worth to create enduring impact beyond financial wealth by fostering meaningful community ties and intergenerational support.

Network-Adjusted Net Worth

Network-Adjusted Net Worth integrates traditional net worth measures with the value of an individual's social and professional connections, providing a more comprehensive metric for legacy planning. This approach recognizes that relationships and networks can significantly enhance asset value and influence wealth transfer strategies.

Trust Capital Matrix

Net worth quantifies an individual's total assets minus liabilities, while relational net worth emphasizes the value embedded within personal and family relationships critical in legacy planning. The Trust Capital Matrix strategically integrates trust assets and relational capital to optimize wealth transfer and preserve multigenerational legacy.

Relational Wealth Continuity

Relational net worth emphasizes the value of enduring personal relationships and social capital in legacy planning, often surpassing the importance of traditional net worth measured by financial assets. Prioritizing relational wealth continuity ensures the preservation and transfer of trust, influence, and family cohesion across generations, which are critical factors for sustaining long-term legacy impact.

Net worth vs Relational net worth for legacy planning. Infographic

moneydiff.com

moneydiff.com