Net worth represents the total value of all assets minus liabilities, providing a comprehensive snapshot of an individual's financial position. Liquid net worth focuses on the subset of assets that can be quickly converted to cash, excluding illiquid items like real estate or retirement accounts. Understanding both helps create effective financial plans by balancing long-term wealth with immediate spending and emergency needs.

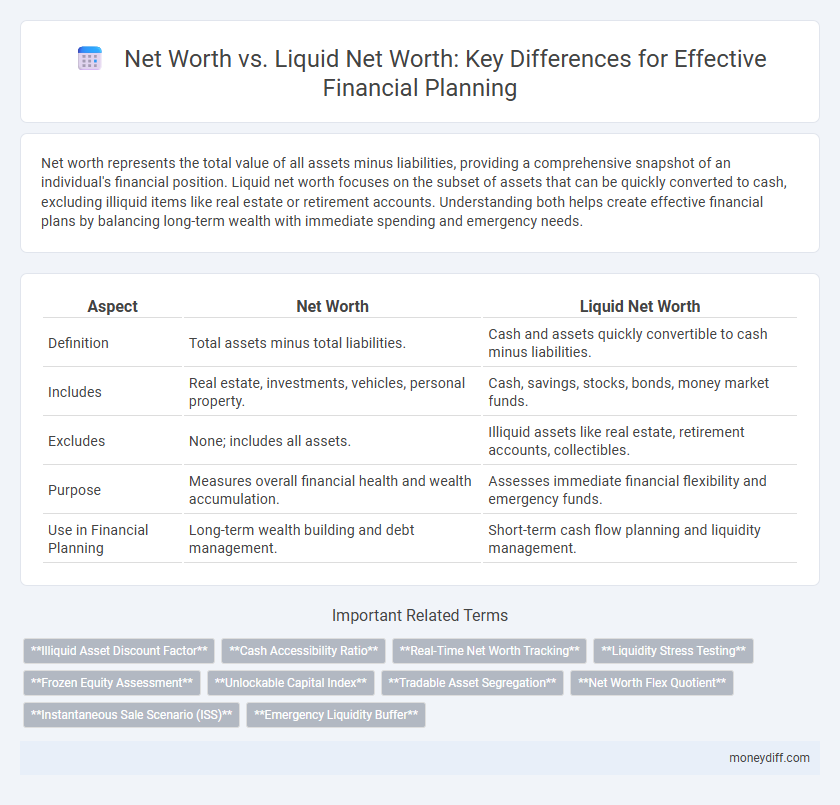

Table of Comparison

| Aspect | Net Worth | Liquid Net Worth |

|---|---|---|

| Definition | Total assets minus total liabilities. | Cash and assets quickly convertible to cash minus liabilities. |

| Includes | Real estate, investments, vehicles, personal property. | Cash, savings, stocks, bonds, money market funds. |

| Excludes | None; includes all assets. | Illiquid assets like real estate, retirement accounts, collectibles. |

| Purpose | Measures overall financial health and wealth accumulation. | Assesses immediate financial flexibility and emergency funds. |

| Use in Financial Planning | Long-term wealth building and debt management. | Short-term cash flow planning and liquidity management. |

Understanding Net Worth and Liquid Net Worth

Net worth represents the total value of all assets minus liabilities, providing a comprehensive snapshot of an individual's financial health. Liquid net worth specifically measures the portion of assets that can be quickly converted to cash without significant loss in value, such as cash, savings accounts, and marketable securities. Understanding both net worth and liquid net worth is crucial for effective financial planning, as it helps assess overall wealth and immediate access to funds for emergencies or investment opportunities.

Key Differences Between Net Worth and Liquid Net Worth

Net worth represents the total value of all assets minus liabilities, encompassing both liquid and non-liquid assets, while liquid net worth specifically accounts for assets that can be quickly converted to cash, such as savings accounts, stocks, and bonds. Liquid net worth is crucial for financial planning because it determines immediate solvency and the ability to cover short-term expenses or emergencies. Understanding the distinction between net worth and liquid net worth helps individuals balance long-term wealth accumulation with liquidity needs for effective cash flow management.

Why Liquid Net Worth Matters More for Emergencies

Liquid net worth represents the cash or assets quickly convertible to cash, making it crucial for immediate financial needs and emergencies. Unlike overall net worth, which includes illiquid assets such as real estate and retirement accounts, liquid net worth ensures access to funds without penalties or delays. Prioritizing liquid net worth in financial planning enhances the ability to cover unexpected expenses and maintain financial stability.

Calculating Your Net Worth Step-by-Step

Calculating your net worth starts by totaling all your assets, including properties, investments, savings, and valuable possessions. Then, subtract your liabilities, such as mortgages, loans, and credit card debt, to determine your net worth. To find your liquid net worth, focus only on assets that can be quickly converted to cash, like checking accounts, stocks, and bonds, providing a clearer picture for financial planning and emergency funds.

How to Determine Your Liquid Net Worth

Calculating your liquid net worth requires listing all cash and cash-equivalent assets, such as savings accounts, money market funds, and easily sellable investments, then subtracting any outstanding short-term liabilities. This precise metric differs from total net worth, which includes non-liquid assets like real estate and retirement accounts that cannot be quickly converted to cash. Understanding your liquid net worth helps create an actionable financial plan by highlighting the funds immediately available for emergencies, opportunities, or debt repayment.

The Role of Liquid Assets in Financial Planning

Liquid assets play a crucial role in financial planning by providing immediate access to funds during emergencies or investment opportunities, directly impacting liquid net worth. Unlike total net worth, which includes illiquid assets such as real estate or retirement accounts, liquid net worth focuses solely on cash or assets easily convertible to cash without significant loss. Prioritizing liquid assets ensures financial flexibility and stability, making it essential for effective cash flow management and risk mitigation in personal finance.

Impact of Illiquid Assets on Net Worth Calculations

Illiquid assets such as real estate, private equity, and collectibles can inflate net worth but do not provide immediate access to cash, complicating financial planning decisions that rely on liquidity. Liquid net worth, which excludes these illiquid holdings, offers a clearer picture of available funds for emergencies or investment opportunities. Accurately distinguishing between total net worth and liquid net worth is crucial for effective budgeting, risk management, and long-term financial strategies.

Which Metric Should Guide Your Financial Decisions?

Net worth represents the total value of all your assets minus liabilities, providing an overall snapshot of financial health, while liquid net worth focuses solely on assets that can be quickly converted to cash, essential for managing emergencies and short-term opportunities. For financial planning, liquid net worth should guide decisions related to immediate liquidity needs, but net worth is crucial for long-term wealth creation and debt management strategies. Prioritizing liquid net worth ensures financial flexibility, while monitoring total net worth supports sustained growth and retirement goals.

Strategies to Improve Liquid Net Worth

Maximizing liquid net worth requires prioritizing high-yield savings accounts, diversified investment portfolios with liquid assets, and reducing liabilities that impact cash flow. Regularly converting portions of illiquid investments into cash or equivalents enhances financial flexibility during emergencies or opportunities. Strategic budgeting and disciplined savings habits further accelerate growth in readily accessible net worth, strengthening overall financial resilience.

Setting Financial Goals with Net Worth Insights

Net worth represents the total value of assets minus liabilities, while liquid net worth specifically measures assets readily convertible to cash without significant loss. Understanding both metrics is essential for setting realistic financial goals, as liquid net worth determines short-term spending power and emergency fund adequacy. Incorporating net worth insights allows for balanced planning, ensuring long-term wealth growth alongside immediate financial security.

Related Important Terms

Illiquid Asset Discount Factor

Net worth represents the total value of all assets minus liabilities, while liquid net worth focuses solely on easily convertible assets; incorporating the illiquid asset discount factor adjusts valuations to reflect marketability constraints, enhancing accuracy in financial planning. This discount accounts for reduced liquidity in assets like real estate or private equity, ensuring that wealth assessments and investment strategies align with realistic cash flow expectations.

Cash Accessibility Ratio

Net worth represents the total value of assets minus liabilities, while liquid net worth focuses on assets readily convertible to cash without significant loss. The Cash Accessibility Ratio, a key metric in financial planning, measures the proportion of liquid net worth to total net worth, highlighting the ease of accessing funds for emergencies or investment opportunities.

Real-Time Net Worth Tracking

Real-time net worth tracking provides an accurate snapshot of both total assets and liabilities, distinguishing between overall net worth and liquid net worth by highlighting immediately accessible funds versus illiquid investments. This dynamic monitoring enables more precise financial planning by allowing users to adjust spending, saving, and investment strategies based on current financial liquidity and asset valuation.

Liquidity Stress Testing

Liquidity stress testing evaluates the difference between net worth and liquid net worth by simulating scenarios where access to liquid assets is critical for meeting short-term financial obligations. This process helps financial planners ensure clients maintain sufficient liquid net worth to avoid forced asset sales or liquidity shortages during periods of financial stress.

Frozen Equity Assessment

Frozen equity assessment distinguishes net worth from liquid net worth by identifying illiquid assets, such as real estate or retirement accounts, that cannot be readily converted to cash for immediate financial needs. Understanding frozen equity enables precise financial planning by highlighting the portion of net worth that is inaccessible, preventing overestimation of available funds.

Unlockable Capital Index

Net worth measures the total value of all assets minus liabilities, while liquid net worth focuses solely on cash or assets easily convertible to cash, critical for immediate financial decisions. The Unlockable Capital Index quantifies the proportion of net worth that can be rapidly mobilized without significant loss, providing a vital metric for assessing liquidity risk and effective financial planning.

Tradable Asset Segregation

Net worth encompasses all assets including non-liquid holdings, while liquid net worth specifically measures assets convertible to cash without significant loss, essential for accurate tradable asset segregation in financial planning. This segregation helps prioritize easily accessible resources for immediate needs versus long-term investments, optimizing liquidity management and risk assessment.

Net Worth Flex Quotient

Net Worth Flex Quotient measures the proportion of liquid assets within total net worth, offering critical insights for financial planning by highlighting an individual's ability to access funds quickly during emergencies or investment opportunities. Understanding this quotient helps balance long-term wealth accumulation with short-term financial flexibility, ensuring optimized portfolio management and cash flow strategies.

Instantaneous Sale Scenario (ISS)

Liquid net worth measures assets that can be quickly converted to cash in an Instantaneous Sale Scenario (ISS), providing a realistic assessment of available funds during urgent financial needs. Net worth includes all assets, but many may not be readily liquidated, potentially overestimating accessible financial resources in emergency planning.

Emergency Liquidity Buffer

Net worth reflects the total value of assets minus liabilities, while liquid net worth highlights easily accessible funds critical for an emergency liquidity buffer. Maintaining a robust liquid net worth ensures immediate financial flexibility without disrupting long-term investments during unforeseen expenses.

Net worth vs Liquid net worth for financial planning. Infographic

moneydiff.com

moneydiff.com